The Rise of the Agentic Workforce🤯, It’s Time for Europe to Stand Up 📢, 100+ Gen. AI Use Cases You Should Know 🔍

BONUS: 144 Family Offices That Cut Pre-Seed Checks

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, and the hottest deals—here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Harmonic — the startup discovery engine

Accel, Anthemis, BCV, Battery, Bedrock, Coatue, Craft, Emergence, 8VC, Greylock, Insight, Left Lane, Menlo, Mosaic, NEA, Norwest, Pear, Redpoint, Spark, Zetta. And hundreds more.

The world’s best VCs use Harmonic to find their fund returners.

In-Depth Insights 🔍

The Rise of the Agentic Workforce 🤯

AI isn’t just automating tasks—it’s reshaping the entire workforce. Here’s what that means for startups and investors. [Tanay Jaipuria]

AI Voice Agents 2025 Update 🎙️

AI-powered voice tech is evolving fast. Andreessen Horowitz breaks down what’s real, what’s just hype, and where it’s all heading. [Olivia Moore]

Venture Capital & Game Development 🕹️

Many legendary games studios were VC-backed at one point or another: Epic Games, Zynga, King, thatgamecompany, Roblox—the list goes on. [Ryan K. Rigney]The System to Secure 1.4 LP Meetings 💼

Raising money from LPs is tough. This guide lays out a proven system to land more meetings and close more deals. [Adam Metz]

It’s Time for Europe to Stand Up 📢

Europe has the talent and ambition—so why is it still playing catch-up with Silicon Valley? A bold take on what needs to change. [Noah Smith]What Happens When Everyone Can Build Anything? 🛠️🌍🚀💭

No-code, AI, and automation are lowering the barriers to innovation. Here’s what that means for founders, investors, and the future of startups. [David Hoang]

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and my other media assets, email: rdominguezibar@gmail.com

Interesting Reports 📊

100+ Generative AI Use Cases You Should Know 🔍

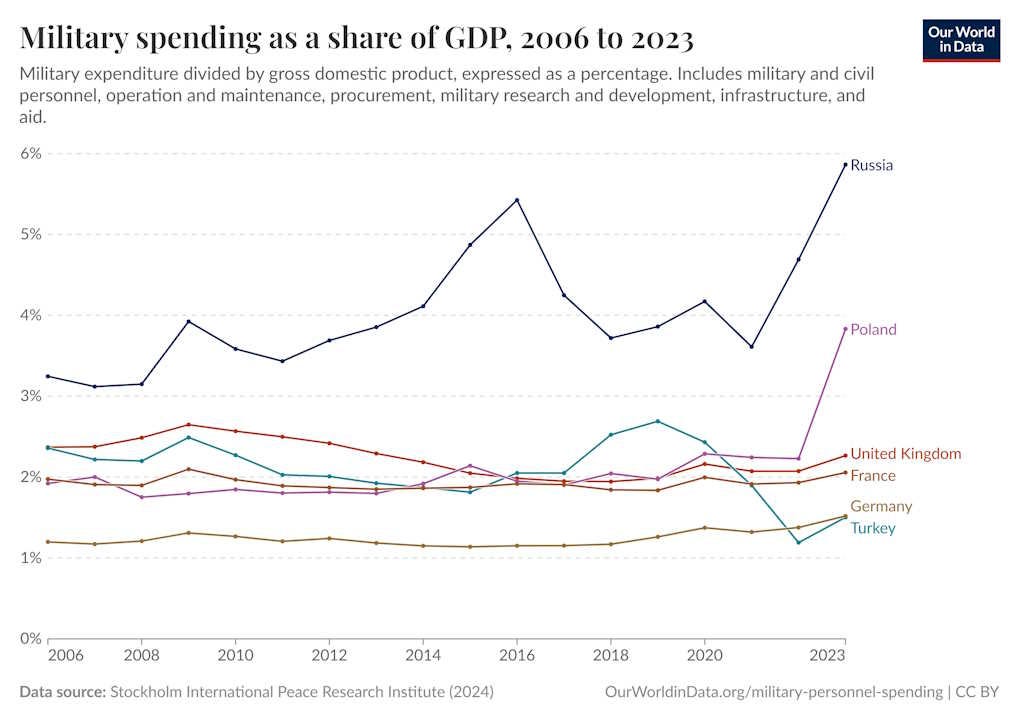

A deep dive into how GenAI is reshaping industries, from healthcare to finance. If you’re building with AI, this is a must-read.The State of Defence, Resilience & Security in Europe 🛡️

