VC Math Explained📊, Grow with Roll-Ups 🔄, The Top 1%🧠

Welcome back to The VC Corner, your weekly dose of Venture Capital and Startups to keep you up and running! 🚀

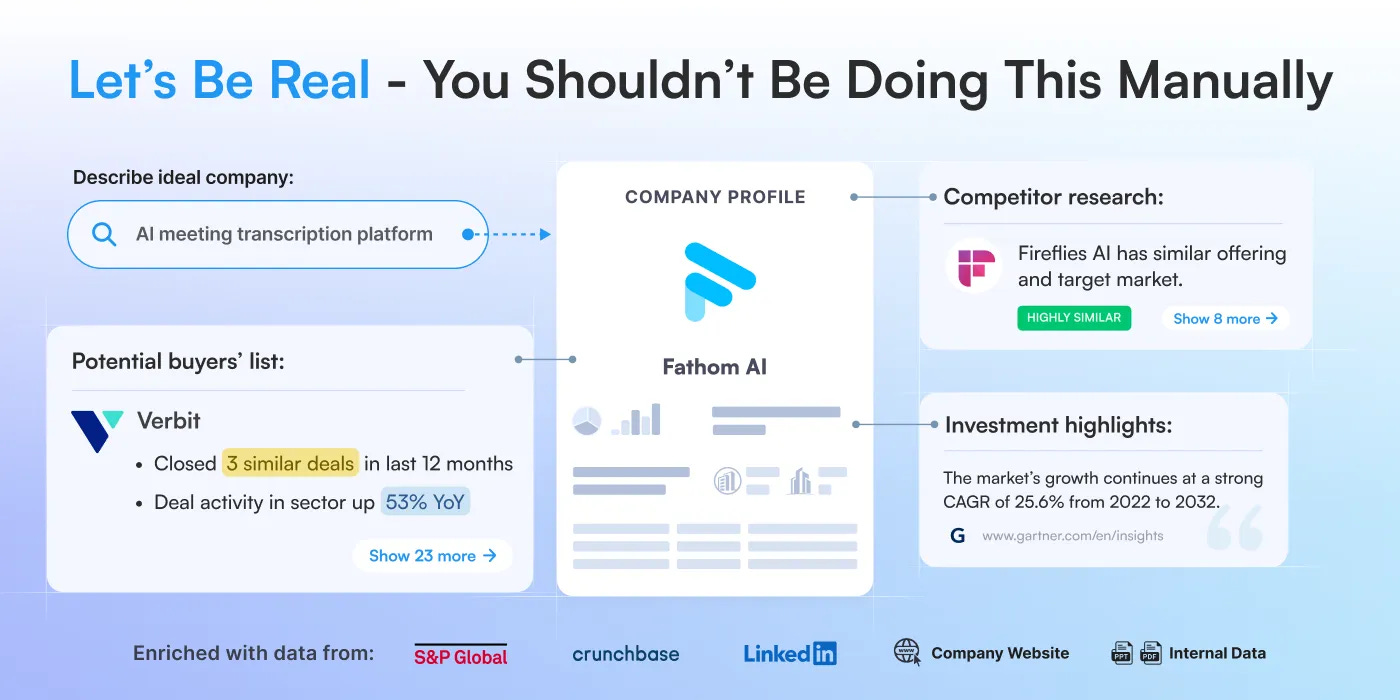

How to Streamline Your Investment Workflow Using AI?

Eilla AI is officially live - built on insights from 600+ VC funds Eilla is here to streamline your investment workflow.

Why Eilla?

Save Hours on Research: Eilla’s gets you the lengthy research and analysis on companies, teams and deals in seconds.

One Platform for Every Step: Manage sourcing, due diligence—all in one platform.

Trusted Data at Your Fingertips: Access validated insights from Crunchbase, LinkedIn, CapIQ, combined with Eilla’s proprietary research and your internal data.

In-Depth Insights 🔍

VC Math Explained: The High-Stakes Game of Startup Funding 📊

Halle Tecco’s blog breaks down the metrics that drive venture capital funding, helping founders understand the high-stakes math behind startup investments.

