AI Eats the World🤖, Trouble for New VCs💀, The IPO Market Is Stirring📉

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, and the hottest deals—here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Harmonic - the complete startup database

Market maps finally in venture software.

Scout — the AI agent made for VCs allows you to market map with ease. Simply describe what you’re looking for, or look up the competitive landscape for a particular company.

Scout handles the rest, scouring the internet as well as Harmonic’s private database trusted by thousands of investors from leading firms like GV and Insight.

In-Depth Insights 🔍

AI Funding Surge Leaves Other Startups Stranded 🧟♂️

AI sucked up 40% of all U.S. startup cash last year - great for OpenAI and friends, bad for everyone else. With exits stalled and IPOs rare, the Valley’s now crawling with “zombiecorns” that can’t scale, can’t die, and definitely can’t IPO. [CNBC]

The IPO Market Is Stirring, but at ‘Down-Round’ Valuations 📉

Hinge Health’s $6.2B peak is now a $2.9B maybe. The era of inflated private rounds is over; discipline is the new norm. [WSJ]It’s Never Been Harder to Make It in Venture Capital 💀

New VCs are getting crushed - funding for emerging managers has plummeted 75% since 2021. Survival now demands a killer edge, perfect timing, or a powerful story. {Bloomberg]

How Gen AI Could Disrupt SaaS - and Change the Companies That Use It 🧬

AI-first systems are ditching rigid workflows for dynamic, goal-based execution - freeing teams from dropdown hell and unlocking 30%+ efficiency gains. [HBR Executive]The Seed 100: The Best Early-Stage Investors of 2025 🌱

Business Insider ranks the top 100 early-stage investors backing breakout startups. Names like Sam Altman, Naval Ravikant, and Keith Rabois lead a list full of bold bets and billion-dollar outcomes. [Business Insider]

