10 Questions to Expect During a First Call With a VC

Unsure how to approach your first call with a VC? Learn more from these 10 questions that are more than likely to surface during your first interaction with investors.

The first call with a VC isn’t a pitch competition—and it’s rarely a make-or-break moment.

It’s a chance to show how you think, how you communicate, and how clearly you understand the problem you’re solving.

No one’s writing a check after 30 minutes. Instead, investors are picking up on three things: clarity, conviction, and chemistry.

That’s what gets you the next meeting…

Brought to you by Vanta: Streamline AI Risk Reviews – Free Template Included

Having trouble assessing AI tools for risk and compliance? Vanta’s AI Security Assessment Template empowers IT and governance teams to accelerate approvals while maintaining robust security and accountability.

✅ Evaluate AI tools before implementation

✅ Stay aligned with GRC best practices

✅ Standardize your internal risk review process

Designed for dynamic security, privacy, and risk teams—scale your AI oversight with confidence.

Most founders try too hard to impress. But the ones who stand out are the ones who are grounded, sharp, and direct. This is the start of a relationship—not a Shark Tank moment.

In that short window, VCs are scanning for signals:

▫️ Is this a real problem?

▫️ Is this the right person to solve it?

▫️ Can this scale into something meaningful?

It all starts with how you show up and how you answer the first few questions.

Let’s break down the 10 questions you’re most likely to get—and how to tackle them like someone who’s done this before.

Table of Contents

What Problem Are You Solving?

Why Now?

Who Are Your Customers and How Do You Reach Them?

What’s Your Unique Insight or Edge?

Who Else is in the Space and How Are You Different?

How Does AI (or New Tech) Power Your Product?

What Traction or Proof Points Do You Have?

Who’s On the Team? And Why Are You the Right Team?

How Big is This Opportunity?

What Are You Looking for in a Partner?

Turning the Tables: Questions You Should Ask the VC

Closing Thoughts: Be Clear, Real, and Ready

1. What Problem Are You Solving?

Why they ask:

Before anything else, a VC wants to know this: is the problem you're solving actually worth solving? They’re looking for something real, something painful, persistent, and expensive enough that people or businesses are already trying to fix it, even if their solution is messy or inefficient.

How to answer it:

Start with the person or team feeling the pain. What exactly are they struggling with? What does that struggle look like in their day-to-day life? Keep the language simple. If you can't explain it without using buzzwords, it probably isn’t clear enough yet.

You could follow this structure:

“Today, [this kind of user] deals with [this frustrating or costly problem]. They try to fix it by [current workaround], but it’s slow, expensive, or broken. We’re building [your solution] to make that process easier, faster, or smarter.”

If your problem statement makes someone say, “yep, I’ve felt that,” you’re doing it right. This is your moment to make the pain point feel real and make your startup feel necessary.

2. Why Now?

Why they ask:

Venture is all about timing. A solid idea in the wrong market won’t move. But the right idea, at the right moment, can take off fast. When a VC asks “Why now?”, they’re trying to understand what’s changed. They want to see if you're catching a wave or just chasing one.

How to answer it:

