World’s Best Founders 🔍, Changing VC Landscape 💼, Venture Trends 🌐

Welcome back to The VC Corner, your weekly dose of Venture Capital and Startups to keep you up and running! 🚀

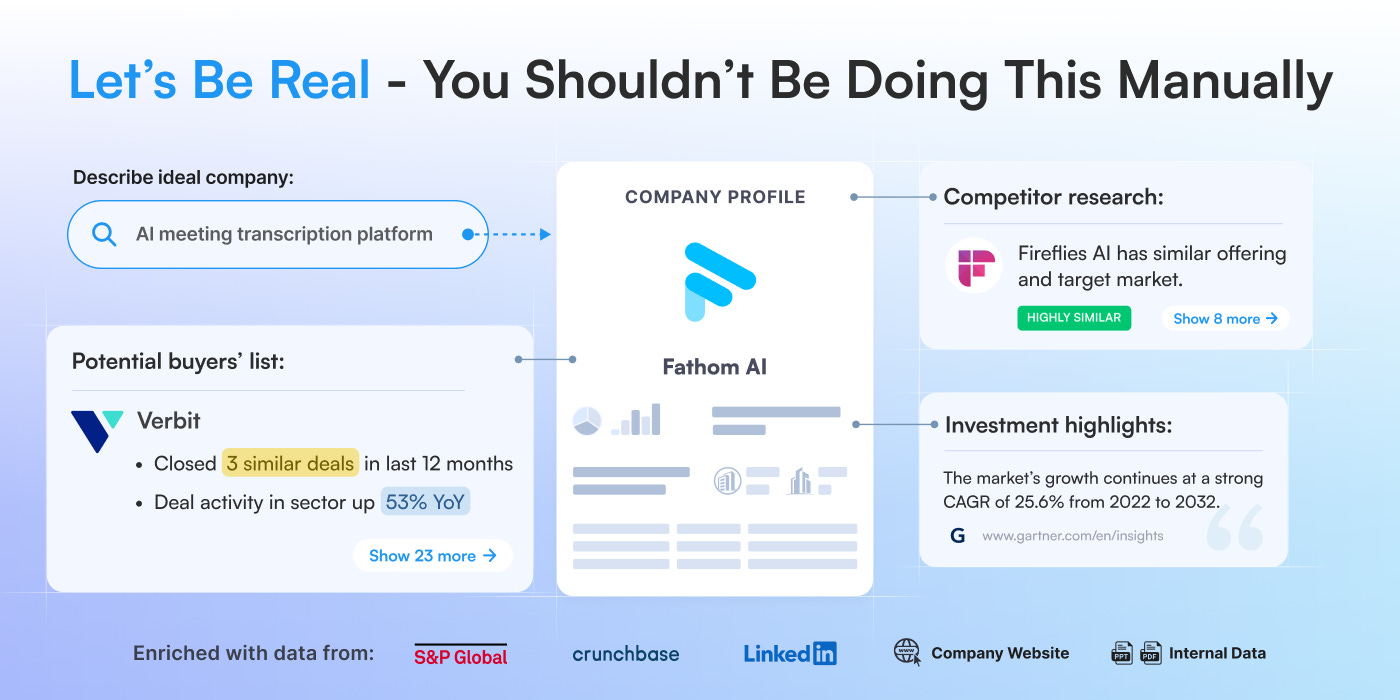

Introducing the first end-to-end AI platform for the VC workflow

After 12 months of working closely with design partners and gathering insights from over 600 VC funds, we’re excited to announce that Eilla is now live!

Why Eilla?

Use AI to analyze 6m+ companies in 10 seconds to find competitors and new opportunities.

Streamline sourcing to due diligence—everything you need in one platform.

Leverage cross-validated insights from Eilla’s proprietary research, Crunchbase, Capital IQ, LinkedIn, and your internal data.

Focus on what truly matters—making informed decisions and closing deals.

