The End of SaaS⚡, Fintech Trends Q3 2024💳, Optionality in Venture Funds💡

Welcome back to The VC Corner, your weekly dose of Venture Capital and Startups to keep you up and running! 🚀

I’m pretty stoked to share a collab with Notion for Startups!

We are partnering to offer 6 months of Free Notion (worth $6K) towards a Plus plan and Unlimited AI ✨ for startups in our ecosystem.

If you don’t know Notion, thousands of startups use Notion to run a wiki, manage projects, share documents, and more.

Select The VC Corner on the partner list.

Then type in your discount code: STARTUP4110P05918

In-Depth Insights 🔍

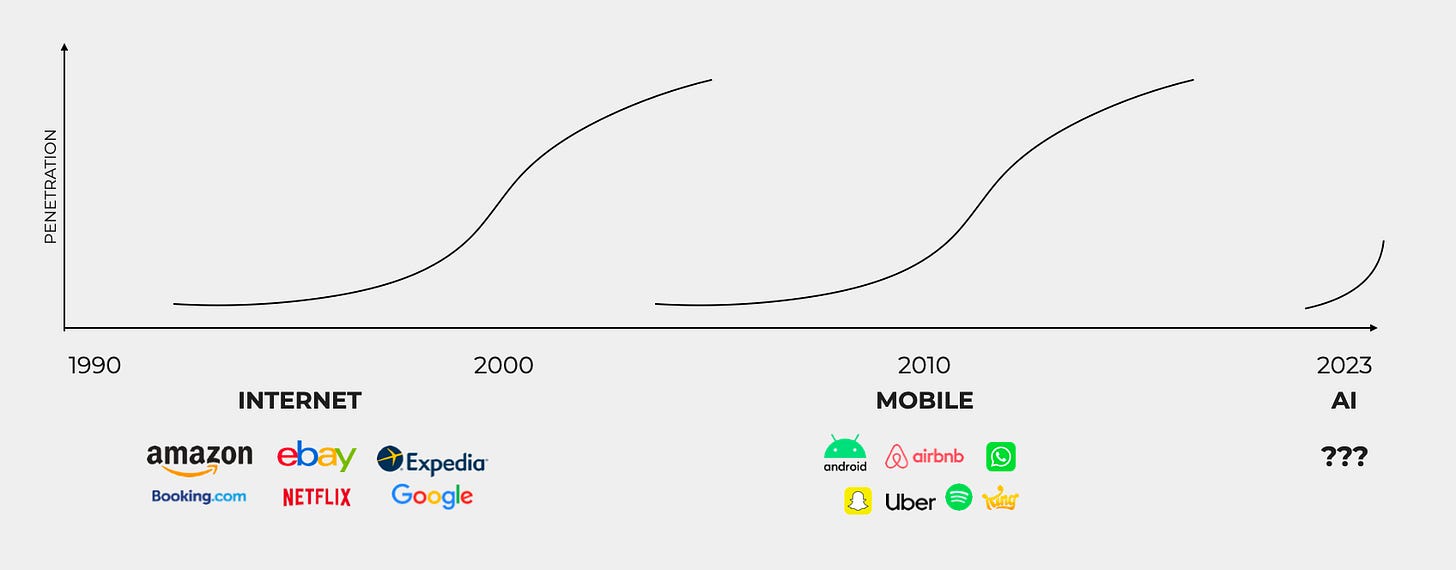

The End of SaaS⚡

The SaaS Era is Over; Software is a Business Tool not a Business Model

How Data Can Generate Pre-seed Deal Flow 📊

This insightful article explores how leveraging data can unlock pre-seed deal flow opportunities without the need for venture studios.The Second $100B AI Company 💸

Exploring the potential rise of the next $100B AI company and its implications for the tech and VC landscape.

The Most Active Femtech VC Investors 🚺

A breakdown of the top venture capital firms that are actively investing in the growing femtech sector.Optionality in Venture Funds 💡

A deep dive into how optionality affects the strategy and performance of venture funds.

Ten Years of AI Venture Capital Deals and Exits 💰

Visual Capitalist takes a look at the rise of AI investments over the past decade, with a focus on key deals and exits.