Ownership Is the Strategy 🎯

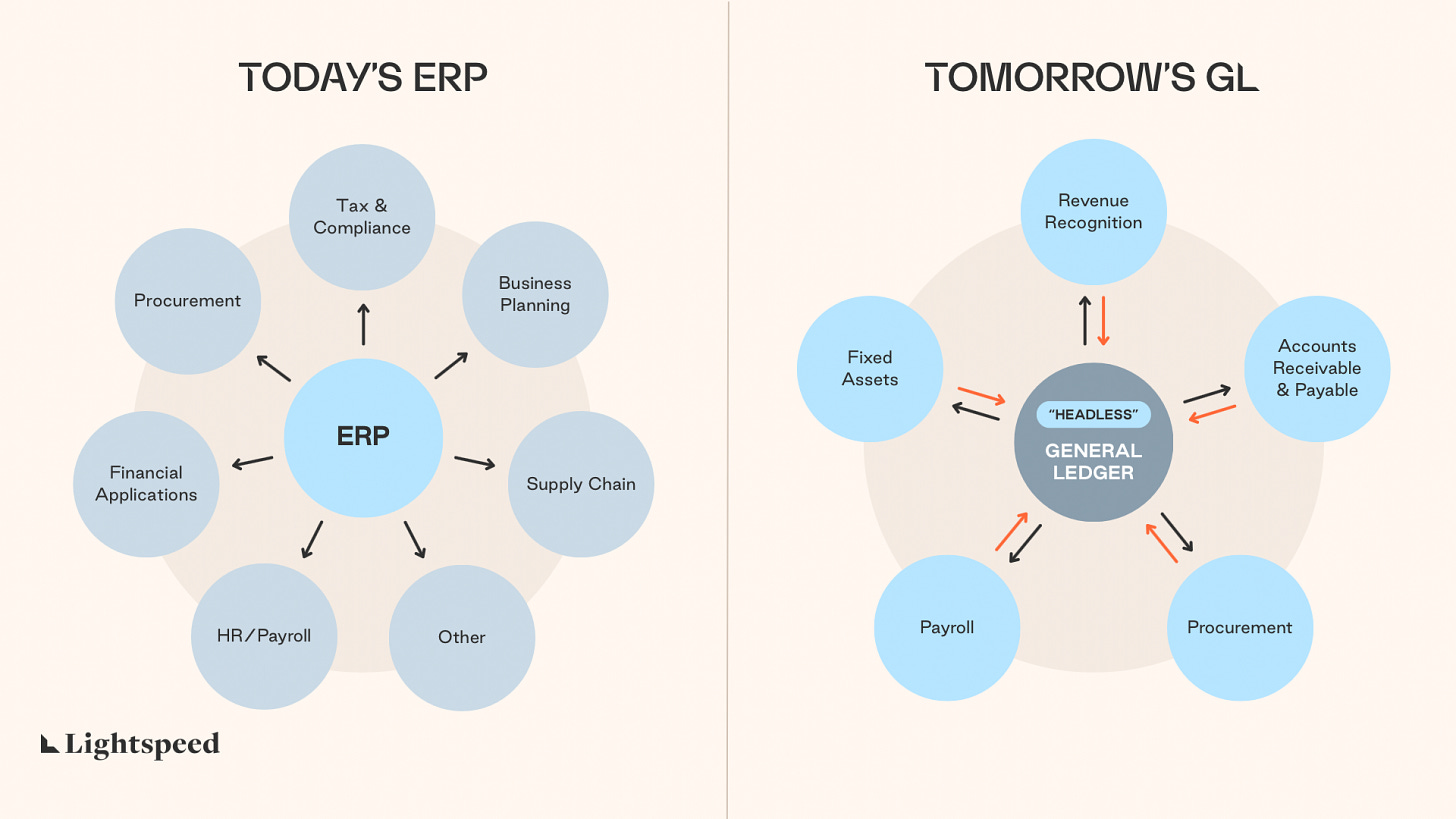

A $10B outcome sounds great - until you realize your slice is 1%. This piece cuts through the hype and shows why cap table math, not company logos, is what actually drives fund returns. Spoiler: bragging rights don’t pay LPs. [James Sedgwick-Heath]The Great ERP Unbundling 🧱

The all-in-one ERP giant is dying. In its place? A $40B+ gold rush as startups carve up the back office into modular, AI-ready apps. One stack, dozens of winners. [Lightspeed]

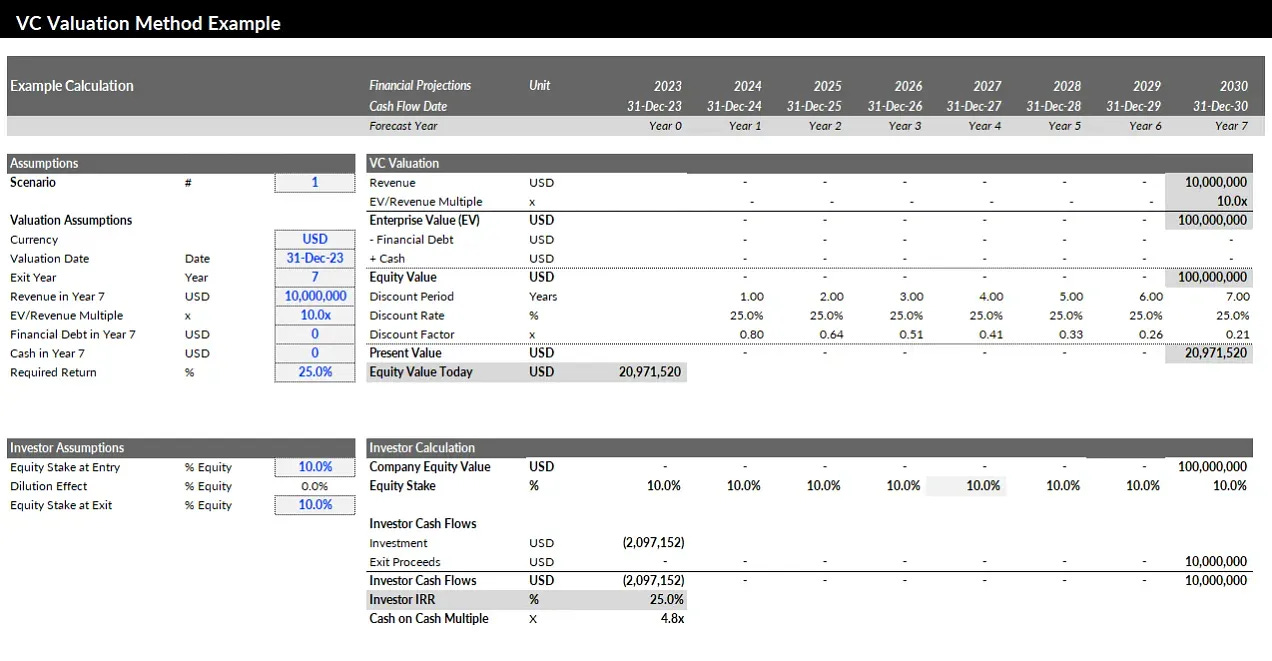

How VCs Value Startups: The VC Method + Excel Template 📊

VCs price your startup based on returns - not vibes. This breakdown shows how they do it, plus an Excel model to run the math yourself.

