The Anatomy of an M&A Deal Inside an Excel template

A hands-on framework for founders, CFOs, and corp dev leaders who want to understand the real economics of a deal.

An M&A Deal Model You Can’t Find Online

So you’ve managed to fundraise for your startup, cleaned up your cap table, perfected your GTM strategy and scaled successfully. Now what? Well, now it’s time to get acquired.

Or say you are working at a deal advisory, or as an associate for a large VC fund. Then your job is to value startups and create M&A models for your portfolio companies.

But this is not as simple as it sounds. The acquisition moment is the most complicated part in a startup’s journey. Most M&A conversations revolve around the price. That makes sense, because it is the cleanest number on the page and the easiest one to anchor on. But price is rarely the thing that determines whether a deal works out well for the people involved.

But the meat of the story is in how that price gets paid.

Two deals with the same headline valuation can leave founders, acquirers, and boards in very different places a year later. One might preserve control and flexibility. The other might expose risks and introduce leverage, dilution, or incentives that only become visible once it is too late to change course.

And that’s why M&A deal structure matters more than most people admit at the start.

Cash, stock, debt, and earn-outs do not just fund a transaction, they juggle risk around. They change who carries downside, influence behavior after the deal closes, and often decide who has leverage in the next board meeting, not just at signing.

The thing is that most founders and operators negotiate price first and structure second. By the time structure becomes the focus, most terms have already been agreed and options have narrowed. And then, regret can be seen in the numbers.

This is why a financial model like this is crucial. To give you the answers early, before you find yourself holding the pen, signing your startup away. This model exists to answer the questions most teams ask too late.

PS. Small win for this community before we start.

I managed to secure something genuinely useful for founders reading this.

If you’re pre-seed or seed, Framer is offering one full year of Framer Pro for free (worth $360).

It’s the same tool many YC-backed teams use to ship a production-ready site in hours, without a dev team, and keep it as they scale with CMS, analytics, and localization.

If your website has been “good enough for now” for a bit too long, this is a good moment to fix that properly:

