The First On-Chain Yield Engine Bringing Institutional Yield Opportunities to Everyday Investors

How Figure Markets is quietly unlocking institutional-grade returns for anyone with a wallet

For all the noise in crypto, very little of it has touched the real world in a meaningful way. Billions have been poured into speculative tokens, meme coins, and hype cycles. The dream of using blockchain to rebuild the plumbing of traditional finance has always been “coming soon.”

Figure has been quietly doing it for years. Founded by Mike Cagney, the fintech veteran behind SoFi, Figure and its institutional arm, Figure Markets, have helped originate around $16 billion in real-world loans, mostly home equity lines of credit, on Provenance Blockchain. They’ve built a network of 170 lending partners, secured licenses in +40 U.S. states, and kept shipping while the rest of the market chased headlines.

The idea is simple: take the stability of private credit markets—assets that have always been locked up for banks and big funds—and open them to anyone with a digital wallet.

Their newest product, Democratized Prime, is the first time that vision has been executed credibly at scale. It packages credit yield into something anyone can access, track, and verify on-chain.

This is how it works, why the timing matters, and why it might be a preview of the financial rails we’ll be using a decade from now.

The Macro Shift: Why Real Yield is the Next Frontier

For years, crypto has cycled through hype waves - memecoins, yield farms, NFTs - yet the big promise of putting real financial assets on-chain has remained largely out of reach. It wasn’t for lack of imagination. It was for lack of regulatory clarity.

That changed in 2025 with the GENIUS Act, which gave stablecoins the legal footing to operate as fully compliant settlement rails for traditional finance. The potential impact is massive: a U.S. Treasury study estimates $6.6 trillion in bank deposits could eventually migrate into stablecoins over the next decade.

But stablecoins themselves don’t offer yield. They hold value, they move fast, but they sit still financially. So where does that capital go? Historically, private credit - things like home equity loans, student loans, auto loans - has delivered steady, low-volatility yields. The catch is that access was reserved for banks, funds, and institutions.

Now, DeFi infrastructure and asset tokenization have unlocked a new path. Credit markets can be funded directly on-chain, with transparency, liquidity, and programmable risk controls built in.

Democratized Prime is the first product to package private credit yield in this format, open to anyone with a digital wallet. It captures a macro shift already underway: real-world yield moving onto crypto rails, not as speculation, but as infrastructure.

What Is Democratized Prime?

If you’ve ever wondered why the best yields in credit markets always seem reserved for institutions, it’s because the infrastructure was built for them. Democratized Prime is Figure’s answer to that imbalance - a way to take one of finance’s most valuable tools and rebuild it for open, transparent, and direct participation.

Before we talk about yield, auctions, or smart contracts, it’s worth understanding what Democratized Prime actually is. At its core, it's a reimagining of one of the most foundational tools in institutional finance, the asset-based borrowing line of credit, but rebuilt for a new era, on crypto rails, with transparency and open access.

An Asset-Based Line of Credit, Rebuilt On-Chain

In traditional lending, a warehouse line of credit is a short-term revolving facility extended by a bank. Mortgage originators and consumer lenders draw on it to fund loans, then repay it once those loans are sold, packaged into securities, or refinanced. It’s the unseen backbone behind most modern lending businesses.

Democratized Prime does the same thing, but without the bank, without the bottlenecks, and without the opacity.

Instead of relying on a single lender behind the scenes, DP creates a decentralized pool of capital. Borrowers, like Figure or other institutions, post real, cash-flowing home equity loans (HELOCs) as collateral. These loans are tokenized directly on the Provenance blockchain - a public chain purpose-built for financial assets - and include full transparency around creditworthiness.

Lenders, whether retail or institutional, can then deposit capital into the pool using YLDS, Figure’s SEC-registered yield-bearing stablecoin. YLDS isn’t just another stablecoin - it’s SEC-registered, and therefore built to comply with U.S. securities laws. Borrowers draw YLDS from the pool to fund new loans, and lenders earn yield sourced directly from homeowner repayments.

