How AI Disrupts Tech Investing🤖, Five Steps to Nail Your Pitch Deck🎯, SaaS Retention📊

Welcome back to The VC Corner, your weekly dose of Venture Capital and Startups to keep you up and running! 🚀

I’m pretty stoked to announce a new Sponsor, Notion for Startups!

We are partnering to offer 3 months of Free Notion (worth $3K) towards a Plus plan and Unlimited AI ✨ for startups in our ecosystem.

If you don’t know Notion, thousands of startups use it to run a wiki, manage projects, share documents, and more.👉 Here’s the link to get it

Select The VC Corner on the partner list.

Then type in your discount code: STARTUP4110P05918

In-Depth Insights 🔍

How AI Disrupts Tech Investing 🤖: Tomas Pueyo explains how AI is reshaping the tech investing landscape, driving change in investment strategies, and creating new opportunities in various sectors

Five Steps to Nail Your Pitch Deck 🎯: A guide to perfecting your pitch deck, focusing on key elements that grab investor attention and secure funding

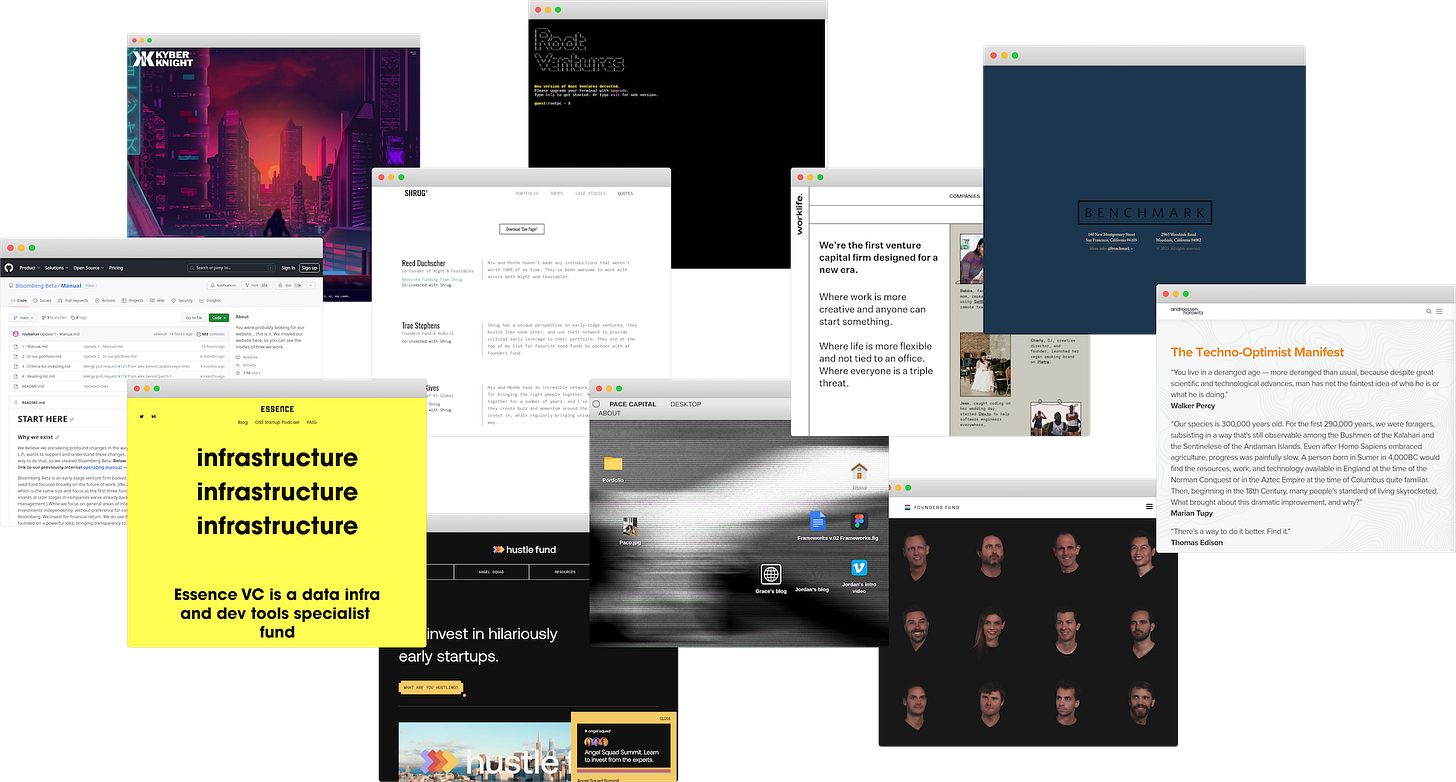

A breakdown of 15+ VC brands 💡 (and why branding matters): VC brands vary greatly. Some are loud. Some are quiet. Some are silly.

