What Venture Capitalists Look for in Startups

From Pitch to Partnership: How to Align Your Startup with VC Expectations

Welcome back to The VC Corner, your weekly dose of Venture Capital and Startups to keep you up and running! 🚀

This article is brought to you by the Early-Stage Virtual Conf

2,500 VCs, angels, Family Offices, startups & advisors registered for the Early-Stage Virtual Conf on January 30, Thu.

Each startup can pitch to 10-20 investors during a 1:1 Speed Pitch Session. Investors can attract co-investors for their deals and add 1K+ startups in their funnels.

100% online: US/Canada + Europe/Israel/Africa + Latam/RoW.

You can choose between a free & paid ticket:

Why Raising VC Is Harder Than You Think 💰

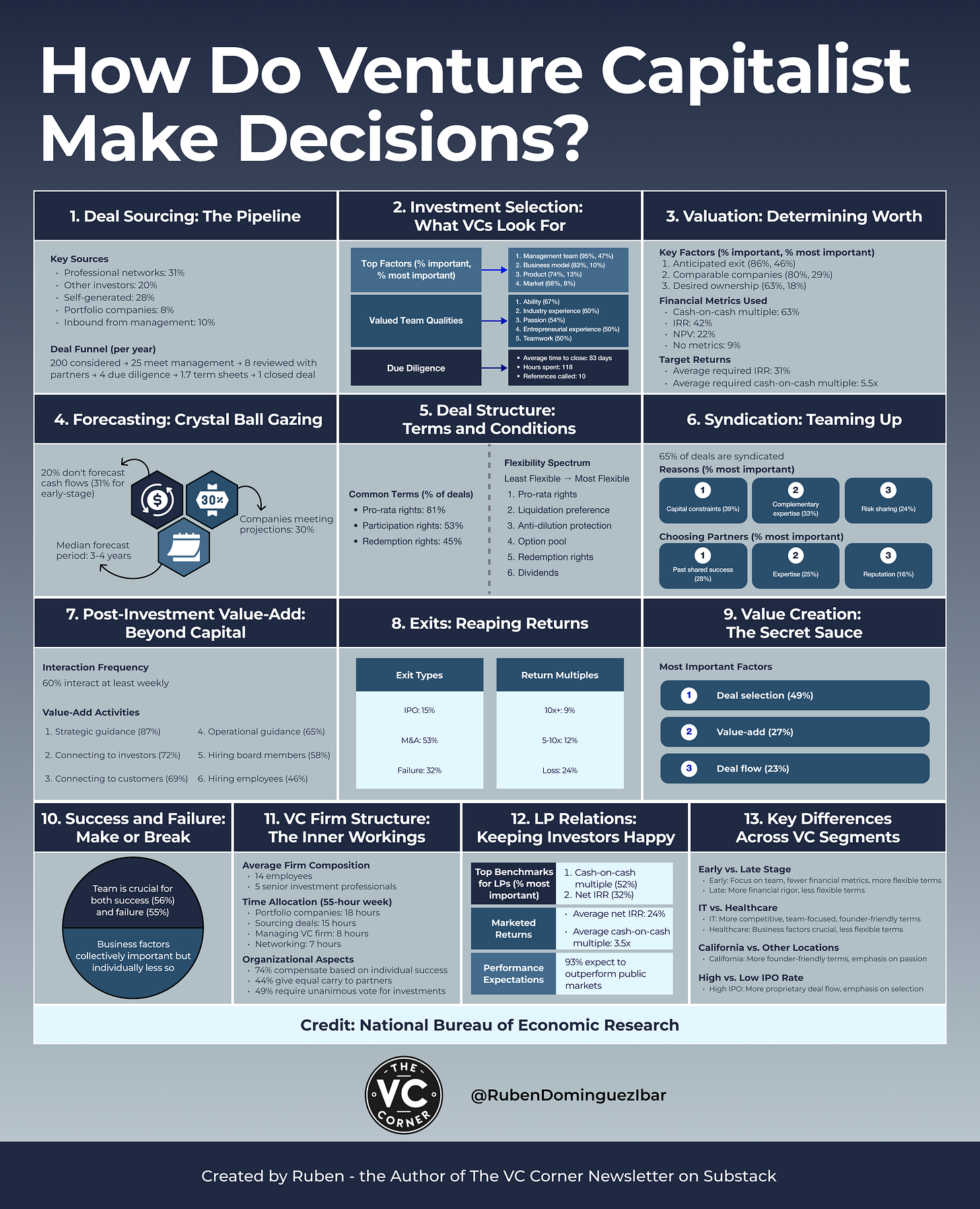

For startups, raising venture capital funding is often the difference between surviving and thriving. But with only 0.05% of startups succeeding in securing VC investment, founders face steep competition. According to the National Venture Capital Association, U.S. VCs invested $330 billion in startups in 2023, yet only a fraction of founders ever receive funding.

