How Founders Can Thrive in VC 3.0: The AI Era of Startup Funding

AI is transforming venture capital—from how investors operate to how startups raise and grow. Here’s the new playbook every founder should know.

Venture capital has come a long way from its buttoned-up beginnings.

What started as a niche corner of finance, reserved for East Coast elites funding post-war tech, has evolved into a global force powering everything from ride-hailing apps to rocket launches.

But the game has changed again: welcome to VC 3.0…

Brought to you by Vanta - Are you ready for the EU AI act?

Vanta’s EU AI Act Checklist helps startups cut through the noise and stay compliant without slowing down.

✅ Understand how the Act impacts your product

✅ Get clear, actionable steps for compliance

✅ Avoid common pitfalls early

Stay ahead:

To understand where we are now, it helps to look at where we’ve been:

VC 1.0 was the “cottage industry” era. Small partnerships. Closed networks. Deals done over golf or gin. This was the 1950s to early 90s, when “venture capital” was more country club than category.

VC 2.0 exploded with the internet. Think Netscape, Google, AWS, SaaS, mobile apps. Founders gained leverage, capital became abundant, and software was king. From the dot-com boom to the unicorn boom, this was the golden age of blitzscaling.

VC 3.0 is what we’re living through now. AI is not just another wave, it’s the tide that’s lifting and reshaping the entire venture landscape. Capital is ubiquitous. Infrastructure is global. VCs are using AI to find and fund startups, and startups are using AI to build faster than ever.

What we’re witnessing is more than just a tech trend. We’re in a new era of venture itself, one where data moves faster than decks, and founders aren’t just pitching VCs, they’re partnering with models.

Table of Contents

What Is VC 3.0?How investors are using AI to fund, find, and support startups

How AI Is Reshaping the Venture Capital Landscape

What Founders Must Do to Succeed in VC 3.0

Tactical Guide: How Founders Can Ride the VC 3.0 Wave

Case Studies: Startups Winning in the New VC Era

Final Takeaways for Startup Founders Navigating VC 3.0

1. What Is VC 3.0?

Venture Capital 3.0 marks a shift from intuition to intelligence, from networks to systems. It's no longer about who you know or how often you’re in the Valley. In this new wave, venture capital has become faster, flatter, and far more technical.

VC firms today are blending capital with computation. They’re using AI tools to source deals, run diligence, and even shape portfolio strategy. Some have in-house large language models scanning the web for emerging talent. Others are building internal platforms that help founders with everything from hiring to GTM, all powered by software.

The investment playbook is evolving, too. Instead of broad, thematic bets, we’re seeing hyper-specific theses driven by data. One fund might focus only on AI infrastructure for enterprise compliance. Another might specialize in pre-seed robotics for agricultural automation. The signal isn’t coming from gut feelings anymore. It’s coming from structured information and predictive patterns.

What also sets VC 3.0 apart is how the line between investor and operator keeps fading. Top firms are doing more than just writing checks. They’re deploying proprietary tools, building internal data platforms, and in some cases, acting as co-builders with their portfolio companies. This is capital with leverage built in.

Firms like Andreessen Horowitz, Index Ventures, and Bessemer are already operating this way. They’ve embraced the idea that value in this era doesn’t just come from boardroom advice. It comes from infrastructure, insight, and speed.

VC 3.0 is slowly moving away from being just a trend. It is turning into a new default.

2. How AI Is Reshaping the Venture Capital Landscape

AI is powering the new VC wave. Over the past two years, generative models have moved from research labs to consumer apps and enterprise workflows at an astonishing pace. This rapid adoption is reshaping how startups get built, how capital gets deployed, and how investors spot what’s next.

The Startup Boom, Rewired by AI

Generative AI startups have flooded the early-stage ecosystem. From LLM-based productivity tools to vertical-specific agents, founders are launching with pre-trained models and getting to market in record time. Product-market fit now comes faster, sometimes within weeks of launch. Even niche tools can scale rapidly when paired with a well-tuned model and the right distribution. Just take another look at CB Insight’s AI 100 list of 2024, full of generative AI companies:

For investors, this creates an entirely new tempo. Early traction that once took six months now takes six days. VCs are seeing user graphs spike in real time, and they’re writing checks just as fast.