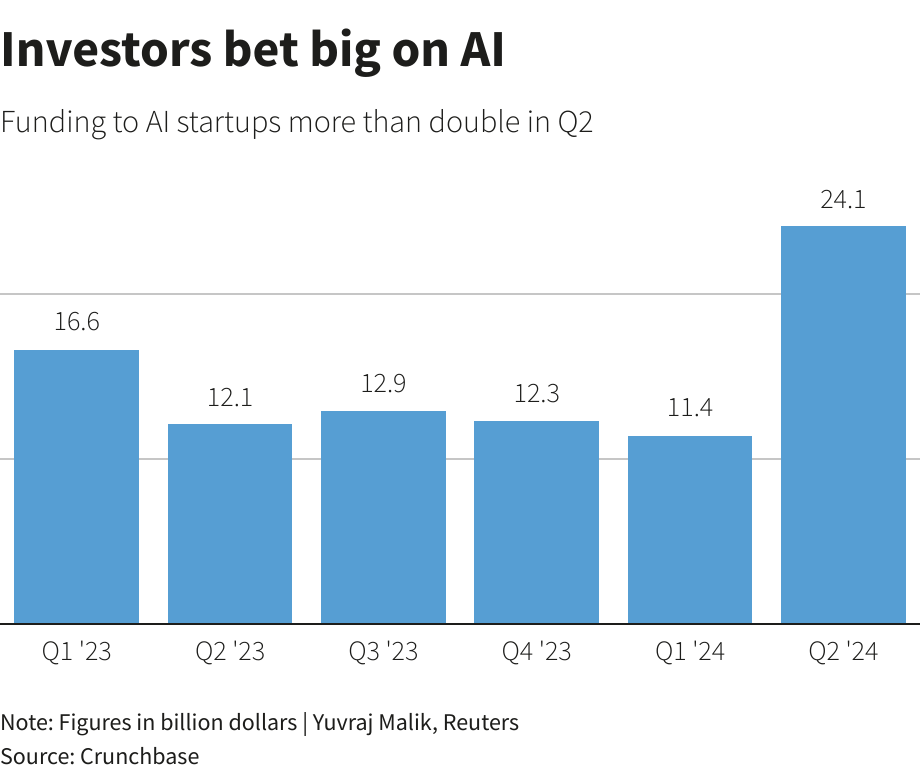

Tie your company’s timing to a real shift in the world. That could be a change in consumer behavior, a new regulation, a platform unlock, or a step-function improvement in tech (like LLMs or chip advances). The key is showing that now is the best possible moment to build this, because something just opened up that wasn’t possible before.

Here are some good examples:

A new AI model suddenly made your solution 10x faster or cheaper

COVID reshaped how your users work, buy, or live

A recent legal change created demand or urgency

The cost of doing something dropped dramatically, creating access

Good answers show awareness of the macro environment. Great answers make it feel like you’ve been waiting for this exact moment, and now you're ready to move.

3. Who Are Your Customers and How Do You Reach Them?

Why they ask:

Startups don’t usually fail because of bad tech. They fail because they can’t find or convert customers. VCs ask this to understand whether you really know who you're building for and whether you’ve found a reliable way to get their attention.

How to answer it:

Be specific. Describe your customer like someone you’ve actually had a conversation with. What’s their job title? What tools do they use? What keeps them up at night? Describing your customer using generic labels like “millennials” or “SMBs” won’t cut it. They want to hear that you’ve spent time in the weeds. Even better if you’ve already identified your ICP.

Then walk through how you’re reaching them. Are you getting signups through niche communities? Closing deals with cold emails? Converting followers from a TikTok series? Don’t shy away from early-stage tactics, especially if they’re working.

If you have early traction, like paid pilots, a waitlist that’s converting, or repeat users, bring it up. Real-world proof always beats a theoretical strategy. What VCs are looking for is a founder who knows their edge, knows where their users live, and has already started knocking on doors.

4. What’s Your Unique Insight or Edge?

Why they ask:

Most startups are solving problems that others have already noticed. What sets you apart is how you see the problem, and what you’re doing differently because of it. VCs ask this to get to the heart of your edge. They want to know what you’ve figured out that the rest of the market hasn’t.

How to answer it:

Think of this as your “earned secret.” Maybe you spent years in the industry and saw a gap no one else addressed. Maybe your team comes from a space where you spotted a pattern early. Maybe your product architecture is fundamentally different because you’re betting on where the world is headed.

Whatever it is, make it feel specific and hard to copy. Avoid vague claims like “we’re more user-friendly” or “we use AI.” Instead, say something that makes the investor pause and think - That’s interesting. I haven’t looked at it that way before.

Your goal here is to show that you're not just building faster, you’re seeing things clearly.

5. Who Else is in the Space and How Are You Different?

Why they ask:

VCs aren’t scared of competition. In fact, its absence can be a red flag. This question is about how well you understand your current landscape, and whether you’ve done your homework. They’re looking for signs that you know who you’re up against, and you’ve thought carefully about your edge.

How to answer it:

Start by acknowledging the key players. Name them. Display to potential investors that you’ve mapped out the market, including the legacy players, the fast-growing startups, and the ones building adjacent tools.

Then, explain your angle of attack. Maybe you’re targeting a niche they’re ignoring. Maybe your tech is 10x faster. Maybe your go-to-market play is different, or your insight comes from a space they haven’t touched.

Avoid making weak comparisons like “we’re like Uber but for X” or “nobody is doing this.” That usually signals you haven’t looked hard enough into your market. Having clarity here shows that you’re both realistic and strategic. You’re not trying to win the whole market on day one, but you’ve found the right place to start.

6. How Does AI (or New Tech) Power Your Product?

Why they ask:

In 2025, nearly every deck mentions AI. Most don’t go beyond the buzz. VCs are trying to figure out if you’re truly building with emerging tech, or just layering it on to sound current. They want to know if the tech drives real value, not just cool demos.

How to answer it:

Shift the focus from what you’re using to why it matters. Are you using LLMs to automate something that was previously manual and expensive? Is your model improving as usage grows? Are you delivering results that weren’t possible a year ago?

Answer this question by talking about outcomes:

Describe how you’re 10x faster than the old way

Explain how your users are getting answers in seconds instead of hours

Break down your cost structure to show how it’s meaningfully better than incumbents

If you're using off-the-shelf tools, that’s okay. But be honest and highlight what you’ve built on top of them. If you’re going deeper - custom models, proprietary data layers, unique infra - explain that in plain language.

Investors don’t need a tech tutorial. They just need to understand why your product gets better because of the tech, not in spite of it.