So, what separates funded startups from the rest? It’s not just about having a great idea; it’s about aligning with what venture capitalists look for in startups.

As Marc Andreessen, co-founder of Andreessen Horowitz, famously said:

"The market is everything. If you choose the right market, the wind is at your back."

This article breaks down the key startup funding criteria, offers actionable advice, and explores how you can position your business to attract top-tier investors.

Why Understanding Venture Capital Criteria Matters

Venture capitalists aren’t just looking to write checks—they’re looking for returns. For startups, this means aligning their vision, business model, and strategy with the expectations of investors.

To stand out, founders must demonstrate:

Scalability: The ability to grow revenue without proportional cost increases.

Product-market fit: Proof that customers want and need what you’re offering.

Market opportunity: A large and expanding industry ripe for disruption.

Understanding these criteria allows founders to tailor their pitch, making it more compelling and aligned with venture capital evaluation processes.

Key Factors Venture Capitalists Evaluate

1. Market Opportunity for Startups

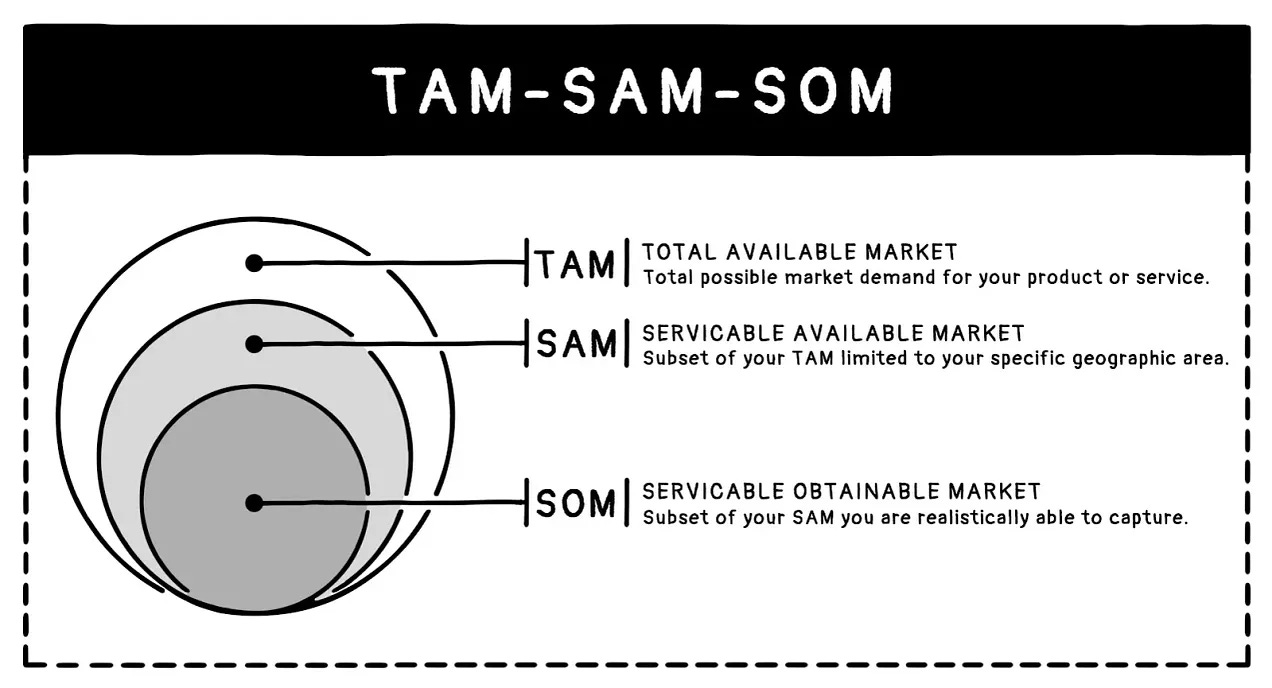

The size and growth potential of your target market are critical. VCs want startups that address large total addressable markets (TAM) with the clear potential for substantial returns.

Stats That Matter:

Startups entering markets valued at over $1 billion are 60% more likely to raise funding.

88% of investors rank market size as the most important factor for early-stage investments.

Case Study:

Consider Tesla, which entered the electric vehicle (EV) market—a sector expected to grow to $1 trillion by 2030. By targeting a transformative market, Tesla became a magnet for billions in VC funding.

