OpenAI Clocks $3.4B in Revenue 🤖, NATO Innovation Fund💸, Future of Work🌐

Welcome to The VC Corner, your weekly dose of Venture Capital and Startups to keep you up and running! 🚀

Unlock the Power of B2B Influence Marketing

B2B influence marketing is HOT right not.

This emerging strategy is proving to be highly effective, offering an average ROI of 6.5x.

Companies like Pipedrive, Clay, or Folk are already seeing impressive results.

With a €5K budget, they achieve 100K impressions and 150 leads.

This channel builds awareness, generates leads, and reduces costs compared to traditional methods.

Marc Richard, CEO at OBVIOUS is a pioneer in this space, working with +50 top brands and +300 B2B creators to harness the potential of B2B influence.

In-Depth Insights 🔍

Venture Capital Distributions and AUM: An analysis of how venture capital distributions are affecting assets under management, with implications for LPs and GPs 📊 [PitchBook]

Annual Prepay for SaaS: Discusses the benefits and strategies of annual prepay models for SaaS businesses, highlighting improved cash flow and customer retention 🔄 [Jason Cohen]

OpenAI Clocks $3.4B in Revenue from ChatGPT Subscriptions: OpenAI has generated $3.4 billion in revenue from ChatGPT subscriptions, reflecting the growing demand for AI-driven solutions 🤖 [Analytics India Magazine]

How the family office became one of the world’s fastest wealth generators. The sector has expanded from a small number of groups to about 15,000 offices worldwide and an estimated $5.9tn in assets 📈 [Financial Times]

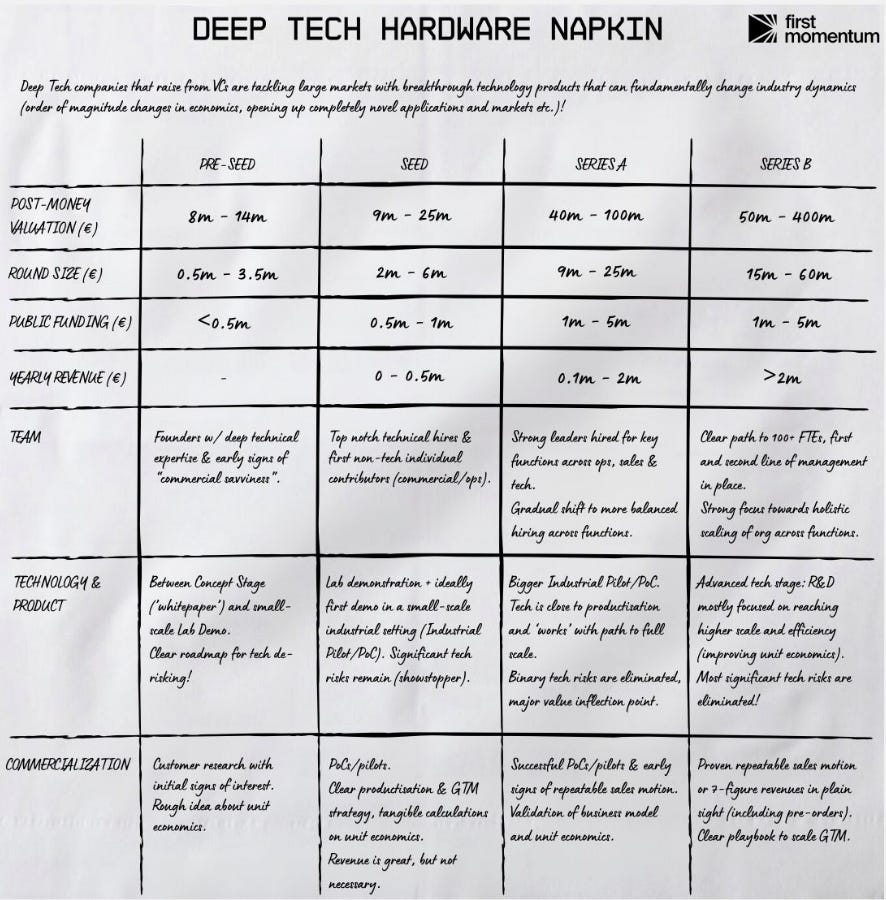

Deep Tech Hardware Napkin: A unique perspective on how deep tech startups can effectively communicate their innovative ideas even with simple tools like a napkin 📝 [First Momentum]

Top 10 Must-Watch Movies for Entrepreneurs: Shares a list of essential movies every entrepreneur should watch for inspiration and valuable lessons 🎬 [Burak Büyükdemir]

A Deep Dive on AI Inference Startups: Examines the technology, market potential, and challenges faced by AI inference startups in the evolving AI landscape 🤖 [East Wind]

Everyone’s Adding AI, But Does It Make a Difference?: Exploring whether integrating AI into products is truly accelerating growth or just a trend 🌟 [SaaStr]

Want to get your brand in front of 36k founders, investors, executives, and startup operators? Fill out this quick form for details on our sponsorships, and we’ll contact you 📣

