The a16z New Media Era + How We Got Into 20 Oversubscribed YC Startups 🫣

At the end, we share a personal launch — don’t miss it

A16Z just launched NEW MEDIA

a16z is no longer just a venture fund. It’s a media company that happens to invest in startups.

Erik Torenberg’s a16z team: Brent Liang (exTBPN) and Henry Williams , Alex Danco just launched a16z New Media.

“Our goal is to build the best turnkey media operation in venture: a single place where founders acquire the legitimacy, taste, brand-building, expertise, and momentum they need to win the narrative battle online”

For those who don’t know it, Erik was the founder of Turpentine a podcast network that was acquihired by a16z some earlier 2025.

Since then, Erik and his team have taken the A16Z Podcast to another level.

The goal is clear: in a world where capital is a commodity, attention is the new advantage.

What is the New Media team and why does it exist

Last week (such good timing) Guillermo Flor wrote an article about Why the VC game is broken.

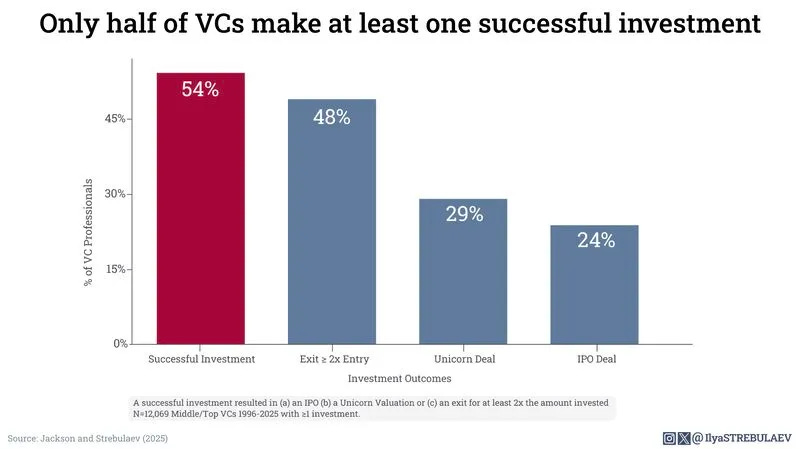

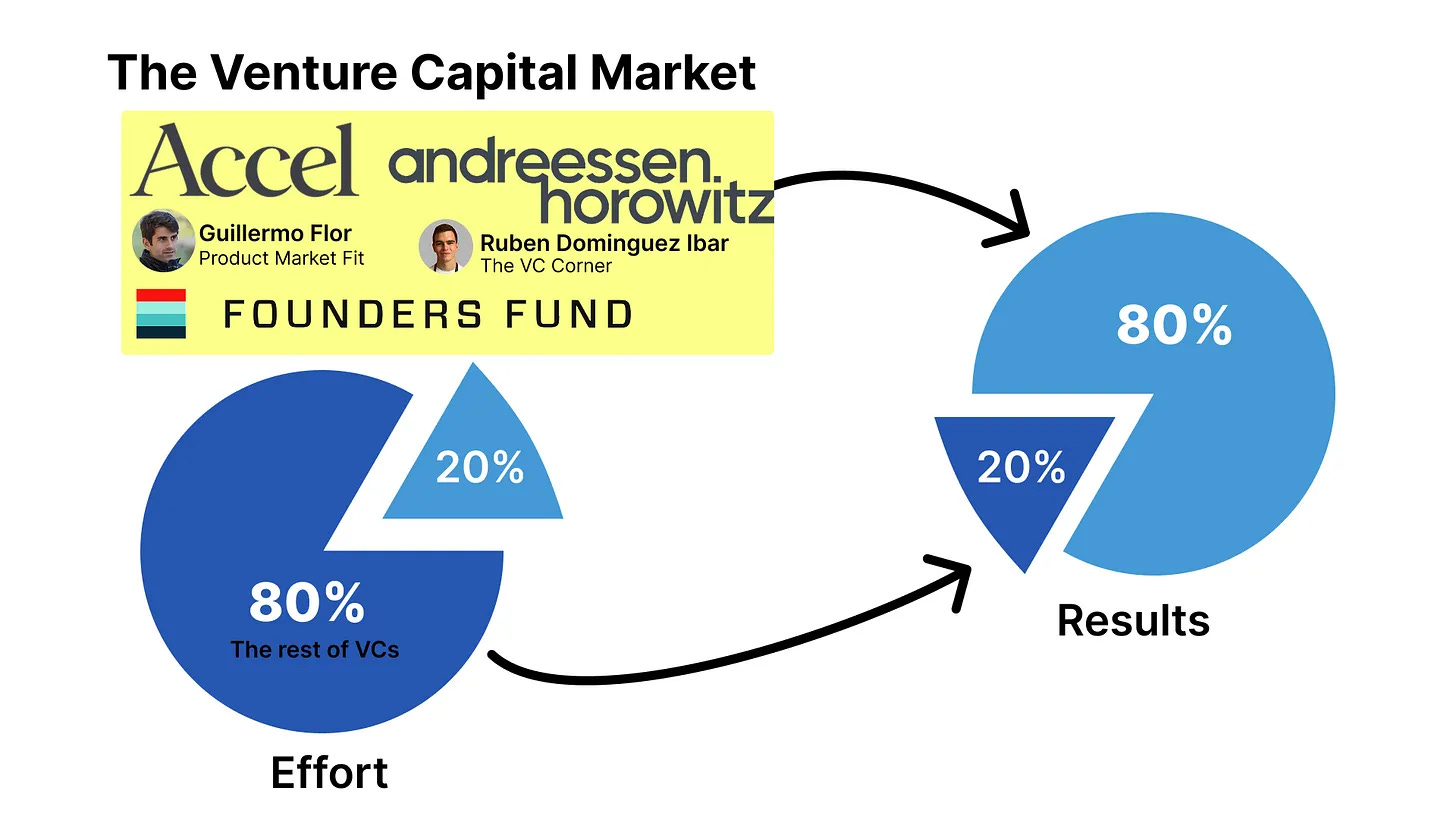

The main idea behind it was that most of the venture returns are generated by a few funds, while all the majority of funds are fighting over the scraps.

The reason behind this is that capital is more abundant than talent & companies, so it’s the great founders who choose the investors and not the other way around.

In this scenario, the VCs with the best brand always win (A16Z, Sequoia, Founders Fund, Benchmark, Accel, Index Ventures, etc).

A16Z knows this, but they are not happy with winning many of the rounds; they want to win them all.

That’s why they’re now building NEW MEDIA to offer a value proposition on top of the capital founders will kill for.

The way that it works is simple:

A16Z NEW MEDIA main focus will be executing the Launch as a Service and getting their portcos as many views as possible

How we’ve followed A16Z’s playbook, investing in +20 oversubscribed YC startups in 5 months