VC Firms Are Becoming AI Users Too

AI isn’t just something VCs invest in, it’s something they use too. Funds are adopting internal tools that scrape job boards, parse LinkedIn moves, and monitor product launch activity across platforms. Some firms are even training their own models to rank inbound deals or generate early investment memos.

This automation doesn't replace judgment, but it does speed up decision-making. It allows lean teams to cover more ground, surface better leads, and stay competitive in a market where the best founders often have multiple offers within days.

Fundraising and Scaling at AI Speed

Founders building in the AI space are experiencing compressed timelines. MVPs come together in weeks thanks to available APIs and pretrained infrastructure. GTM cycles are faster, too, especially for freemium tools that go viral through social demos or developer communities.

The result is that a founder might go from idea to product to seed round in less than a quarter. Traditional startup timelines don’t apply when the stack and distribution channels are this evolved.

New Signals, New Models

The signals VCs used to rely on, like founder pedigree, early ARR, and warm intros, are being replaced or supplemented by new ones. Investors are now tracking GitHub activity, API usage, Discord engagement, and waitlist conversion rates. They're watching how well a startup integrates with foundational models or how differentiated its data pipeline is.

AI is changing the definition of what’s investable. In this environment, insight comes from pattern recognition across fast-moving public and private data. And the winners are those who can interpret that noise quickly and clearly.

3. What Founders Must Do to Succeed in VC 3.0

VC 3.0 moves faster, goes broader, and demands more clarity from founders. This is no longer the era of long beta cycles and backroom funding. It’s a moment built on speed, precision, and strategic storytelling. To thrive, founders need to adapt across three core fronts:

Speed Is No Longer Optional

In this landscape, timing is a competitive edge. Founders are building MVPs in weeks, not months. They’re leveraging existing AI infrastructure, such as pretrained models, API integrations, and open-source frameworks, to reduce build time and get to market quickly.

This compression affects everything. VCs are moving faster, and startups that show traction early get noticed. Speed also creates momentum. If you can launch, iterate, and show user pull in the same quarter, you change the shape of your fundraising. Conversations shift from hypotheticals to proof.

But speed isn’t about rushing. It’s about focusing only on what moves the needle: shipping tight, learning fast, and staying close to the customer signal.

Storytelling as a Strategic Weapon

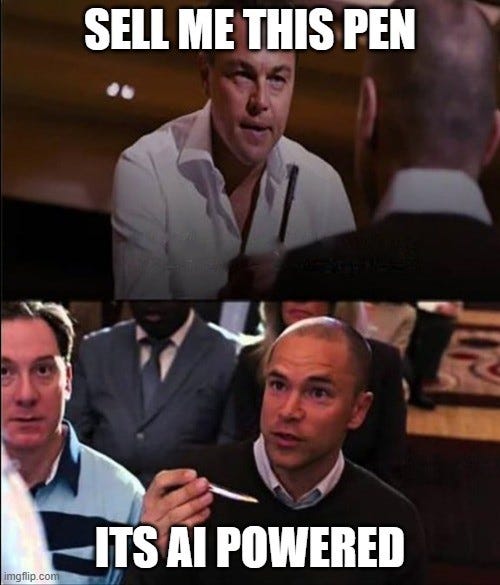

Founders in the AI era are competing not just on tech, but on narrative. The best pitch isn’t just that you use AI. It’s how your product couldn’t exist without it. That distinction matters.

VCs today are looking for companies that feel inevitable. The way you position your startup (how you frame the problem, the tech, the opportunity) can create that inevitability. An AI-native company isn’t just layering GPT on top of a workflow. It’s reimagining the workflow altogether.

This also means founders need fluency. Investors expect a clear articulation of how your AI model works, what data it's trained on, how it performs, and what makes it better over time. If you're not technical, bring someone who is. Your narrative has to match the complexity of the product you're building.

Data Is the New Moat

In a world where access to AI models is becoming more democratized, proprietary data is what sets you apart. It’s the fuel that makes your system smarter, more accurate, and harder to copy.

Founders need to think about defensibility from day one. Are you collecting data that others can't easily replicate? Is your data getting better as more users engage? Does your system improve in ways that compound over time? To build a robust data moat, founders should consider:

Gathering their best proprietary data

Leveraging advanced analytics like Power BI, Tableau, or Zoho Analytics

Ensuring data quality and security

Acceldata offers a quick guide to building a data moat with scenario-based solutions for this. Investors are interested in seeing that you build something that gets stronger the more it’s used, and that others can’t easily catch up to. They want to see not just clever usage of AI, but a path toward long-term advantage rooted in data.

