Musk, Trump, and the VCs Picking Sides ⚔️, Thoma Bravo’s Record $34.4B Fundraise💸, VCs Are Funding 2 Things💡

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, and the hottest deals—here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Vanta:🚀Streamline AI Risk Reviews – Free Template Included

Having trouble assessing AI tools for risk and compliance? Vanta’s AI Security Assessment Template empowers IT and governance teams to accelerate approvals while maintaining robust security and accountability.

✅ Evaluate AI tools before implementation

✅ Stay aligned with GRC best practices

✅ Standardize your internal risk review process

Designed for dynamic security, privacy, and risk teams—scale your AI oversight with confidence.

In-Depth Insights 🔍

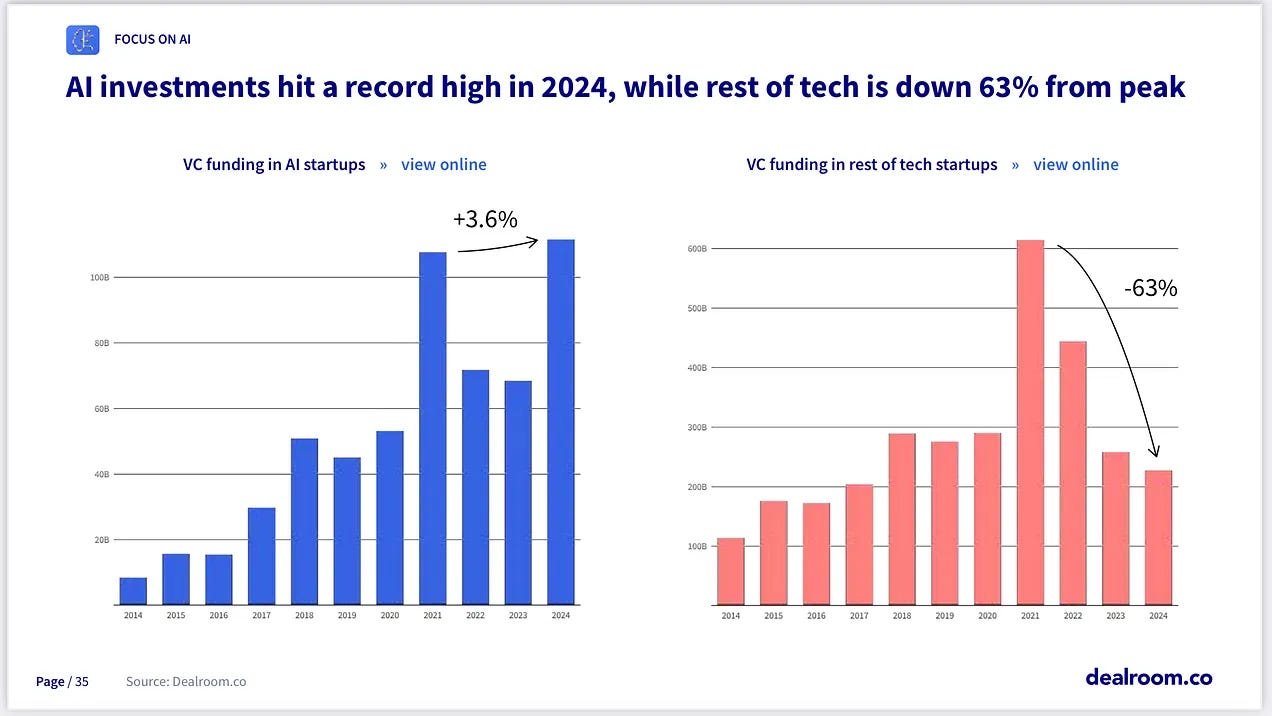

VCs Are Funding Two Things Right Now 💡

Venture capital is doubling down on two sectors: AI and sustainable energy. This shift highlights where the money is moving in the current market. [Monday Morning Meeting]

