The Go-To Pricing Guide for Early-Stage Founders + Toolkit

A practical guide to choosing the right pricing model, avoiding rookie mistakes, and boosting early revenue.

Most early-stage founders wing their pricing. They pick a number, copy a competitor, or go with what “feels fair.”

But pricing isn’t guesswork. It’s a growth lever, a positioning tool, and a signal to both customers and investors. It affects who you attract, how long they stay, and how efficiently you scale.

This guide gives you the playbook, backed by data, founder lessons, and proven frameworks, to get pricing right from day one.

Table of Contents

Why Pricing Can Make or Break Your Startup

Understanding the Psychology of Pricing in SaaS and Consumer Startups

Market-Driven vs. Value-Based Pricing: Choosing the Right Framework

Benchmarking Your Price Point: How Top Startups Run Pricing Research

The Investor Perspective: What VCs Look For in a Pricing Strategy

The Anatomy of a Perfect Pricing Page (With Conversion in Mind)

Avoiding Common Pricing Pitfalls That Hinder Growth

When and How to Raise Your Prices Without Losing Customers

Global Expansion? Here’s How to Localize Pricing for Maximum ROI

Pricing Strategy as a Growth Lever for Fundraising

Bonus Toolkit: Templates, Calculators, and Frameworks

1. Why Pricing Can Make or Break Your Startup

Pricing is one of the most powerful yet most overlooked decisions a founder makes. It touches nearly every part of your business: how fast you acquire customers, how long they stay, how much cash you burn, and what story you tell investors.

Set your price too low, and you may attract the wrong customers; those who churn quickly, demand more support, or undervalue your product. Go too high without justification, and you’ll struggle to convert even ideal prospects. But get it right, and pricing becomes a growth engine. You improve lifetime value (LTV), reduce your dependence on discounts or paid ads, and open up room for expansion revenue.

From a fundraising perspective, pricing also shapes your unit economics. Investors don’t just want to see revenue revenue; they want to understand how you generate it. Can your pricing model scale? Does it align with your value proposition? Are you leaving money on the table? These are the kinds of questions VCs ask when assessing the strength and maturity of your business model.

Done right, pricing isn’t reactive; it’s strategic. It tells the market what you’re worth and gives you the financial runway to prove it.

2. Understanding the Psychology of Pricing in SaaS and Consumer Startups

Customers don’t buy with spreadsheets. They buy with perception. That’s why pricing psychology - how people feel about your price - is just as important as the number itself. Founders who’ve been through the trial-and-error phase often lean on a few proven strategies to guide how they present pricing.