4. Tactical Guide: How Founders Can Ride the VC 3.0 Wave

Founders building in the AI era are designing for this moment from day one. The ones who break out are leaning into what VC 3.0 offers, not trying to retrofit yesterday’s playbooks.

Make AI Core, Not Cosmetic

There’s a difference between a startup that uses AI and one that doesn’t work without it. In this new wave, founders are building businesses where AI isn’t just a feature, it’s the foundation. Whether it’s a product that automates complex workflows or a tool that learns with every user interaction, the best companies make AI the engine, not the decoration.

This approach creates structural advantages. You move faster, adapt better, and scale smarter. And more importantly, it sends the right signal to investors who are looking for depth in this era, not hype.

Use the Infrastructure Around You

Venture firms are no longer just capital providers. Many now operate like full-stack platforms offering model access, AI talent networks, distribution support, and product feedback loops. If you're backed by one of these firms, lean in. If you're not, find ways to plug into the broader ecosystem by looking into open-source communities, accelerator APIs, cloud credits, and research hubs.

In VC 3.0, leverage is everywhere. Founders who know how to tap into these ecosystems build with more velocity and have fewer blind spots.

Fundraise Smarter, Not Louder

AI is changing how fundraising works, on both sides of the table. Founders are using tools to refine decks, target the right investors, and optimize their messaging. Some are even testing their pitches with AI feedback loops before stepping into a live meeting.

At the same time, VCs are scanning your metrics before you speak. They're using internal systems to spot signals from web traffic, API usage, social mentions, and even GitHub commits. That means every data point you put out is part of your story. Founders who understand this dynamic shape their public presence with intention and precision.

5. Case Studies: Startups Winning in the New VC Era

The shift to VC 3.0 isn’t just playing out in investor memos, it’s happening on the ground. Founders across industries are building faster, raising smarter, and growing on the back of AI-native strategies and VC partnerships that go well beyond capital.

Series: AI-Powered Networks, Born in a Dorm Room

In early 2025, two Yale undergrads raised $3.1 million to launch Series, a social networking platform powered by an AI agent that curates meaningful introductions between startup founders, investors, and operators. The idea is simple: reduce noise, increase signal, and let machine learning broker relationships that matter.

What makes Series stand out isn’t just the product. It’s how quickly they moved. With no traditional tech pedigree or prior exits, the founders built an MVP in months, generated buzz through targeted demos, and tapped into the rising curiosity around AI agents.

VCs took notice. Pear VC led the round, joined by angels like Reddit’s CEO Steve Huffman and other high-profile operators. But it wasn’t just a check. Backers brought distribution muscle, product feedback loops, and signal amplification that helped Series land thousands of early users even before launch. This is what VC 3.0 looks like - capital plus capability, backing founders who move fast and think differently.

Mistral: European Models, Global Ambition

Mistral, a Paris-based AI lab, launched in 2023 and almost immediately raised a $113 million seed round, one of the largest ever in France. The company focuses on building open-weight large language models that rival offerings from OpenAI and Anthropic. Within a year, it released Mistral 7B, a highly performant open-source model that gained traction with developers and enterprises alike.

What Mistral tapped into was a deep global appetite for open alternatives in the AI infrastructure layer. Their approach wasn’t just technical, it was philosophical. By building transparent, open-weight models, they rallied a growing community around their platform.

Venture firms including Lightspeed, Redpoint, and Index backed them early. But more importantly, these firms helped Mistral navigate compute sourcing, talent acquisition across continents, and strategic go-to-market plays with corporate partners. In a world dominated by American AI labs, Mistral’s rapid rise shows how VC 3.0 is decentralizing not just funding, but innovation itself.

Harvey: Vertical AI for a Complex Industry

Harvey, an AI-powered legal assistant built on top of OpenAI’s models, secured over $500 million in five funding rounds from investors including Sequoia Capital and Kleiner Perkins. The company targets large law firms, helping them draft contracts, summarize case law, and handle repetitive legal tasks more efficiently.

This isn’t a generic AI wrapper. Harvey’s team is composed of legal experts and engineers working in tandem to fine-tune models for one of the most regulation-heavy industries in the world. Its product roadmap reflects deep understanding of the domain, not just the tech.