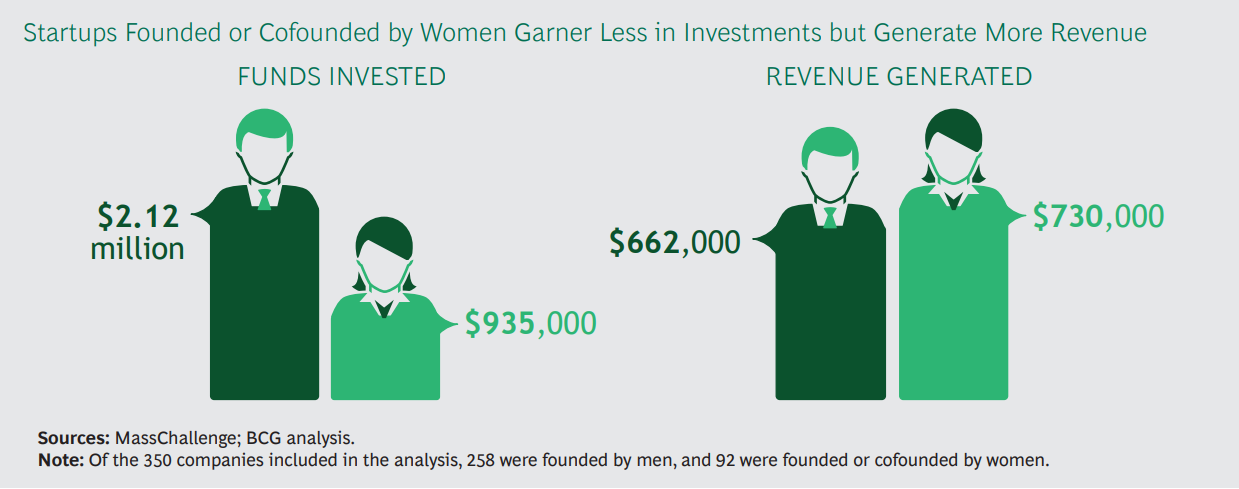

Dealroom breaks down Europe’s defense and security landscape—where the investment is going and what it means for startups.Why Women-Owned Startups Are a Better Bet 👩💼

The data is in: female-founded startups generate better returns. Here’s why VCs should pay attention.

Recently Launched Funds 💸

Greenfield Partners closes $400M in new capital to fuel European tech investments.

NextView Ventures is raising up to $135M for its sixth fund, doubling down on early-stage startups.

NaturalX Health Ventures secures €100M to back digital health and biotech innovations.

Antler announces the close of its second Nordic fund at $100M to support early-stage founders.

Fahraeus Startup & Growth secures €75M to fund high-growth startups in Europe.

Coatue Management closes approximately $249M for its second ClimateTech fund, pushing sustainability-focused innovation.

z21 Ventures announces a $20M first close of its $40M Fund II, backed by WestBridge Capital.

venBio secures $528M to invest in life sciences innovation.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup enthusiasts. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

VC Jobs 💼

Principal at Fitch Ventures (New York City, NY)

Manager at Redalpine (Berlin, Germany)

Associate at Coparion (Cologne, Germany)

Associate at Notion Capital (London, England)

Investor at Quantum Light (London, England)

Managing Director at Techstars (Los Angeles, CA)

Investor at Finality (Los Angeles, CA)

Investor at Monarch Collective (Los Angeles, CA)

Internship at Equal Ventures (Remote)

Fellowship at Gold House Ventures (Remote)

Hottest Deals 💥

Dream, the first AI company focused on national cybersecurity, raised $100M to defend nations and critical infrastructure (read here)

Abridge, a Pittsburgh-based AI-driven medical documentation company, secured $150M in Series D funding to expand its AI-powered clinical tools (read here)

Figure AI, a robotics startup developing humanoid robots, is in talks for new funding at a $3.9B valuation (read here)

xAI, Elon Musk’s AI startup, is reportedly discussing a $10B raise at a $75B valuation to compete in the AI space (read here)

Nvidia-backed Lambda, secured a $480 million Series D round, led by Andra Capital and SGW. (read here)

Saronic, the autonomous shipbuilding startup raised a $600 million Series C round at a $4 billion valuation, led by Elad Gil (read here)

Verkada, Specializing in building security hardware and software, Verkada raised a $200 million Series E round, led by General Catalyst, valuing the company at $4.5 billion (read here)

Pocket FM, An India-based audio entertainment platform, Pocket FM is in talks to raise over $100 million in its next funding round (read here)

Baseten, This San Francisco-based startup developing inference software for AI applications raised a $75 million Series C round, led by IVP and Spark Capital (read here)

Augury, The company raised a $75 million Series F round for its platform that monitors maintenance needs of machines in industrial and manufacturing sectors. (read here)

Spyne, An India-based AI platform assisting businesses with visuals for online listings, Spyne raised $16 million in a round led by Vertex Ventures (read here)

Capi Money, a London-based cross-border payments startup, secured an $18 million Series A led by Creandum (read here)

Avandra, a startup building a network for medical imaging data, raised a $17.75 million round led by Aegis Ventures and SpringRock Ventures (read here)

BONUS: 144 Family Offices That Cut Pre-Seed Checks

Most founders waste time chasing the wrong investors. VCs move slow, reject 99% of deals, and follow rigid investment cycles. But family offices? That’s a different game.

They’re flexible, long-term thinkers, and often write checks faster than VCs—without requiring you to pitch a full partnership or hit arbitrary traction milestones.

So here’s something that will save you weeks of fundraising pain:

I’m sharing a curated list of 144 family offices that are actively deploying capital at the earliest stages. No guesswork, no outdated directories—just real decision-makers who invest in pre-seed.

By subscribing to The VC Corner, you’ll unlock not just the Family Offices List but also:

✅ The Startup Founder’s Guide to Financial Modeling (7 free templates included)

✅ The Best 23 Accelerators Worldwide for Rapid Growth (and How to Get Into Them)

✅ The Ultimate Startup & Venture Capital Notion Guide: Knowledge Base & Resources 📚

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox 🛠️

✅ How to Create a Co-Founder Agreement 📝 + 3 Templates

Remember: you can take a 7-day free trial.

Access the Family Offices List below 👇

I hope you find it helpful!

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.