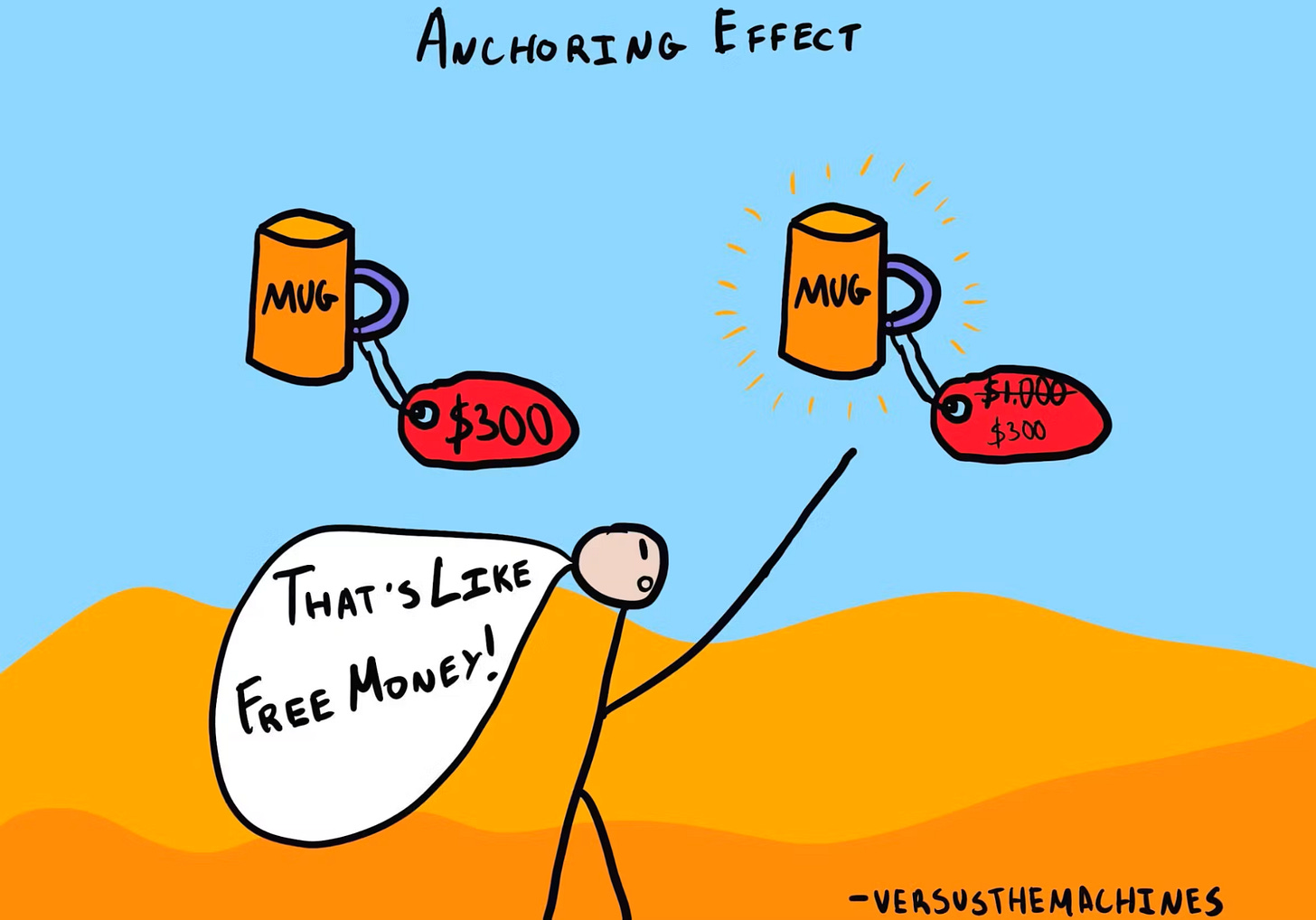

Anchoring: Shape Perception with Strategic Framing

Start high to make everything else look like a deal. Anchoring works by introducing a premium option first, which makes your middle tier feel like better value. Even if few customers choose the highest tier, its presence boosts conversion elsewhere. It’s not deception; it’s decision design.