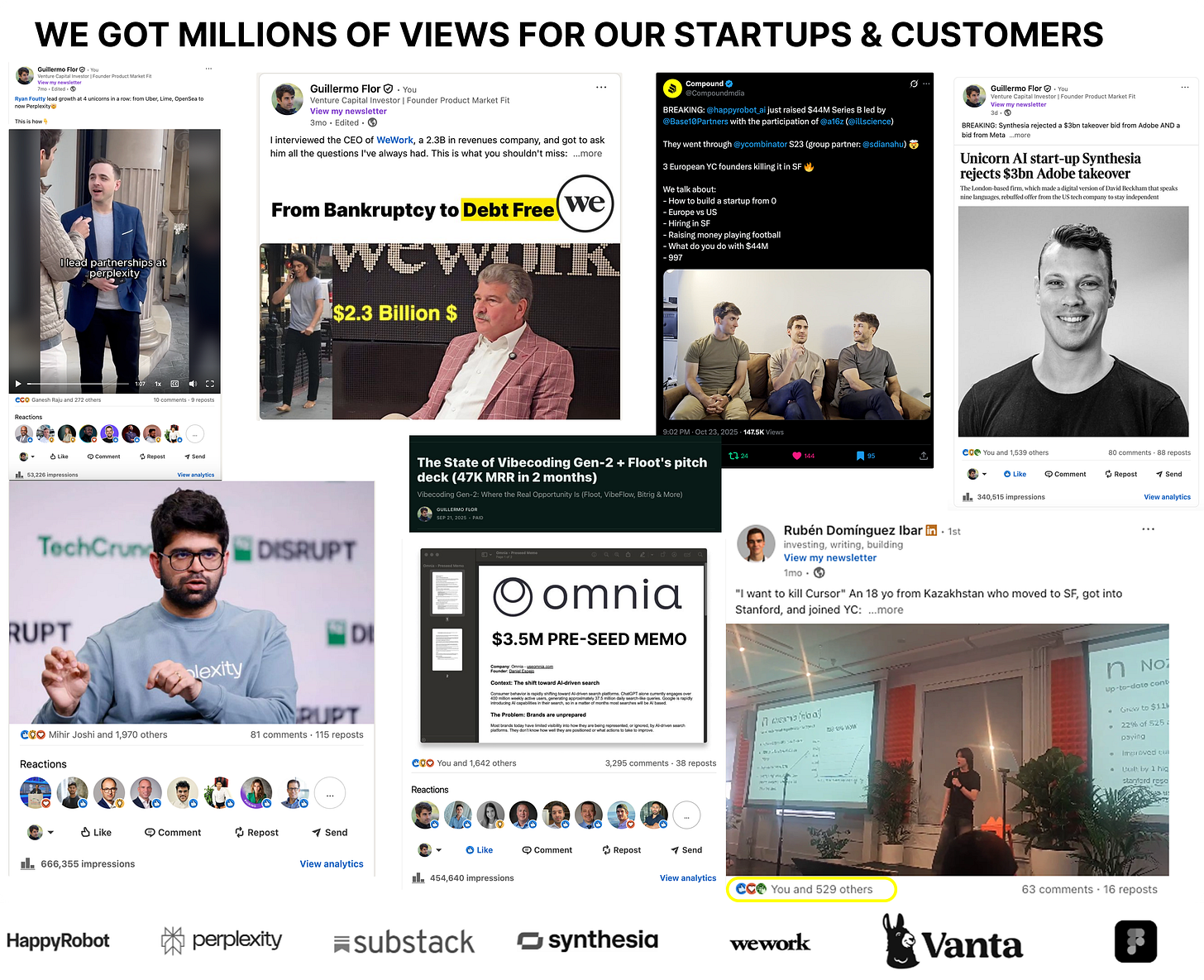

So, it’s been pretty apparent for us that for most funds, it’s almost impossible to invest in the best companies (thus the image below)

That’s why we have been working on a way to do so and be part of the 80% of VCs and angels who get 20% of the results.

STEP 1: Grow a Global Audience

There is no trick to this: it’s all about giving value away 24 7.

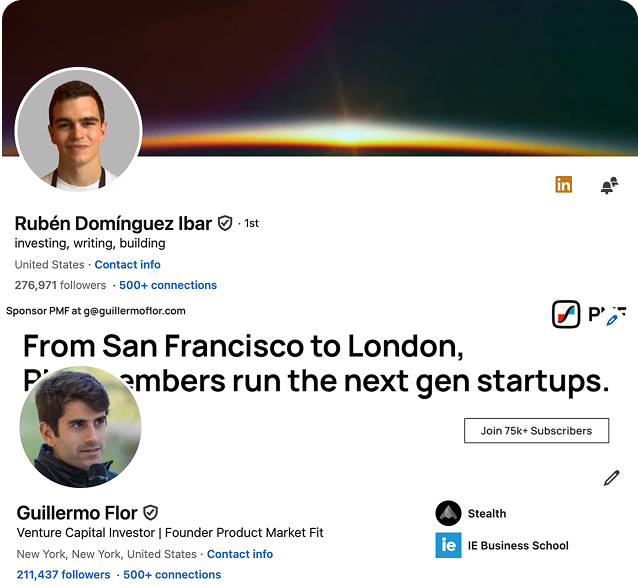

We built two large LinkedIn channels independently that allow us to connect with founders and investors worldwide. We’re getting 5M weekly views, consistently.

What we do is simple but really hard: we create and find the best resources for founders and VCs worldwide and give them before anyone else—always trying to add value.