Pro Tip:

Highlight how trends (e.g., AI, renewable energy, or blockchain) position your startup for growth.

Max Pog, the host of the Early-Stage Conf, prepared a list of 100+ fundraising advisors working without retainers, you can access the spreadsheet here.

2. Team and Leadership

Investors bet on people, not just ideas. A strong, visionary team is often the deciding factor in securing venture capital funding. According to First Round Capital, 92% of VCs say the team is the most important element in their decision-making process.

What VCs Look For in Teams:

Founders with relevant expertise and leadership skills.

Teams with complementary technical and business capabilities.

A proven track record or evidence of resilience.

Quote:

"I invest in people, not businesses. A great team will figure out how to pivot and succeed." – Reid Hoffman, co-founder of LinkedIn

Example:

A SaaS startup led by a serial entrepreneur, a technical co-founder with deep engineering experience, and a CMO skilled in scaling user acquisition campaigns is a dream team for VCs.

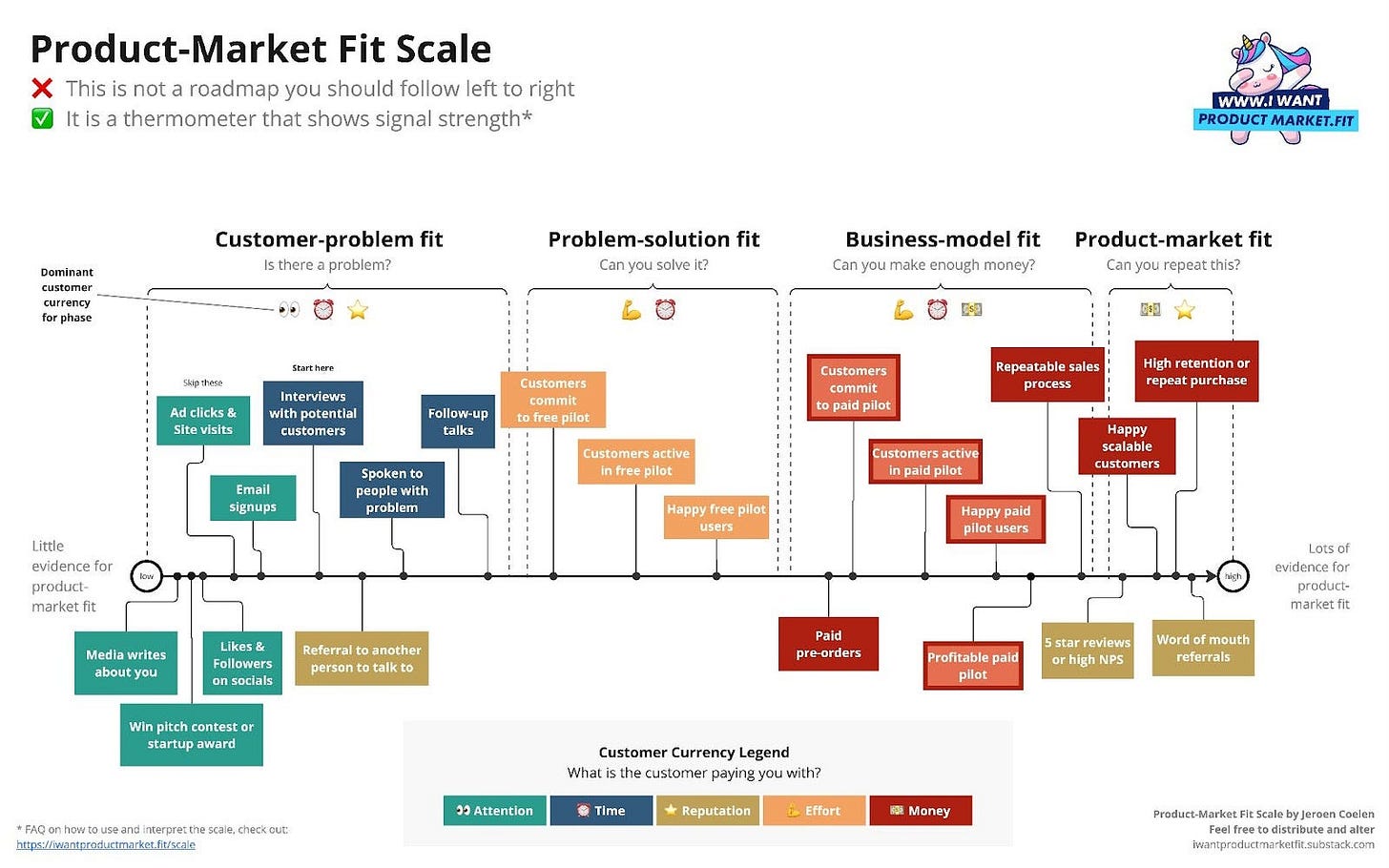

3. Product-Market Fit

Product-market fit signals that your startup is solving a real problem, and customers are willing to pay for it. This is often the most important milestone for early-stage companies.

