the 8 Cap Table Commandments every founder should learn early

+ a downloadable Excel Template

Most founders don’t think seriously about their cap table until an investor asks to see it.

By then, the mistakes are already baked in.

A cap table defines ownership, incentives, dilution, and how future rounds and diligence play out.

I’ve seen many strong companies struggle, not because the product was weak or the market was small, but because early equity decisions compounded in ways no one had modeled properly.

Instead of another long explainer, this article is a short, opinionated set of rules. Think of them as commandments. They are simple, but ignoring them tends to be expensive.

The Cap Table Commandments

1. Build your cap table the day you incorporate

Not when you raise. Not when lawyers ask. From day one, you should be able to see who owns what today and what that ownership could look like after future rounds.

Early clarity prevents late surprises.

2. Always model the future, not just the present

A cap table that only shows current ownership is incomplete. You should be able to answer questions like: What happens after SAFEs convert? What does dilution look like after two more rounds? What if the option pool expands again?

If your cap table cannot answer “what happens next,” it’s not doing its job.

3. Treat SAFEs as real dilution before they convert

They may not appear as shares yet, but economically they already exist. Ignoring them creates a false sense of ownership that usually disappears right before a priced round.

Good founders model SAFEs early and assume they will convert in the least flattering way.

4. Assume the option pool will be topped up again

Because it almost always is.

Founders often think of the option pool as a one-time decision. In reality, it tends to expand at each major round. Planning for that early avoids painful renegotiations later.

5. Keep one single source of truth

Multiple versions of a cap table are a silent red flag. Investors notice immediately, and it raises questions about discipline and governance.

One clean version, always updated, always consistent.

6. Use legal names and clean structure from the start

Small inconsistencies seem harmless early, but they compound during diligence. Clean naming, consistent entities, and clear security types save time, money, and trust later on.

7. Never grant equity without modeling the long-term outcome

Every equity decision should be modeled across future rounds. If you cannot explain what a grant looks like after Series A and Series B, you are making the decision blind.

Equity is permanent. Treat it that way.

8. Dilution is a decision, not an accident

You cannot avoid dilution, but you can choose when it happens and under what assumptions. Founders who model this early make calmer, better decisions under pressure.

What premium subscribers unlock in this article

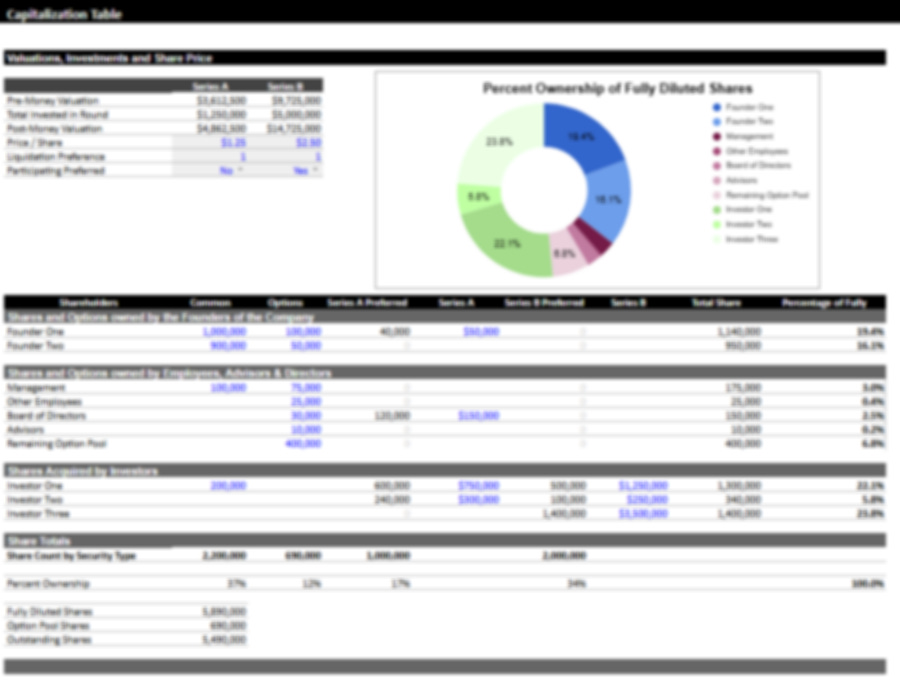

• A cap table template you can use immediately

• A structure designed to model SAFEs, option pools, and future rounds clearly

• Practical guidance on keeping your cap table clean as the company grows

On top of that, premium subscribers get full access to The VC Corner private library, including:

• 50+ founder resources already published

• Pitch decks, financial models, and fundraising tools

• Cap table, runway, and dilution templates

• Investor lists and operating playbooks

• All future resources published while you’re subscribed

If you want the Cap Table template and the full library, it’s right below 👇

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.