Data-Driven Equity Splitting📊, The Path to PMF, Figma's $12.5 Bn Valuation🎨

Welcome to The VC Corner, your weekly dose of Venture Capital and Startups to keep you up and running! 🚀

Fundraising Season is Almost Here

Nearly half of all capital raises happen between Labor Day (September 2nd) and Christmas. If you want to get funded, this is the time to do it.

Start building your investor list NOW using Fundingstack.com. Search a proprietary database of 227,000 global investors including angels, VCs, LPs, family offices and more. Load them into our industry-leading CRM to manage your pipeline and use our Virtual Data Room to run due diligence. Send out pitch decks, investor updates, and “nudge” emails (now with Templates and ChatGPT) to get your raise over the finish line.

Try it out now at www.Fundingstack.com or contact us for a demo and see how you can gain fundraising superpowers.

Use code VCCorner here to get 30% off your first 3 months. No contracts, cancel anytime

In-Depth Insights 🔍

It is Too Early to Judge African Venture Capital. The African VC ecosystem is young, inching past its first decade of existence. The African internet revolution took a different shape than it did elsewhere: between 2005 and 2019, the share of African households possessing a computer went from 4% to 8%, while other developed economies witnessed a 55% to 80% jump over the same period 🌍 [Mathias Leopoldie, Julaya]

Slicing the Startup Pie: Data-Driven Equity Splitting: A data-driven approach to equity splitting among startup founders, providing insights and best practices for fair distribution 📊 [Wildfire Labs, Carta]

Who's Who: A List of Active Business Angels, Pre-Seed, Seed, Series A, and Series B VC Firms in Spain 2024: K Fund provides an extensive list of the most active investors in Spain for 2024, offering valuable insights for startups seeking funding at various stages 📈 [K Fund]

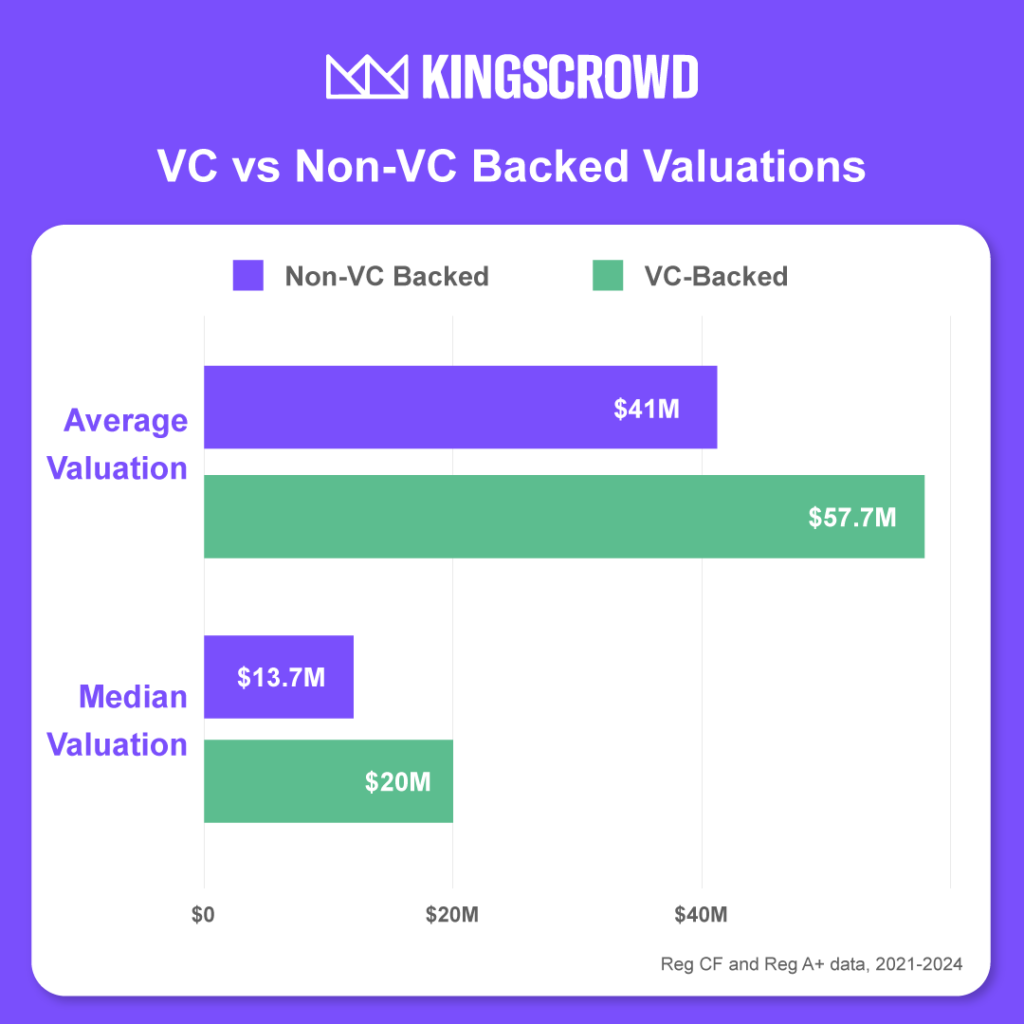

VC vs. Non-VC Backed Valuations in Equity Crowdfunding: An analysis comparing the valuations of companies backed by venture capital versus those without such backing in the equity crowdfunding space, highlighting key trends and implications for investors 💰 [KingsCrowd]

