What to expect when you’re expecting (dilution)

How founders should think about selling equity to investors by round

Today, I’m glad to have Peter Walker share insights on The VC Corner.

Peter is Head of Insights at Carta and runs The Data Minute, a weekly newsletter featuring the most striking data from 43,000 startups.

1. Introduction

Appreciate the guest stage!

Let’s jump into a question we get all the time at Carta - how much of my company should I sell in each venture round?

All data below comes from the 43,000+ companies using Carta as their cap table platform today. US data only.

2. Dilution Dynamics in Early-Stage Rounds

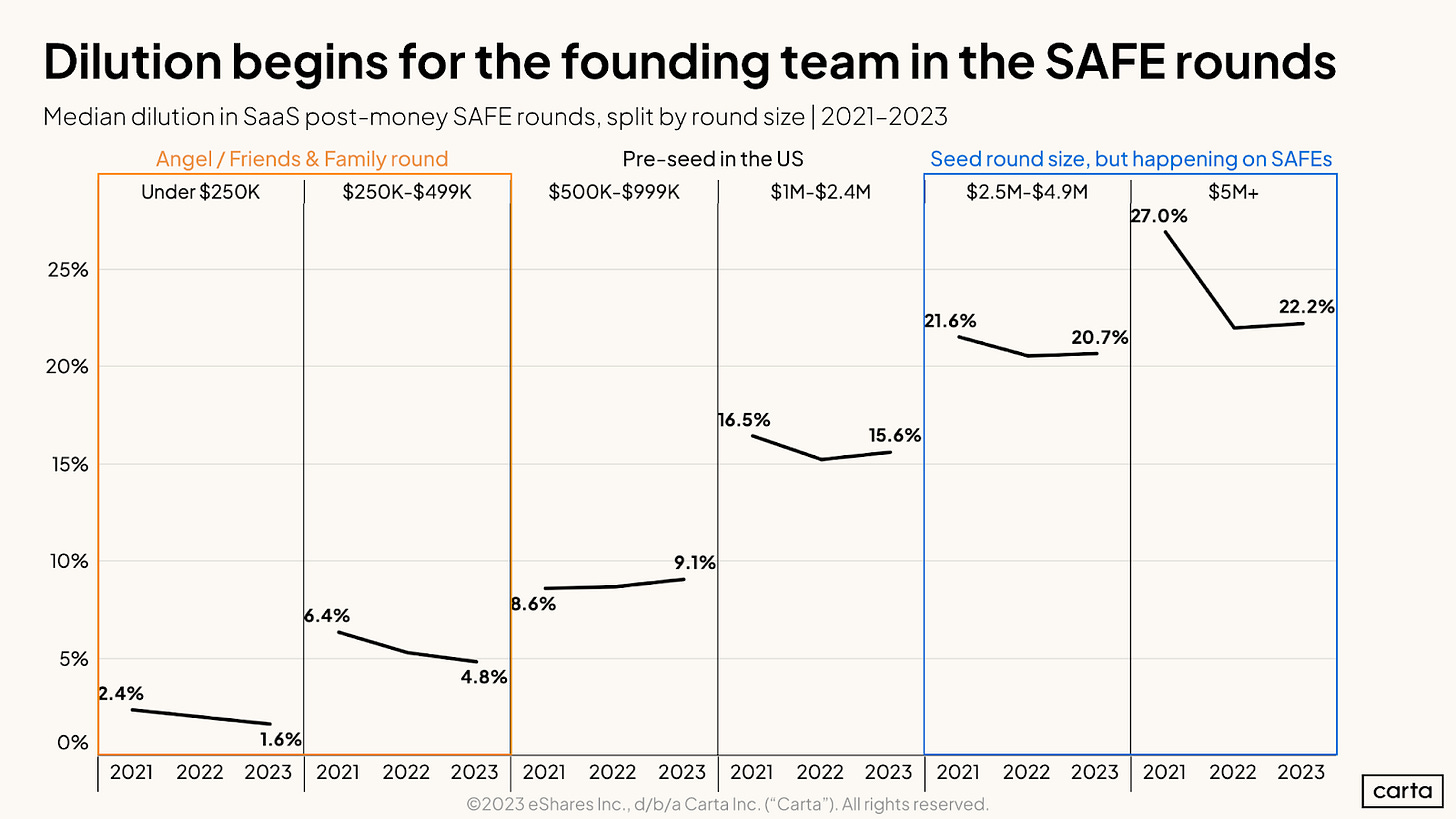

Dilution starts (even though it may not feel this way) with the SAFE round.

Lots of founders are using SAFEs to raise their initial $500K…or $1M…or $5M. It’s much more common than it used to be.

But if those SAFEs are all post-money, the dilution adds up quickly. Founders should be wary of stacking too many SAFEs on each other as they come with anti-dilution effects for investors.

3. Trends in Founder Equity Sales

Alright, on to the priced equity.

Only for premium subscribers 👇

4. Challenges in the Fundraising Market

5. Impact of Bridge Financings on Dilution

6. Importance of Deal Terms

7. Conclusion

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.