The Ultimate Investors List of Lists 🚀

Finding the Right Investors: Venture Capital funds, Family Offices, Accelerators, CVCs, and Angel Investors

Securing the right investors is make-or-break for any founder. The right partnerships propel you forward; the wrong ones hold you back. But with a crowded field—VCs, family offices, angel investors, CVCs, and accelerators—knowing where to start can be overwhelming.

I’ve curated a highly targeted guide covering every key investor list you need. This isn’t just a directory; it’s a strategic roadmap to the people and funds that can fuel your startup growth.

Why This Guide Matters:

Target the Investors Who Count

Forget chasing general lists. This guide points you to investors who specialize in your industry and stage. Think precision, not randomness.Save Valuable Time

Researching investors takes hours, sometimes weeks. This guide skips to the good part: connecting with the right people faster so you can focus on scaling.Maximize Your Funding Potential

By tapping into a diverse and curated set of potential investors, you significantly increase your odds of finding the right match—someone who believes in your vision and has the resources to back it.

What’s Inside?

Venture Capital Firms – From niche VCs to the biggest names, find firms tailored to your industry and growth stage.

Family Offices – For founders seeking a personalized approach, family offices can offer not only capital but also strategic guidance.

Angel Investors – Target active angels in your region who back early-stage startups, from the U.S. to Australia and beyond.

Corporate Venture Capital – CVCs offer more than funding; they provide strategic industry insights and potential partnerships.

Accelerators – Access top accelerators worldwide to accelerate growth and gain access to mentors and industry experts.

Unlock the full guide to save hours, connect with the right investors, and move your startup forward faster. Don’t leave your funding journey to chance. Get access now and position yourself for success.

Still a free subscriber? Upgrading to a premium subscription will give you access not only to these invaluable lists but also to the entire archive of articles published on The VC Corner. You'll gain insights, resources, and strategies that have already helped thousands of founders

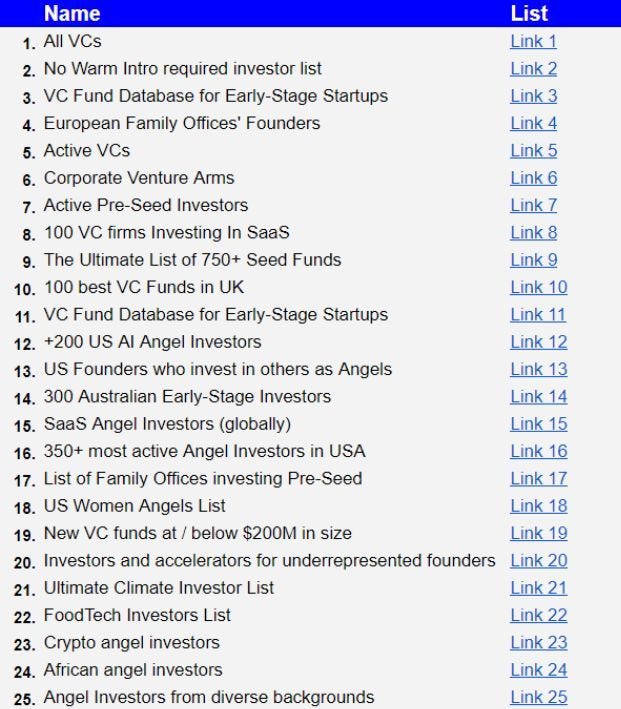

Here’s the Ultimate Investor List of Lists 👇

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.