In short, it’s the asset-based borrowing model, but open, transparent, and programmable.

Real Yield from Real Borrowers

The rates in Democratized Prime aren’t determined by a spreadsheet or committee. They’re discovered in real time.

Borrowers typically pay 8.5% to 9.5% interest to access capital through DP. That yield flows back to the lending pool, where it’s distributed to participants. Today, lenders are earning around 9% on their capital depending on the pool they are participating in.

What makes this different from most yield products in crypto is where the yield comes from. It’s not from token inflation. It’s not subsidized by venture capital. It’s not a flywheel of staking rewards or liquidity incentives.

It’s interest paid by real people with real homes - borrowers with strong credit - making real monthly payments.

This isn’t “high APY” in the DeFi summer sense. This is private credit, the kind of yield historically reserved for banks, insurance funds, and private credit firms. DP is the first time retail investors can access it directly.

The Dutch Auction: Where Rates Meet the Market

Every hour, Democratized Prime runs a Dutch auction to set interest rates. Here’s how it works:

Lenders submit offers: You choose how much YLDS you want to lend, and the minimum interest rate you’re willing to accept.

Borrowers place bids: They specify the maximum rate they’re prepared to pay for new capital.

The auction clears: At the top of the hour, the smart contract matches supply and demand. All accepted lenders earn the clearing rate, even if they bid lower.

This system eliminates the need for term sheets, rate negotiation, or any centralized gatekeeping. It’s rate discovery as a public marketplace.

And even if your bid isn’t accepted, your capital doesn’t sit idle. YLDS itself earns a baseline yield (~3.85%: SOFR - 50bps) just by being held. So lenders can wait for the right entry point, without losing time or returns.

Built-In Risk Management and Transparency

One of the most impressive elements of DP is how deeply risk controls are embedded into the protocol design.

Over-collateralization: Borrowers can only draw up to 90% of their loan pool’s value, creating a built-in cushion.

Smart-contract enforcement: Liquidation and replacement triggers are coded into the protocol, not left to legal teams.

Withdrawal flexibility: Lenders can withdraw capital as long as there’s liquidity available, hour by hour.

In traditional finance, warehouse lines can be pulled with little notice. Funding can dry up in a crisis. With DP, there’s no single counterparty risk. Lenders and borrowers interact through code, and the system handles funding, interest, and settlement atomically.

The Simple Analogy: Lending to a Homeowner, Transparently

Imagine this: You open an app. You see a pool of home equity loans with 750+ FICO scores and sub-80% loan-to-value ratios. You deposit $5,000. An hour later, your capital is matched with a borrower. Every hour, interest from that homeowner’s payments flows back to your wallet. If you need the cash, you can withdraw, assuming someone else wants in.

That’s Democratized Prime.

No other platform today offers this combination of private collateral, transparent data, and open participation, all without the frictions of traditional credit markets. And it’s the first time the credit system’s inner workings have been made auditable, programmable, and accessible, at this scale.

