Rubrik IPO: Lessons From a $5.6 Billion Milestone 📊

How a Data Security Pioneer Made Its Public Debut and What Founders Can Learn

The Rubrik IPO in April 2024 marked a pivotal moment for the data security sector. Priced at $32 per share, Rubrik raised $752 million and reached a valuation of $5.6 billion. By the end of its first trading day on the New York Stock Exchange, Rubrik's shares surged 16%, reflecting the rising demand for cybersecurity solutions in an increasingly digital world.

Rubrik’s journey to its IPO is not just a financial milestone—it’s a masterclass in resilience, market timing, and adapting to industry shifts. This article unpacks the Rubrik IPO, its key numbers, and the strategies that propelled the company to success. For founders and VCs alike, Rubrik offers a playbook for scaling in high-demand sectors.

The IPO Details: Breaking Down Rubrik’s Market Entry

Rubrik’s IPO was one of the most anticipated tech offerings of 2024. Here’s a quick snapshot of the key metrics:

Ticker: RBRK

IPO Price: $32 per share

Shares Sold: 23.5 million

Proceeds Raised: $752 million

Valuation: $5.6 billion

First-Day Closing Price: $37 (16% above IPO price)

The offering, led by Goldman Sachs, placed Rubrik squarely on the New York Stock Exchange, positioning it as a leader in cybersecurity. This move comes as enterprises are increasingly focused on protecting their digital assets against sophisticated cyber threats.

Why Rubrik IPO Stands Out

1. A Strong Product-Market Fit in Cybersecurity

Rubrik’s flagship solution, the Rubrik Security Cloud, provides an integrated platform to secure data across private clouds, enterprise networks, and SaaS applications. Unlike traditional backup systems, Rubrik’s platform is built on Zero Trust architecture, which automates threat detection, enforces data policies, and orchestrates rapid recovery after an attack.

Why it Matters: With ransomware attacks on the rise, Rubrik addresses a growing, mission-critical need for businesses of all sizes.

2. Transition to a Cloud-Native, Subscription-Based Model

Rubrik’s evolution from an on-premises backup provider to a subscription-driven, cloud-native platform is one of the most remarkable aspects of its story.

FY 2024 ARR: $784 million, up 47% year-over-year.

Cloud ARR Growth: 119% year-over-year.

Subscription Revenue: 91% of total revenue by 2024, compared to 59% two years earlier.

This predictable revenue stream appealed to investors, underscoring Rubrik’s ability to adapt and lead in a rapidly changing market.

3. Backing From Industry Leaders

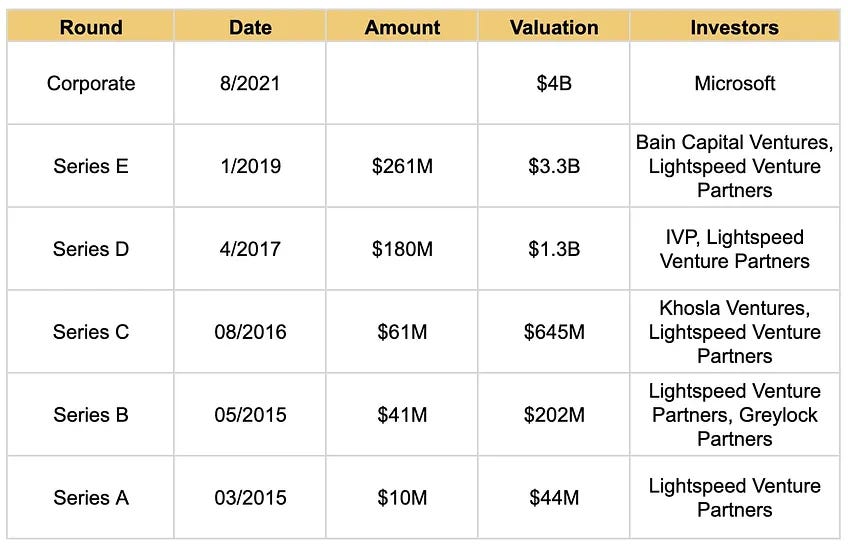

Rubrik’s strategic partnerships and backing from notable investors added significant momentum:

Microsoft: Invested during Rubrik’s Series E round in 2021, integrating its solutions into Microsoft’s ecosystem.

Lightspeed Venture Partners & Greylock Partners: Lightspeed held 25% of Rubrik’s voting power pre-IPO, highlighting the role of early-stage support in scaling growth.

Post-IPO Performance: Navigating Market Volatility

The Rubrik IPO debut was a success, but the journey didn’t end there. The expiration of the IPO lock-up period in September 2024 led to a temporary 6% dip in share prices as insiders sold shares. However, Rubrik demonstrated resilience with its second-quarter earnings:

Revenue: $205 million, beating analysts’ expectations of $196.2 million.

Adjusted Loss Per Share: $0.40, narrower than the projected $0.49.

Rubrik’s CEO, Bipul Sinha, emphasized the company’s ability to help enterprises recover from cyberattacks, a testament to the real-world impact of its solutions.

Lessons for Founders From the Rubrik IPO

1. Build for Critical Problems

Rubrik’s success stems from solving a mission-critical issue: securing enterprise data in an era of escalating cyber threats. Founders should aim to address problems with growing urgency and high stakes.

2. Embrace Business Model Transitions

Rubrik’s shift to a subscription-based model enabled it to capture recurring revenue and scale predictably. Flexibility and willingness to pivot are key for startups navigating market changes.

3. Time Your IPO Strategically

Rubrik capitalized on renewed investor interest in tech IPOs. Timing matters—companies should align their readiness with favorable market conditions.

4. Focus on Sustainable Metrics

Rubrik’s high net retention rate (133%), strong ARR growth, and shift toward subscription revenue proved to investors that its growth was both scalable and sustainable. Founders should prioritize metrics that reflect long-term stability.

What VCs Can Learn From Rubrik’s IPO

The Rubrik IPO reinforces the value of backing companies in high-demand sectors like cybersecurity. Key takeaways for VCs include:

Support Through Transitions: Helping portfolio companies pivot toward scalable models (e.g., cloud-native, subscription-based).

Invest in Pain Point Solutions: Cybersecurity’s growth demonstrates the importance of solving massive, urgent problems.

Prioritize ARR Growth: Investors are drawn to companies with predictable, recurring revenue streams.

What’s Next for Rubrik?

Rubrik’s IPO is just the beginning. Its future hinges on:

Scaling Efficiently: Balancing growth with operational discipline.

Defending Market Share: Competing against rivals like Cohesity and Commvault.

Global Expansion: Extending beyond its U.S. stronghold to capture international markets.

As enterprises face growing data security challenges, Rubrik’s innovative approach positions it as a leader in the cybersecurity landscape.

Closing Thoughts

The Rubrik IPO isn’t just a financial milestone—it’s a case study in building and scaling a business to address mission-critical needs. For founders, it offers a blueprint for sustainable growth, from mastering subscription revenue to navigating IPO readiness. For VCs, it highlights the opportunities in backing companies solving large, high-growth problems like cybersecurity.

As the demand for robust data security grows, Rubrik’s ability to innovate and lead will determine its trajectory. Its IPO is a testament to the power of resilience, adaptability, and solving the challenges that matter most.