Signs of Product-Market Fit:

Strong customer retention rates.

Consistent growth in Monthly Recurring Revenue (MRR).

Positive user feedback and testimonials.

Stat That Matters:

Companies with strong product-market fit grow their revenue 20-30% faster than competitors still searching for it.

Pro Tip:

Showcase growth metrics like user acquisition and retention rates.

Provide data or testimonials that demonstrate customer satisfaction.

4. Scalability and Growth Potential

Scalability is critical for VCs because it determines how far a startup can go with additional capital. Startups that scale efficiently can grow revenues exponentially without proportional increases in costs

Key Metrics for Scalability:

Low Customer Acquisition Cost (CAC) relative to Lifetime Value (LTV).

High Monthly Recurring Revenue (MRR) growth rates.

Clear strategies for geographic or market expansion.

Example:

Slack scaled rapidly by offering a product that quickly gained traction among teams. Their low CAC and strong network effects made them a top target for VC funding.

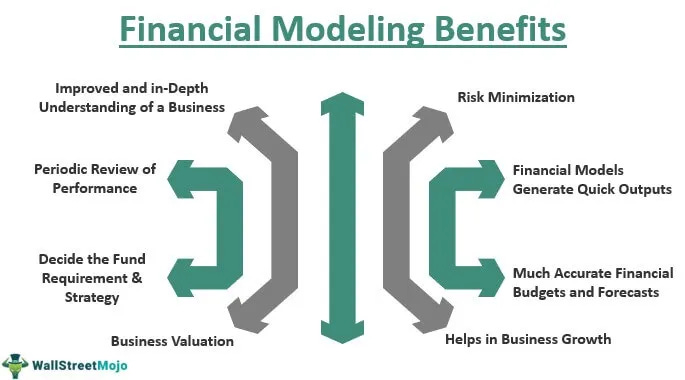

5. Financial Health and Projections

While early-stage startups don’t need to be profitable, they must demonstrate financial discipline and realistic projections.

What VCs Evaluate in Financials:

Cash runway: How long you can operate with your current funding.

Revenue streams and profitability potential.

Efficiency in managing operational costs.

Stat That Matters:

Startups with at least 18 months of cash runway are 3x more likely to secure follow-on funding.

Pro Tip:

Present clear, data-backed financial projections.

Emphasize your ability to manage cash efficiently while scaling.

6. Competitive Advantage

In a crowded startup ecosystem, differentiation is critical. Whether it’s proprietary technology, first-mover advantage, or network effects, your unique selling proposition (USP) must be clear.

Quote:

"Your advantage must be defensible—otherwise, it’s only temporary." – Peter Thiel, co-founder of PayPal

Example:

Startups like Palantir have succeeded by building proprietary platforms that create high barriers to entry for competitors.

Common Pitfalls to Avoid When Pitching to VCs

1. Lack of Preparation

Failing to research a VC’s investment thesis or portfolio signals a lack of effort.

2. Unrealistic Valuations

Overvaluing your startup can alienate potential investors.

3. Overpromising

Exaggerated claims erode trust. Be transparent about your projections and challenges.

Actionable Tips for Founders

Tailor Your Pitch

Align your presentation with the VC’s focus areas.

Build Relationships Early

Network with investors before you need funding.

Prepare for Due Diligence

Transparency is key during evaluations.

Iterate and Learn

Use feedback to refine your pitch and strategy.

Wrapping Up

Securing venture capital funding is more than pitching a great idea—it’s about aligning your startup’s vision, execution, and metrics with what venture capitalists look for in startups. Focus on the fundamentals: market opportunity, team strength, product-market fit, and scalability.

As Sam Altman once said:

"The best way to raise money is to build a company people love. The rest takes care of itself."

For more actionable venture capital insights, visit The VC Corner. Unlock tips, strategies, and insider advice to navigate the startup ecosystem.

FAQ: What Venture Capitalists Look for in Startups

1. What do venture capitalists look for in startups?

Venture capitalists look for startups with:

Scalability: The ability to grow revenue without significantly increasing costs.

Market Opportunity: A large and growing total addressable market (TAM).

Product-Market Fit: Evidence of strong demand for the product or service.