Interesting Reports 📊

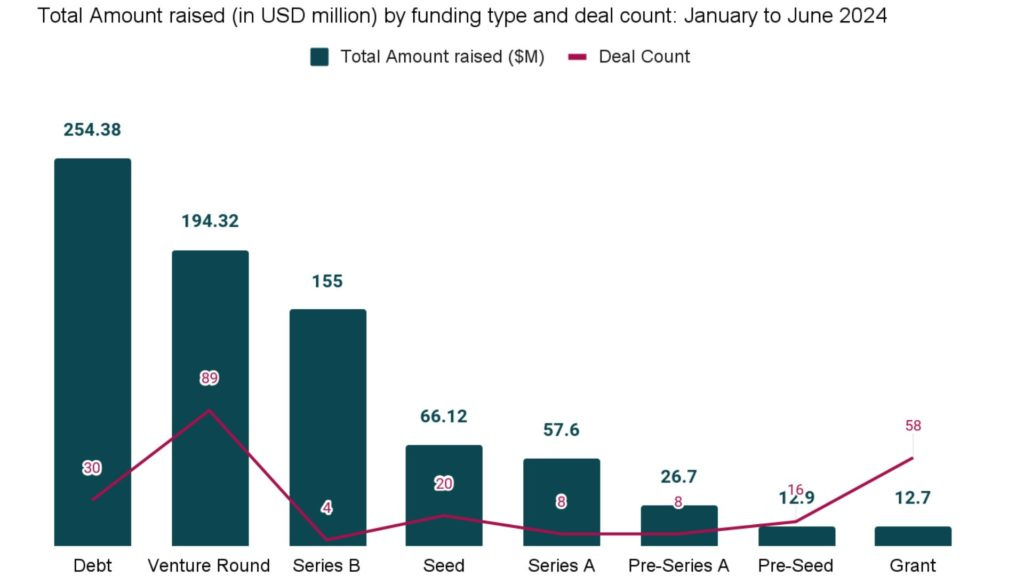

State of Tech in Africa: An in-depth look at the current technology landscape in Africa, highlighting major trends and key players shaping the future of the continent's tech industry 🌍 [TechCabal]

Future of Work 2024: Insights and trends shaping the future of work, with a focus on remote work, digital transformation, and emerging technologies 🌐 [Sifted]

Dealroom France Tech Update: A comprehensive update on the latest trends and key developments in the French tech ecosystem by Dealroom [Clement Aglietta]

Recently Launched Funds 💸

NATO Summit Innovation Fund: Venture capital takes the stage at the NATO summit with a new innovation fund aiming to boost tech advancements and political cooperation in Europe.

Mundi Ventures raises $25M for Latam-focused insurtech. This funding supports innovations in the Latin American insurance technology sector.

Spanish Government Approves €400M Social Impact Fund: The Spanish government has approved a €400 million fund dedicated to social impact investments, aiming to drive positive change and innovation in the social sector.

DFJ Growth raises nearly $1.05 billion for its latest fund, focusing on supporting high-growth technology companies.

NewView Capital targets $700M for venture secondaries. This fund aims to provide liquidity options for VCs and startups.

Hottest Deals 💥

Sequoia Capital's Insider Round for Stripe: Sequoia Capital backs an insider round for Stripe, reflecting continued confidence in the fintech giant's growth and innovation 🏦

Byju's, once valued at $22 billion, now faces insolvency proceedings due to mounting financial troubles 😟

LevelTen Energy secures $65 million in Series D funding to expand its renewable energy marketplace and accelerate global clean energy projects 🌍

Thyme Care has raised $95 million in Series C funding to further develop its oncology care management platform, improving patient outcomes and care coordination 🏥

Cardurion Pharmaceuticals has secured $260 million in Series B financing to advance its cardiovascular disease treatments and expand its clinical programs ❤️

CatalYm raises $150 million in Series D funding to develop innovative cancer immunotherapies and accelerate its clinical trials 🌟

AI Defence Startup Helsing secures $450 million in funding to advance its technology and expand its market presence 🚀

VC Jobs 💼

360 Capital (Paris, France) is seeking a VC Analyst to join their team. The ideal candidate will have strong analytical skills and a passion for venture capital.

Link: https://johngannonblog.com/job/vc-analyst-360-capital-in-paris-france/Dreamcraft Ventures (Copenhagen, Denmark) is looking for an Associate to support their investment activities. This role is ideal for someone with a background in finance or startups.

Nauta Capital (Barcelona, Spain) is hiring a VC Analyst to join their team. The candidate should have a keen interest in early-stage tech investments.

AXA Venture Partners (London, UK) is seeking an Associate to work on investments and portfolio management. The role requires excellent analytical and communication skills.

Speedinvest (Berlin, Germany) is offering an internship opportunity for students or recent graduates interested in venture capital. This is a great way to gain hands-on experience in the industry.

Atlantic Bridge (Dublin, Ireland) is seeking a VC Associate to join their global technology investment firm. This role involves deep tech investments and scaling internationally.

Middlegame Ventures (Luxembourg City, Luxembourg) is looking for a VC Associate to identify, source, and evaluate new investment opportunities across Europe.

Ship2B Ventures (Barcelona, Spain) is hiring a VC Associate to focus on investments in the healthcare vertical, improving the quality of life for vulnerable populations.

3VC (Vienna, Austria) is seeking a VC Associate to join their team, bringing a Silicon Valley-inspired approach to venture capital in Europe.

How do you create these graphs?

Fascinating. The part about OpenAI is surprising, to see such a 3.4 Bn$ revenue developed in such a short time...the question is above all what is the future of such a company which is recording losses of the order of 5 billion this year because of the cost of running ChatGPT! Are they destined to be totally swallowed up by MSFT one day?