VC Megadeals Are Booming, and AI Isn’t the Top Category 💥

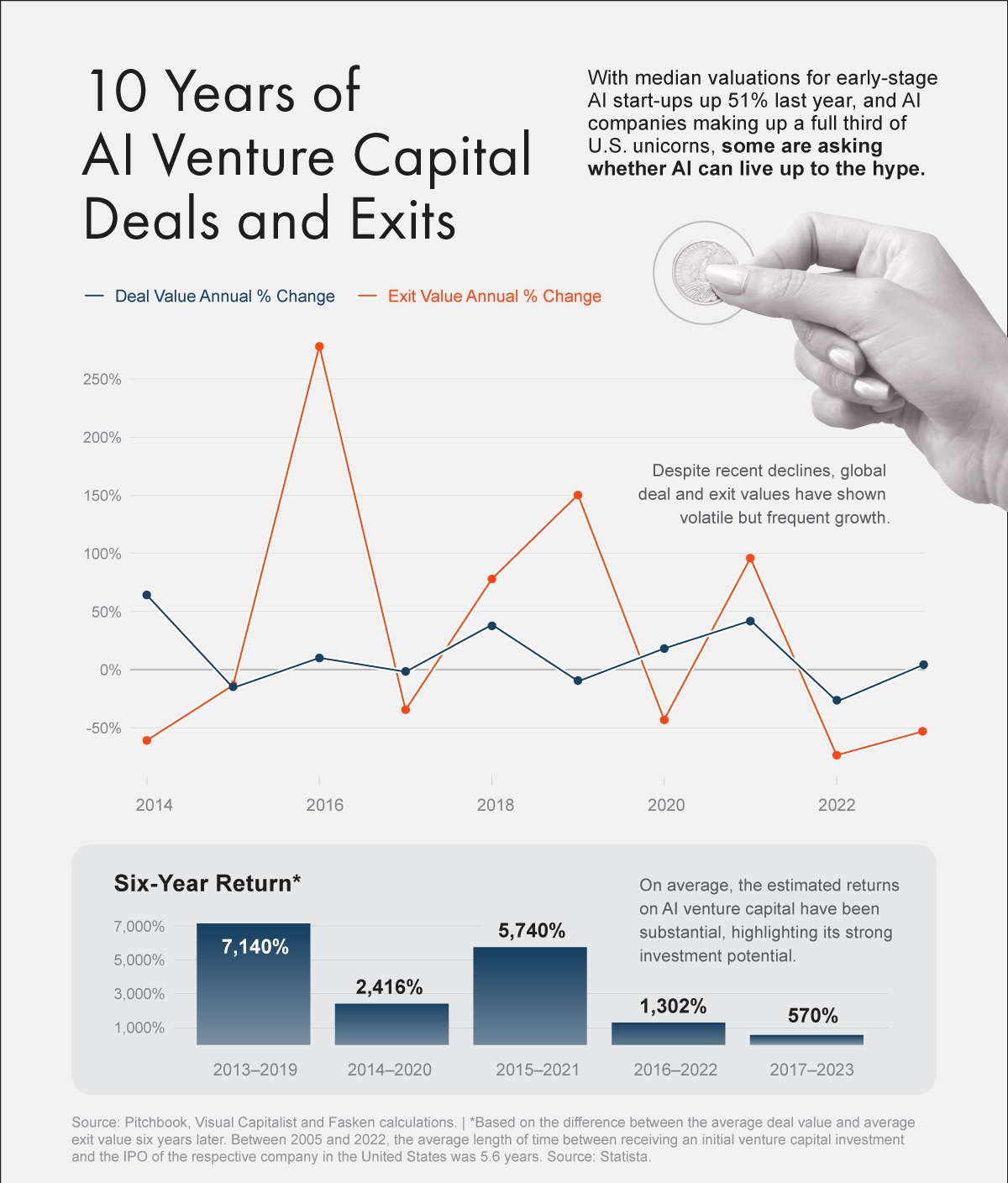

TechCrunch analyzes the recent surge in VC megadeals, revealing surprising data on which sectors see the biggest deals beyond AI.Ten Years of AI Venture Capital Deals and Exits 🤖

Visual Capitalist provides an in-depth look at AI venture capital trends over the last decade, showcasing the major deals, exits, and growth in the AI sector.

Beyond the Obvious: How Data Generates Pre-Seed Deal Flow 💡

Exploring how innovative data strategies now help VCs source pre-seed deals, this article dives into the data-driven transformation in early-stage investment.How to Join the Top 1% of Intelligence: Full Guide 🧠

Dan Koe shares insights on habits, strategies, and mindsets that lead to peak performance, aiming to help individuals elevate their intellectual game in competitive spaces.

How Industry Consolidators and Serial Acquirers Use Roll-Ups 🔄

An exploration of “roll-up” strategies used by industry consolidators to scale quickly by acquiring smaller players in fragmented markets.Shifting Venture Capital Dynamics: 2024’s Liquidity Landscape 💸

A LinkedIn deep dive into the evolving liquidity landscape in VC, analyzing shifts in capital flow, distributions, and commitments from LPs through 2024.

📣Want to get your brand in front of 100k founders and investors?

If interested in sponsoring The VC Corner, reach out via email: rdominguezibar@gmail.com

Interesting Reports 📊

The Unicorn Profile: Southeast Asia Since 2000 🦄

M Venture Partners analyzes the unique characteristics of unicorn founders in Southeast Asia, uncovering insights that define this dynamic tech ecosystem.