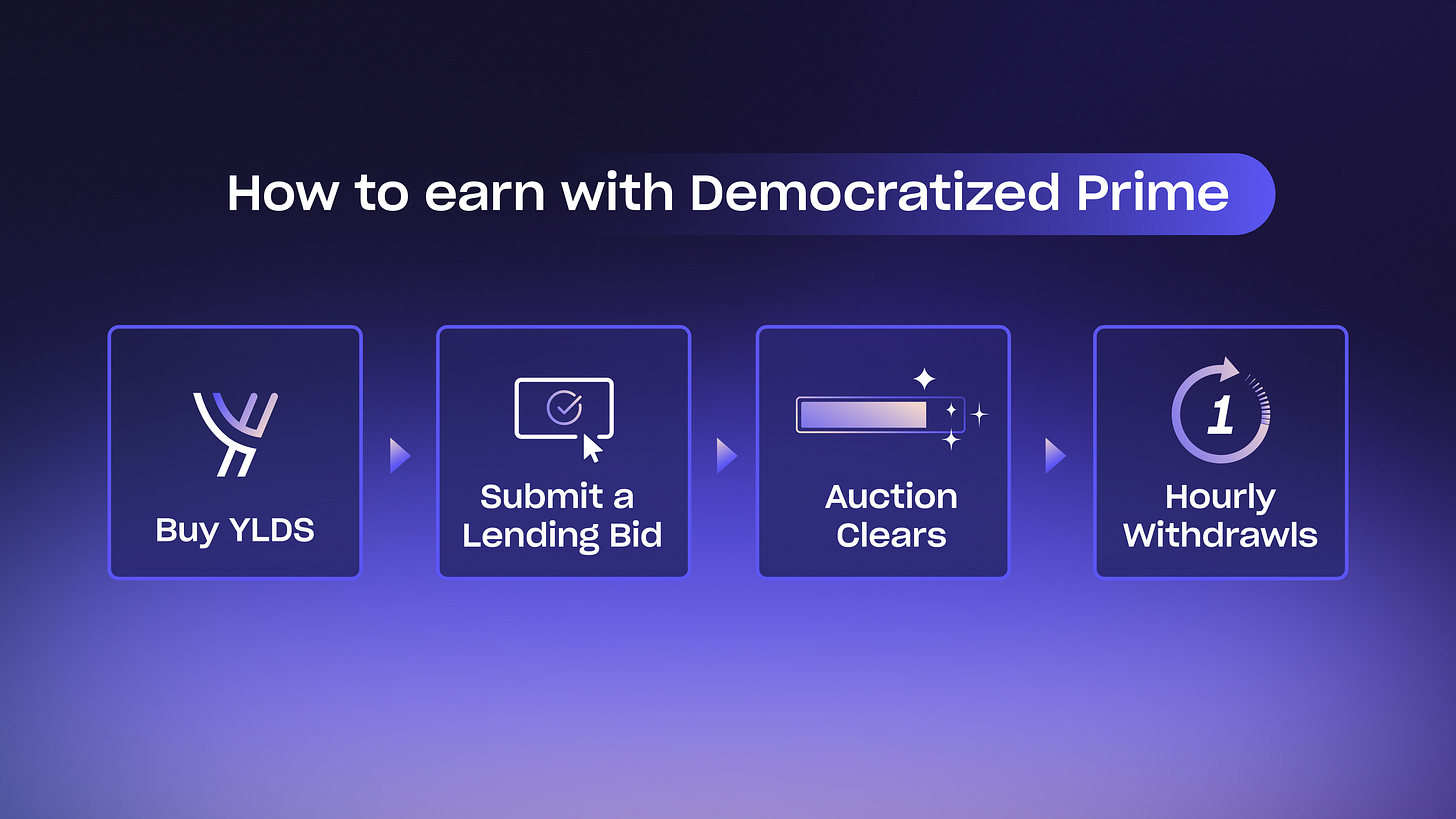

How It Works: From Wallet to Yield in 4 Steps

Democratized Prime is built to feel as seamless as any DeFi app, but under the hood, it’s enforcing the kind of credit risk discipline you’d expect from a top-tier bank. Here’s how everyday investors can participate in the pool and earn real yield, one step at a time.

Step 1: Buy YLDS

To get started, you’ll need YLDS, the SEC-registered, yield-bearing stablecoin native to Figure Markets. You can purchase it directly within the Figure Markets app or website, always at a 1:1 exchange rate with USD. Just holding YLDS earns a base yield (~3.85%), but the real opportunity begins inside DP.

Step 2: Submit a Lending Bid

Once you’ve acquired YLDS, enter the Democratized Prime lending interface. There, you’ll choose:

How much capital you want to lend

The minimum interest rate you're willing to accept

This bid enters the on-chain order book for the upcoming hourly auction. On the other side of that order book are institutional borrowers posting real, cash-flowing home equity loans as collateral.

Step 3: Auction Clears

At the top of each hour, DP runs a Dutch auction. The clearing rate is set by matching borrower demand with lender offers.

