Elon Musk and the Outer Limit of Vertical Integration

How SpaceX and xAI collapsed AI, compute, capital, and deployment into one system

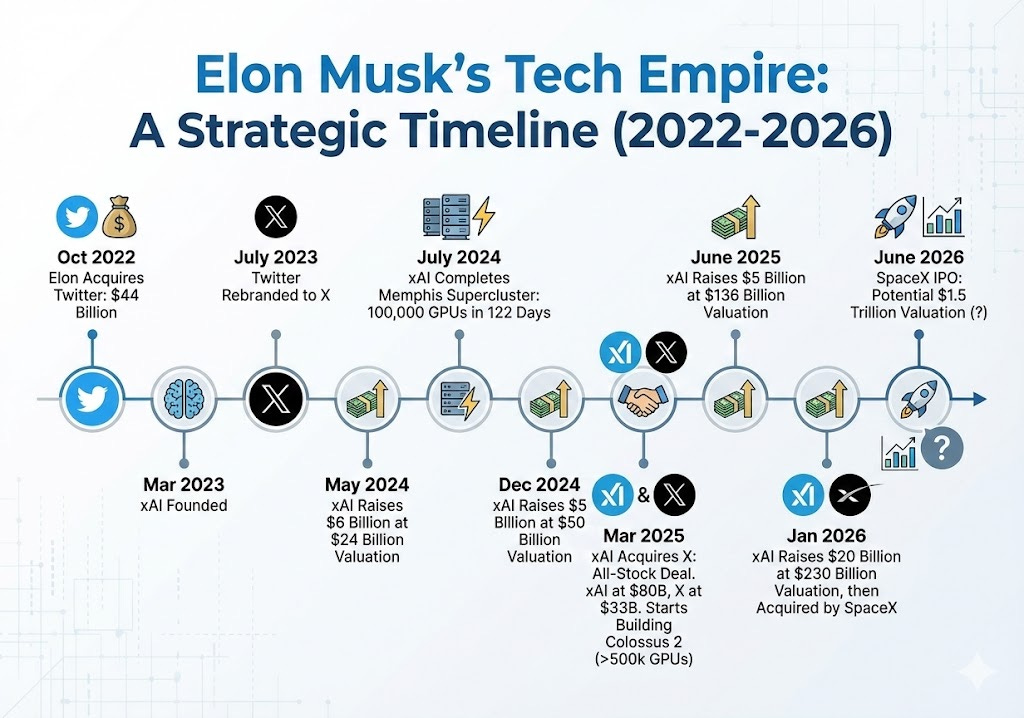

In a short span of time, Elon Musk stopped operating separate companies and started assembling a single stack.

A social platform consolidated attention and data.

An AI lab was created and scaled aggressively.

Compute was treated as an industrial asset.

Then the AI lab was absorbed by SpaceX.

Taken one by one, these moves invite speculation. Taken together, they reveal a consistent operating logic.

This piece explains how that structure came together, why it echoes Musk’s earlier companies, and why the implications reach far beyond AI headlines.

Why vertical integration appears again

Most AI companies rely on external layers:

hyperscalers for compute

platforms or enterprises for distribution

licensed or scraped data

third-party infrastructure pricing and policy

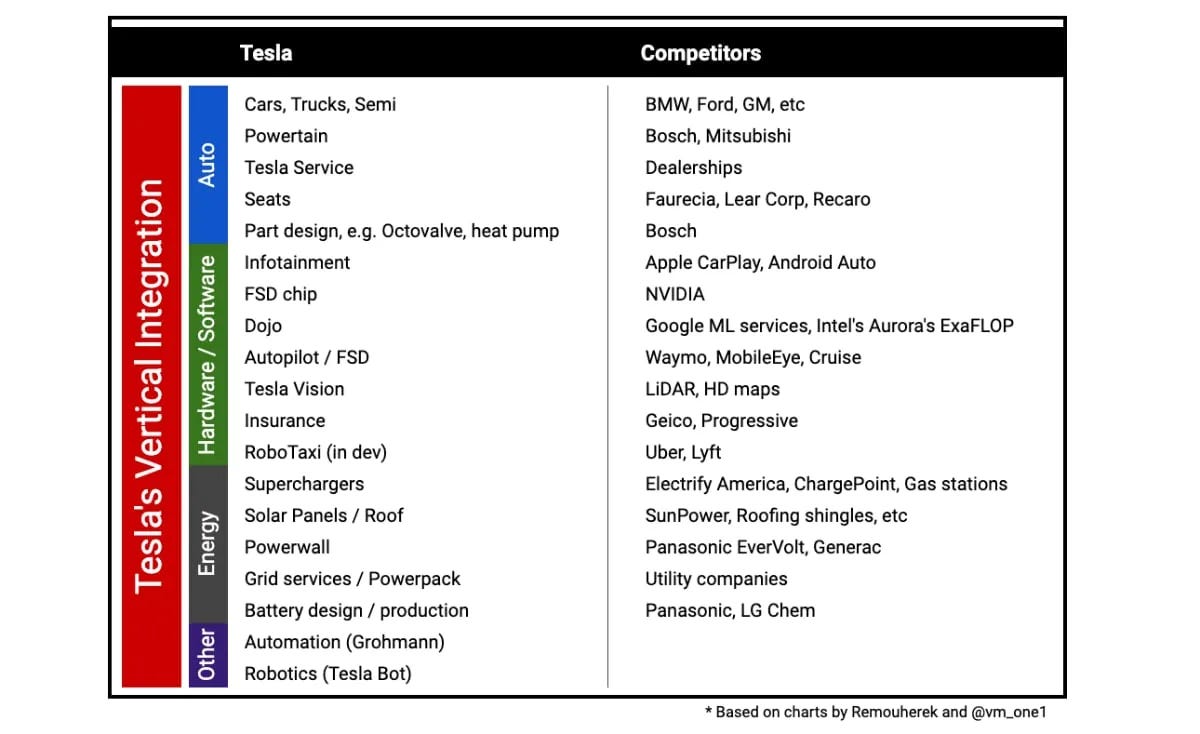

Musk’s companies have spent years moving in the opposite direction.

Launch was internalized at SpaceX.

Factories became strategic assets at Tesla

Connectivity was built into the system through Starlink.

