Vertical SaaS: Now With AI Inside, B2C is Back, AI Agents Landscape

Welcome back to The VC Corner, your weekly dose of Venture Capital and Startups to keep you up and running! 🚀

Brought to you by Harmonic — the startup discovery engine

Did a former portfolio employee just start something new? With the new alert flow in Harmonic, you’ll never miss an opportunity to engage with the best startups at the right time.

Join the likes of NEA, Bessemer, and Redpoint, and monitor your searches automatically from your inbox or Slack!

In-Depth Insights 🔍

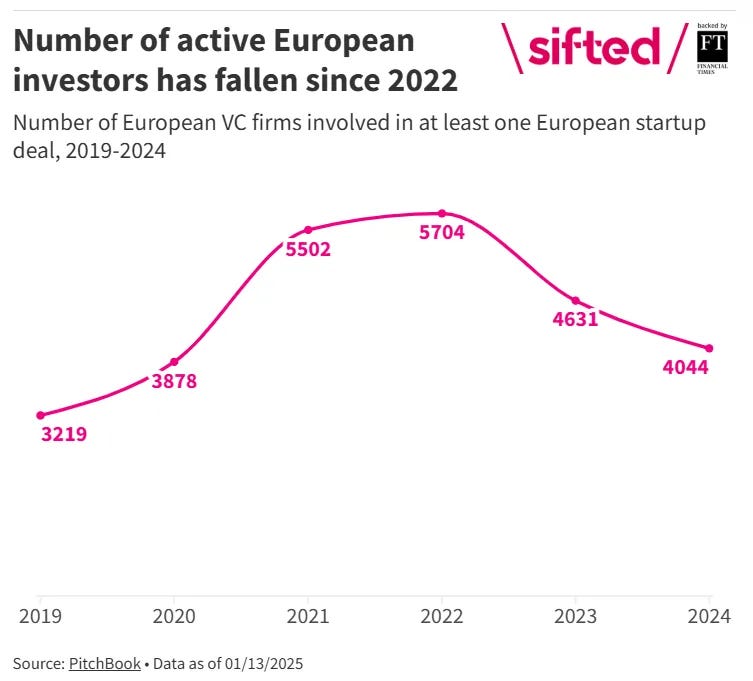

Active VCs in Europe Drop Dramatically 📉

Learn about the decline in active VCs across Europe and its impact on the startup ecosystem.

Why Invest in Venture Capital? 💰

Gain insights into the long-term value proposition of investing in venture capital.Vertical SaaS: Now With AI Inside 🖥️🤖

Discover how AI integration is transforming vertical SaaS and unlocking new opportunities.