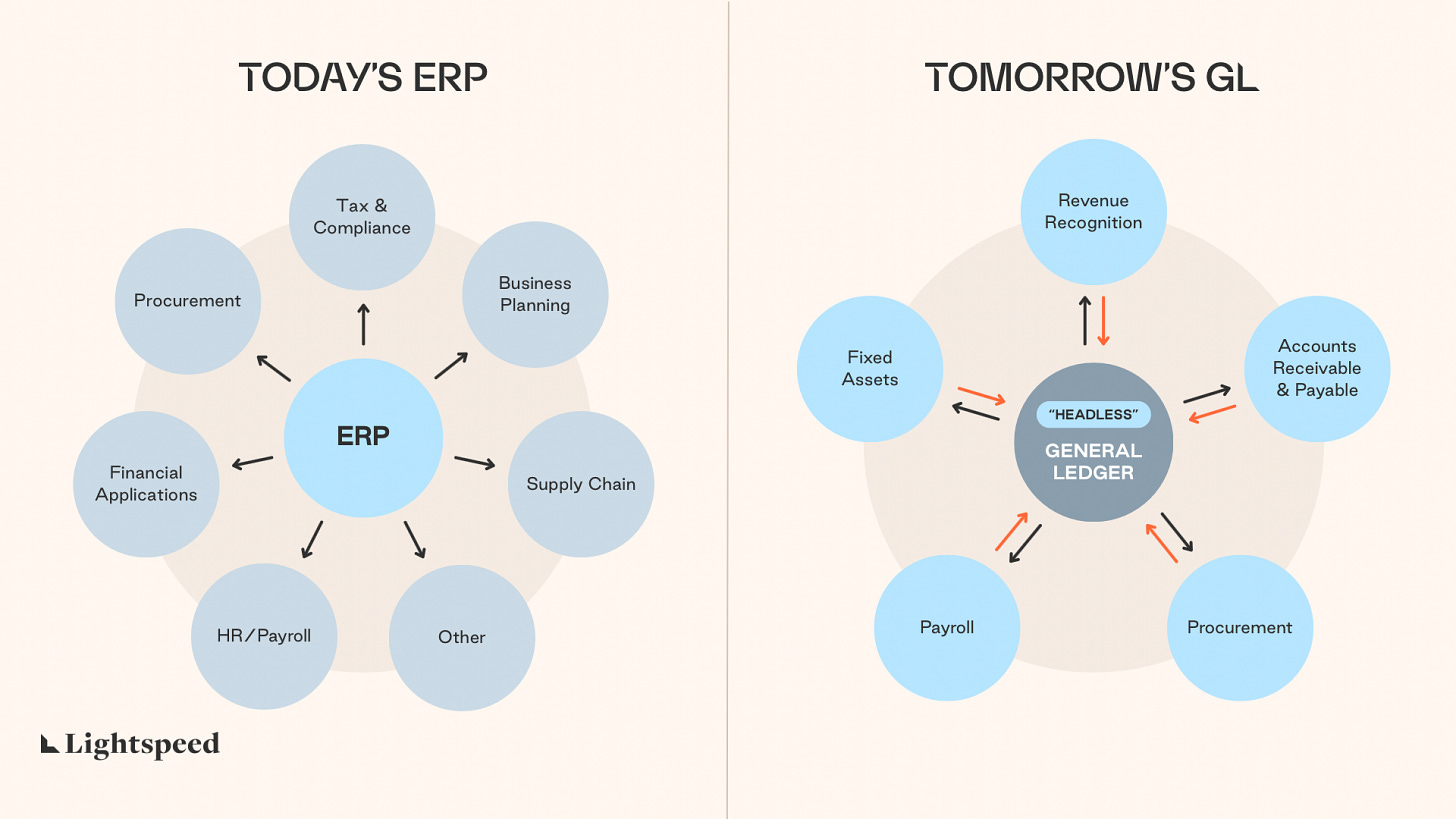

The Great ERP Unbundling 🔄

ERP systems are unbundling, shifting away from all-in-one solutions to specialized tools. This change is driven by the need for more flexibility and faster innovation in enterprise software. [Lightspeed]