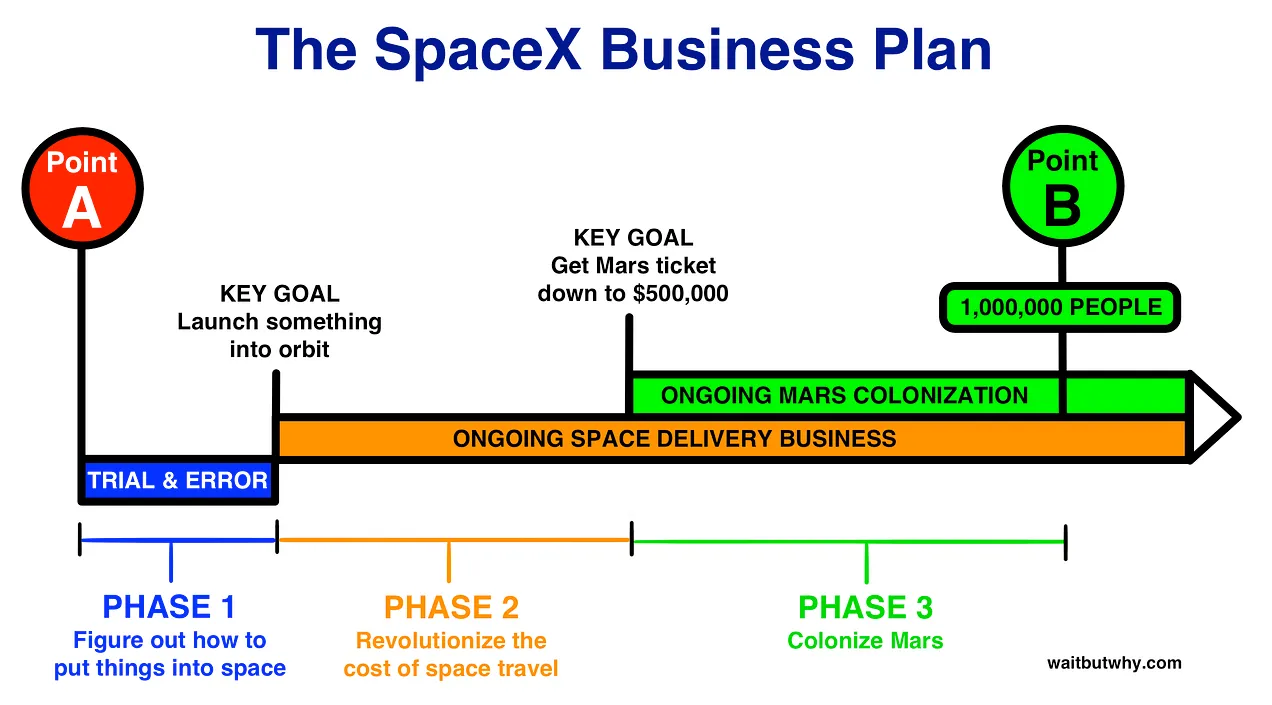

Pulling xAI into SpaceX follows the same logic. Owning more of the stack reduces exposure to constraints that persist even as scale increases.

Power, cooling, launch cadence, satellite density, and manufacturing throughput do not behave like software abstractions. They reward ownership over time.

Risk tolerance as structure

Walter Isaacson’s biography highlights a recurring pattern.

As uncertainty rises, Musk tends to concentrate exposure rather than spread it. He absorbs volatility early and removes exit paths that would slow execution later.

That approach fits domains where partial commitment fails. Rockets, satellite networks, and frontier compute carry fixed costs that punish hesitation.

The SpaceX–xAI structure reflects that bias toward full commitment.

The Google precedent

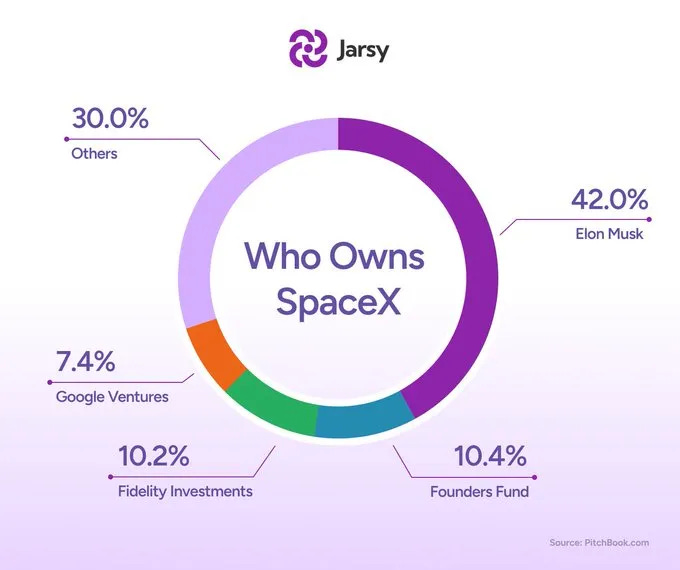

In 2015, Google and Fidelity invested roughly $1B into SpaceX at a reported valuation near $12B.

At the time:

reusable rockets were unproven

Starlink existed as ambition rather than revenue

failure remained plausible

A decade later, SpaceX is widely discussed as a candidate for one of the largest IPOs ever.

The lesson is not the return multiple. It’s the decision to commit before outcomes were visible and to remain committed while risk stayed high.

That posture now appears again, this time around AI.

Why xAI inside SpaceX changes the story

SpaceX was already an infrastructure company.

With xAI inside the organization, it also becomes AI infrastructure.

That shifts how future investors, regulators, and partners will view the business:

compute supply becomes part of the core narrative

satellite networks intersect with model deployment

regulatory exposure broadens

long-horizon optionality expands

Public markets struggle to price systems that combine capital intensity, fast technological cycles, and geopolitical relevance. That tension will shape any future listing.

What’s behind the paywall

For premium subscribers, the next section covers:

Musk’s manufacturing “Algorithm” and its relevance to AI systems

why over-automation failed at Tesla and how that lesson applies to model pipelines

Starship as a forcing function for compute scale

the orbital data center thesis and its implications for AI economics

how SpaceX, Starlink, and xAI reinforce each other structurally

Inside Musk’s Operating System

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.