Peter Thiel Only Explained Once How to Raise Money. Here It Is:

A rare document from the PayPal and Founders Fund co-founder — the only deck he ever wrote himself, and the lessons that still matter today.

Peter Thiel rarely talks about how to raise money.

But when he does, founders pay attention.

He’s one of the few people alive who’s shaped both sides of venture capital — as a founder and as an investor.

He co-founded PayPal. He wrote Zero to One, one of the most influential startup books ever published.

He backed the first generation of founders who built companies like Facebook, Palantir, and SpaceX.

But what most people don’t know is that more than a decade ago, while running Founders Fund, Thiel shared something extraordinary.

It wasn’t a speech. It wasn’t a book.

It was a pitch deck — an example he wrote himself, showing founders exactly how he believed a startup should communicate its story to investors.

Why This Deck Matters

This is the only time Peter Thiel ever publicly explained what makes a good deck.

And it’s surprisingly practical.

The deck walks through how to tell your story clearly, how to build trust with data, and how to get a meeting instead of a rejection.

It’s a framework for how great founders think.

Thiel’s example is from 2012, but almost everything inside it still applies in 2025.

The market has changed, but the psychology of fundraising hasn’t.

Here’s why it’s worth studying.

What Thiel Gets Right

The deck is built on clarity.

It follows a story founders still get wrong today:

Explain why your problem matters.

Show how your product solves it.

Back it up with data that investors can’t argue with.

Introduce a team that can actually deliver.

That’s it.

No jargon. No buzzwords. No unnecessary slides.

Thiel understood something that most pitch decks forget:

investors don’t want to read your vision. They want to believe your logic.

Every slide in his deck tries to do that.

Every claim is backed by a number or a study.

Every idea has a “why” behind it.

That’s what makes it powerful.

Where It Falls Short

Thiel’s example deck has just eleven slides, and each one is dense with text.

By today’s standards, that’s not ideal.

Modern decks work better when they’re between 17 and 22 slides — shorter on words, longer on visual clarity.

Each slide should make one point, cleanly and quickly.

Headers should tell the story.

Instead of “Team,” say “A Team That’s Built and Exited Together.”

Instead of “Market,” say “A $3B Market Growing 12% a Year.”

Your slides should talk even when you’re not in the room.

Thiel’s deck also merges sections that deserve their own space — like “Problem” and “Solution.”

Separating them gives investors time to understand context before seeing the answer.

Still, even with its flaws, the logic of Thiel’s deck holds up: build a narrative that makes investors nod along before they even reach the last slide.

What Founders Should Take Away

A pitch deck exists to open doors.

Its goal is to spark interest and make investors want to learn more.

The best decks create curiosity through logic and evidence.

They explain clearly what the business does and why it matters.

When you can tell that story in under twenty slides, you give investors something rare — clarity.

The Hidden Artifact of Venture Capital

This deck wasn’t made for a startup.

Peter Thiel created it as a guide for how he wanted founders to pitch him.

It offers a rare look into how one of the sharpest minds in venture capital thinks about persuasion, structure, and storytelling.

For more than a decade, very few people had access to it.

Now it’s available here.

Why I’m Sharing It

After reviewing thousands of pitch decks, it’s hard to find one with this level of precision and reasoning.

Thiel’s version stands out because it’s logical, simple, and timeless.

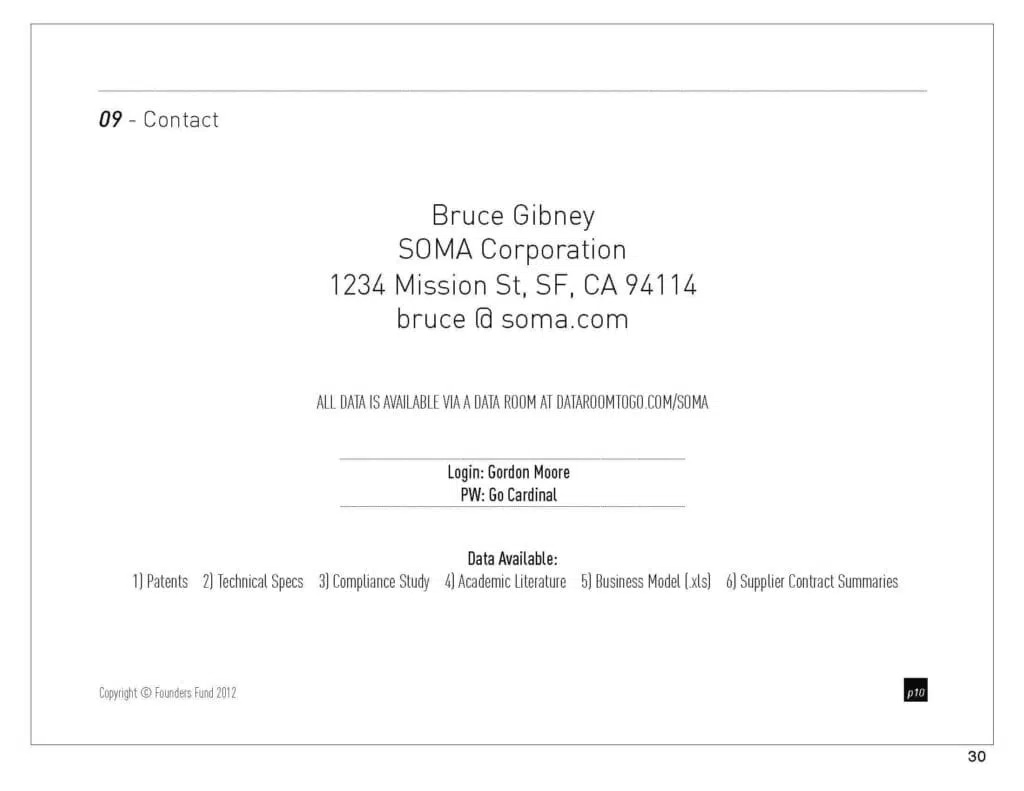

The full original Peter Thiel Pitch Deck is available inside The VC Corner.

It sits behind the paywall because this isn’t something to skim — it’s something to study and apply.

You can take the limited discount and access ALL resources ever shared on The VC Corner.

For founders preparing their next raise, this is a resource worth keeping.

It includes the structure, logic, and insights that continue to influence how top investors evaluate startups today:

Peter Thiel Good Pitch Deck Example

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.