State of Private Markets Q3 2024 📊, How to Value a Startup 🧮, Risk of AI's Failure ⚠️

Welcome back to The VC Corner, your weekly dose of Venture Capital and Startups to keep you up and running! 🚀

MECO - Enjoy newsletters in a space designed for reading

Some of you have mentioned that my newsletter sometimes ends up in your spam folder or gets mixed up with your work and personal emails, causing you to miss an issue now and then.

I’ve found a great solution to this problem. It’s an app called Meco that organizes all your newsletters in one place, ensuring you never miss out.

The app is completely free and packed with features designed to supercharge your learnings from your favorite writers.

Become a more productive reader and cut out the noise with Meco - try the app today!

In-Depth Insights 🔍

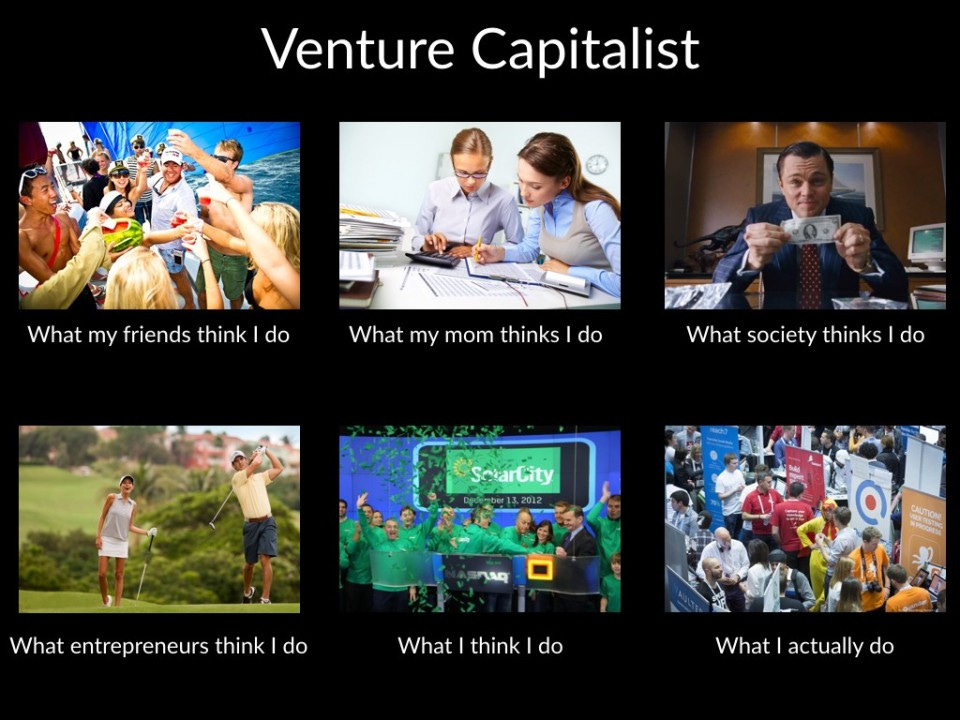

I Forced My Way into VC 🚪

A personal story on breaking into venture capital without traditional credentials, showing the grit and strategies needed to stand out in a competitive industry.

Time Dislocations in Venture Capital ⏳

Exploring how venture capital deals often operate in “time dislocation,” where funding cycles and business growth timelines rarely align.

The Real Risk of AI's Failure ⚠️

Reflections on AI's potential risks—not in causing mass unemployment, but in creating inequality, loss of human connection, and accountability challenges.

29 business moats that helped shape the world’s most massive companies 🌍

From Amazon and Tesla to Starbucks and Coinbase, here is how 29 of the world's biggest companies have built and defended their moats.

Why AI Won’t Cause Unemployment 🤖

Marc Andreessen argues that AI will enhance productivity rather than displace jobs, transforming industries while creating new types of work.

📣Want to get your brand in front of 120k founders and investors?

If interested in sponsoring The VC Corner, reach out via email: rdominguezibar@gmail.com

Interesting Reports 📊

State of Private Markets Q3 2024

Carta’s Q3 report highlights shifts in private markets, focusing on trends in fundraising, valuations, and liquidity.

How to Value a Startup 🧮

Traditional methods like DCF fall short for startups. Innovative approaches such as Real Options and the VC Method better capture growth potential and strategic flexibility.The State of Impact Startups and VC 2023 🌍

A look at impact-focused startups and VC trends, showing growth in sustainability, social impact, and innovation investments.

Recently Launched Funds 💸

Shamrock Capital has raised $1.6B for two new investment funds, aiming to further expand its media and entertainment portfolio.

Axeleo Capital launched a €50M FOAK fund, targeting innovative climate tech startups across Europe.

Emerge VC has raised a fresh fund with a focus on the growing edtech sector, looking to support transformational education technologies.

Genius Ventures secures $100M to invest in tech and entertainment projects, with a focus on advancing digital content and media innovation.

BYND Venture Capital has launched a €40M fund to support tech startups across the Iberian Peninsula, focusing on early-stage innovation.

Emerge has closed a $73M Fund II, aiming to invest in high-growth potential startups across various sectors.

4impact Capital has closed a €68M Fund II to support digital innovation and sustainability initiatives across Europe.

VC Jobs 💼

Disruptive Ventures – VC Associate in Stockholm, Sweden

TCD Capital – VC Internship in Brussels, Belgium

Allocator One – VC Associate in London, England

Fable Investments – VC Internship in Paris, France

Liquidity Group – Head of Community in London, England

Altos Ventures – VC Investor in Burlingame, CA

Carbon Equity – VC Analyst in Amsterdam, Netherlands

Hottest Deals 💥

Ualá raises $300M in Series E funding led by Allianz X, strengthening its position in Latin America's fintech space.

Cogna secures $15M to advance AI-driven enterprise software solutions.

BlackBuck prepares for IPO with a valuation cut amid tough market conditions.

WeRide, a Chinese self-driving company, raises $120M, paving the way for its upcoming U.S. IPO.

Fintech Klarna files for IPO in US

Nuvei Corporation acquires Payaut BV, expanding its presence in the European payments sector.