The Startup Sprint: Inside the Accelerator Engine 🚀

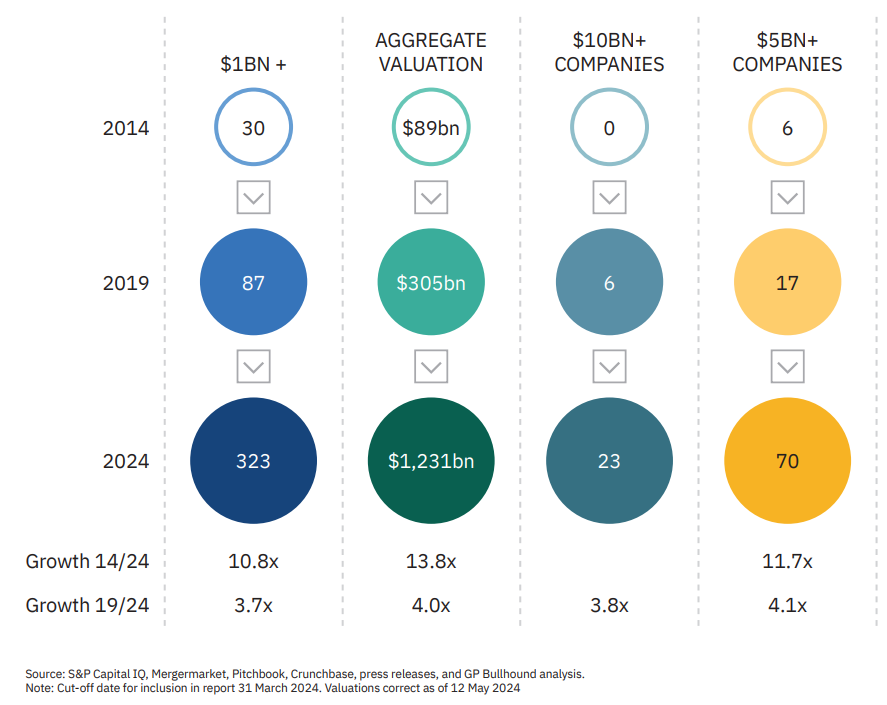

A look into the world of startup accelerators, these high-stakes programs aim to convert early-stage startups into scalable, high-growth businesses.Titans of Tech 2024 🦸♂️

GP Bullhound’s latest report examines the biggest players in global tech, focusing on their growth strategies and market influence.

Recently Launched Funds 💸

Aramco’s Venture Arm allocates $100M to fuel AI innovation, targeting transformative startups in artificial intelligence.

Axon Partners Group is set to raise up to €250M, focusing on tech SMEs across Europe with growth-oriented investments.

Chemistry Ventures, launched by former Bessemer and a16z alums, enters the scene to support tech-driven companies with early-stage capital.

BITKRAFT Ventures has unveiled a $275M fund for gaming and Web3 ventures, aiming to accelerate innovation in interactive entertainment.

Riyad Bank’s Fintech Fund launches with $213M to support the burgeoning Saudi fintech ecosystem and enhance digital financial services.

Stride Ventures Fund III closes at $165M, focused on expanding its venture debt portfolio and supporting high-growth startups in India.

Benchmark is raising a $170M fund exclusively for partners, furthering its legacy of backing transformative tech startups.

VC Jobs 💼

NextGen Ventures - VC Associate, Ede, Netherlands

Ring Capital - VC Associate, Abidjan, Ivory Coast

Hivemind - VC Partner, New York City, NY

Telkomsel Ventures - Senior VC Associate, Jakarta, Indonesia

TNB Aura - VC Analyst, Singapore

Altos Ventures - VC Investor, Burlingame, CA

Partners Capital - VC Associate, New York City, NY

AI Fund - VC Principal, Palo Alto, CA

GSV Ventures - Program Associate, Remote

Impact Assets - VC Associate, Remote

Capital Impact Partners - Chief Strategy Officer, Remote

Serent Capital - Head of IR, Austin, TX

Hottest Deals 💥

Vinted raises €340M, reaching a €5B valuation. The Lithuanian second-hand marketplace scales new heights, solidifying its unicorn status.

Waymo secures $5.6B from Alphabet, a16z, and Silver Lake. The autonomous driving leader continues its mission to commercialize self-driving technology.

WeWork restructures amidst a Chapter 11 bankruptcy filing. Embassy Group and Virwani step up to help reconfigure its growth strategy in India.

Nooks secures $43M in Series B to advance its collaborative workspaces platform.

Reverie Labs raises funds to drive precision medicine in oncology through AI-powered solutions.

Caduceus AI secures new financing to expand its AI-driven healthcare technology.

Eventum AI closes a strategic funding round to enhance its event analytics and prediction platform.

Sphere Bio secures capital to scale its bioinformatics solutions for drug discovery.

Investment decisions are only as good as the data behind them—AI makes that data smarter.