The New World for Entrepreneurs 🌍, State of Private Markets 🔍, AI Eating Software 🚀

Welcome back to The VC Corner, your weekly dose of Venture Capital and Startups to keep you up and running! 🚀

In-Depth Insights 🔍

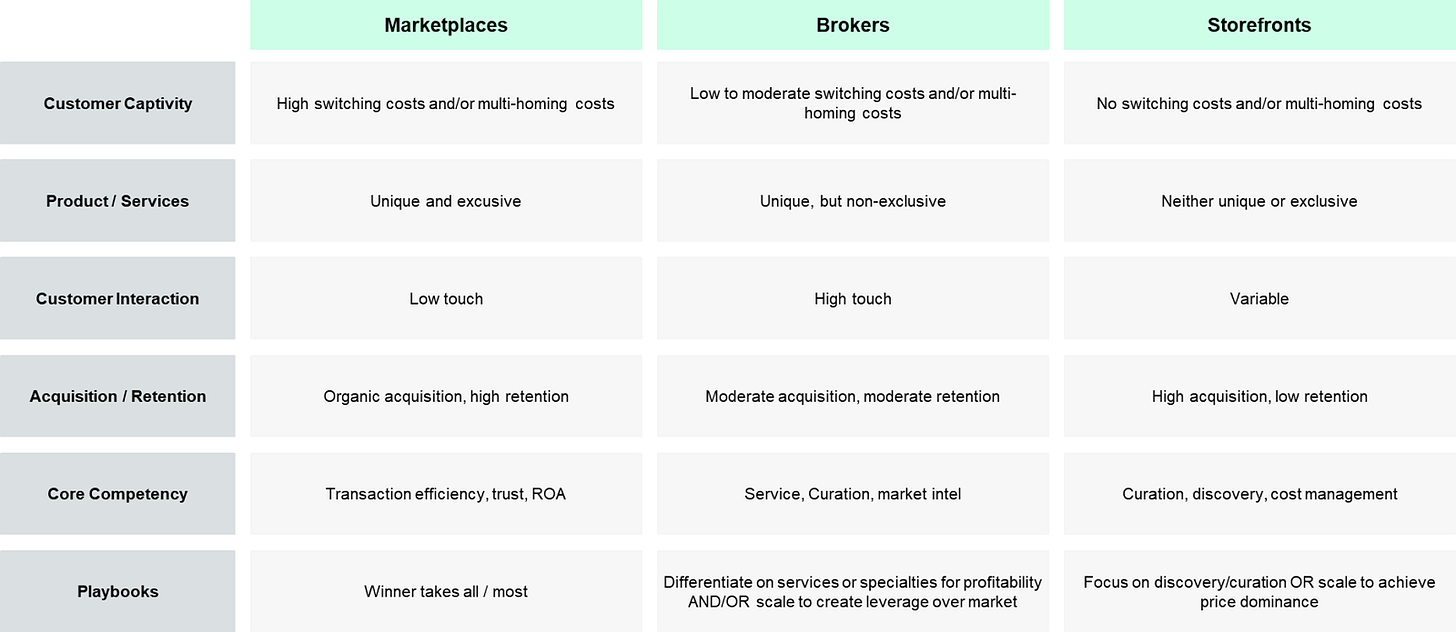

Marketplaces, Brokers, and Storefronts 🛍️

Equal Ventures breaks down the evolving dynamics of online marketplaces, brokers, and storefront models.

Y Combinator's Startup Duplication Trend 🛠️

TechCrunch explores how Y Combinator frequently funds startups with overlapping ideas, particularly in AI and SaaS.The New World for Entrepreneurs 🌍

Rick Zullo analyzes how founders are adapting to the shifting startup ecosystem in 2024 and beyond.

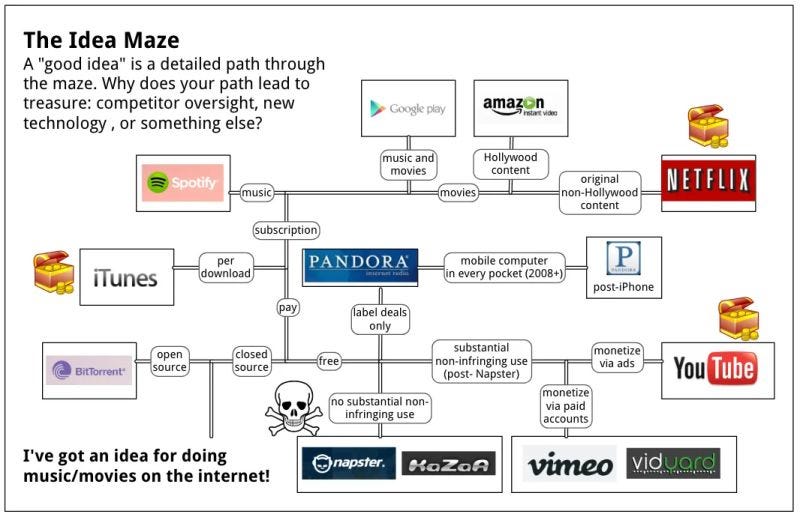

99% of vc's skip the market sizing slide 📊

Replace it with this instead: An idea maze slide.