Musk, Trump, and the Venture Capitalists Picking Sides ⚔️

Venture capitalists are choosing sides in the Musk-Trump feud. The divide is impacting both tech investments and political influence. [Wired]NATO Innovation Fund Loses Third Partner 💥

NATO’s Innovation Fund faces setbacks as it loses another partner. The challenge now is maintaining momentum in defense tech innovation. [Shifted]Trump Cuts Climate Tech Funding in Europe 🌍

Trump’s cuts to climate tech funding in Europe are raising concerns. The decision impacts key initiatives aimed at combating climate change with new technologies. [Sifted]

Thoma Bravo’s Record $34.4B Fundraise: Great News for B2B and SaaS Founders 💰

Thoma Bravo’s massive $34.4B fundraise signals strong investor confidence in B2B and SaaS. It’s a promising sign for founders looking for growth capital. [SaaStr]

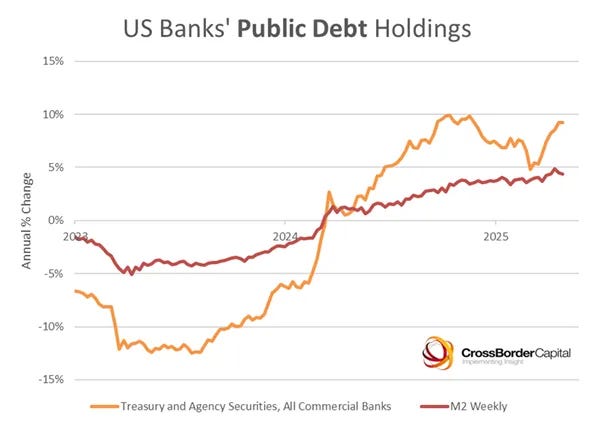

Capital Wars: Economic Risks, Faster Inflation, Rising Asset Prices? 💥

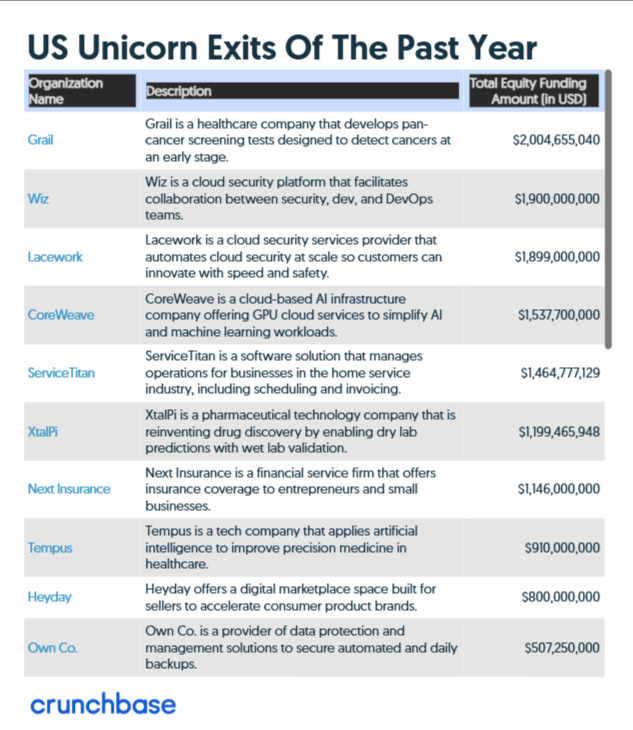

The Fed’s reaction is limited, but the US Treasury may pump liquidity through its own stimulus. This could push asset prices higher, despite a slow-growth, inflationary environment. [Michael Howell]Exits, Unicorn Backlog Shrinks: AI, Cyber, and Health 📉

Exits are increasing as the unicorn backlog clears, particularly in AI, cybersecurity, and health. This points to a rising wave of M&A and IPO activity in these sectors. [Crunchbase News]

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and my other media assets, email: rdominguezibar@gmail.com

Interesting Reports 📊

Bond Capital Releases Comprehensive 340-Slide Report on AI Trends 🤖

Bond Capital’s report shows AI adoption skyrocketing, with ChatGPT’s global reach outpacing the internet’s timeline. Key findings include a 73% human-like recognition rate and a 99% drop in inference costs.StackAI’s 25 AI Agent Use Cases for 2025 💡

It showcases how AI agents can automate complex tasks, from financial analysis to customer support. These use cases highlight AI’s growing role in boosting business efficiency.Europe Tech Update – Q1 2025 🌍

The Q1 2025 update tracks venture activity in Europe, covering major funding rounds and sector trends. It also benchmarks the region’s performance against global standards.