If your bid is below the clearing rate, you’re in, and begin earning interest immediately

If your bid isn’t filled, you still earn the base YLDS rate (~3.85%)

All cleared lenders receive the same clearing rate, regardless of their original bid

Because this all settles on Provenance blockchain, every matched loan, interest rate, and collateral metric is recorded immutably and visible to anyone.

Step 4: Track + Withdraw Hourly

You can monitor your position, accrued interest, and collateral metrics directly in the app. As long as there’s liquidity on the other side of the pool, you can withdraw your capital hourly; no lockups, no commitment.

How Risk Is Managed

Behind the simplicity is a deeply embedded risk framework:

Overcollateralization: Borrowers can only draw up to 90% of their posted loan pool value, leaving a built-in cushion.

Smart contract enforcement: If a borrower defaults or metrics degrade, the protocol auto-liquidates their collateral to repay lenders.

It’s a system where the protections of TradFi meet the transparency of DeFi, and where every lender, large or small, operates by the same rules.

Who Is This For (And Who It’s Not For)

Let’s be honest: Democratized Prime isn’t for everyone.

If you’re only here to chase meme coins, ape into Fartcoin forks, or farm the next obscure airdrop, this probably isn’t your game. And that’s okay.

But if you’re serious about earning predictable yield on-chain, with real collateral and fully transparent credit data, DP is built for you.

Who It Is For:

Stablecoin holders sitting on idle capital in a self-custodied wallet

FIRE community investors seeking passive income streams with lower volatility

Crypto-native institutions that want real exposure to tokenized credit, not just wrapped tokens

Fund managers and allocators exploring income-generating RWA strategies

Yield-hunters from TradFi - anyone who’s bought a junk bond ETF, hunted for high-yield savings rates, or considered private credit exposure, but wanted a cleaner, more transparent path to access

Think of it as private credit access for the rest of us, without a fund manager middleman, multi-year lockup, or opaque risk disclosures. The entire process runs on Provenance blockchain, so your capital is matched, tracked, and secured by code, not back-office paperwork.

This is real cash flow, sourced from actual homeowners and businesses, open to anyone with a digital wallet and a bit of curiosity.

Why No One Else Can Do This Yet

In crypto, good ideas are easy to copy. Infrastructure isn’t.

At first glance, Democratized Prime may look like something a dozen other DeFi protocols could spin up. But behind the scenes, it’s anchored in years of regulatory work, enterprise-grade tech, and large-scale credit origination, and that’s the part no one else has.

Most DeFi platforms simply don’t have:

A reliable loan origination network that already moves billions

Lending licenses in all 50 states

An, SEC-registered stablecoin like YLDS

Access to blockchain-native collateral with hourly credit updates

Without those pieces, you can’t run a warehouse line of credit that meets TradFi’s standards, let alone open it up to everyday lenders.

What It Took to Build Democratized Prime

Democratized Prime exists because:

$12B+ in loans have already been originated on Provenance blockchain

Figure holds state-level lending licenses and operates with full regulatory compliance

The company has earned the trust of 170+ institutions, proving it can settle real money at scale

Its tech stack uses smart contracts that enforce, not just automate, terms

The Road Ahead

The moat is only getting wider. Upcoming Democratized Prime pools will cover auto loans, student loans, and SMB receivables; each backed by real payments, real collateral, and real transparency.

As the team puts it:

“Others will get here eventually. But right now, we’re the only ones you can do this with.”

The New Capital Stack: Tokenized Credit at the Base Layer

Democratized Prime isn’t a one-off yield product. It’s a new capital markets primitive, a blueprint for how credit will be originated, priced, and distributed in the decades ahead.

In traditional finance, warehouse lending is the hidden bridge between institutional capital and consumer credit markets. DP takes that same bridge and rebuilds it on-chain, where retail and institutional lenders fund real borrowers directly, governed by smart contracts, not spreadsheets and servicers.

This model is composable, programmable, and transparent by design. It’s not a side experiment, it’s base-layer infrastructure for the next wave of credit markets.