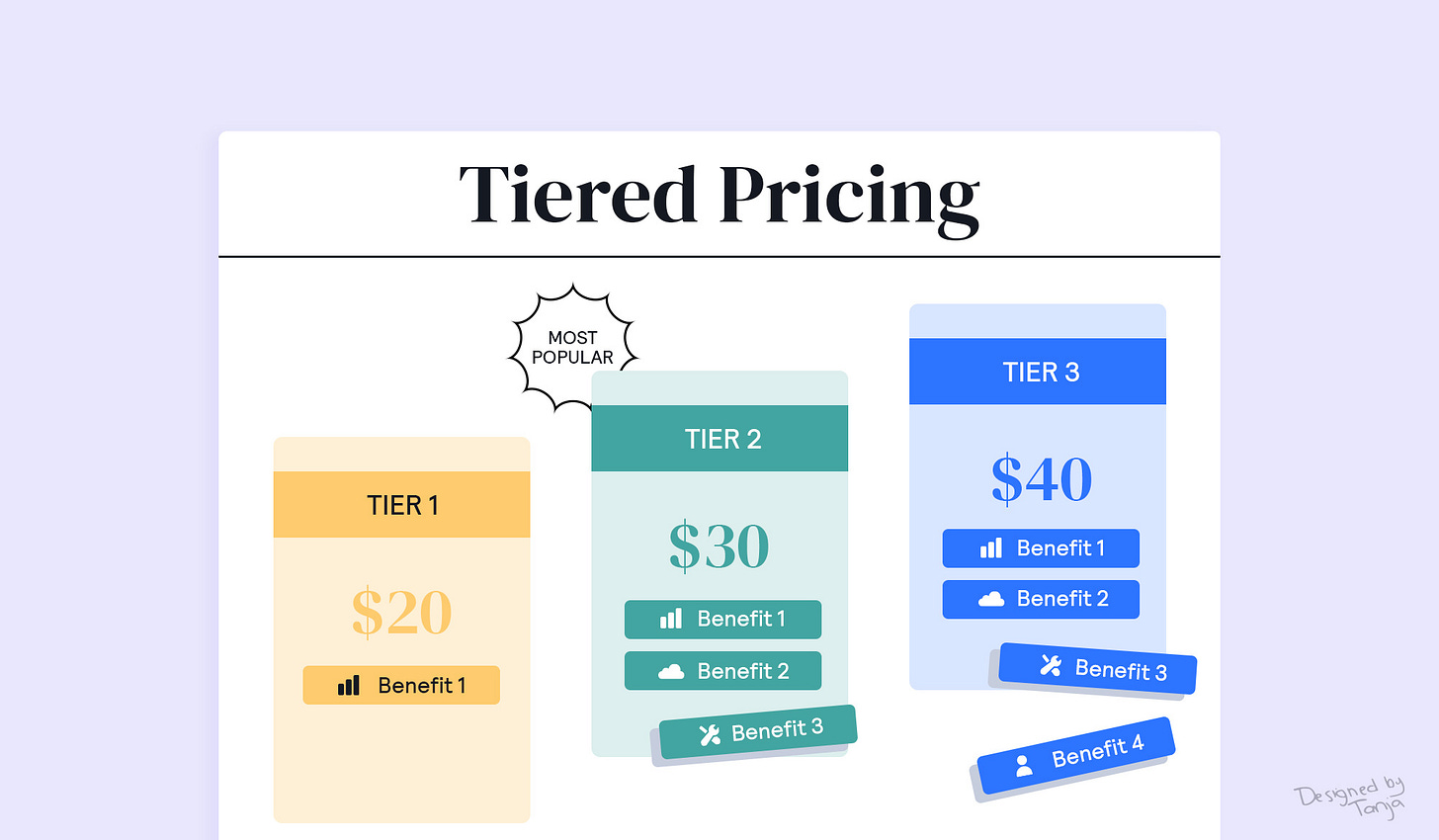

Tiered Pricing: Guide the Buyer Journey

Three is often the magic number. A basic plan for access, a middle tier for most users, and a premium option for power buyers. Most conversions happen in the middle, especially when it’s labeled as “most popular.” Done right, tiered pricing creates clarity, not confusion.

Which MacBook should we buy?

Freemium vs. Free Trial: Choose with Intention

Freemium models can supercharge acquisition, but there’s a catch: if you offer too much value for free, users won’t upgrade. If you see conversion stalling, a better option may be a time-limited trial or a freemium model that locks premium features until usage scales. Don’t just give value; create momentum.

3. Market-Driven vs. Value-Based Pricing: Choosing the Right Framework

Most founders default to what others are charging. It feels safe. But safe pricing often leaves money on the table, or attracts the wrong customers. Choosing the right pricing model means understanding the tradeoffs between cost-plus, market-driven, and value-based strategies, and knowing which suits your product, market, and customer best.

Cost-Plus: Internally Focused, Externally Risky

Cost-plus pricing is simple: calculate your costs, tack on a margin, and call it a day. It guarantees you won’t sell at a loss, but it ignores what customers are actually willing to pay. In software, where marginal costs are low and perceived value varies widely, this model can be dangerously limiting. Use it to set a minimum viable price, not your ceiling.

Market-Driven: Useful Benchmarks, But Limited Vision

Market-based pricing pegs your price to what competitors are charging. It’s helpful if you’re entering a crowded space with well-defined price ranges. But it also assumes your product is interchangeable. If you’ve built something better or more niche, this model leaves value uncaptured. Copying your competitors may win short-term users, but it won’t create long-term pricing power.

Value-Based: Customer-Centric and Margin-Rich

Value-based pricing flips the question from “What do others charge?” to “What is this worth to the customer?” This model is especially powerful in B2B and SaaS, where impact can be measured. If your product helps a company save $50,000 a year, pricing it at $5,000 isn’t aggressive, it’s a bargain. The challenge is that you need deep customer insight, clear value proof, and the confidence to charge what you’re worth. A high-risk high-reward strategy.