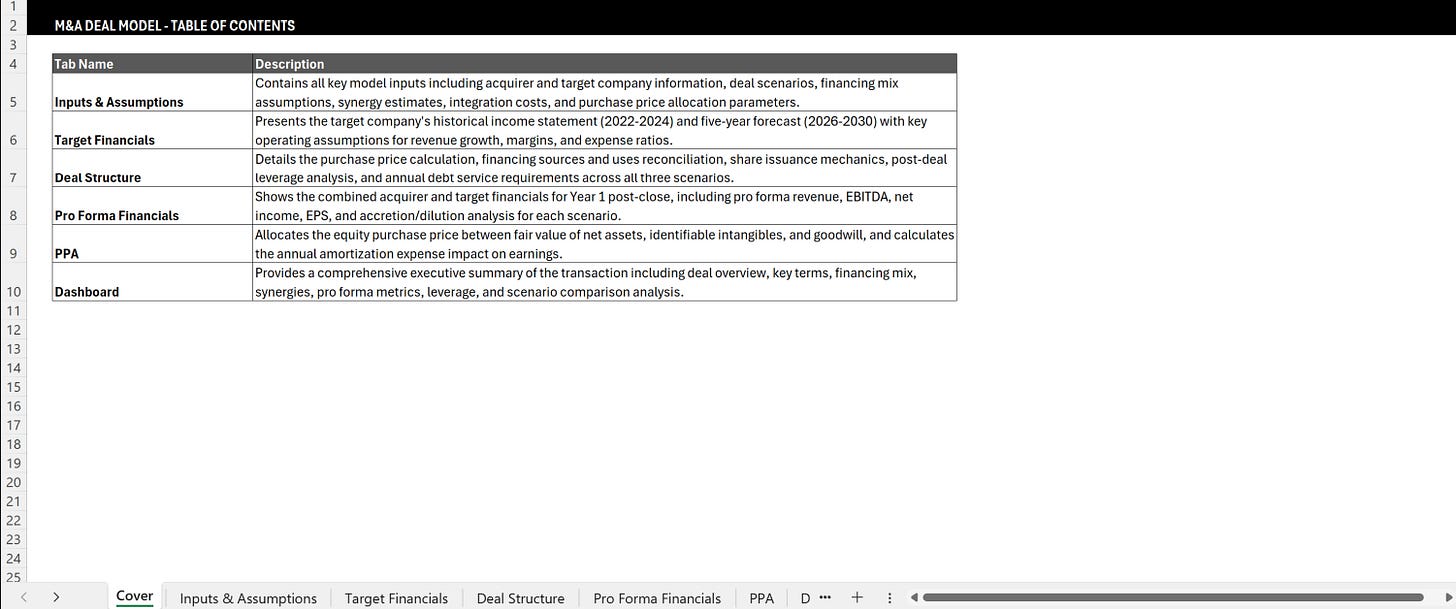

Table of Contents

1. What’s Inside The Deal Structuring Model

2. Who Should Use This Model

3. How This Deal Structuring Model Works

4. Download the Deal Structuring Model in Excel

5. Frequently Asked Questions (FAQs)

1. What’s Inside The Deal Structuring Model

This is not a generic financial model meant to impress with complexity, but a highly practical deal structuring model designed to make consequences visible while there is still time to adjust.

Each section of the model serves a specific decision.

Inputs

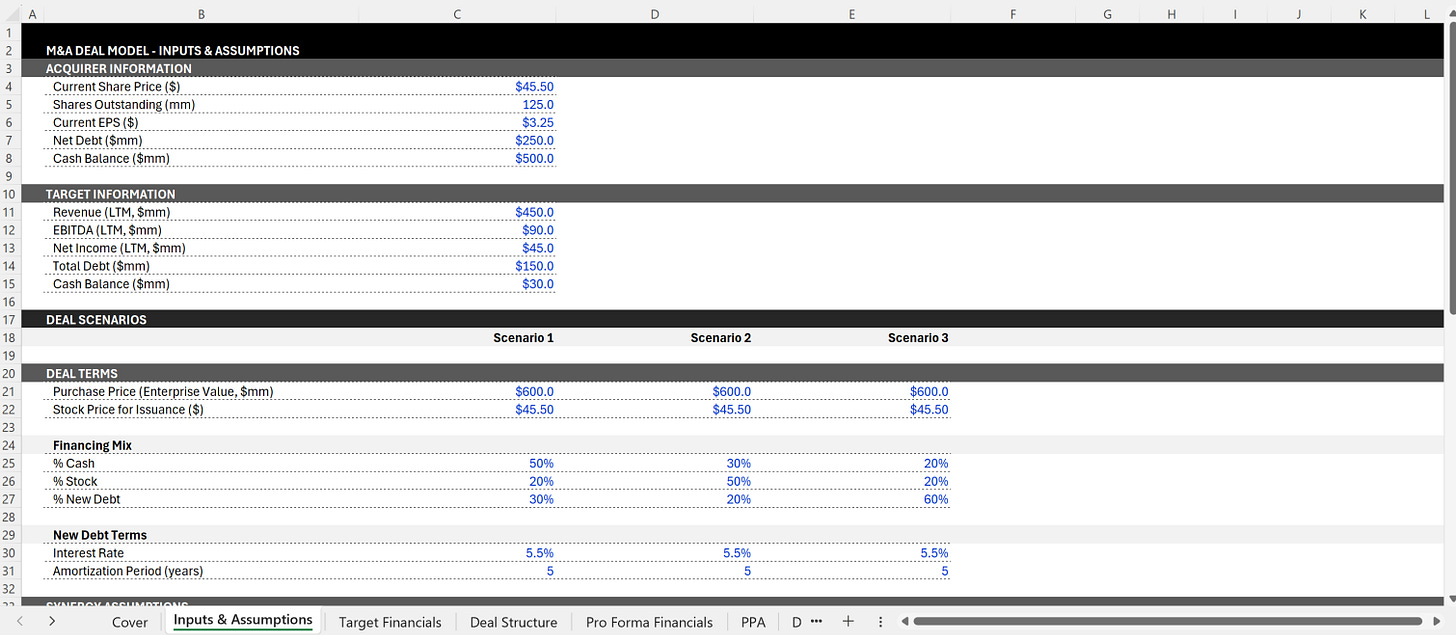

Everything starts with inputs, but the intent here is all about alignment between the acquirer and the target. You need to be as accurate as you can be here.

Acquirer block

The acquirer inputs anchor the entire dilution and earnings-per-share (EPS) conversation. Share price and shares outstanding determine what stock actually costs when used as currency. EPS or net income grounds the accretion and dilution math in reality.

Cash available is equally important. Many teams confuse theoretical capacity with usable capital. The first advantage of this model is that it keeps those separate.

EBITDA, tax rate, and the interest rate on new debt together define how much leverage the business can absorb without distorting earnings.

This is where you paint the picture of what the acquirer looks like, by answering what they can really afford without changing their own risk profile.

