AGI Vibes Are Getting Weird, 2025 SaaS Valuations, Most Active Angels

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, and the hottest deals—here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Vanta

Stay ahead of AI regulations in Europe. Watch Vanta’s on-demand webinar to learn how emerging laws and regulations will impact your tech business.

Understand the steps to ensure compliance, mitigate risks, and prepare for the future of AI legislation to ensure you are ahead of the curve.

In-Depth Insights 🔍

On the Lifecycle of Industries ✍️

Eric Flaningam explores how industries evolve, from AI’s rapid growth to software’s consolidation, and what it means for businesses and investors. [Eric Flaningam]

AGI Vibes Are Getting Weird 🧠

NYT’s Kevin Roose says today’s AI feels… sentient. It’s not just smart—it’s weirdly aware. [Kevin Roose]AI Just Rewrote the Startup Playbook 📊

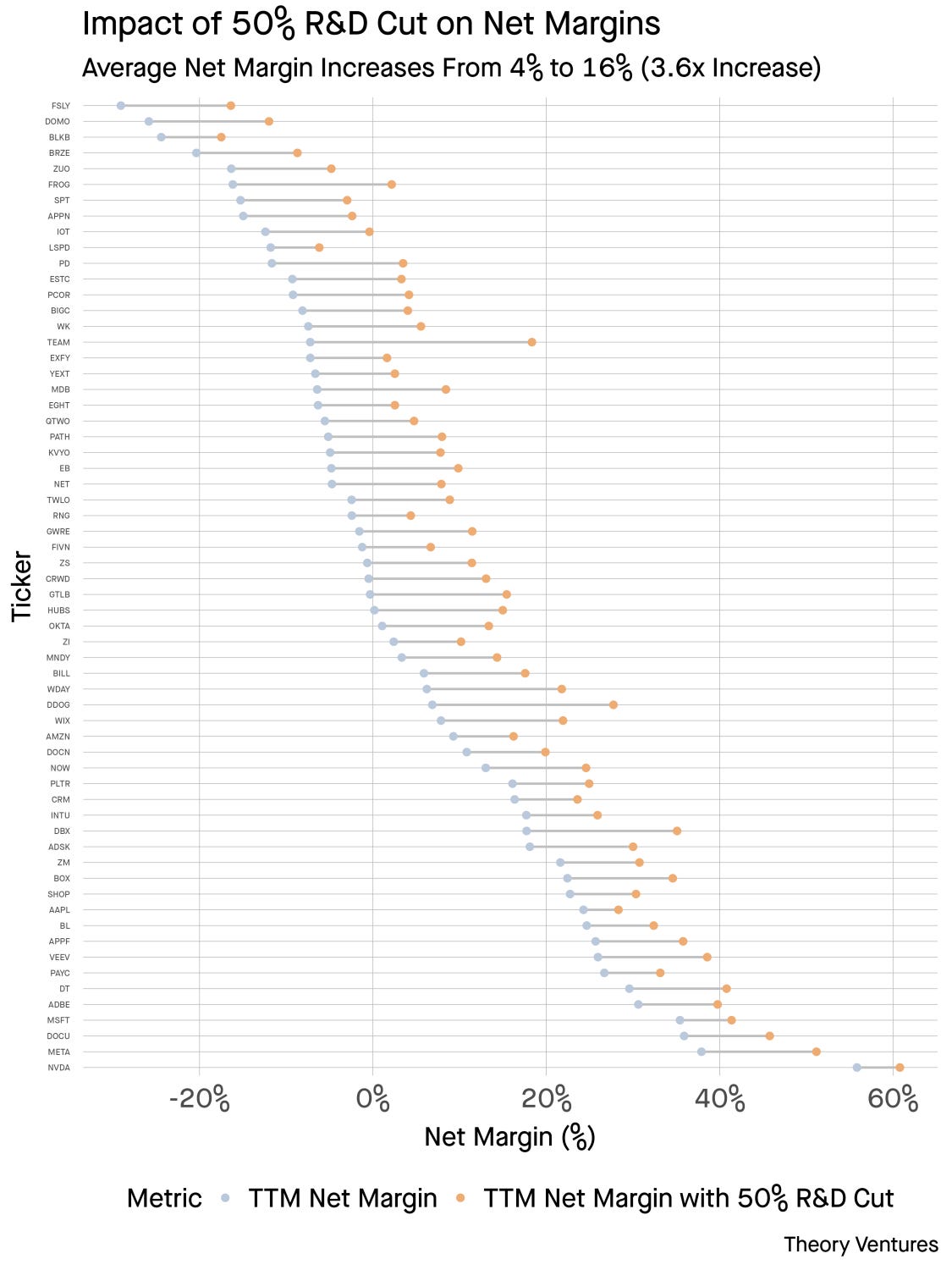

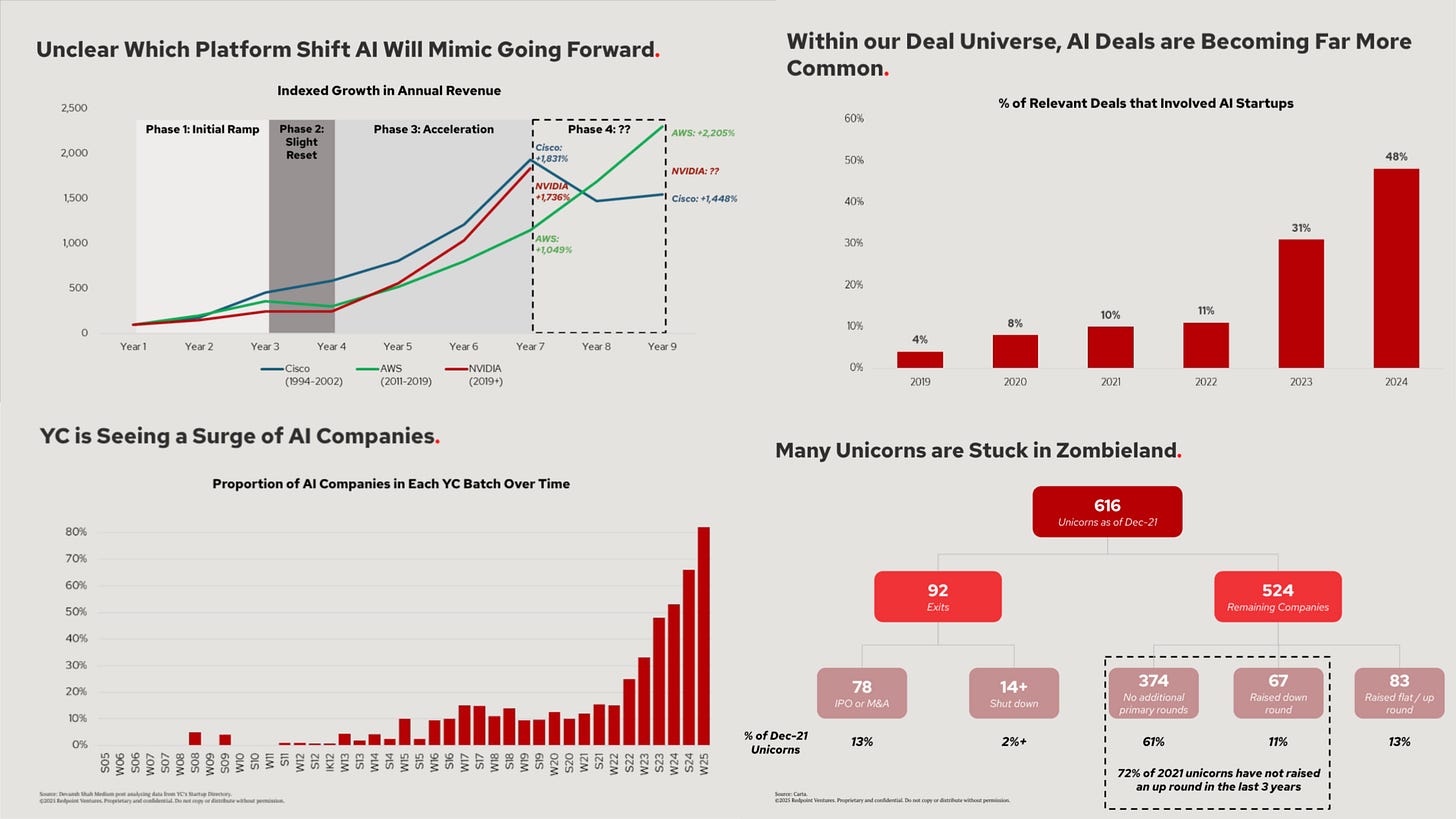

Tomasz Tunguz breaks down how AI slashes costs, speeds up cycles, and drives up valuations. [Tomasz Tunguz]2025 SaaS Valuations: Grow Like Hell or Go Home 🔍

If you're not growing 100%+, public markets look better. Harsh truth from Redpoint’s latest. [Matt Harney]

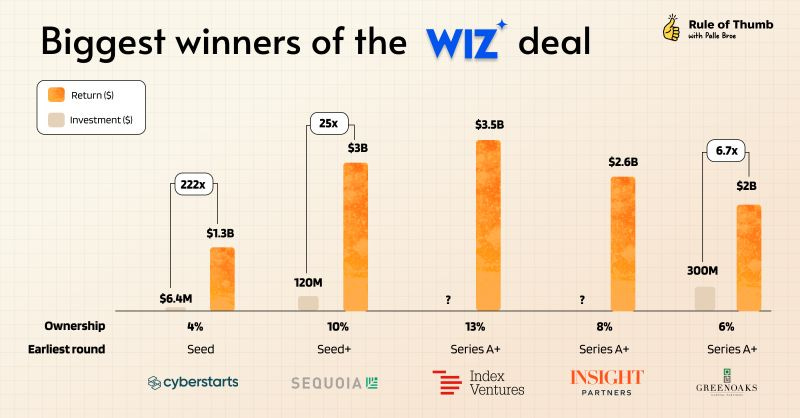

How Wiz Pulled Off a 222x 🔥

Wiz wasn’t a fluke. It was built to explode. Here’s how they pulled it off. [Palle Broe]