How to Choose Your Model

If you're launching in a commoditized market with clear pricing benchmarks, market-driven pricing can ease adoption.

If you’re selling physical goods with tight margins, cost-plus gives you a baseline.

If you're delivering clear ROI or solving a painful problem, value-based is your biggest lever.

Founders who obsess over costs or competitors often miss the bigger picture: What is the customer truly paying for, and how much is that worth to them?

4. Benchmarking Your Price Point: How Top Startups Run Pricing Research

Pricing isn’t a guessing game. It’s a data problem. The best startups don’t set prices by instinct. They run lean, targeted research to find out what customers are actually willing to pay, and why.

Customer Interviews: Start With Conversations

Founders often skip this step, but it’s where the real insights come from. Talk to potential buyers. Ask how they’re solving the problem today, what they’re paying, and what outcomes they expect. Present mock pricing tiers. Watch for where they flinch, and where they lean in. These conversations reveal both perceived value and non-negotiables.

Van Westendorp Analysis: Find the Sweet Spot

This survey method helps you define a pricing range that feels both credible and acceptable to your target customers by identifying where perceived value turns into resistance. It asks four simple but powerful questions:

At what price does the product feel too cheap to be credible?

At what point does it start to feel expensive?

At what point is it too expensive to consider?

Which price makes it a bargain?

Charting the overlap between these answers gives you a data-backed pricing window. It’s simple, fast, and surprisingly revealing, even with a small sample size.