In-Depth Insights 🔍

Big Funds, Small Funds, and the Changing VC Landscape 💼

Jord Snel explores the evolving dynamics between large and small venture funds and what it means for the future of VC.Inside the Secret School for the World’s Best Founders 🔍

The Generalist dives into Avra's ambitious strategy to invest in transformative frontier technologies.

Lab-Grown Meat: The Future of Sustainable Food? 🌱

The New York Times explores whether lab-grown meat can be the next step toward sustainable food solutions.The Software Explosion 📈

Philip Joubert breaks down the rapid growth and transformation happening within the software industry.

Venture Capital's Crisis 📉

Marvin Liao outlines the major crisis looming over the venture capital industry and its implications.VC Math Explained: The High-Stakes Game of Startup Funding 📊

Forbes breaks down the critical numbers that founders need to know to secure funding in today's competitive VC landscape.

Norway's Startup Crisis 🚨

Haje Jan Kamps discusses the imminent challenges that Norway's startup ecosystem is facing due to regulatory changes.

📣Want to get your brand in front of 100k founders and investors?

If interested in sponsoring The VC Corner, reach out via email: rdominguezibar@gmail.com

Interesting Reports 📊

Venture Trends Q3 2024 🌐

CB Insights presents the latest insights into venture trends for Q3 2024.

The State of Glasgow Ecosystem 2024 🏙️

Dealroom dives into Glasgow’s venture capital and startup scene in 2024.The State of VC in Italy 2024 💼

Dealroom presents an in-depth look into the venture capital ecosystem in Italy.

Recently Launched Funds 💸

Rasmal Ventures launches a $100 million fund to back startups focused on innovative technologies

Redalpine secures $200M for its RAC VII Fund to back InsurTech, FinTech, and high-impact tech sectors across Europe

European Investment Fund and Hungarian National Capital Holding launch a €40M VC fund to back startups in Hungary

Sabadell Asabys II Fund closes at €180M to invest in health tech startups

Boldstart Ventures raises $250M for its seventh fund to invest in B2B startups

ARCH Venture Partners closes over $3B for a biotech-focused fund

Headline raises $865M and hires a new Head of Growth

Hottest Deals 💥

Scope3, a NYC-based provider of a collaborative sustainability platform decarbonizing media and advertising, raised $25M in funding. (read here)

Numeric, a San Francisco, CA- and NYC-based provider of an AI accounting automation platform, raised $28M in Series A funding (read here)

Rivermark, a Milwaukee, WI-based company which specializes in minimally invasive solutions for Benign Prostatic Hyperplasia (BPH), raised $30M in Series C funding (read here)

Relyance AI, a San Francisco, CA-based AI-powered data governance platform that provides complete visibility and control over enterprise-wide data, raised $32M in Series B funding (read here)

Suki, a Redwood City, CA-based leader in artificial intelligence (AI) technology for healthcare, raiserd $70 in Series D funding (read here)

Farther, a NYC-based technology-centric financial advisory firm, raised $72M in Series C funding (read here)

Imprint, a NYC-based provider of co-branded credit cards, raised $75M in Series C funding (read here)

Toca Football, Inc., a Costa Mesa, CA-based soccer experience company, raised approximately $100m in Series F funding (read here)

Cytovale, a San Francisco, CA-based commercial-stage medical diagnostics company, raised $100M in Series D funding (read here)

From Energy, Weirton, WV-based technology company developing and commercializing a new class of multi-day energy storage systems, raised $405M in Series F funding (read here)

Sidepit, a Berkeley, CA-based fintech startup, raised an undisclosed amount in Pre-Seed funding (read here)

VC Jobs 💼

Senior VC Director @ Cambridge Associates (Boston, MA)

VC Manager @ Samsung Ventures America (Mountain View, CA)

VC Internship @ Truebridge Capital (Chapel Hill, NC)

VC Internship @ Pender Capital (Montreal, Quebec)

VC Associate @ BDC (Vancouver, Canada)

VC Associate @ GE Ventures (Cambridge, MA)

Senior VC Manager @ Visa Ventures (San Francisco, CA)

VC Principal @ Triatomic Capital (Palo Alto, CA)

VC Associate @ Capital Q Ventures (Maitland, FL)