Europe’s Fintech Unicorns: Profits Are the New Flex 🦄

Just 13 of Europe’s 50 fintech unicorns are profitable. Turns out, vibes don’t pay the bills. [Tom Matsuda and Maya Dharampal-Hornby]The Angels Who Keep Winning 💸

Lenny Rachitsky’s shortlist of investors who spot unicorns before they fly. [Lenny Rachitsky]

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and my other media assets, email: rdominguezibar@gmail.com

Interesting Reports 📊

Funding is exploding. AI breakthroughs abound. Europe’s deep tech revolution is here—don’t get left behind.

2024 Annual Global Private Debt Report 📑

Rates are up, and so’s private debt. Smart investors are shifting fast—time to jump on the opportunity

The Perfect Pitch Deck: Insights from 350+ Startups 📊

Master your pitch deck with key slides, common mistakes to avoid, and real-world examples that won funding.

Recently Launched Funds 💸

Long Journey Ventures locked in $181.8M to back bold bets in consumer, commerce, and culture across the U.S.

Incore Invest launched Fund II to fuel early-stage software across Europe—with laser focus on founder-market fit.

SemperVirens Venture Capital closed $177M across two funds to shape the future of work, health, and financial wellness.

Motion Ventures launched a $100M fund to transform maritime, supply chain, and logistics through tech.

Bread & Butter Ventures baked up $40M for Fund IV, doubling down on foodtech, digital health, and enterprise SaaS in the Midwest.

Soulmates Ventures dropped a €50M climate tech fund for startups driving sustainability and green innovation.

Sofinnova Partners closed a €165M Biotech Acceleration Fund—targeting early-stage European biotech breakthroughs.

Pillar VC raised $175M for Fund IV to keep backing deep-tech and life sciences from zero to one.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup enthusiasts. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

VC Jobs 💼

25Madison (New York City, NY): VC Associate (apply here)

LG Tech Ventures (New York City, NY): Senior VC Manager (apply here)

a16z (San Francisco, CA): VC Associate (apply here)

Green D Ventures (Boston, MA): Senior VC Associate (apply here)

Energy Impact Partners (Washington, DC): Finance Manager (apply here)

Zinc Ventures (London, England): VC Lead (apply here)

Earlybird Ventures (Berlin, Germany): VC Internship (apply here)

Maximus (Remote): Senior VC Director (apply here)

Biotech Fund (Remote): VC Investor II (apply here)

Bitkraft (Remote): VC Associate (apply here)

Hottest Deals 💥

Adara Ventures, announced the first close of AV4 to invest in Europe’s next wave of deep tech. (read more)

Dataminr, raised $85M to advance its AI-driven alert platform across enterprise and public sectors. (read more)

Asper AI, secured $20M from Fractal to scale its AI copilots, simplifying enterprise decision-making. (read more)

InspireN, raised a $35M Series A to expand its intelligent patient care platform for hospitals. (read more)

Camber, raised a $4M seed round to help finance teams reduce SaaS bloat and optimize spend. (read more)

Kosli, raised a $10M Series A to deliver real-time compliance tracking for DevOps teams. (read more)

ClearGrid, raised $10M to digitize utility infrastructure data and modernize the power grid. (read more)

Good Good Golf, raised $45M to grow its content, merchandise, and product offerings for the modern golf lifestyle. (read more)

Manifest, raised a $2.5M pre-seed round to streamline freight billing for logistics teams. (read more)

RESOURCES 🛠️

✅ Ultimate Investor List of Lists (+5k VCs)

✅ 40 Pitch Decks That Raised Over $460M

✅ The Startup Founder’s Guide to Financial Modeling (7 free templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth (and How to Get Into Them)

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ The Ultimate Startup & Venture Capital Notion Guide: Knowledge Base & Resources

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox

✅ How to Create a Co-Founder Agreement + 3 Templates

Bread and butter ventures eventually food u will sell just u know where to cook place means alot aswell at 40 how much can rise that? Need to check that others not worth because without looking can say jumping from left to right

Hi I’d love a read as I dive into the ethics of tech through the lens of Japanese animation

https://open.substack.com/pub/davidfoye/p/akira-and-the-ethics-of-technological?r=4g90ob&utm_medium=ios