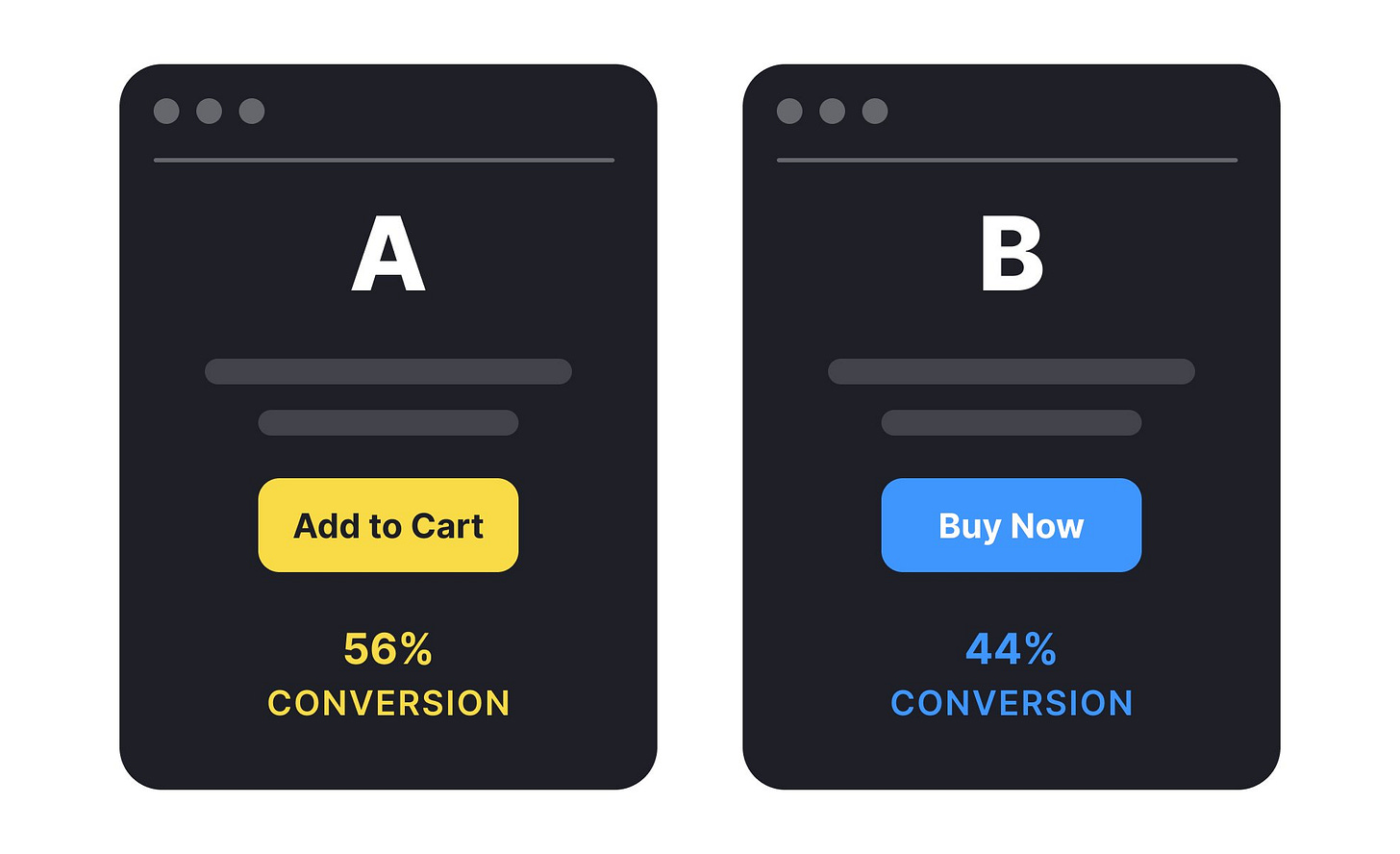

A/B Testing: Let Behavior Reveal the Truth

A/B testing is the process of showing two or more variations to different users to see which performs better. If you’ve got enough traffic, you should definitely be running real-time A/B tests. Show different price points to different users and track conversions, retention, and average revenue per user (ARPU). Test not just price, but pricing models (per-user vs. per-feature), tier names, and how you message value. Startups that test early build sharper instincts faster.

Competitor Mapping: Don’t Copy, Position

Yes, you should know what competitors charge. But don’t just mimic. Map out their pricing tiers, and use that intel to identify white space. That will allow you to differentiate. If everyone’s clustered at $49/month, there may be room to charge more with a stronger ROI pitch, or undercut at $29 by simplifying features. Use competitors as context, not as a blueprint.

Iterate With Intent

Pricing isn’t one decision, it’s an evolving strategy. Research gives you the inputs. Testing gives you the evidence. Customer feedback keeps you grounded in reality. The startups that win don’t just price better. They price smarter, over time.

5. The Investor Perspective: What VCs Look For in a Pricing Strategy

When VCs evaluate pricing, they’re not just asking how you make money. They’re looking for proof that you understand how to build a business. Pricing is a proxy for founder clarity - on customer value, market fit, and the economics that make your startup fundable.

The first thing they look for is intentionality. Did you choose this price because it aligns with your value proposition, or because it’s what your competitors charge? A founder who can explain who the price is designed for, how it supports retention, and why it scales is already ahead.

Next, they dig into unit economics, especially your CAC:LTV ratio.

CAC (Customer Acquisition Cost) tells them how much it costs to get a user in the door.

LTV (Lifetime Value) shows what each user is worth over time.

If LTV is at least 3x CAC, you’re in a healthy range. If it’s below 1:1, pricing (or retention) likely needs work.

Pricing also influences growth strategy. A low-ACV product with high CAC is a red flag; it suggests unsustainable growth. Burning capital to acquire users who won’t pay it back. In contrast, a high-retention product with pricing that allows expansion is investable.

Finally, VCs look for evidence of experimentation and traction. Have you tested different models? Do you know what increases ARPU or drives upgrades? If you’ve already found ways to grow revenue without growing spend, your pricing isn’t just a strategy, it’s a story about a company that’s scaling.

The best founders treat pricing like a hypothesis worth validating. The best investors notice when they do.

6. The Anatomy of a Perfect Pricing Page (With Conversion in Mind)

Your pricing page isn’t just where users pick a plan, it’s where they decide whether to pay at all. It’s one of the highest-stakes pages on your site. And most startups get it wrong.

Here’s what separates high-converting pricing pages from the rest:

Clarity First, Always

Confusion kills conversions. Avoid clutter. Keep your tiers simple (3–4 max), and clearly labeled by user type and what’s included. If visitors need to read an FAQ to understand your pricing, you've already lost them.

Use plain language. Avoid vague plan names like “Professional” or “Business Pro.” Instead, use purpose-driven labels (e.g. “For Startups,” “For Scaling Teams,” “For Enterprise”). Highlight your recommended tier visually with a badge or shaded box. People follow visual hierarchy.