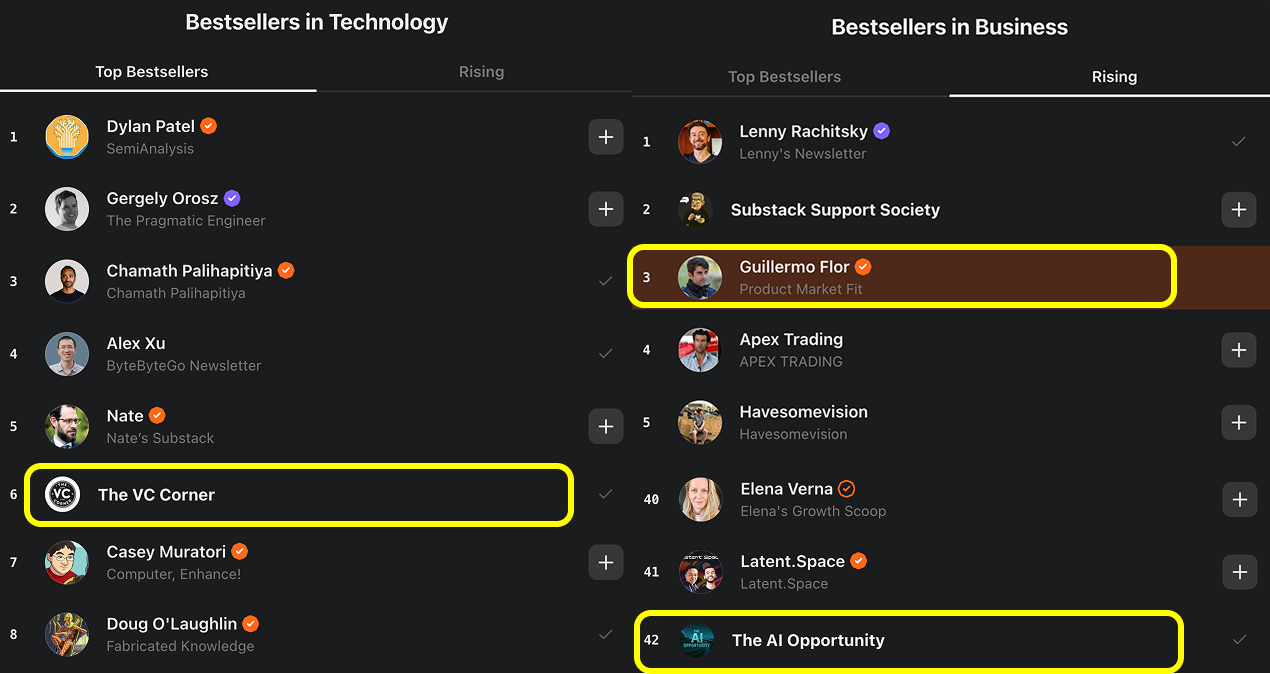

At the same time, we built 3 of the top newsletters in Substack, with +200k subs and +2.5M monthly views.

The VC Corner (you know it) - top resources for founders and VCs

PMF - how to grow and fund your company

The AI Opportunity - Guillermo’s unique insights on where the market’s opportunity is before it’s mainstream

STEP 2: Turn Media Into Acces

2025 has been wild so far. We’ve angel-invested in 20+ Y Combinator startups, co-investing alongside top-tier funds like Lightspeed, SV Angel, a16z, First Round, and Peak XV (formerly Sequoia India & SEA).

Some of the companies we’ve invested in:

• Replit (Coatue, a16z, Khosla, YC) - Turn your ideas into apps

• HappyRobot (a16z, YC, Base10) - Intelligence that runs your operations

• Artisan (Glade Brook, YC, Hubspot, Day One) - AI employees for sales teams

• Murphy (Northzone, Seedcamp, Lakestar) - AI Powered Debt Collection

• Pally (Pioneer Fund, YC, Founders Inc) - Personal relationship management platform

• Throxy (YC, Base10) - Vertical AI agents that automate the full sales funnel

• Azimov (a16z speedrun) - Building the missing half of the digital world

• Cubic (Peak XV, YC) - AI powered code review platform

• QFEX (General Catalyst, YC) - The 24/7 exchange for traditional financial markets

• Bloom (YC, Moonfire, Pioneer Fund) - Build and share mobile apps in seconds

• Emblematic AI (Passion Capital, Caesar VC, K Fund, PnP) - Transforming Financial Ops with AI

• Klavis AI (YC) - Open source MCP integrations for AI applications

• Clova (Founders Inc) - Cursor for video editing

• Cua (Peak XV, YC) - Docker for Computer-use Agents

• Flai (First Round, YC, Liquid 2, SV Angel) - Turn every call into a sale with AI that never misses a lead

….

