When we sat down with Mark Cuban at the Clover x Shark Tank Summit in Las Vegas, we knew the conversation would be special. Cuban is not just another investor or billionaire. He is one of the few people who have lived through every stage of entrepreneurship, from poverty to multi-billion-dollar exits.

He built and sold companies before most people even had internet access. He owned an NBA team that went on to win a championship and turned Shark Tank into a global phenomenon. But halfway through our conversation, he surprised us.

He looked at us and said, “Send me your best dealflow.”

Yes, Mark Cuban wants us to send him startups.

And now we are asking you: if you are building something ambitious, share your blurb in the comments. We will personally review them and forward the best ones to Cuban himself.

Before we get there, here is what he told us about startups, AI, and the future of building.

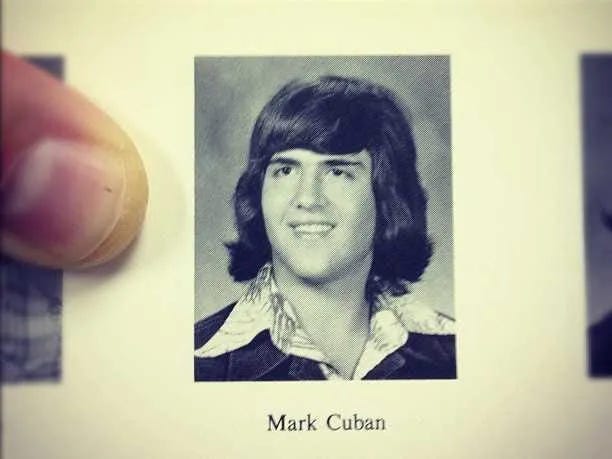

From Immigrant Kid to Tech Billionaire

Mark Cuban’s story doesn’t start in Silicon Valley or Wall Street. It starts in Pittsburgh, where he grew up in a working-class family that had fled Communist Yugoslavia. At twelve, he was selling garbage bags door to door. In college, he was already running side hustles to pay for tuition.

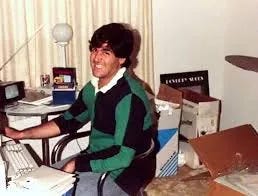

After moving to Dallas, he was fired from his first job and decided to build his own company, MicroSolutions, a computer consulting business. He sold it to CompuServe for six million dollars, his first exit

Then came the moment that changed everything. In 1995, he co-founded Broadcast.com, one of the first live-streaming platforms. Four years later, Yahoo bought it for 5.7 billion dollars. Cuban hedged his stock before the dot-com crash and became one of the youngest billionaires in America.

But what is most interesting about his journey is that he never stopped reinventing himself.

The Mavericks, Shark Tank, and Cost Plus Drugs

In 2000, Cuban bought the Dallas Mavericks for 285 million dollars. He ran the team like a startup. Courtside every game, hands-on with every decision. The Mavericks went from a losing franchise to NBA champions in 2011.

Then came Shark Tank, the show that turned investing into entertainment and made entrepreneurship cool again. Over fifteen seasons, he invested in hundreds of startups and mentored founders who went on to build global brands.

But the company that best reflects who he is today is Cost Plus Drugs. It’s his attempt to fix the broken American pharmaceutical industry by selling medicine at cost, with full transparency. Cuban calls it “capitalism with a conscience.”

That philosophy has always defined his career. He looks for inefficiency, breaks it, and rebuilds it better.

What He Told Us About AI and Startups

When we asked Cuban about building startups in 2025, his answer was sharp and direct.

“AI is the simplification of every business process. If you’re building a startup today and not using AI for the fundamentals, you’re already behind.”

He explained that AI levels the playing field but also creates more noise. Since anyone can now build fast, what matters most is what AI cannot replicate: brand, story, and trust.

“Because AI makes it easy to copy, branding and storytelling are more important than ever.”

When we asked what startup he would build if he were starting from zero, he didn’t hesitate.

“Infrastructure. Everyone is focused on consumer apps, but the real opportunity is in AI infrastructure. That’s where the long-term value is.”

He mentioned Databricks and Snowflake as examples. Consumer AI might get the headlines, but infrastructure is where the generational wealth will be built.

Why Founders Shouldn’t Raise VC

Mark Cuban: “You should never raise money”

The only way to become a billionaire is to own as much of your company as you possibly can:

If you can avoid fundraising, you’ll be a whole lot richer. If it’s generating cash, put it in your pocket.

Many founders get caught up in their top line, rather than their bottom line…

”Raising money isn’t an accomplishment; it’s an obligation for many founders”

Mark Cuban: “Europe Is a Bigger Opportunity Than the U.S.”

This one shocked us. While most founders dream of moving to the United States, Cuban told us that the next big opportunity is actually in Europe.

“There is a bigger technology opportunity in Europe than in the United States. It’s easier to compete there. The talent is incredible, and the markets are still wide open.”

He talked about the talent arbitrage happening across Europe, with world-class engineers, lower costs, and less competition. While everyone else is looking west, Cuban sees a once-in-a-generation opening eastward.

And then he added, “Send me your European dealflow.”

That’s right. Mark Cuban asked us to send him startups from Europe.

On Founders, Grit, and Pitching Investors

When we asked him what he looks for in a founder, he said it comes down to adaptability.

“The best founders aren’t the ones with the perfect plan. They’re the ones who can change the plan when everything shifts.”

And when it comes to pitching investors, he gave us the best advice we’ve heard all year.

“Before you sell me your product, sell me yourself. The biggest mistake founders make on Shark Tank is starting with the product. Business is a human relationship first.”

He explained how two founders can both forget their numbers during a pitch. One gets rejected. The other gets a deal. The difference is connection, trust, and presence.

What He Told Us About Scaling

At the end of our conversation, we asked him how we could scale our own media and investing business. His response was brutally simple.

“Keep doubling down on content. Don’t stop doing what’s working. And don’t ignore traditional media. It still builds credibility. Look at Shark Tank. Each of us built massive leverage through it. But in the end, you need scalable products. Content gives you reach. Products give you wealth.”

That line stuck with us. Content creates leverage, but products create wealth.

Mark Cuban Is Proof That Storytelling Still Wins

Mark Cuban went from selling garbage bags as a kid to building a five-billion-dollar company and owning an NBA team. His story is a reminder that the game hasn’t changed — just the tools.

In a world full of automation and AI, Cuban’s advantage has always been human: energy, communication, storytelling, and sp

eed. He knows how to capture attention, convert it into trust, and turn trust into capital.

That’s what the best founders do. They build stories people want to be part of.

Want Mark Cuban To See Your Startup?

He asked us to send him our best dealflow. So if you are building something ambitious, especially in AI, healthcare, or infrastructure, share your startup idea in the comments below.

Guillermo and I will personally review them and share the best ones with Mark Cuban.

He’s waiting for our email.

What are you building?

🛠️Startup resources you may find helpful:

✅ SaaS MRR Projection Model

✅ IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ CLTV vs CAC Ratio Excel Model

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox