GTM Benchmarks📊, Age of Unicorn Founders💰, Future of Sales with AI🤖

Welcome back to The VC Corner, your weekly dose of Venture Capital and Startups to keep you up and running! 🚀

Your invitation to join Europe's #1 Investor Gathering

The Investor Summit, happening during Bits & Pretzels Festival in Munich, is the yearly gathering of Europe's top VCs.

As a subscriber of The VC Corner, you're invited to join 1,000 fellow professionals, connecting and investigating about chances, trends, and opportunities.

Data-driven investing, boutique vs asset aggregator, SPVs, solo GPs, fundraising, generational transition – there is much that needs to be explored.

In-Depth Insights 🔍

Overbuilding in AI: A Modern Twist: Tanay Jaipuria explores the challenges of overbuilding in AI, analyzing its impact on product development and business strategies 🤖

2024 GTM Benchmarks: A detailed look by OnlyCFO at the go-to-market benchmarks for 2024, providing insights for startups and CFOs on setting effective strategies 📊

The Ultimate Guide to Term Sheets: Wildfire Labs Substack offers an in-depth guide to understanding and negotiating term sheets, essential for any startup founder 📜

A16z and Founders Fund Lead Defense VC Investment: A deep dive into how top VCs like a16z and Founders Fund are backing defense technology startups, driving innovation in the sector 🛡️

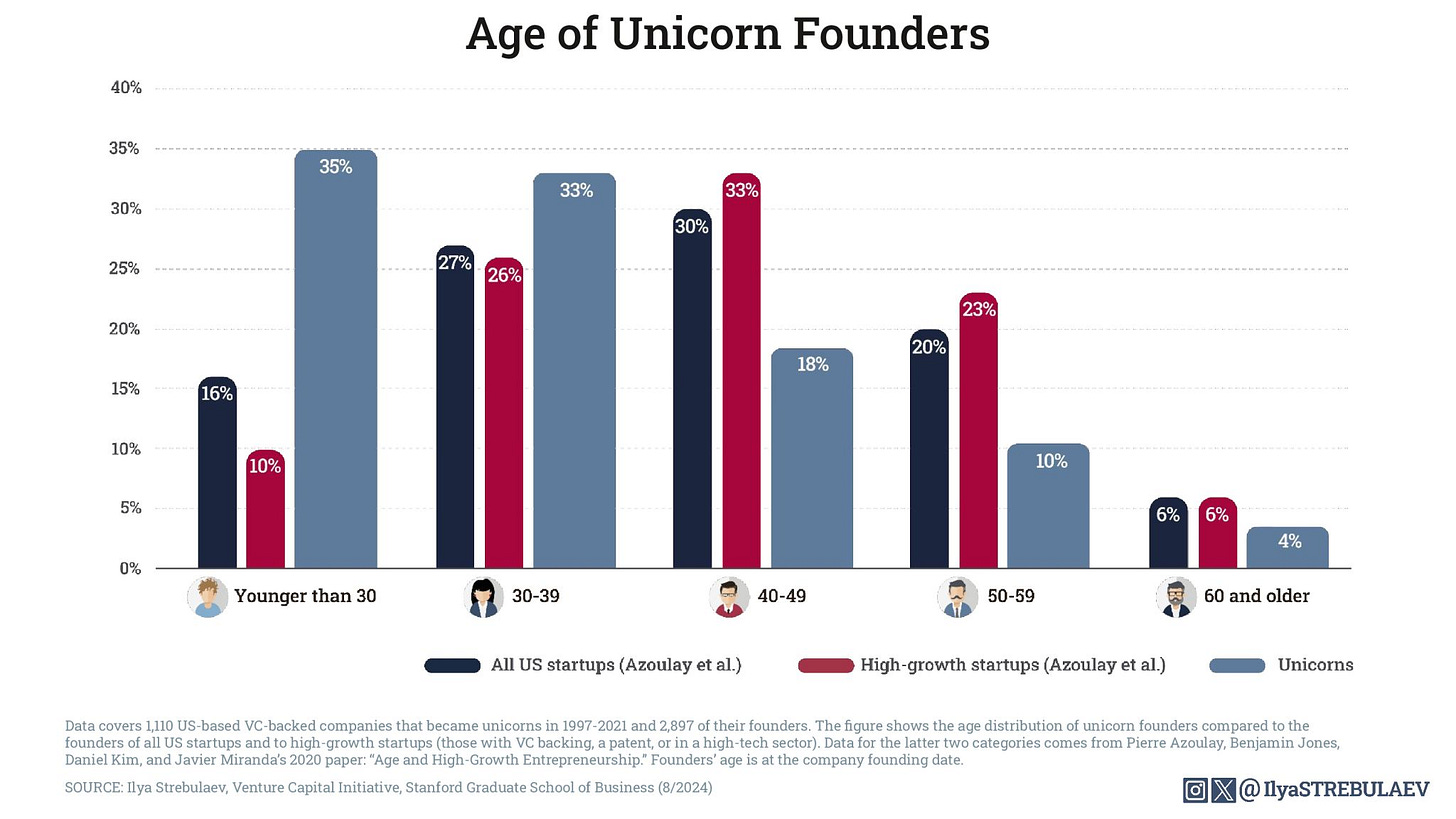

Age of Unicorn Founders and Founder Salaries: Data-driven VC explores trends in unicorn founders’ ages and how their salaries stack up in the startup ecosystem 💰

The Banks That Loaned Musk $13B to Buy Twitter Might Be Having Regrets: TechCrunch delves into the current situation of the banks that financed Elon Musk's Twitter acquisition and the challenges they now face 💼

Bolt’s Audacious Letter to Investors: Newcomer discusses Bolt's bold communication with investors, reflecting on the company's current challenges and future plans 📧

Beyond B2C and B2B: A New Approach to Business Models: Justin Jackson explores a fresh perspective on business models, pushing beyond traditional B2C and B2B frameworks 🛠️

Not a premium subscriber yet? Each week, I share actionable tips and resources for founders and VCs.

These are some articles you may have missed:

Behind $800M in Funding: 25+ Successful Startup Pitch Decks 💰

The confidential YouTube Investment Memo by Sequoia

Term Sheets Demystified 📄🤝

Interesting Reports 📊

State of Pre-Seed Q2 2024: Carta's report on the trends and data from the pre-seed stage in Q2 2024, offering insights into early-stage investment dynamics 📈

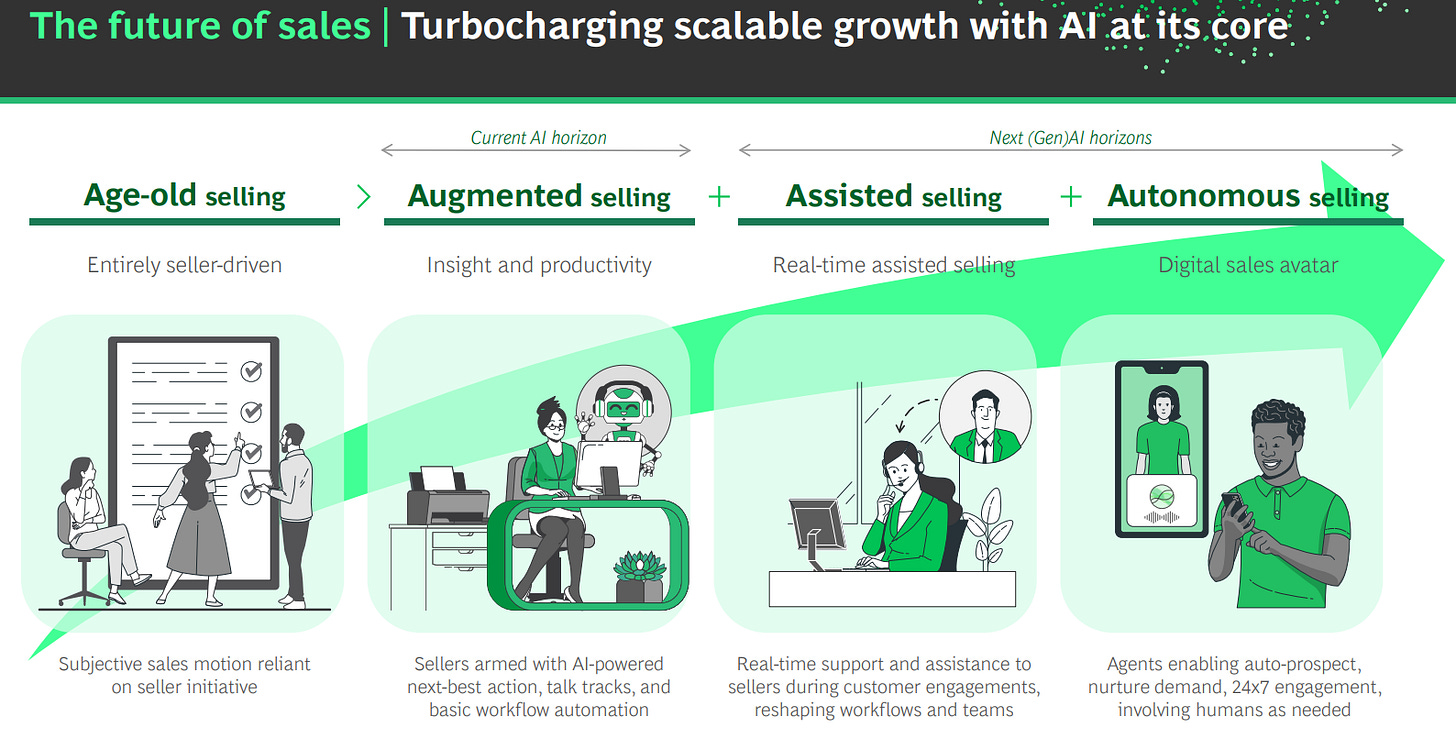

Future of Sales with AI: BCG's Executive Perspectives explore how AI is reshaping the future of sales, offering key strategies for businesses looking to leverage AI in their sales processes 🤖

Want to get your brand in front of 42k founders, investors, executives, and startup operators? Fill out this quick form for details on our sponsorships, and we’ll contact you 📣

Recently Launched Funds 💸

2Gether International announces Summer 2024 MVP cohort to support emerging startups with innovative solutions

Pack Ventures to strengthen innovation at the University of Washington by backing startups and promoting entrepreneurial activities

Nine Realms Venture Capital raises €50 million from EIF for latest fund

Hottest Deals 💥

Fabric Cryptography Raises $33M in Series A Funding to expand operations and its development efforts.

Fortera secures $85 million in Series C funding to to scale the deployment of its low-carbon cement technology that integrates with existing infrastructure.and scale operations

Fresha raises €27.8 million in debt financing to expand its beauty and wellness marketplace

Defcon AI raises $44 million in seed funding to address military logistics challenges

Fortera raises $85 million in Series C funding to scale its carbon capture and cement production technology

The Rounds raises $24 million in Series B funding to expand its sustainable supply chain services

WSPN, a Singapore-based provider of stablecoin infrastructure, raised $30M in Seed funding

VC Jobs 💼

VC Manager @ Samsung Ventures America (Mountain View, CA): Manage venture investments and support portfolio companies at Samsung Ventures America

VC Partner @ NLC (Amsterdam, Netherlands): Lead investment activities and drive growth initiatives at NLC

VC Partner @ Aduna Capital (Nigeria): Oversee investment strategy and portfolio management at Aduna Capital

VC Associate @ KDT (Wichita, KS): Engage in deal sourcing, due diligence, and portfolio management at KDT

VC Vice President @ IvyCap Ventures (Bengaluru, India): Lead investment efforts and support portfolio companies at IvyCap Ventures

VC Principal @ Untrod Capital (Singapore): Manage investments and provide strategic guidance at Untrod Capital

VC Investor @ Iron Key Capital (Remote): Work remotely to identify and evaluate investment opportunities at Iron Key Capital

Senior VC Associate @ B Capital (San Francisco, CA): Support the investment team in sourcing and managing deals at B Capital