A big reason we’ve been able to get into competitive allocations is our ability to help founders with distribution, which investors and founders really value. Capital is abundant, attention is scarce.

STEP 3: Help Founders Launch Faster

For the last year, we’ve helped founders launch, go viral and become relevant. We worked with companies such as WeWork, Perplexity, Vanta, Synthesia, ElevenLabs, Attio, Framer, Delve, and HappyRobot.

The results have been mindblowing. We got millions of views for the startups we worked with.

That accelerated their revenue growth and investor momentum massively

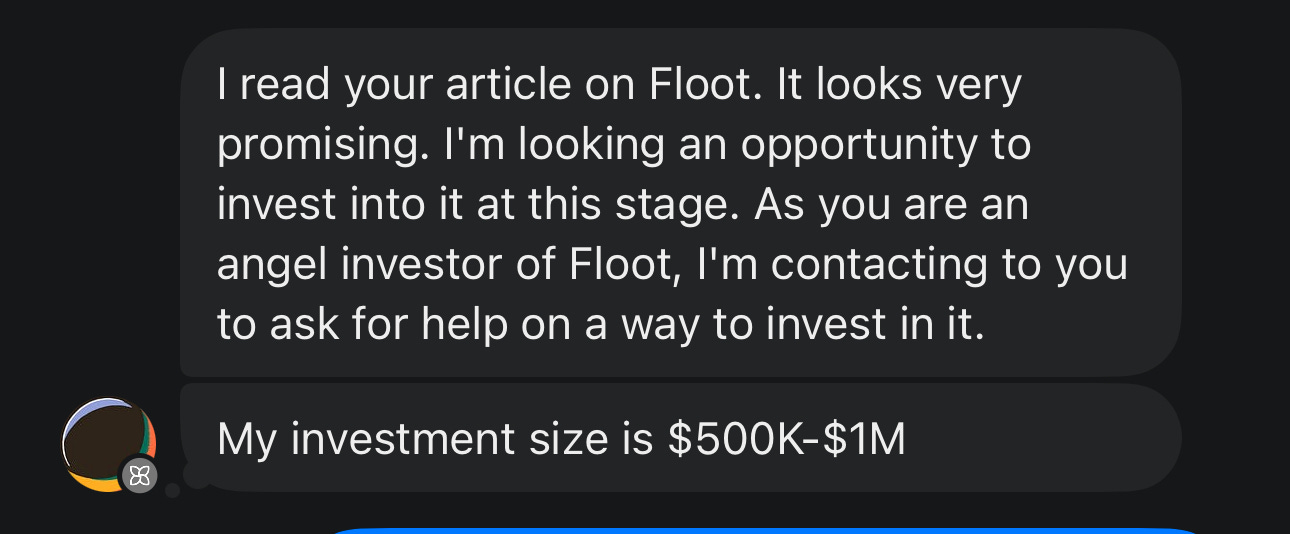

Just recently, we received this message from one of our readers, which blew my mind. (Floot is one of our portcos).

The round was oversubscribed, but he ultimately committed to co-investing with us for the next 24 months.

STEP 4: What’s Next: Co-Investing and Media Services

BETTER & MORE, this was the MVP and just the beginning of something BIG.

1. Investing:

We’re now opening a small, properly structured vehicle to let a small circle of people from our network who can add value co-invest with us.

The goal is to write slightly larger tickets while maintaining flexibility and speed, which is super essential for getting into the best deals.

If you think we should consider you, let us know. We are open to exploring adding a few more people to the group. We’ll check if there is a strong fit.

You can let us know why we should study your case:

ruben@thevccorner.com , g@guillermoflor.com

Quick note: this isn’t an offer to sell or a solicitation to buy any security. Details would be shared privately only with qualified individuals through the proper documents.

2. Media:

We’re launching a service to help companies that are already well funded (SEED TO IPO) launch & go viral.

The process is simple: we apply our knowledge + use our channels to help companies go viral and grow faster.

Message us if interested! We’ll select 2 more this month.

This is just the beginning.

We’re opening a small, structured vehicle to let a handful of operators and investors co-invest with us in oversubscribed deals.

And we’re expanding our media services to help well-funded startups go viral.

If you want to build, launch, or invest with us, reach out.

ruben@thevccorner.com / g@guillermoflor.com

Best, Guillermo and Ruben 🫶🏻

Only starting!!!

Boooomm🔥