Reduce Cognitive Load

Make comparisons easy. Use clean tables or toggles for monthly vs. annual pricing. Minimize the number of decisions they need to make. Focus on one clear call-to-action per plan - no dropdowns, no friction, just a clear “Start Free Trial” or “Buy Now.”

Leverage Social Proof Where It Matters

Your pricing page is the moment of trust. This is where testimonials, customer logos, review badges, and “trusted by 5,000+ teams” banners make a real difference. Place them near the CTA buttons. These cues nudge users when it matters most.

Drive Upgrades with Smart Design

Use anchoring. Show your most expensive plan first to reframe the others as affordable. Include subtle upsell nudges - highlight the features only available in premium tiers and position them as must-haves (“Includes automation tools,” “Priority support,” etc.). Many companies see their ARPU climb when they make higher-tier value more obvious.

Remove Risk, Increase Action

Free trials, money-back guarantees, and clear refund terms reduce hesitation. Make them visible, not buried in fine print. Buyers convert faster when they feel safe.

A great pricing page doesn't just list prices. It communicates value, builds confidence, and makes it stupid-simple to take the next step.

7. Avoiding Common Pricing Pitfalls That Hinder Growth

Many early-stage startups don’t fail because of a bad product. They fail because of bad pricing. Missteps here quietly drain revenue, erode trust, and attract the wrong customers. The good news is that most mistakes are avoidable, or fixable.

Underpricing: A Race to the Bottom

This is the most common trap. Founders fear pricing themselves out of the market before they even enter it, so they play it safe. But pricing too low sends the wrong signal. It can make your product seem less valuable or less capable. Worse, it attracts high-churn, bargain-hunters who clog your support queue. You end up working harder for less.

Example: A productivity SaaS founder launched at $5/month. They gained users, but not growth. After raising prices to $19 and narrowing features for the lowest tier, revenue rose and churn dropped. They ended up keeping the users that mattered.

Overcomplicating the Pricing Structure

More choices don’t always mean more conversions. When startups offer too many plans, tiers, add-ons, or confusing metrics (like usage-based pricing without clear benchmarks), customers hesitate. Complexity slows decision-making and hurts trust.

Keep it clean. Bundle features meaningfully. Save advanced add-ons for when you’ve earned customer loyalty, not before.

Ignoring Churn Signals

If users are downgrading, cancelling, or ghosting after trial, don’t just blame product gaps. Pricing may be the issue. Maybe the value isn’t clear, or the model doesn’t match how people use the product. Flat pricing when customers want seat-based or usage-based can hurt.

Pay attention to the data. Where do users drop off? Where do drop-offs happen? What plans lose the most customers? Every churn spike is a pricing insight waiting to be noticed.

Smart pricing isn’t just about setting the right number. It’s about noticing what happens after. That’s where growth lives, or dies.

8. When and How to Raise Your Prices Without Losing Customers

Raising prices is one of the fastest ways to grow revenue, if you don’t blow it. Done right, it can boost margins, filters for ideal users, and funds further growth. Done wrong, it triggers churn, frustration, and reputation damage.

So how do you get it right?

Know When You’ve Earned It

Timing matters. You’ve earned the right to raise prices when:

You’ve added significant value such as new features, better support, and improved outcomes.

You’re consistently selling out or reaching operational limits.

You’ve upgraded your positioning or serve a more premium market segment.

In short, if your product is delivering more, charging more is not just fair; it’s expected.

Gather Feedback First

Before pulling the trigger, talk to customers. Find out what they value most. Learn what they’re actually using. This helps you justify the increase, and identify which features can anchor the higher price.

Some founders run mini-surveys or 1:1 calls with top users before announcing a change. It’s not about asking for permission but about framing and fine-tuning the increase.

Communicate With Confidence

When you announce a price increase, don’t apologize. Be direct, respectful, and clear. Explain what’s changed, when it takes effect, and what additional value customers can expect. Many startups offer a grace period for current users (e.g. old pricing stays until renewal). It goes a long way. Retaining user trust is key.

HoneyBook, for example, raised prices after launching new tools. They gave customers a heads-up, highlighted the added value, and offered early lock-in at the old rate. The result? Minimal churn, and stronger MRR.