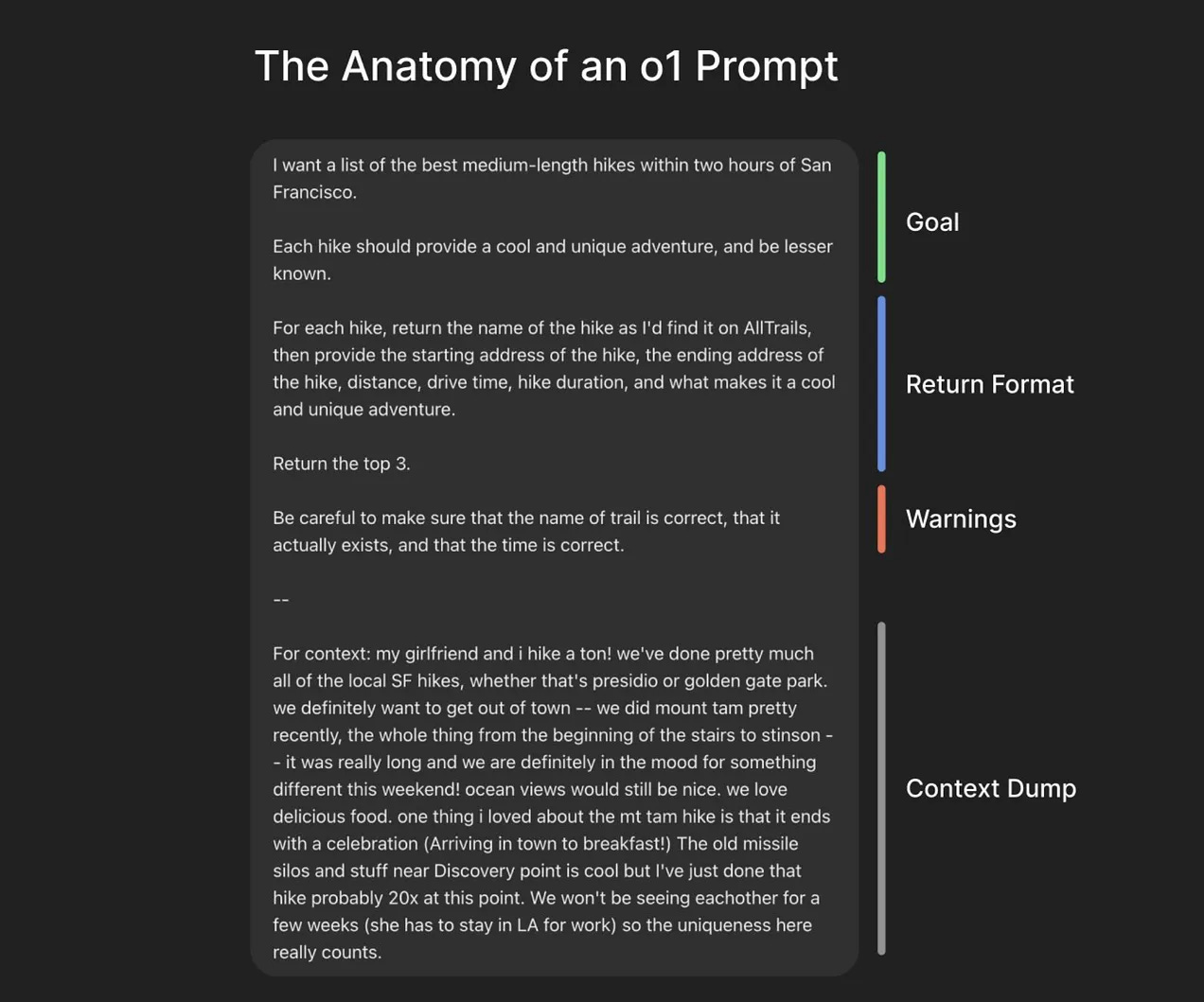

o1 isn’t a chat model (and that’s the point) 🧑💻

How Ben Hylak turned from ol pro skeptic to fan by overcoming his skill issue.

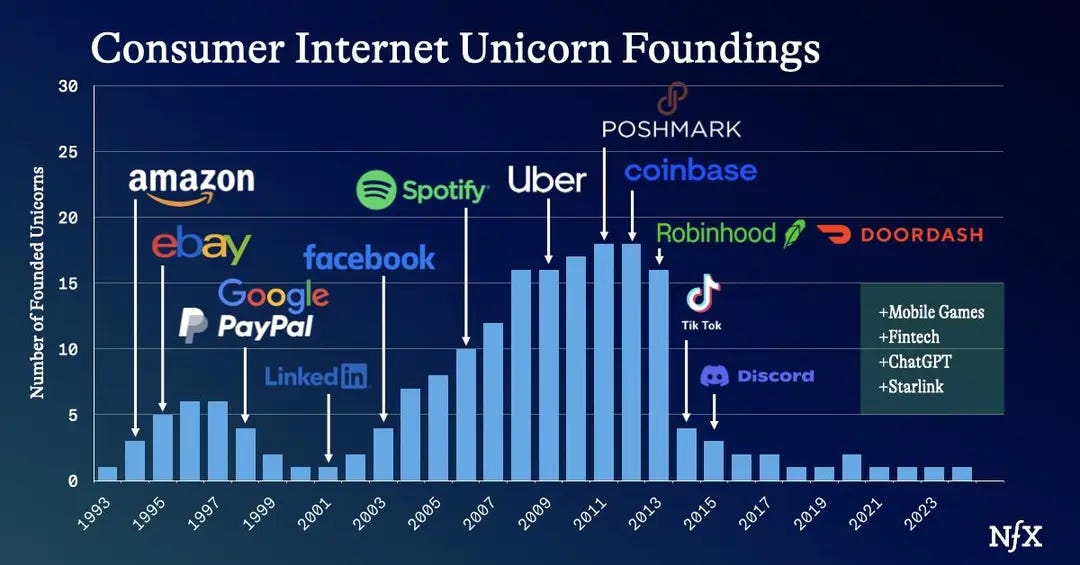

The Consumer is Back 🛒

Examine the resurgence of consumer-focused startups and trends driving the sector.AI Agents Landscape 🤖

A comprehensive directory and analysis of the evolving landscape of AI agents.

📣Want to get your brand in front of +300k founders and investors?

If interested in sponsoring any of my media assets, reach out via email: rdominguezibar@gmail.com

Interesting Reports 📊

UK Innovation: Forward Look for 2025 🇬🇧

An in-depth analysis of the UK's innovation landscape and its trajectory for 2025.