7. What Traction or Proof Points Do You Have?

Why they ask:

VCs use traction to judge two things: validation and velocity. Validation tells them the market wants what you’re building. Velocity shows how fast you're learning and moving. Even if you’re early, they want to see signs that something is clicking.

How to answer it:

Focus on signals that show real demand or strong execution. These could be:

Revenue growth (monthly or quarterly, even if small)

Activation and retention rates

Number of paying users or pilots

Pipeline value or waitlist conversions

Repeat usage or expansion within accounts

If you're pre-revenue, no problem. Talk about what you've validated, like an MVP that's getting strong feedback, or users coming back without prompts. Make sure your numbers are clean, current, and easy to follow. Don’t flood the conversation with vanity metrics. One strong KPI, clearly explained, is more powerful than a messy list of half-truths.

VCs are looking for traction, but they’re also watching how you talk about traction. Confidence, precision, and honesty go a long way.

8. Who’s On the Team? And Why Are You the Right Team?

Why they ask:

At early stages, most startups are bets on the team. The idea might shift. The product might pivot. What matters is whether this group of people can navigate the chaos and still ship something great. VCs want to understand where the execution risk lies and whether you've got the chops to overcome it.

How to answer it:

Start with the core team. What does each person bring to the table? Why are those skills essential to what you're building? Founders with deep technical know-how, domain experience, or a history of working together tend to stand out.

Then, zoom in on founder-market fit. Did this problem come from something you personally experienced? Do you know the customer because you’ve been one? That kind of alignment matters more than credentials.

If it’s just you for now, be honest, but show the plan. Who’s advising you? Who’s lined up to join once funding comes through?

The best teams show they’re built for the road ahead. They don’t need to be complete yet. But they should feel inevitable.

9. How Big is This Opportunity?

Why they ask:

Venture capital runs on outcomes. For a VC to invest, they need to believe your startup has the potential to reach serious scale, enough to return their fund, or at least swing big. That’s why this question comes up. They want to see if the opportunity is large, growing, and realistically within reach.

How to answer it:

Start by showing you understand how to size a market. Avoid vague claims like “It’s a $50B industry.” That’s top-down thinking, and it doesn’t say much. Instead, go bottom-up, like how many potential customers are there in your initial wedge? What would they realistically pay you per year? What does that add up to over time?

This approach shows you’re not just chasing a big number, you’re mapping a path toward it.

For example:

“There are about 80,000 independent clinics in the U.S. We’re starting with the 10,000 that have in-house billing. Our average contract is $8K/year, which gives us an initial reachable TAM of $80M. From there, we expand into adjacent verticals.”

Good answers blend ambition with facts and credibility. You’re painting a vision of scale without skipping the steps to get there.

10. What Are You Looking for in a Partner?

Why they ask:

This isn’t a throwaway question. VCs ask it to see if you’re thoughtful about the kind of support you need, and whether they’re a fit for your stage, vision, and style. It also gives them a sense of how self-aware and coachable you are as a founder.

How to answer it:

Be clear about what you’re looking for. It could be capital with speed and conviction. Or someone who’s deep in your category and can help you navigate early customer conversations. It might be a steady voice who’s seen companies go from Seed to Series C and knows where the traps are.

There’s no one right answer, but vague responses like “we want a value-add investor” don’t say much. Be specific, and be real.

This is your chance to show that you’re not just raising money, you’re choosing a partner for the next several years. That mindset lands well with the right investors.

11. Turning the Tables: Questions You Should Ask the VC

First calls aren’t one-sided. The best founders treat them as mutual vetting, not just a pitch. Asking smart, thoughtful questions signals that you’re looking for a long-term partner instead of just a check.

Here are a few questions that open up real conversation and show you’re thinking ahead:

What’s your thesis in this space?

This helps you understand if they’re actively backing companies like yours, or if you’re potentially a one-off bet.

How do you support founders after investing?

Every VC says they’re “hands-on.” Ask for examples. Do they help with hiring? Introductions? Strategy? This gives you a sense of how involved they really are.

Can I speak to a founder you’ve backed?

This is a strong move. It shows confidence and curiosity. Pay attention to how they respond. Great investors are proud of their founder relationships and happy to connect you.

You don’t need to ask all of these on the first call. But showing that you’ve done your homework and are evaluating them just as they’re evaluating you always lands well.

12. Closing Thoughts: Be Clear, Real, and Ready

First calls don’t require perfect answers. They just require thoughtful ones. VCs are looking for clarity, confidence, and a sense that you’ve put in the work. If you can explain your problem clearly, show why now is the moment, and speak honestly about what you're building, you're already ahead.

Treat the call like the start of a relationship, not a transaction. Be yourself, be sharp, and be ready to ask questions, too. That’s how great conversations and great partnerships begin.

Fantastic Article Ruben. Brilliant Q&A for Founder Investor Prep. We've Loads of Actionable Answers to these on The Founders Corner and so the resources we're both creating is getting jam packed for Founders 🌟