Here’s where this is heading:

Banks will tokenize their loan portfolios

Funds will tokenize private credit assets

Developers will plug into DP-style pools as default financial plumbing

Tokenized debt markets are already 3x the size of tokenized equity, and we’re still early. The rails are being laid, and this time the foundation isn’t speculative equity, it’s income-generating, cash-flowing credit.

If Robinhood democratized access to stocks, Democratized Prime is quietly building the BlackRock for on-chain debt.

The old capital stack was opaque, centralized, and exclusionary. The new one is transparent, composable, and open to anyone with a wallet, and it’s already here.

Real Yield with Real Collateral and Real Access

For decades, the best real-world asset yields were reserved for banks, funds, and institutions. Democratized Prime opens that door to everyone.

Now, anyone can lend stablecoins against real collateral like home equity loans and earn over 9 percent through a transparent, fully on-chain system.

This is not a speculative token or a promise written in a whitepaper. It is live, working, and already reshaping how credit flows through the economy.

If you want to step away from hype and into the part of crypto that is quietly building the future of capital markets, this is the moment to look closely.

Figure Markets is building the infrastructure that could power the next decade of finance, one pool at a time.

Disclosures:

The rates referenced are not guaranteed and subject to change as new offers are placed. Democratized Prime uses a Dutch auction method for its borrowers/lenders. There is an inherent risk due to interest rate volatility in a Dutch auction interest rates in the auction may rise rapidly. At the time of acceptance, your loan may be filled with a different or higher interest rate than offered at the time of selection. The interest rate is only fixed at the time of loan approval and not at the time of loan acceptance.

Participation in Democratized Prime loan pools is exclusively conducted using YLDS. YLDS must be purchased prior to participating in the lending pool. No other tokens or currencies (including USD or USDC) can be used for lending in this pool.

YLDS Stablecoins are unsecured face-amount certificates and solely backed by the assets of Figure Certificate Company (FCC), who is the issuer of the certificates. As a subsidiary of Figure Markets Holdings, Inc., FCC is (absent exclusion or exemption) required to comply with certain limits on its activity, including investment and/or trading limitations on its portfolio and other limitations under applicable banking and securities laws. FCC is not a bank, and the securities it offers are not deposits or obligations of, or backed or guaranteed or endorsed by, any bank or financial institution, nor are they insured by the Federal Deposit Insurance Corporation (FDIC), the Federal Reserve Board or any other agency. The Certificates are not an insurance company product, an equity investment, or an investment in a money market mutual fund. FCC's qualified assets on deposit may exceed the deposit amounts required by applicable regulations. If there are losses on FCC's assets, FCC may not have sufficient resources to meet its obligations, including making interest and/or principal payments on your certificates. Most of FCC's assets are debt securities and are subject to risks including credit risk, interest rate risk and prepayment and extension risk. You could lose money by investing in the Stablecoin. Although the Stablecoins seeks to preserve the value of your investment at $0.01 per share, it cannot guarantee it will do so. You should consider the investment objectives, risks, charges and expenses of certificates carefully before investing. Download a free prospectus, which contains this and other important information about our certificates Figure Certificate Company Prospectus available here. More information about YLDS and FCC can be found here.

Interest rate applicable to all Certificates is the overnight Secured Overnight Financing Rate (“SOFR”) less 50 basis points, with a minimum rate of 0.00%. SOFR stands for the Secured Overnight Financing Rate (SOFR), which is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities. For more information, please visit the Federal Reserve Bank of New York's Website by clicking here.

Figure Payments Corporation offers self-directed investors and traders cryptocurrency services. It is neither licensed with the SEC or the CFTC nor is it a Member of NFA. Figure Payments Corporation's NMLS ID number is 2033432, and is located at 100 West Liberty Street, Suite 600, Reno, NV., 89501. You can verify Figure Payments licensing status at the NMLS Consumer Access website. Click here for Figure Crypto's state license and regulatory disclosures.

Figure Lending LLC dba Figure. Equal Opportunity Lender.

NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.