How Startups Can Use EU Funding Programs to Raise Capital Without Giving Up Equity

Discover how EU Framework Programs like Horizon Europe offer non-dilutive funding, R&D access, and global scale to ambitious startups across Europe

EU startup funding is one of the best-kept secrets in early-stage innovation.

Through massive programs like Horizon Europe and the EU Innovation Fund, the European Union is pouring billions into tech, sustainability, and research. And yet, only 5% of this funding goes to startups.

That’s a missed opportunity.

Brought to you by Harmonic — the complete startup database

Leading VCs are sourcing up to 50% of their total investments with Harmonic.

With just €12 billion in public funding, EU-backed startups have already created over €520B in enterprise value—without giving up a single share of equity. For founders, this is one of the most powerful ways to fundraise without VCs, scale internationally, and plug into top-tier research and partnerships.

In this guide, we’ll break down:

What EU Framework Programs offer

Who qualifies—and how to apply

How to use EU funding to supercharge your growth without diluting your ownership

If you're building in Europe and not considering EU programs, you’re probably leaving money on the table.

Let’s fix that.

Table of Contents

Dealroom’s March 2025 Report Explores Europe’s Startup Landscape

Where Startups Can Secure EU Funding

How to Apply for EU Funding

Maximizing EU Support Beyond Funding

A Stronger Future for EU Startups

1. Europe’s Startup Landscape in March 2025: Inside Dealroom’s Latest Report

Startups are critical engines of economic growth—and in Europe, they rely heavily on public funding to get off the ground. The European Union has poured billions into innovation programs. But is it working?

The latest Dealroom report reveals a high-impact return on investment, but also a major funding gap. While some startups thrive, others struggle to raise the capital needed to grow.

Horizon Europe: Big Budget, Uneven Reach

With €95B allocated through Horizon Europe (FP9), the EU runs one of the world’s largest innovation programs. These grants help early-stage startups build deep tech, prove concepts, and attract initial investors. But when it’s time to scale, too many founders hit a wall.

Despite the success of EU-backed ventures, venture capital investment in the EU sits at just 0.03% of GDP—a fraction of the 0.19% seen in the U.S. That gap continues to limit the scale-up potential of promising European startups.

The result? Massive innovation at the early stages, but a funding cliff at scale.

This problem isn't new. A report by the European Investment Bank reveals that venture capital investment in the EU constitutes only 0.03% of its annual GDP. Compare this to approximately 0.19% in the United States, and you’ll notice the disparity that underscores the challenges European startups face in accessing substantial growth capital.

Where EU-Backed Startups Are Thriving: Deep Tech, Climate, and Biotech

Startups receiving EU funding tend to focus on capital-intensive industries. Deep Tech, Climate Tech, AI, Biotech, and Space are the most funded areas, according to the Dealroom report. 80% of EU-backed startups are not SaaS or consumer tech-focused which are typically backed by traditional VCs. However, all of these businesses are built on physical technologies; hardware, clean energy solutions, biotech platforms, and space tech.

Why “Hard Tech” Gets Funded

These industries are expensive and slow to develop, but they show higher graduation rates and better scale-up potential. That’s why cities like Eindhoven, Glasgow, and Lisbon are emerging as deep tech innovation hubs.

EU grants are helping build Europe's next generation of industrial tech—think space, energy, and health—not just apps.

The Real Challenge: Scaling Beyond Grants

Public funding helps founders build the first version—but many struggle to transition to private capital.

Without follow-on funding from VCs or corporates, promising startups stall.

That’s where startup hubs and accelerators matter. Networks like Founders Factory help startups bridge the gap. They connect founders with investors, marketing experts, and legal teams. Since its launch, Founders Factory has supported over 300 startups, helping them grow beyond early-stage funding.

At the policy level, leaders like Airbus Chair René Obermann are pushing for stronger cross-border collaboration—especially in AI, quantum, and cloud. Without unified support, Europe risks falling behind U.S. and Asian innovation ecosystems.