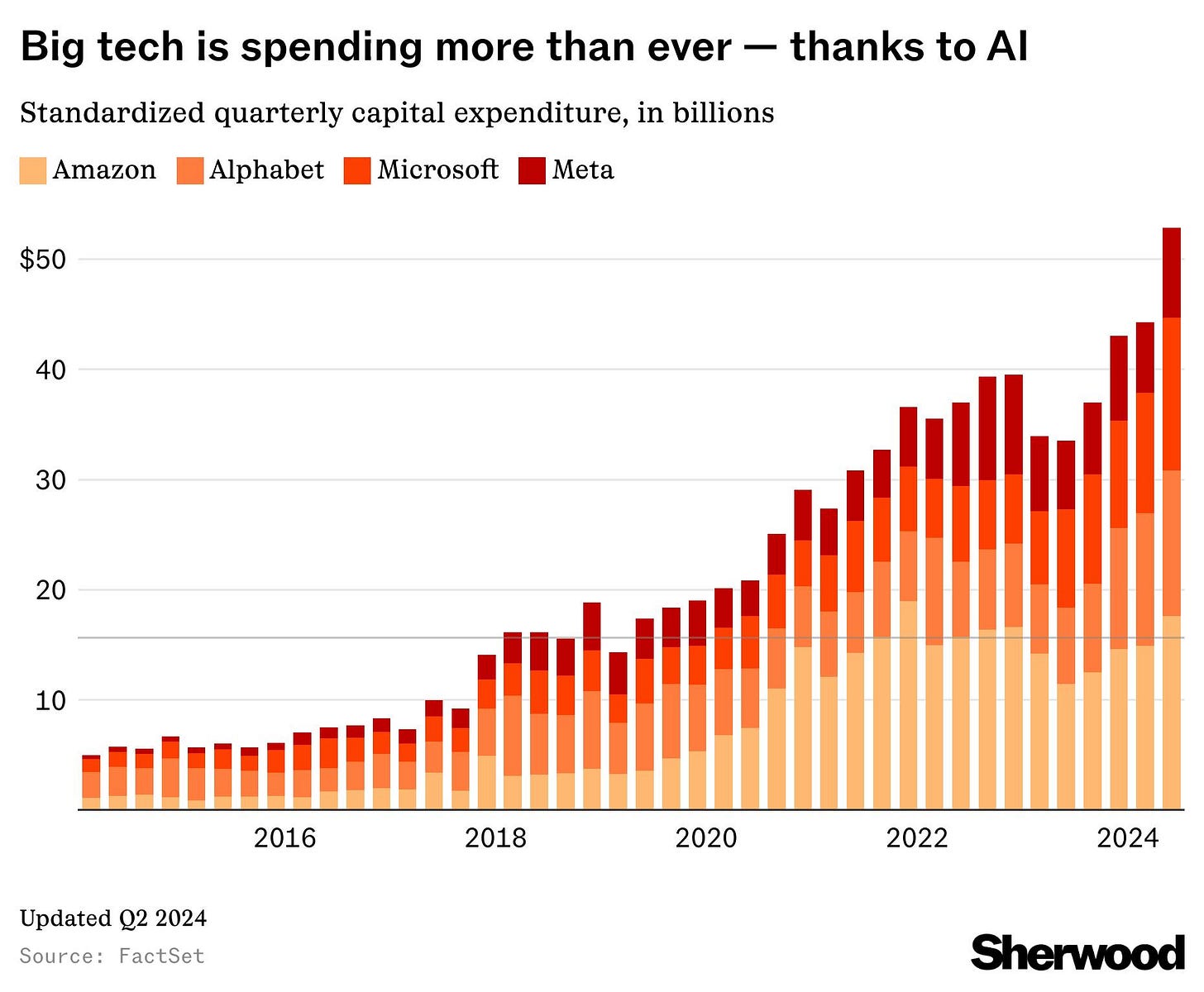

Crazy to see the capex expenditure is not leading to higher revenue growth rates. Maybe that will set the foundation for future growth but still surprised for now