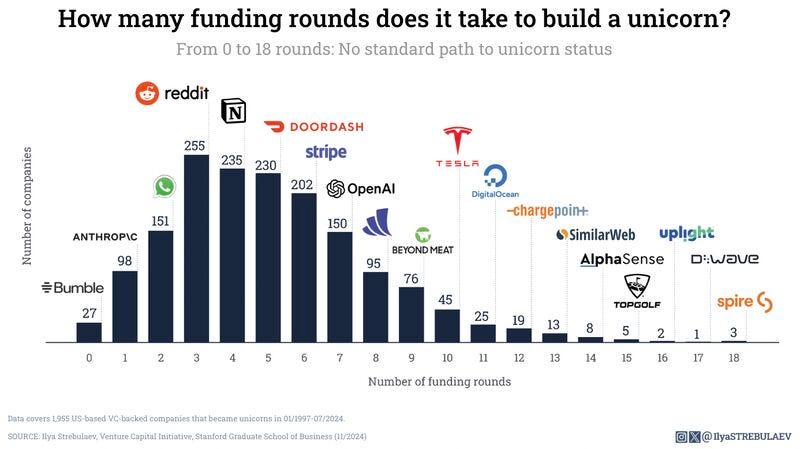

It takes an average of 5 funding rounds to build a unicorn 🦄

Companies that become unicorns in private rounds need slightly fewer rounds than those that become unicorns upon exit (IPOs or sales).

📣Want to get your brand in front of 150k founders and investors?

If interested in sponsoring The VC Corner, reach out via email: rdominguezibar@gmail.com

Interesting Reports 📊

The State of Private Markets Q3 2024 🔍

CB Insights dives into the latest private market performance trends across Q3 2024.

Euroscape: AI Eating Software 🚀

Explore Accel’s latest insights on the European cloud ecosystem and its accelerating growth trajectory.

Q1 2024 PitchBook Benchmarks 📑

PitchBook presents its detailed benchmarks and key insights from the first quarter of 2024, with preliminary Q2 data.EIF VC Survey 2024 📊

A comprehensive survey on venture capital trends, highlighting key findings from European VC professionals.

Recently Launched Funds 💸

Frumtak Ventures has raised €87M in its fourth fund to back Icelandic tech startups.

Connexa Capital closed its debut $20M fund, investing in early-stage technology companies.

Berlin-based Extantia Capital closes €204 million flagship fund

Chemistry Capital: Founded by former Index Ventures, Bessemer, and a16z investors, this $350M fund targets chemistry-based solutions in sustainability, agriculture, and energy.

Thrive Capital: A $5B fund led by OpenAI’s backer Thrive Capital, focused on tech infrastructure, AI, and companies pushing the boundaries of digital transformation.

XGen Venture Fund: XGen announces a $160M first close, with a focus on early-stage investments in transformative tech across the U.S. and Europe.

Dawn Capital V: Launches its fifth fund at €400M, dedicated to scaling B2B software across Europe.

VC Jobs 💼

VC Associate @ a16z – Menlo Park, CA

VC Associate @ Cogito Capital Partners – Warsaw, Poland

Chief of Staff @ Pathlight Ventures – New York City, NY

VC Associate @ Thomvest Ventures – San Francisco, CA

VC Director @ Empire State Development – Albany, NY

VC Investor @ Defy VC – San Francisco, CA

VC Internship @ Madrona Venture Labs – Seattle, WA

Hottest Deals 💥

Circleback, a San Francisco, CA-based provider of an AI-powered app for meeting notes and automations, raised $2.5m in seed funding (read here)

Doron Therapeutics, a Chapel Hill, NC-based clinical-stage biotech company focusing on degenerative musculoskeletal conditions, raised $11M in Series A funding (read here)

Roon, a NYC-based company providing an access to a guide for health, raised $15M in Series A funding (read here)

360Player, a Raleigh, NC-based provider of a digital platform for modern sports clubs, received a $25M investment from Five Elms Capital (read here)

Sirona Medical, a San Francisco, CA-based provider of cloud-native radiology workflow software, raised $42M in Series C funding (read here)

Tricentis, an Austin, TX-based company which specializes in continuous testing and quality engineering, received a $1.33 Billion investment from GTCR, at $4.5 billion valuation (read here)

Advanced Recycling Technologies Holdings, a Flemington, NJ-based company that designs, installs, owns, and operates distributed metals recovery systems, received a growth investment from Ember Infrastructure (read here)

Hyperheat, an Offenburg, Germany-based startup that develops electric heaters for steel, cement, and chemicals industries, raised $3.7m in funding (read here)

plentysystems AG, a Kessel, Germany-based provider of an e-commerce ERP software platform PlentyONE, received a strategic investment from PSG Equity (read here)

Argil, a Paris, France-based video engine company for the creator economy, raised €4.9M in funding (read here)

Volta, a Milan, Italy- and Paris, France-based provider of an SaaS AI powered B2B distribution platform, raised $6.3m in pre-seed funding (read here)

Springtime Technologies, a Vienna, Austria-based accounts payable automation software company, received a strategic investment from Scottish Equity Partners (read here)

Randamu, a Bangkok, Thailand-based randomness technology company, raised $3.3M in Pre-Seed funding (read here)