Strong Leadership: A team with vision, expertise, and execution skills.

Competitive Advantage: Differentiators like proprietary technology or network effects.

2. Why is market size important for venture capitalists?

Market size determines the potential for significant returns. VCs invest in startups that can capture substantial market share in industries valued at $1 billion+, as these markets offer higher growth opportunities.

3. How can a startup demonstrate scalability?

Startups can demonstrate scalability by showing:

Revenue growth without proportional cost increases.

Low Customer Acquisition Cost (CAC) relative to Lifetime Value (LTV).

A clear roadmap for expanding into new markets or customer segments.

4. What is product-market fit, and why does it matter?

Product-market fit occurs when your product or service addresses a significant customer need, and demand is evident. It matters because:

It validates that customers want your product.

It attracts funding by reducing perceived risk for VCs.

5. How do VCs evaluate a startup team?

VCs assess the team based on:

Founders’ Expertise: Relevant experience in the industry or domain.

Leadership Skills: Ability to inspire, execute, and pivot as needed.

Team Complementarity: Skills across key areas like engineering, sales, and marketing.

6. How important is financial health for early-stage startups?

While profitability is not expected for early-stage startups, VCs value:

Clear revenue streams and financial projections.

Cash runway showing the startup can sustain operations for at least 12–18 months.

Efficient use of resources to achieve growth.

7. What are common red flags for VCs when evaluating startups?

Common red flags include:

Unrealistic financial projections or valuations.

Lack of product-market fit or customer traction.

Poor leadership or gaps in the founding team’s expertise.

High customer churn rates or unsustainable growth strategies.

8. How do venture capitalists decide how much to invest in a startup?

The investment amount depends on factors like:

Startup stage (seed, Series A, etc.).

Market size and growth potential.

Risks involved and expected returns.

Current valuation and funding needs.

9. What is due diligence, and how can founders prepare for it?

Due diligence is the process VCs use to verify a startup’s claims before investing. Founders can prepare by:

Organizing financial records and growth metrics.

Providing a clear business plan and roadmap.

Being transparent about challenges and risks.

10. How long does the VC funding process take?

The VC funding process typically takes 3 to 6 months, though it can vary depending on:

The complexity of the startup.

The due diligence process.

Negotiations over valuation and terms.

11. What are the different stages of venture capital funding?

The main stages of VC funding include:

Seed Stage: Initial funding to develop the product and validate the idea.

Series A: Funding to scale operations and gain market traction.

Series B and Beyond: Funding for market expansion and scaling.

12. How do startups calculate their valuation?

Startups calculate valuation using methods like:

Comparable Analysis: Comparing similar startups in the industry.

Discounted Cash Flow (DCF): Estimating future cash flows and discounting them to present value.

Venture Capital Method: Estimating future exit value and expected ROI for investors.

13. What is a pitch deck, and what should it include?

A pitch deck is a presentation used to pitch your startup to investors. It should include:

Problem and solution.

Product overview.

Market opportunity (TAM, SAM, SOM).

Business model.

Financial projections.

Team background.

14. How can startups stand out to venture capitalists?

To stand out, startups should:

Solve a significant problem with a clear value proposition.

Demonstrate traction with user growth or revenue.

Highlight a unique selling proposition (USP).

Align their pitch with the VC’s investment thesis.

15. Why do some startups fail to secure VC funding?

Common reasons include:

Targeting a small or stagnant market.

Lack of product-market fit or customer traction.

Poorly articulated business model or value proposition.

Gaps in the leadership team.

16. What industries are venture capitalists most interested in?

Industries with high growth potential attract the most VC interest, including:

Artificial intelligence (AI).

Renewable energy and climate tech.

Fintech and decentralized finance (DeFi).

Healthtech and biotech.

SaaS and cloud-based solutions.

17. How do VCs measure the success of their investments?

VCs evaluate success based on:

Return on investment (ROI).

Growth in valuation during subsequent funding rounds.

Successful exits through IPOs or acquisitions.

18. What should a startup’s financial projections include?

Financial projections should include:

Revenue forecasts.

Key expenses (e.g., operating costs, marketing).

Profitability timelines.

Cash runway and burn rate.

19. How can startups leverage network effects?

Startups can create network effects by:

Building platforms where value increases as user numbers grow.

Encouraging user referrals to drive organic growth.

20. How do VCs approach risk management?

VCs manage risk by:

Diversifying their portfolio across industries and stages.

Conducting thorough due diligence on startups.

Monitoring key metrics like customer acquisition and retention rates.

Great read!

Rubén excellent post! !Felicidades!