How VCs Value Startups: The VC Method + Excel Template

Learn the Venture Capital Method step-by-step with a Excel template that models valuation, dilution, and investor returns across funding rounds.

"Wondering how venture capitalists decide your startup’s valuation?" This guide breaks down the proven Venture Capital Method — and includes a free Excel model to help you run your own numbers.

If you’re a founder raising capital, understanding how investors value your startup is one of the most underrated superpowers you can have.

Most founders know about pre-money, post-money, and dilution. But few truly understand how venture capitalists back into a valuation based on their return expectations — or how that math changes across multiple rounds.

Enter the VC Method: a fast, practical framework that investors have used since the ’80s to price deals. And today, we’re sharing a FREE Excel template, built by eFinancialModels, that helps you run the same analysis in minutes — with no fancy modeling skills required.

What Is the Venture Capital Valuation Method for Startups?

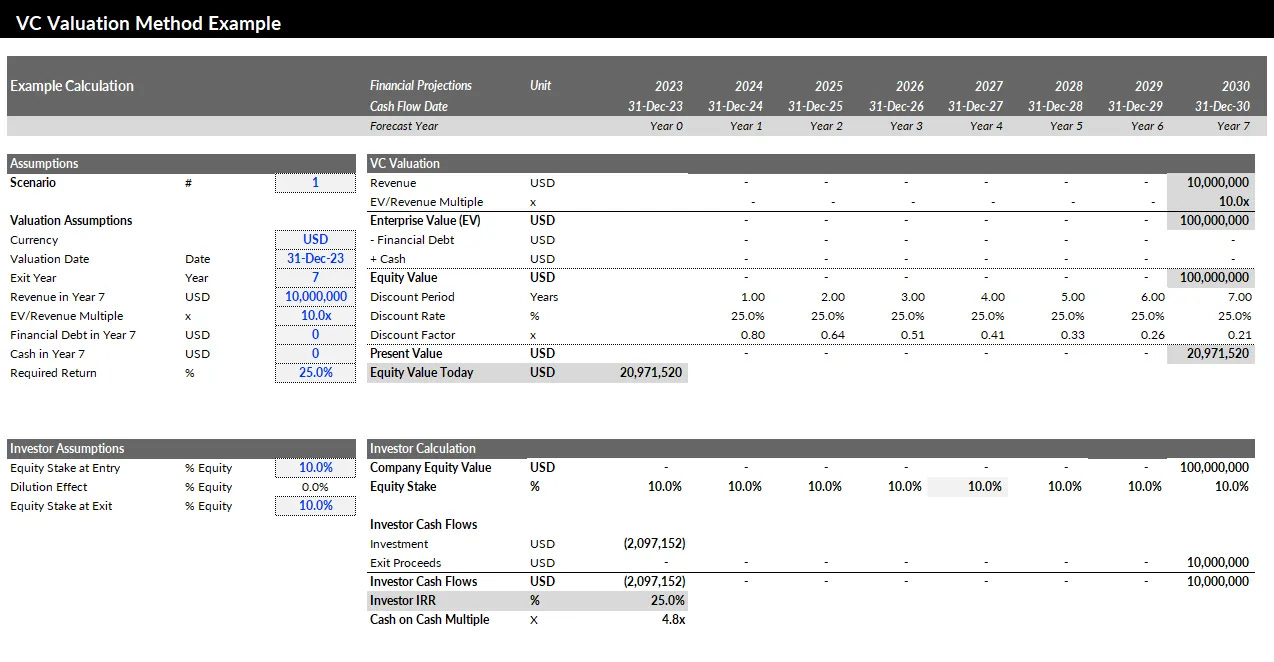

The Venture Capital Method is a startup valuation approach that works backward from a future exit.

Instead of trying to value a company based on cash flows (hard to do when you’re pre-revenue), the VC Method estimates what the company could be worth at exit (IPO or M&A), then discounts that number back to today using the investor’s target return.

It looks like this:

▫️ Forecast exit value (e.g. $100M based on comps or revenue x multiple)

▫️ Apply a required return (typically 25%–40%)

▫️ Discount back to today to get your valuation

▫️ Compare your check size to that valuation to determine your ownership stake

This method helps VCs answer one question: “If I invest $X today, will I get a 10x return if this company exits in Y years?”