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and my other media assets, email: rdominguezibar@gmail.com

Interesting Reports 📊

AI Eats the World - 2025 Strategic Tech Trends 🤖

Benedict Evans drops a deck that slices through the hype: AI isn’t just a layer - it’s the platform shift. If you build product or run strategy, don’t skip this. [Benedict Evans]

Best Breakdown of Private Equity Fund Types 🧠

Finally, a breakdown that doesn’t suck: fund structures, GP vs LP power plays, and the lingo every founder should tattoo on their pitch deck.

Rise of Cambridge Tech 🧬

Step aside, Silicon Roundabout - Cambridge is beating London and Oxford in unicorn velocity and early-stage growth. Bay Area, watch your back.

Understanding the Model Context Protocol (MCP) 🌐

BCG X’s Daniel Sack explains the Model Context Protocol - how AI agents are about to get 10x smarter. OpenAI, Anthropic, and Microsoft are already building on it.The Stablecoin Market Map: $12.3B Surge Signals Explosive Growth 🔐

$12.3B+ in 2025 alone. CB Insights just mapped 172 breakout stablecoin players transforming everything from global payments to enterprise finance. [CNB Insights]

Recently Launched Funds 💸

Emil Capital Partners rebranded as ECP Growth and closed Fund IV at $100M targeting consumer innovation.

South Loop Ventures raised $21M for its debut fund, focused on early-stage Midwest tech startups.

Mitsui Chemicals launched its second $60M corporate VC fund to drive sustainability and innovation.

Cathay Innovation completed a $1B global fund to back next-gen startups across health, finance, and climate.

FundersClub planning to raise $176M for its fourth fund, continuing its digital-first investment model.

Metalayer Ventures closed Metalayer Fund I at $25M to invest in AI infrastructure and tooling.

TMR Ventures raising $40M for its inaugural fund to focus on deep tech and frontier markets.

HJF MDC Venture Fund looking to raise $20M to support dual-use technologies with military and civilian applications.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup enthusiasts. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

VC Jobs 💼

Multiple Capital (Berlin, Germany): VC Analyst (apply here)

Various Firms (London, United Kingdom): Multiple VC Roles (apply here)

500 Global (Remote): VC Partner (apply here)

Autark Ventures (Remote): VC Associate (apply here)

Necessary Ventures (Remote): VC Internship (apply here)

B Capital (Los Angeles, CA): Capital Formation Associate (apply here)

Various Firms (Washington, DC): Multiple VC Roles (apply here)

Hitachi Ventures (Boston, MA): VC Analyst (apply here)

Samsung Next (San Francisco, CA): VC Investor (apply here)

GSR (New York City, NY): VC Associate (apply here)

Hottest Deals 💥

Uplinq, raised $10M in Series A funding to revolutionize business credit access for SMBs. (read more)

R1, received a strategic investment from Khosla Ventures to advance its robotic kitchen automation tech. (read more)

Vima Therapeutics, secured $60M in Series A funding to accelerate longevity-focused biotech development. (read more)

Unbound, raised $4M to grow its community platform empowering women and nonbinary creators. (read more)

Roxfit, landed $800K in funding to expand its AI-driven personal fitness platform. (read more)

Snorkel AI, scored $100M in Series D at a $1.3B valuation to scale its data-centric AI development suite. (read more)

Volteras, raised $11.1M in Series A to drive smarter energy management for EV fleets. (read more)

CurifyLabs, secured €6.7M to scale its personalized medicine compounding solutions. (read more)

Rime, raised $5.5M in seed funding to enhance AI-native collaboration and productivity tools. (read more)

Outcomes4Me, closed $21M in funding to expand its AI-powered cancer navigation platform. (read more)

Tengr.ai, raised $1.2M in equity funding to build its neural network optimization engine. (read more)

Naoris Protocol, secured $3M in strategic funding to decentralize cybersecurity infrastructure. (read more)

David, closed $75M in Series A to disrupt B2B payments for modern businesses. (read more)

Empathy, raised $72M in Series C to scale its end-of-life planning and grief support tech. (read more)

Dreampark, raised $1.1M in seed funding to reimagine community living for digital nomads. (read more)

RESOURCES 🛠️

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 70+ Startup Pitch Decks That Raised Over $1B in 2024

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The 100+ Pitch Decks That Raised Over $2B

✅ Ultimate Investor List of Lists (+5k VCs)

✅ 40 Pitch Decks That Raised Over $460M

✅ The Startup Founder’s Guide to Financial Modeling (7 free templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth (and How to Get Into Them)

✅ The Ultimate Startup & Venture Capital Notion Guide: Knowledge Base & Resources

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox