SpaceX: how to Build and Pitch the most ambitious company of our time

What founders can learn from SpaceX’s strategy, narrative, and their 2017 deck

At the end of this article, we’re sharing a SpaceX deck from 2017 that has been circulating privately among founders and investors. It’s one of the clearest examples w’ve seen of how a company with extreme ambition explains itself without overexplaining.

Before getting there, it’s worth understanding why SpaceX’s story works so well.

What SpaceX actually got right

SpaceX didn’t win because it had better slides, better branding, or a louder vision. It won because it picked the right constraint to obsess over.

From the beginning, the company focused on one idea that mattered more than everything else: cost per kilogram to orbit.

That single metric influenced every decision that followed, from reusability to vertical integration to launch cadence. Once you see that, a lot of SpaceX’s strategy stops looking bold and starts looking obvious.

Great companies usually work like this. They find the variable that actually matters and organise the entire organisation around it.

The narrative mistake most founders make

Most founders explain what they’re building.

SpaceX explains what changes if they succeed.

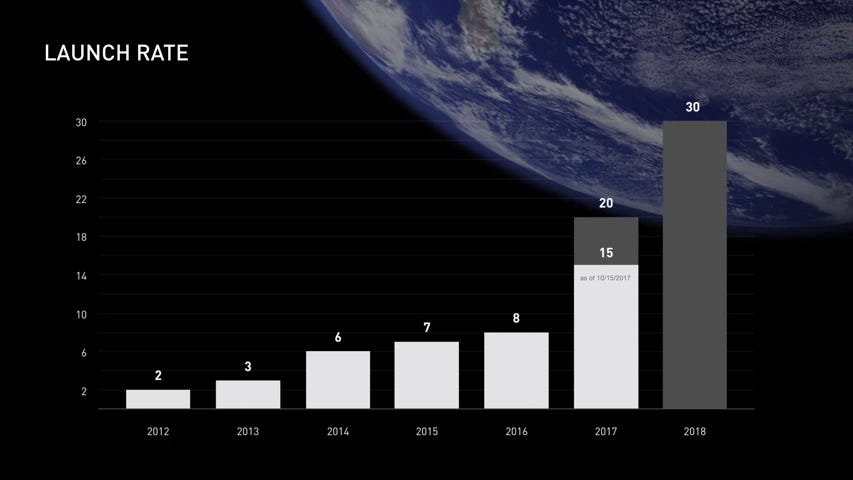

Instead of leading with technology, they lead with outcomes: cheaper access to space, more frequent launches, and eventually, infrastructure that makes things like satellite internet and deep-space missions economically viable.

That framing matters because investors fund trajectories.

When you understand the direction a company is moving in, you’re more willing to tolerate uncertainty along the way.

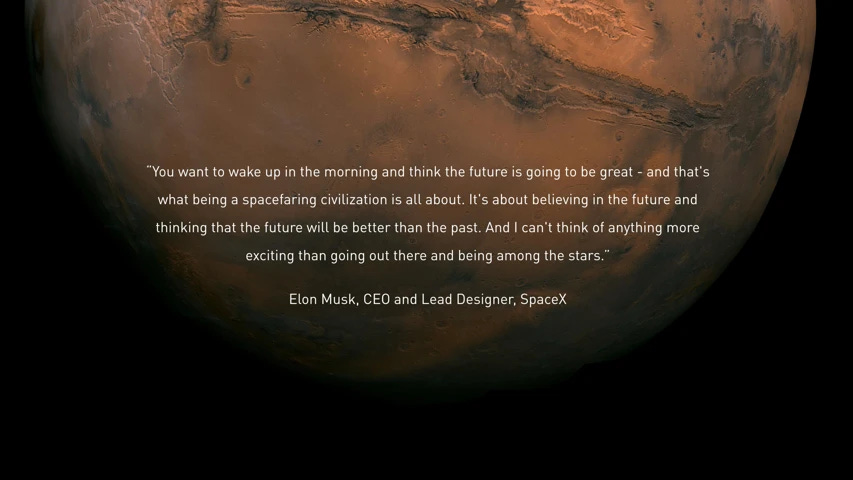

Vision without losing credibility

Long-term vision is risky. Talk too far into the future and you lose credibility. Stay too close to today and you cap your upside.

SpaceX manages this tension better than almost any company I’ve studied.

The trick is sequencing.

Near-term milestones are concrete and testable. Medium-term goals expand the market. Long-term vision pulls everything forward without being used to justify today’s execution.

That’s why talking about Mars doesn’t feel like science fiction in a SpaceX context. It feels like a direction, not a promise.

What investors actually latch onto

Behind the ambition, the story is surprisingly grounded.

Investors focus on a few things:

• A clear economic lever

• Evidence that costs fall with scale

• Milestones that reduce technical risk

• A path where each step makes the next one easier

SpaceX consistently shows how progress compounds. Reusability lowers cost. Lower cost increases demand. More launches improve reliability. Reliability unlocks new markets.

That loop is what makes the story believable.

Lessons founders can steal immediately

You don’t need to build rockets to apply this.

A few takeaways that translate well to startups:

• Anchor your story around the one variable that really matters

• Explain the future first, then work backwards

• Show how progress compounds, not just what improves

• Use long-term vision as direction, not justification

• Make milestones do the work instead of promises

If your pitch needs many explanations to feel convincing, it’s usually a signal that the core insight isn’t sharp enough yet.

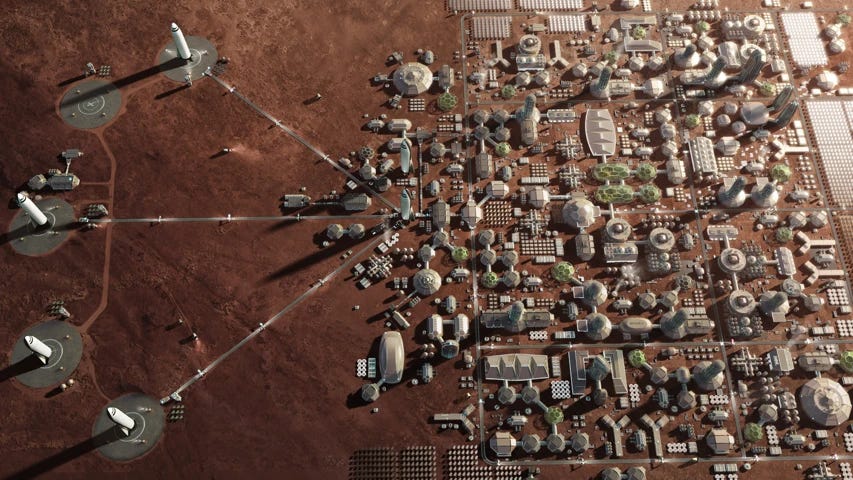

the 39 slides SpaceX deck 🚀

As promised, below I’m sharing a SpaceX deck from 2017. Definitely one of the best decks I’ve seen ever.

It’s not interesting because of design or visuals. It’s interesting because of what it chooses not to explain, how clearly it frames trade-offs, and how little effort it takes to understand where the company is going.

If you’re building something ambitious, this is worth studying slowly.

Not to copy it.

But to recalibrate what “clarity” actually looks like at the highest level 👇

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.