Excel Template for Startup Valuation and Dilution Modeling

This isn’t just a basic calculator. It’s a multi-round, fully built VC Method modeling tool designed for both founders and investors.

✅ Key features:

Round-by-round inputs for Seed, Series A, B, C and beyond

Target revenue and multiple-based exit valuation

Fully modeled dilution by round

Equity stake evolution for founders, investors, and ESOP

IRR and cash-on-cash return calculations per investor

Dynamic scenario analysis: base, upside, downside

Visual ownership waterfall across time

It’s the clearest way to understand:

💸 How much equity you’re giving away

💥 What future returns investors expect

🧮 How multiple rounds affect your cap table and exit math

Why Founders Should Use the VC Method to Plan Startup Valuation

This model is designed for one purpose: long-term clarity.

Founders often negotiate valuation one round at a time — but capital planning is a multi-round game. If you raise $1M now and $5M next year, what’s the real cost of that capital when you exit?

This template helps you answer:

What’s a fair pre-money for this round — given investor return expectations?

How will dilution affect me across multiple rounds?

What does an exit at $200M actually look like for early investors vs. late?

Can I justify my valuation with actual numbers — not vibes?

Whether you’re preparing for investor conversations, negotiating term sheets, or planning internal cap table strategy, this model gives you a clear, defensible view of startup valuation over time.

📥 Download the VC Valuation Template 🎁

The spreadsheet is fully editable and works in Excel. Just plug in your startup’s projected revenue, round sizes, expected dilution, and the rest is auto-calculated.

The VC Valuation Template is available exclusively to premium subscribers of The VC Corner.

It’s part of a growing library of resources designed to help startup founders raise capital, grow smarter, and move faster. As a member, you’ll get:

✅ Ultimate Investor List of Lists: +10k VCs, BAs, CVCs, and FOs

✅ 70+ Startup Pitch Decks That Raised Over $1B in 2024

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ The 100+ Pitch Decks That Raised Over $2B

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 118 AI Communication Agent Use Cases

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox 🛠️

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ The Best 23 Accelerators Worldwide for Rapid Growth (and How to Get Into Them)

✅ The Ultimate Startup & Venture Capital Notion Guide: Knowledge Base & Resources

… and much more

If you’re serious about raising, this is the unfair advantage you’ve been looking for.

Download the VC Method Valuation Template below 👇

The VC Corner hopes you find it helpful :)

More Resources 👇

As a premium subscriber (free trial available), you will also get access to the full library of resources (+50) shared on The VC Corner

Some examples you may find very useful:

✅ IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox

FAQ: How VCs Value Startups and Model Returns

What is the Venture Capital Method (VCM)?

The VC Method values a startup based on its projected future exit, then discounts it back to today based on the investor’s target return.

What’s the typical required return VCs expect?

It ranges from 25% to 40% depending on the stage, market risk, and competition for the deal.

What’s the difference between pre-money and post-money valuation?

Pre-money is the valuation before the new investment. Post-money is after. Post-money = pre-money + new investment.

How do VCs determine the exit value?

Usually based on revenue forecasts and comparable company multiples (e.g., 10x ARR). Some also use EBIT or EBITDA depending on the industry.

Why is this method better than a DCF?

Early-stage startups rarely have positive cash flows. DCF models break. VCM works when there’s no historical data, by focusing on exit-driven valuation.

Can I use this model for multiple funding rounds?

Yes — this template supports Seed to Series C+, tracking dilution, ownership, and returns across all rounds.

Does the model work globally or only in USD?

You can use any currency — just adjust the symbol and inputs. The math stays the same.

What’s the biggest mistake founders make in valuation?

Ignoring how much dilution compounds over time. Valuing your startup too high too early might make it harder to raise later.

Final Thought

Startup valuation is part math, part psychology — but having a clear model gives you a huge edge.

Whether you’re a founder pitching VCs or an investor evaluating risk and return, this template gives you clarity across the board. Think of it as your valuation compass — for today, and for the road ahead.

If you found this valuable, pass it along.

Share the article on LinkedIn or your favorite social platform — it might save someone else a lot of time and confusion.

I've seen the VC Method for valuations in action many times having invested in over 500 Founders. It's a game changer. Thanks for sharing it Ruben 🌟