Harvey’s investors didn’t just provide money, they opened doors. Sequoia helps their portfolio with product market fit, and Kleiner Perkins facilitates partnerships and other connections. In a vertical where trust and nuance are non-negotiable, the backing of credible VCs became a moat in itself.

6. Final Takeaways for Startup Founders Navigating VC 3.0

This new era of venture capital isn’t defined by bigger checks or louder pitches. It’s defined by the speed of execution, the depth of insight, and the quality of partnerships between builders and backers.

Founders who succeed in VC 3.0 will be the ones who move with clarity. They’ll treat AI as core infrastructure, not a marketing layer. They’ll tell better stories because they understand the tech and the market. And they’ll pick partners who don’t just fund the journey, but accelerate it.

The playbook has changed. You don’t need permission, perfect timing, or proximity to Sand Hill Road. What you need is a real problem, a sharp solution, and the ability to build fast while staying focused. The rest - capital, support, reach - is more available than ever.

If you’re building in this moment, lean in. The wave is here. Ride it with intention.

FAQ: Navigating VC 3.0 as a Startup Founder

▫️ What is VC 3.0?

VC 3.0 is the new phase of venture capital where AI is reshaping how startups get funded, how investors operate, and how quickly markets move. It’s faster, more data-driven, and powered by tools instead of only networks or intuition.

▫️ How is AI changing how VCs invest?

AI is transforming everything from deal sourcing to due diligence. VCs are using models to surface founders earlier, scan thousands of signals from GitHub to waitlists, and make faster, smarter investment decisions. It’s not replacing judgment—but it’s definitely supercharging it.

▫️ What does this shift mean for early-stage founders?

Speed and clarity are the new currency. Founders need to ship faster, tell sharper stories, and show traction earlier. The startups that win will be the ones that treat AI as a core ingredient—not a cosmetic feature.

▫️ Do I need to be technical to raise in this new environment?

Not necessarily—but you do need to speak the language. If you’re building an AI-native product, be ready to explain your model, your data pipeline, and your moat. If you’re not technical, make sure someone on your team is.

▫️ What are VCs looking for now that they weren’t before?

Signals have shifted. Today’s investors track things like developer engagement, Discord buzz, product demo virality, and integration with foundational models. Traditional credentials still matter—but they’re no longer the only story.

▫️ Can I raise funding without a warm intro?

Yes—and even more so in VC 3.0. Many top VCs now use AI to spot under-the-radar founders. If you’re building fast and showing real usage data, you can bypass the gatekeepers. Cold is no longer cold when your traction speaks for itself.

▫️ How do I make AI core to my startup?

Design your product around what AI uniquely enables. Don’t just bolt on GPT—build a product that wouldn’t work without it. Investors want to see structural advantages and defensibility, not gimmicks.

▫️ What’s a “data moat” and why does it matter?

A data moat is your proprietary edge—the unique dataset that makes your model smarter and harder to replicate. In an open-model world, your data is what sets you apart. VCs want to see compounding value and long-term defensibility.

▫️ Which startups are succeeding in VC 3.0?

Companies like Harvey (legal AI), Mistral (open LLMs), and Series (AI-powered networks) are thriving by building fast, using AI deeply, and partnering with VCs who offer more than money. These are the playbook examples of the new era.

▫️ What’s the biggest takeaway for founders in VC 3.0?

Don’t build like it’s 2015. Leverage today’s tools, move with speed, and partner with investors who act like collaborators, not just check-writers. The new wave is here—ride it with intent, or get swept aside.

At a risk of oversimplifying:

VC 3.0, with the entire network of support for the startups they fund, seems a hell lot like every single version of VC should look.

I would argue that quite a lot of the dynamics between founders and funders is less-than-healthy, but evolution toward more help coming from vetted people who have seen much (including failures) is a welcome change.

In fact, the VC 2.0 always seemed weird to me. Again, oversimplifying: "Let's throw a bag of money at them and hope for the best. Some have to turn to unicorns, right? *Right?*"

If an individual were investing in their neighbor's small-scale business, they'd go the extra mile to help the business. VCs redefined the game through the scale and unprecedented valuation growth. Only to see it go out of the charts with AI businesses these days.

Let's see how the landscape for them will look once the AI race settles. In the meantime, many funding-starved non-AI startups will reinvent themselves, and they may not come back knocking when VC 3.5 will face another turn in "the control curve."