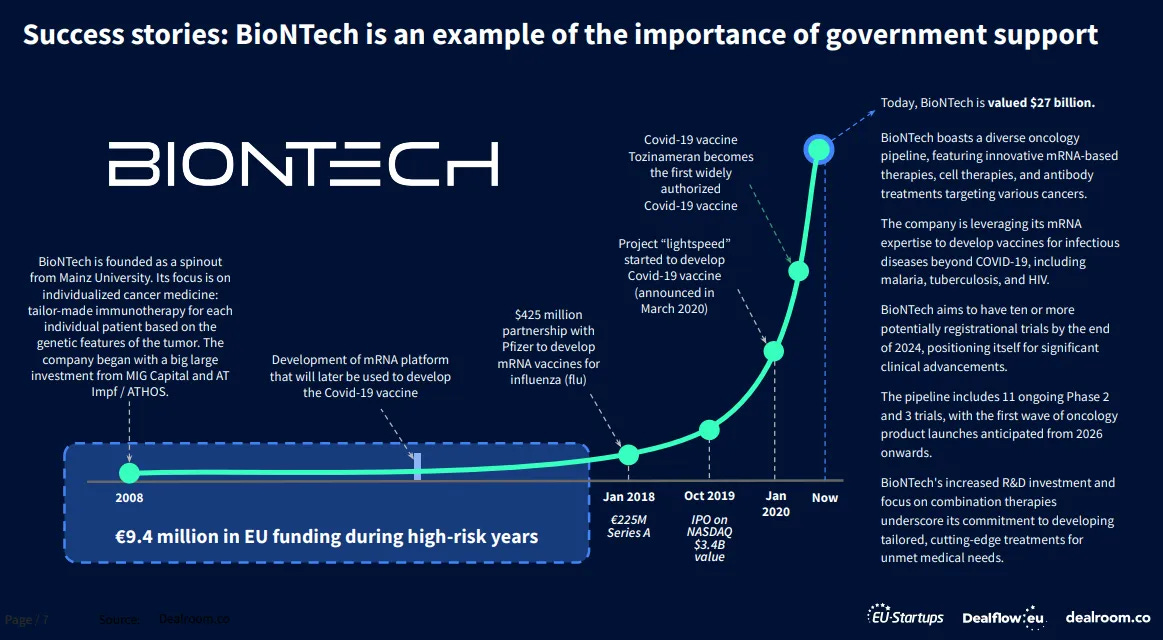

BioNTech: From EU Grant to $27B Global Breakthrough

BioNTech is the gold standard for what EU funding can spark when paired with bold execution.

The German biotech startup began in 2008 as a university spinout focused on personalized cancer therapies. Early on, it secured €9.4 million in EU grants, which funded the development of its mRNA platform—years before the world knew how critical it would become.

Between 2015 and 2018, BioNTech scaled fast, forging partnerships with pharma giants and attracting top-tier investors. In 2019, it went public on NASDAQ, reaching a $3B valuation.

Then came COVID-19.

In 2020, BioNTech used its mRNA expertise to co-develop the first approved COVID vaccine with Pfizer. Its valuation jumped to $27 billion, solidifying it as one of the EU’s greatest startup success stories.

EU funding planted the seed. But BioNTech scaled because it also secured private capital, formed commercial partnerships, and executed at speed.

BioNTech’s success proves that EU funding can kickstart global breakthroughs. But it also highlights a key reality: grants alone won’t take startups to the next level. BioNTech scaled for many other reasons such as securing private investment, forming industry partnerships, and going public.

Looking Ahead: Europe’s Growing Support for Startups

To stay competitive, Europe is doubling down on supporting young founders. Over 120 European tech leaders have recently launched Project Europe, a €10 million venture to mentor and fund the next generation of early-stage startups. The aim is to prevent talent from leaving for the U.S. by helping build Europe’s next wave of tech giants. There are also programs like Dealflow.eu and Innovation Radar, making it easier for startups to find investors, apply for EU funding, and connect with corporate partners. These initiatives and digital platforms bridge the gap between public and private funding and help startups scale beyond grants.

The EU startup ecosystem has huge potential. Grants and innovation funding are helping founders build breakthrough technologies. But to close the funding gap, startups need stronger private investment links, better scaling support, and more cross-border collaboration. The Dealroom report makes one thing clear: EU-backed startups deliver massive value. The challenge is to make sure that more of these startups survive and scale.

2. Where Startups Can Secure EU Funding

EU funding will change the game for startups aiming to innovate and scale. For founders to take advantage, it’s important to understand the landscape, identify available funding avenues, and learn how to navigate the application process effectively.

The EU’s Funding Landscape

There are a variety of funding mechanisms that the EU provides to support startups at different stages of development. Let’s go over a few funding programs and the different types of funding offered.

Horizon Europe

Horizon Europe is the EU's most prominent research and innovation program. With a budget of over €90 billion for 2021-2027, the program offers direct grants and equity funding to support innovative projects across various sectors. SMEs, mid-caps, or large companies can apply for funding under Horizon Europe.

European Innovation Council (EIC)

Started in 2021 under Horizon Europe, the European Innovation Council supports the commercialization of high-risk, high-impact technologies. With a budget of €10.1 billion, the council offers funding through three main avenues: EIC Pathfinder, Transition, and Accelerator.

EIC’s Pathfinder provides grants of up to €4 million for early-stage development of future technologies, while Transition offers up to €2.5 million to validate and demonstrate technology in application-relevant environments and develop market readiness. EIC’s Accelerator supports individual SMEs, specifically startups and spinout companies, granting up to €2.5 million and equity investments of up to €15 million to scale game-changing technology.

The European Investment Bank (EIB) and Fund (EIF)

The European Investment Bank offers funding through long-term loans and venture debt, while the European Investment Fund focuses on venture capital and guarantees for SMEs. Both financial institutions play a key role in financing projects that align with the EU’s priorities. More recently, the EIB announced plans to boost funding for EU tech startups to address the funding gap and support the growth of innovative companies throughout Europe.

Cascade Funding Hub

Cascade funding streamlines the administrative process by platforming certain EU-funded projects to host open calls for further funding. The funding hub is also known as the Financial Support for Third Parties (FSTP), and their approach is particularly favorable for SMEs, offering equity-free funding from €50,000 to €150,000.

By exploring these various EU-sponsored funding mechanisms, startups can more easily find opportunities that align with their development stage and strategic goals.

3. How to Apply for EU Funding

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.