Shifting from Outputs to Outcomes: Exploring the importance of focusing on outcomes rather than outputs in product development to drive real value and impact 🚀 [Product Talk]

Anthology 2: PayPal: A detailed look at PayPal's journey and growth, offering lessons and insights for entrepreneurs and startups 📚 [A Letter a Day]

Want to get your brand in front of 37k founders, investors, executives, and startup operators? Fill out this quick form for details on our sponsorships, and we’ll contact you 📣

Interesting Reports 📊

PitchBook-NVCA Venture Monitor. At a glance, Q2’s venture numbers look promising: With $55.6 billion invested, deal value rose to an eight-quarter high. But $14.6 billion of that capital was concentrated in just two companies—CoreWeave and xAI 📈

Harvard Innovation Labs: The Path to PMF. Here's the entire 6-hour, 91-slide workshop for Harvard Innovation Labs on the path from $0-$1M and B2B product-market fit 🚀

Recently Launched Funds 💸

Menlo Ventures and Anthropic Team Up on a $100M AI Fund: Menlo Ventures and Anthropic have launched a $100 million fund dedicated to advancing AI technologies and supporting innovative AI startups.

Cambridge Future Tech Announces £5M for Early-Stage Investments: Cambridge Future Tech has announced a £5 million fund to support early-stage tech startups, focusing on groundbreaking innovations and technologies.

DFJ Growth Raises Nearly $1.05 Billion for Latest Fund: DFJ Growth has raised nearly $1.05 billion for its latest fund, focusing on supporting high-growth technology companies.

NewView Capital Targets $700M for Venture Secondaries: NewView Capital, a spin-out from NEA, is targeting $700 million for a venture secondaries fund, aiming to provide liquidity options for VCs and startups.

Amazon Commits Up to $230M to Startups Building Generative AI Applications: Amazon announces a commitment of up to $230 million to support startups developing generative AI-powered applications, fostering innovation in the AI space.

Paris-Based Breega Hits First Close of $75M Africa Fund: Breega has reached the first close of its $75 million Africa fund, aimed at backing pre-seed and seed startups across the continent.

Hottest Deals 💥

Dechra Pharmaceuticals to Acquire Invetx for Up to $520M: Dechra Pharmaceuticals announces plans to acquire Invetx for up to $520 million, expanding its footprint in the veterinary pharmaceutical industry.

Slope Raises $65M in Funding: Slope has raised $65 million in a new funding round to enhance its financial services platform for startups and SMBs.

Stax Engineering Raises $40M in Funding: Stax Engineering secures $40 million in funding to accelerate the development and deployment of its innovative engineering solutions.

Coatue and General Catalyst Back Figma at $12.5 Billion Valuation: Coatue and General Catalyst back Figma, raising its valuation to $12.5 billion, underscoring the continued investor confidence in design and collaboration tools.

Sam Altman and JP Morgan Back Slope with $65M: Slope secures $65 million in funding from high-profile investors including Sam Altman and JP Morgan, highlighting the platform's growing influence in financial services for startups.

Deepfake-Detecting Firm Pindrop Lands $100M Loan to Grow Its Offerings: Pindrop, a leader in voice authentication and fraud prevention, secures a $100 million loan to expand its deepfake detection capabilities and product offerings.

CytoReason Raises $80M in Funding: CytoReason, a company specializing in computational models of the human immune system, raises $80 million to advance its technology and therapeutic applications.

Robotics and AI Firm Secures Significant Investment: A leading robotics and AI firm secures significant investment to expand its technological capabilities and market reach.

VC Jobs 💼

Isomer Capital (London, UK) is seeking a VC Associate to support their investment activities across Europe. The ideal candidate will have experience in early-stage venture capital or startups.

Partech (Paris, France) is hiring a VC Analyst to join their team. The role involves sourcing and evaluating investment opportunities in the tech sector.

Earlybird Venture Capital (Berlin, Germany) is looking for a VC Associate to identify and support high-growth tech startups in Europe.

Highland Europe (London, UK) is seeking a VC Analyst to assist in evaluating investment opportunities and supporting portfolio companies.

Balderton Capital (London, UK) is hiring a VC Associate to join their team. The role involves sourcing and analyzing investment opportunities in the tech sector.

Point Nine Capital (Berlin, Germany) is offering a position for a VC Analyst to help identify and support early-stage startups in the SaaS and marketplace sectors.

https://open.substack.com/pub/emilyalexandraguglielmo/p/the-meaning-of-god?r=2mtps5&utm_medium=ios