The Future of AI Is Vertical 🔧: Bessemer Venture Partners explores how the future of AI will be shaped by vertical integration, reshaping industries with highly specialized AI solutions

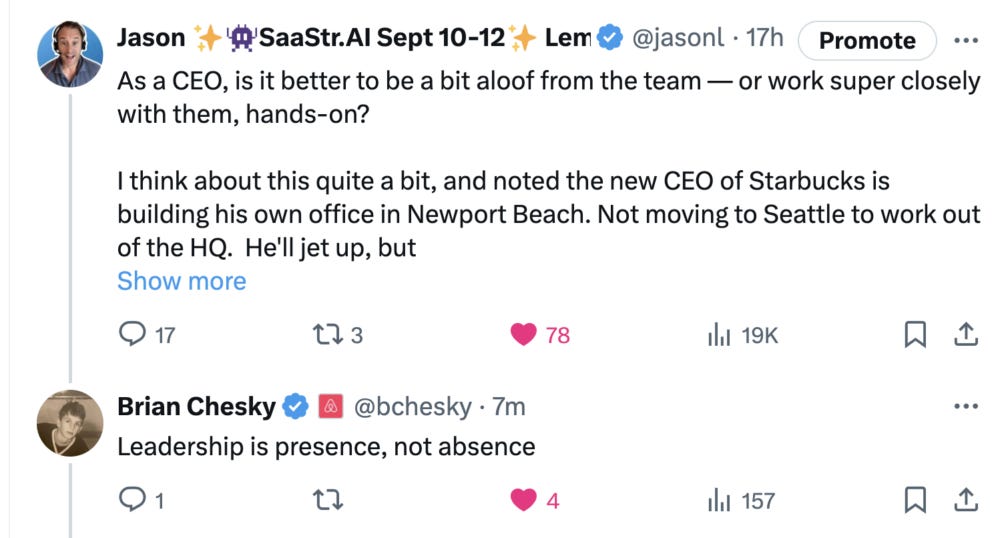

How Aloof Should You Be as a CEO? 🧑💼: SaaStr discusses the delicate balance between being approachable and maintaining authority as a CEO, offering insights on leadership dynamics

How annual pre-pay creates an infinite marketing budget🔄: Dozens of founders have used this technique to transform the cash-flow of their businesses. Now it’s your turn

Venture Capital in China💡: Mainland China, with its political structure, economic culture, and investment habits, plays by its own rules in this otherwise standardized VC world

Each week, I share premium actionable tips and resources for founders and VCs.

These are some articles you may have missed and could have complete access to by upgrading your subscription:

The Ultimate Investors List of Lists 🚀

Behind $800M in Funding: 25+ Successful Startup Pitch Decks 💰

The confidential YouTube Investment Memo by Sequoia 📄

Term Sheets Demystified 🤝

Interesting Reports 📊

SaaS Retention: The New Normal 💻: ChartMogul’s comprehensive report on the shifting landscape of SaaS retention, highlighting new benchmarks and strategies for customer retention in 2024

June 2024 Global Markets Snapshot 🌍: PitchBook’s snapshot of global markets, offering key insights into sector performance and trends in Q2 2024

Want to get your brand in front of 44k founders, investors, executives, and startup operators? Fill out this quick form, and we’ll contact you 📣

Recently Launched Funds 💸

Climate Tech VC Clean Energy Ventures closes new fund to back innovative solutions in clean energy

Chipotle doubles the size of its VC fund, Cultivate Next to $100M to continue investing in innovative startups in the food industry

Wa’ad Investment launches to back growth-stage startups

Set Ventures raises €200M fund to support clean energy and sustainability-focused startups

The AbbVie Foundation and MATTER launch the AbbVie Foundation Health Equity Accelerator to promote innovation in healthcare equity

GGV Capital's Transformation: GGV Capital, once a major player in the venture capital world, has split into two new brands—Inspiration Ventures and Expedition Capital—each focusing on distinct stages of the venture ecosystem

Hottest Deals 💥

Venova Medical raises $30M in Series B financing to advance medical innovations in women's health

Oyster raises $59M in Series D funding to expand its global employment platform

Plug and Play NeoCity welcomes 10 additional startups into its first cohort, supporting innovation in smart cities and infrastructure

Fabric raises $50M to accelerate the development of its on-demand robotics fulfillment technology

Vesta Healthcare raises $65M in financing to expand its home healthcare solutions platform

Sakana AI raises Series A funding to further its development of AI solutions in the seafood industry

You.com secures $50M in Series B to continue scaling its AI-powered search platform

VC Jobs 💼

VC Manager @ Redalpine (London, England): Manage investments, portfolio companies, and strategic initiatives at Redalpine

VC Analyst @ Vireo Ventures (Berlin, Germany): Conduct market research, deal sourcing, and financial analysis for Vireo Ventures

VC Investor @ August Global Partners (Singapore): Source deals, perform due diligence, and manage portfolio investments at August Global Partners

VC Analyst @ MicroVentures (Austin, TX): Support investment activities through research, deal evaluation, and portfolio management at MicroVentures

VC Internship @ Teja Ventures (Singapore): Gain hands-on experience with Teja Ventures’ investment team in Singapore

Senior VC Associate @ Alumni Ventures (Menlo Park, CA): Support investment teams in sourcing deals and managing portfolio companies at Alumni Ventures

VC Principal @ Azolla Ventures (San Francisco, CA): Lead investment strategies, source deals, and support portfolio companies at Azolla Ventures

VC Principal @ Destiny (Remote): Oversee investment strategy and portfolio growth remotely for Destiny

VC Analyst @ KfW Capital (Frankfurt, Germany): Conduct market analysis, evaluate startups, and support portfolio management at KfW Capital

VC Associate @ Four Cities Capital (San Francisco, CA): Support deal sourcing and due diligence while managing portfolio investments at Four Cities Capital

VC Partner @ SG Innovate (Singapore): Lead investment efforts and support deep tech startups in Singapore at SG Innovate

VC Partner @ 500 Global (India): Manage investments and strategic initiatives across India for 500 Global