Revenue Retention or Bust 📊, Why Venture GPs Keep Going Solo🧑💼, CVC Units Closed in 2024 📉

BONUS: 70+ Pitch Decks That Raised $1B+ in 2024 (go to the bottom of the article)

Welcome back to The VC Corner, your weekly dose of Venture Capital and Startups to keep you up and running! 🚀

Live Demo: How to streamline ISO 27001 and SOC 2 compliance with automation

Whether you’re a startup founder navigating your first audit or a seasoned security professional scaling your GRC program, proving your commitment to security has never been more critical—or more complex.

That’s where Vanta comes in.

Businesses use Vanta to establish trust by automating compliance needs across over 35 frameworks like ISO 27001 and SOC 2, centralise security workflows, complete questionnaires up to 5x faster, and proactively manage vendor risk.

Join the live demo on 16 January to see it in action and get your compliance questions answered.

In-Depth Insights 🔍

2025: Revenue Retention or Bust 📊

A sharp look at revenue retention strategies, underscoring their critical role in driving startup resilience and scalability. [OnlyCFO]

Optimism Infrastructure 🌱

Why the stories of Europe’s builders need to be amplified. Exploring the intersection of optimism and infrastructure.

CVC Units Closed in 2024 📉

A detailed analysis of the corporate venture capital units that shuttered operations in 2024 and what it means for the ecosystem.

Why Venture GPs Keep Going Solo 🧑💼

Dive into the rising trend of general partners launching solo ventures and the motivations behind these shifts. “Everything falls on him or her. Their name is their brand, not the name on the door.”

📣Want to get your brand in front of 150k founders and investors?

If interested in sponsoring The VC Corner, reach out via email: rdominguezibar@gmail.com

Interesting Reports 📊

Global Venture Capital Outlook 💡

An overview of key trends shaping the global venture capital market, highlighting areas of growth and strategic opportunities.

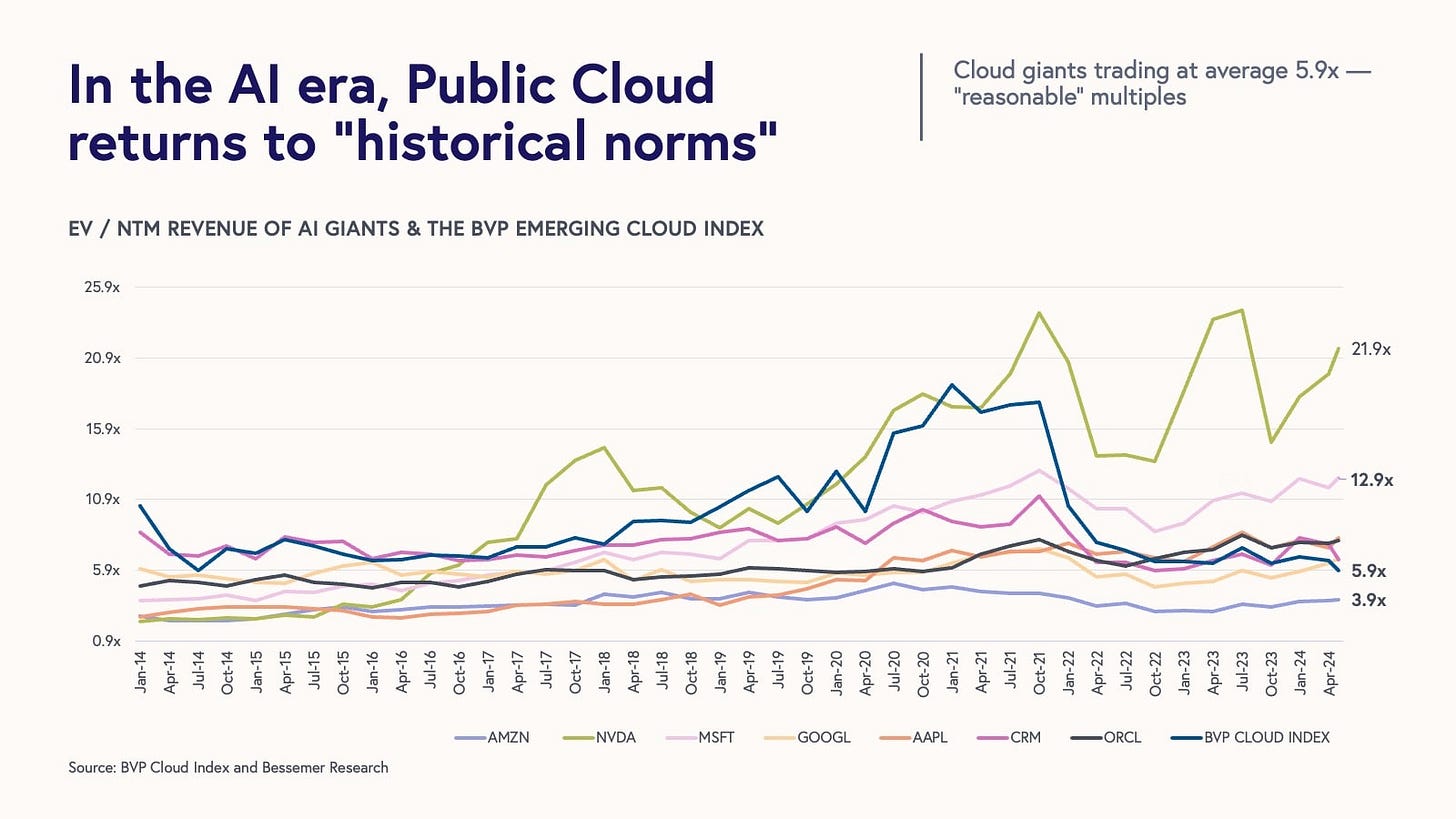

State of the Cloud 2024. The Legacy Cloud is dead — long live AI Cloud! ☁️

Bessemer Venture Partners' annual deep dive into cloud computing, exploring the market's evolution and future projections.

SaaS Retention: The New Normal 🔄

ChartMogul's report on SaaS retention trends, focusing on customer behavior, revenue patterns, and strategies for sustainable growth.

Recently Launched Funds 💸

Coliseum launches a $2M fund to invest in Web3 gaming projects, emphasizing innovation in blockchain-powered entertainment.

Hashkey Chain unveils a $50M Atlas Grant Program to support early-stage blockchain and Web3 initiatives.

Redesign Health secures $175M for healthcare innovation, accelerating the development of transformative health tech solutions.

Scientifica Venture Capital announces a €200M fund to back cutting-edge ventures in science-driven technology sectors.

Beam Ventures debuts its first gaming-focused venture fund and accelerator in Abu Dhabi to foster the gaming and eSports ecosystem.

Morph introduces a venture capital collective aimed at pooling resources for diverse, innovative startup investments.

VC Jobs 💼

Village Capital - VC Manager, Washington, DC

NYS Innovation Fund - VC Director, Buffalo, NY

Alpaca VC - VC Associate, Alberta, Canada

Amex Ventures - VC Analyst, New York City, NY

Mighty Capital - VC Internship, Remote

Datadog - Corporate Development Lead, New York City, NY

New Catalyst - VC Investor, Washington, DC

Joyance Partners - VC Associate, San Francisco, CA

GTM Fund - VC Associate, Vancouver, Canada

Hottest Deals 💥

Veradermics, a New Haven, CT-based clinical-stage aesthetics and dermatology-focused biopharmaceutical company, raised $75M in Series B funding (read here)

Angitia Biopharmaceuticals, a Woodland Hills, CA-based biotech focused on serious musculoskeletal diseases, raised $120M in Series C funding (read here)

Ayar Labs, a San Jose, CA-based company which specializes in optical interconnect solutions for large-scale AI workloads, raised $155M in Series D funding (read here)

Crusoe, a San Francisco, CA-based vertically integrated AI infrastructure provider, raised $600M in Series D funding, at $2.8 Billion valuation (read here)

Kaymbu, a Boston, MA-based provider of a classroom documentation and family engagement platform for early childhood education, received a growth funding from Decathlon Capital Partners (read here)

Flare, a Montreal, Canada-based threat exposure management (TEM) company, raised $30M in Series B funding (read here)

KAST, a financial technology platform built on stablecoins to deliver a neobank-style experience, has raised US$10 million in seed funding (read here)

Carbogenics, an Edinburgh, Scotland, UK-based company which specializes in sustainable biochar technology, raised nearly GBP500K in funding (read here)

Aisti, a Jyväskylä, Finland-based technology company focused on developing acoustic tiles made of renewable wood fibres, raised €29M in Series A funding (read here)

Fleet Space Technologies, an Adelaide, Australia-based space exploration company, raised USD$100M in Series D funding, at USD$525M valuation (read here)

BONUS: 70+ Pitch Decks That Raised $1B+ in 2024🎁

Ever wondered how top startups secure massive checks from investors? Here’s your chance to learn from the best.

What’s inside?

70+ pitch decks curated by Maximilian Fleitmann from startups that raised over $1 billion this year.

Subscribe now (possibility of taking the free trial) to unlock 70+ pitch decks and get ahead in your fundraising journey.

You can take advantage of a limited 25% discount as we celebrate the end of the year and how we went from 0 to 60k subscribers in 12 months

Access the 70+ pitch decks below 👇

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.