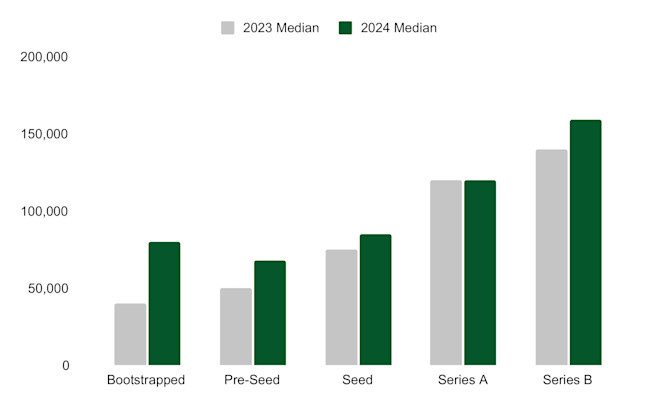

Founder Compensation 3.0 💼

Explore the latest trends and best practices in founder compensation across the startup ecosystem.

India Venture Capital Report 2024 📖

Insights into India's venture capital trends and the drivers shaping its ecosystem in 2024.

Recently Launched Funds 💸

dYdX Capital launches its new VC firm, focusing on transformative investments.

Insight Partners closes on $12.5B in fresh capital for global growth-stage investments.

Blockchain Founders Capital adds Animoca Brands’ Yat Siu as a Limited Partner.

FTV Capital secures $4.05B for its latest growth equity fundraise.

Smartfin closes its third growth fund with €250M for scaling European tech companies.

Scrum Ventures closes its fifth tech fund, targeting sports and entertainment innovation.

Zero Carbon Capital has closed a $23.4M fund to support scientific solutions for deep decarbonization.

Intel Capital is now a standalone fund, spun off by Intel to focus on strategic investments independently.

Capmont Technology has raised €100M to back early-stage B2B tech founders across Europe.

Cerulean Ventures launched its Fund I at Climate Week NYC 2024, targeting climate-tech innovations for a sustainable future.

VC Jobs 💼

Reuters (New York City, NY): VC Principal (apply here)

Seeds Capital (Singapore): VC Manager (apply here)

Tenity (Singapore): VC Manager (apply here)

Polychain Capital (San Francisco, CA): VC Associate (apply here)

Square Peg (Sydney, Australia): VC Investor (apply here)

Qualcomm Ventures (Israel): Senior VC Manager (apply here)

Amazon Catalytic Capital (Seattle, WA): Portfolio Manager (apply here)

Schrödinger (New York City, NY): VC Director (apply here)

Neom (New York City, NY): Managing VC Director (apply here)

Morningside (Newton, MA): VC Associate (apply here)

Endeavor (New York City, NY): Chief of Staff (apply here)

Hottest Deals 💥

GT Medical Technologies, a Tempe, AZ-based medical device company, raised $37M in Series D funding (read here)

Core Sound Imaging, a Raleigh, NC-based provider of medical imaging platform, received a $80M Growth investment from PSG (read here)

Netradyne, a San Diego, CA-based SaaS provider of artificial intelligence (AI) and edge computing solutions, raised $90M Series D funding (read here)

Stoke Space, a Seattle, WA-based company building a reusable medium-lift rocket, raised $260M in Funding (read here)

Adaptive Reader, a Cambridge, MA-based provider of an edtech platform for reading accessibility, raised an undisclosed amount in Pre-Seed funding (read here)

SwiftComply, a Pleasanton, CA-based provider of water and wastewater compliance software, received an investment from M33 Growth (read here)

Healthfuse, a Milwaukee, W-based revenue cycle vendor management company, received an investment from InTandem Capital (read here)

BeZero Carbon, a London, UK-based carbon ratings agency, raised US$32M in Series C funding (read here)

Komainu, a St Helier, Jersey-based regulated digital asset services provider and custodian, backed by Laser Digital, a Nomura company, received a $75M investment from Blockstream Capital Partners (read here)

Recharge, an Amsterdam, the Netherlands-based company which specializes in online prepaid payments, received a €45M facility from ABN AMRO (read here)

Omega Systems, a Reading, PA-based provider of managed information technology and cybersecurity managed services, received a strategic investment from Revelstoke Capital (read here)

W Capital Markets Pte Ltd, a Singapore-based corporate finance firm, has completed its Series B fundraising round, at a post-money valuation of S$42M (read here)

ControlMonkey, a Tel Aviv, Israel-based provider of an end-to-end cloud automation platform, raised $7M in Seed funding (read here)

Love this newsletter!

thanks for this great summary