Expect (Some) Churn, and Be Okay With It

Some customers will leave. Often, they’re the ones who weren’t profitable to begin with. A price increase helps filter for customers who value what you offer.

The real risk isn’t raising prices. It’s waiting too long and building a business that can’t afford to grow.

Bonus question: How much are you paying for Netflix today?

9. Global Expansion? Here’s How to Localize Pricing for Maximum ROI

As your startup expands internationally, one-size-fits-all pricing stops working. Buyers in San Francisco and São Paulo don’t think, or spend, the same. If you want to maximize global conversions and margins, your pricing strategy needs to adapt across geographies.

Start with Cosmetic Localization

The simplest wins come from how you present prices. Local currencies, local languages, and region-specific formatting build instant trust. Showing ₹1,499 to an Indian buyer or €29 to a German one removes mental math and friction. According to Transifex, over 40% of consumers won’t buy from a site that’s not in their native currency or language.

This is a low-effort, high-return move. Most modern billing platforms (like Stripe or Paddle) allow you to localize currency display, tax handling, and payment options with minimal engineering effort.

Adjust for Purchasing Power

Cosmetic changes aren’t enough. Pricing should reflect real economic differences. A $29/month plan might work in the U.S., but be entirely out of reach in Southeast Asia. Localizing price levels based on GDP per capita, average income, or regional SaaS benchmarks, allows you to unlock underserved markets without devaluing your product.

Netflix offers a masterclass here. They charge roughly $15/month in the U.S., $2.50 in Pakistan, and $21 in Switzerland. Same product, adapted thresholds.

Factor in FX and Margin Integrity

Don’t forget currency fluctuations and payment processing costs. Either set prices in local currencies or build in exchange-rate buffers to preserve margin stability. Revisit international pricing quarterly to ensure it reflects current FX realities. Pricing set three years ago in a different FX environment could be quietly bleeding revenue.

Match Packaging to Local Norms

Localization doesn’t stop at numbers. In some markets, annual billing is the standard. In others, flexible pay-as-you-go pricing builds more trust. Payment method preferences also vary widely. Mobile wallets dominate in India, while SEPA direct debits are preferred in Europe. Even cash vouchers matter in select LATAM and Southeast Asian markets.

Adapting structure and payment logic to local behavior shows respect for how your customers already buy and reduces friction at checkout.

Global pricing isn’t just about being fair. It’s about meeting your customer where they are: economically, culturally, and behaviorally.

10. Pricing Strategy as a Growth Lever for Fundraising

Investors don’t just want to see revenue, they want to understand the engine behind it. A thoughtful pricing strategy signals more than product-market fit. It shows how well you understand your market, your customer, and the economics of your own growth.

Align Pricing with Go-To-Market Strategy

Your pricing model should complement your distribution model. If you're product-led and self-serve, your pricing needs to be intuitive, transparent, and scalable. Sales-led approaches on the other hand, especially in B2B, have more room for custom quotes and value-based tiers. In either case, pricing becomes part of the GTM story.

Founders who clearly connect pricing to GTM strategy are the ones that stand out. For example: “We went with usage-based pricing because our product’s value grows with customer engagement, and that lets us land small and expand fast.”

Showcase Monetization Potential

Pricing isn’t just about what users pay today. It’s about what they are willing to pay as they grow. If you’ve tested different tiers, seen successful upgrades, or found pricing levers that improve average revenue per user (ARPU) without hurting retention, that’s proof of future upside. Highlight it.

Maybe your base tier converts well, but your mid-tier doubles ARPU with minimal churn. That’s more than a pricing insight; it’s a monetization roadmap.

Strengthen Your Unit Economics Story

VCs care about CAC, LTV, and payback periods. Smart pricing improves all three. Value-based pricing increases LTV. Scalable pricing models improve CAC efficiency. If your payback period is short and your margins are improving over time, investors see that as leverage.

In a pitch, this translates to a stronger valuation story. You're not just growing, you're doing it with discipline, capital efficiency, and upside.

A well-designed pricing strategy is a strategic asset. Use it to tell a story about how your business is not just gaining traction, but compounding value.

11. Bonus Toolkit: Templates, Calculators, and Frameworks

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.