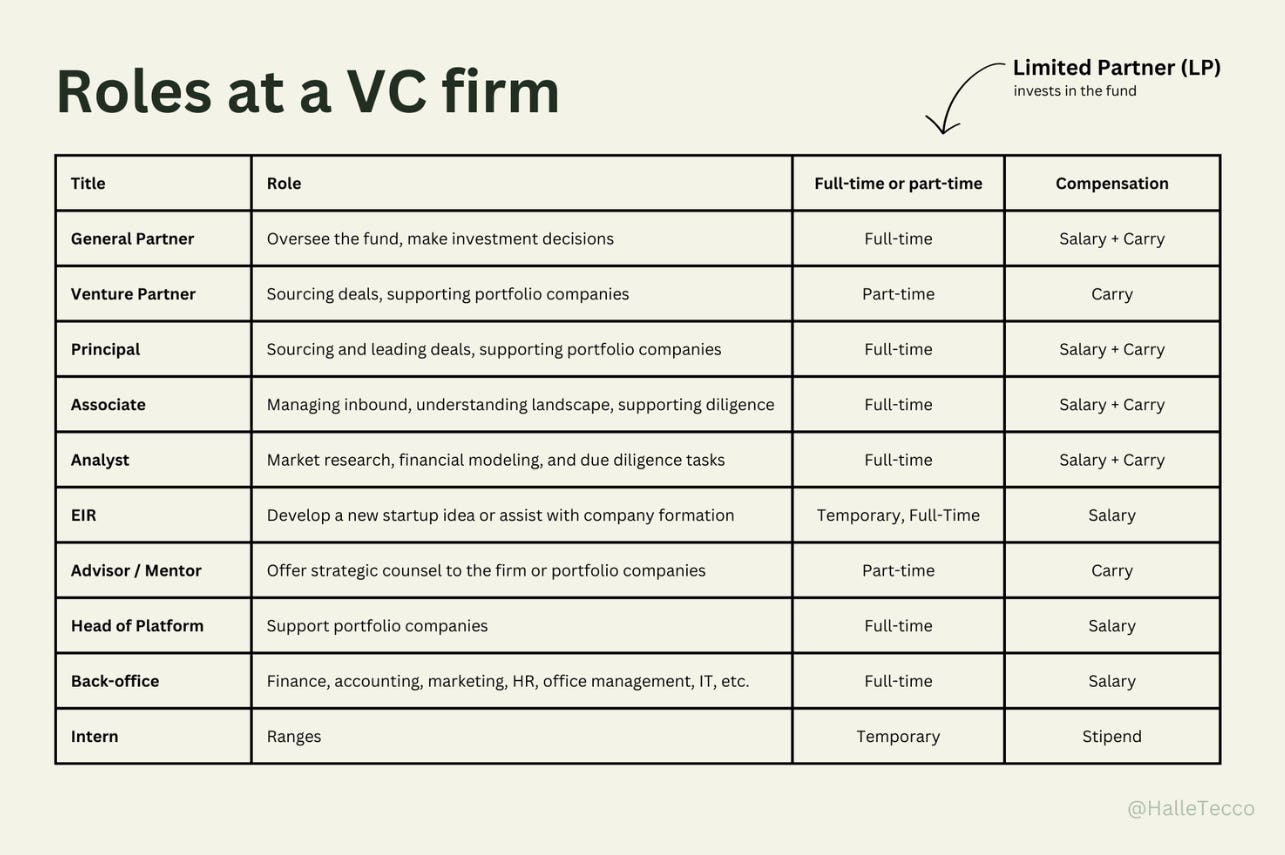

Roles at a Venture Fund 💼

Halle Tecco outlines the various roles within a venture fund and the career paths for those interested in joining the industry.

📣Want to get your brand in front of 100k founders and investors?

If interested in sponsoring The VC Corner, reach out via email: rdominguezibar@gmail.com

Interesting Reports 📊

State of Crypto 2024 🪙

A16Z’s report analyzes the state of the crypto industry and highlights the trends that will shape 2024 and beyond.

Q1 2024 PitchBook Benchmarks 📊

PitchBook dives into Q1 2024 benchmarks, with preliminary Q2 data offering insights into venture capital performance.