Recently Launched Funds 💸

Harper Court Ventures launches its first fund with $25M to back early-stage ventures in tech and healthcare.

Merlin Ventures has closed its inaugural fund at over $75M, focusing on tech-driven startups.

Cybernetix Ventures plans to raise a $100M fund to support startups in the cybersecurity space.

Mitsubishi Electric has invested in the AT Partners III L.P. fund to advance its interests in tech and manufacturing.

Energize Capital has closed its third fund at $430M to support the energy and industrial tech sectors.

Taste Tomorrow Ventures has launched a $30M fund aimed at the food and beverage industry, focusing on sustainability.

Poland PFR has launched a €150M fund of funds, investing in deep tech ventures across Europe.

Planeteer Capital has raised $54M for its maiden fund, with a focus on environmental and climate tech.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup enthusiasts. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

VC Jobs 💼

Thomson Reuters (New York City, NY): VC Analyst (apply here)

a16z (San Francisco, CA): VC Partner (apply here)

Moderne Ventures (Chicago, IL): VC Internship (apply here)

Unreasonable (Remote): VC Manager (apply here)

Theory Ventures (Remote): VC Investor (apply here)

Construct Capital (Washington, DC): VC Investor (apply here)

Austrade (Washington, DC): VC Director (apply here)

Tempocap (London, England): VC Internship (apply here)

Reimann Investors (Munich, Germany): VC Internship (apply here)

Utum (Munich, Germany): VC Manager (apply here)

Hottest Deals 💥

Payall Payment Systems raised funding from Ventura Capital to scale its payment solutions. (read more)

Signify Bio secured $15M to accelerate biopharma advancements. (read more)

Cosm Medical, raised seed financing to advance its cutting-edge medical technology. (read more)

Flank, secured $10M in funding to scale its cybersecurity solutions. (read more)

Thread AI, raised $20M in Series A funding to enhance its AI-driven solutions. (read more)

Nectar Social raised $10.6M in pre-seed and seed funding to scale its social media platform. (read more)

Crabi, raised $13.6M in funding to grow its auto insurance technology solutions. (read more)

CyberQP, received financing from CIBC Innovation Banking to scale its cybersecurity offerings. (read more)

Swtch Energy, received $4M investment from Constellation Technology Ventures to expand its electric vehicle infrastructure solutions. (read more)

Obt Live secured $2.25M in Series A to scale its live-streaming platform. (read more)

PopID, closed equity financing to boost its biometric identification technology. (read more)

Kohort, completed a funding round to further its efforts in digital education tools. (read more)

Filament Syfter, raised $4.8M in Series A funding to enhance its data-driven software solutions. (read more)

Aeon, secured €8.2M in seed funding to accelerate its AI-powered sustainability solutions. (read more)

Burstverse, raised seed funding to advance its blockchain-based platform for content creators. (read more)

Shield Technology Partners, raised over $100M in initial funding to expand its cybersecurity technologies. (read more)

RESOURCES 🛠️

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 70+ Startup Pitch Decks That Raised Over $1B in 2024

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The 100+ Pitch Decks That Raised Over $2B

✅ Ultimate Investor List of Lists (+5k VCs)

✅ 40 Pitch Decks That Raised Over $460M

✅ The Startup Founder’s Guide to Financial Modeling (7 free templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth (and How to Get Into Them)

✅ The Ultimate Startup & Venture Capital Notion Guide: Knowledge Base & Resources

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox

JUNE’s FORM 👉https://tally.so/r/nWBZ6e