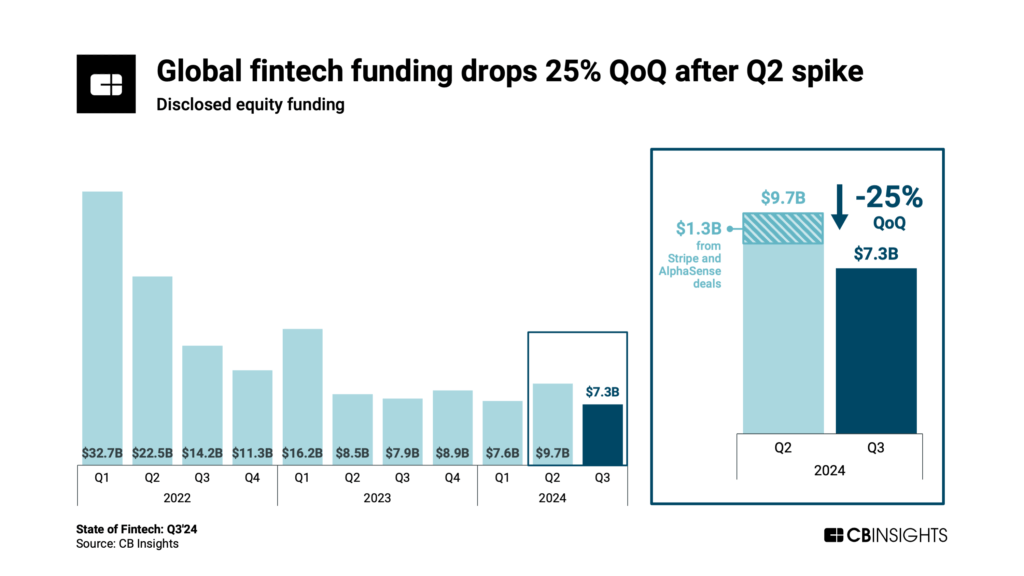

Fintech Trends Q3 2024 💳

CB Insights’ latest report dives into fintech funding and market trends for Q3 2024.

Recently Launched Funds 💸

Forbion Raises Over €2 Billion for Two New Funds

Forbion has raised more than €2 billion for two new funds, focusing on life sciences and healthcare innovations across Europe.Gate.io Launches Cryptocurrency Venture Capital Fund

Gate.io has launched a new venture capital fund dedicated to supporting cryptocurrency and blockchain startups, marking a major move in the growing digital asset space.RW3 Ventures, Mubadala, and Raptor VC Launch New Crypto Fund

RW3 Ventures, Mubadala, and Raptor VC have launched a new cryptocurrency and blockchain-focused venture fund, targeting the next generation of digital assets.Cisco Launches $1B Global AI Investment Fund

Cisco has announced the launch of a $1 billion global AI investment fund, aimed at accelerating AI innovation and growth in various industries.Nordic Entrepreneur-Led VC Firm Node VC Closes €71M First Fund

Node VC, a Nordic entrepreneur-led venture capital firm, has closed its first fund at €71 million, focusing on early-stage startups in the region.Marc Andreessen and Sequoia Back Kearny Venture Partners in New Fund

Kearny Venture Partners has secured backing from Marc Andreessen and Sequoia for its new fund, which will focus on transformative startups in healthcare and technology.

VC Jobs 💼

Neoteq Ventures — VC Manager (Cologne, Germany)

Critical Ventures — VC Manager (Portugal)

Occident — VC Internship (Munich, Germany)

Allocator One — VC Analyst (Vienna, Austria)

FoodLabs — VC Internship (Berlin, Germany)

Positron Ventures — VC Investor (Amsterdam, Netherlands)

Speedinvest — Chief of Staff (Paris, France)

Indicator Capital — Community Manager (São Paulo, Brazil)

Capital Factory — Fund Analyst (Austin, TX)

Voy Ventures — VC Analyst (Los Angeles, CA)

Scale Asian Ventures — VC Associate (New York City, NY)

Bold Ventures — VC Director (Remote)

Connexa Capital — VC Associate (New York City, NY)

Hottest Deals 💥

Kick, a Palo Alto, CA-based startup that creates accounting and bookkeeping AI agents, raised $9M in funding (read here)

Agency, a Boston, MA-based B2B customer success startup, raised $12m in seed funding (read here)

Opacity Labs, a NYC-based data verification platform using zero-knowledge proofs, raised $12m in seed funding (read here)

Perry Weather, a Dallas, TX-based provider of a technology platform for weather safety and operations, raised $15M in Series B funding (read here)

Bitnominal, a Chicago, IL-based digital asset derivatives exchange company, raised $25M in funding (read here)

Equilibrium Energy, a San Francisco, CA-based technology company helping companies through clean power solutions, raised $39M in Series B funding (read here)

Terray Therapeutics, a Los Angeles, CA-based biotechnology company improving human health by enhancing small molecule drug development, raised $120M in Series B funding (read here)

DTiQ, a Framingham, MA-based provider of SaaS-based video, analytics, and optimization solutions for operators within the restaurant, convenience store and specialty retail industries, received a $145M growth investment from Bain Capital Credit (read here)

Splitero, a San Diego, CA-based financial technology company for homeowners, received a $300M investment from Antarctica Capital (read here)

Red Nucleus, a Yardley, PA-based provider of strategic services across research and development, medical affairs, market access, and learning and development, medical affairs, market access, and learning and development, received a majority investment from THL Partners (read here)

Altuzarra, a NYC-based fashion brand, received an investment from P180 (read here)

Tour24, a Boston, MA-based self-guided tour company for the multifamily property industry, received an investment from Mirasol Capital (read here)

Iconic Arts, a Los Angeles, CA-based entertainment venture studio, received an investment from Suntory Holdings (read here)

Motion Controls Robotics, a Fremont, OH-based company which specializes in robotic automation solutions, raised an undisclosed amount in funding (read here)

Jüsto, a Mexico City, Mexico-based online grocer, raised USD $70M in Equity and Debt financing (read here)

Diesta, a London, UK-based B2B SaaS company which specializes in payment operations, raised $3.8M in Seed funding (read here)