Target block

The target inputs are structured in a way to provide a clear distinction between equity value and enterprise value.

Cash, debt, and deferred tax assets (DTAs) change the real price paid, and ignoring them usually leads to surprises. Including EBITDA and earnings is not optional if the deal will ever be discussed in EPS terms.

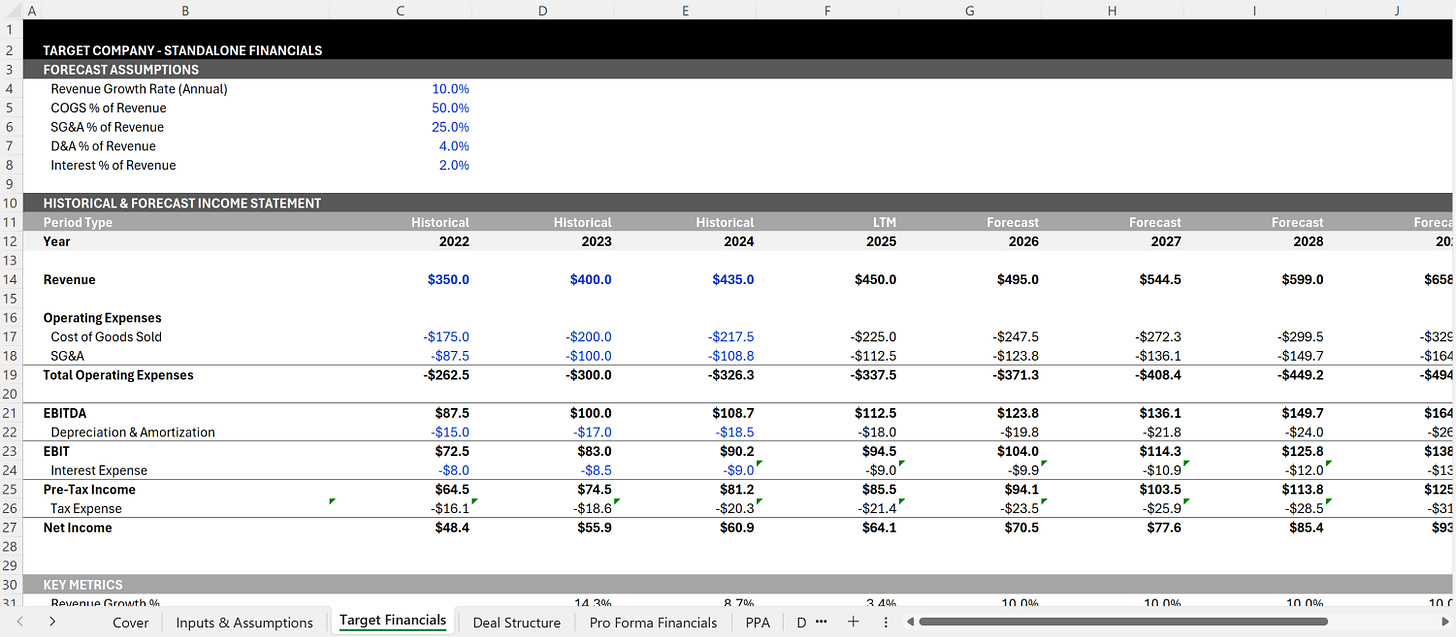

Target Financials

The model also includes a dedicated Target Financials view. Historical performance and forward assumptions sit here on their own, separate from deal mechanics, so valuation, leverage, and EPS math are grounded in how the business actually performs, not just what it costs on paper.

This block reframes the offer from what sounds fair to what is actually being acquired.

Earn-out controls

Earn-outs exist to bridge gaps. Sometimes they bridge valuation differences, and sometimes they bridge trust. Cash earn-outs and equity earn-outs do very different things, even when the nominal value looks similar.

Auto-calculating earn-out shares removes a common blind spot. It shows dilution when performance triggers, instead of just at close.

What needs to be noted here is that present value matters more than nominal size. A large earn-out far in the future often carries less economic weight than people assume. This section keeps earn-outs honest.

Scenario toggles (1–3)

Scenarios are the core of the model. Deals do not live at a single point, but across ranges. Running multiple scenarios side by side encourages thinking in tradeoffs rather than absolutes. It makes it easier to ask better questions early.

Each scenario flows through the entire model, recalculating funding sources, share issuance, leverage, and earnings, so differences are visible in outputs, not just implied in assumptions.

Consideration & Funding

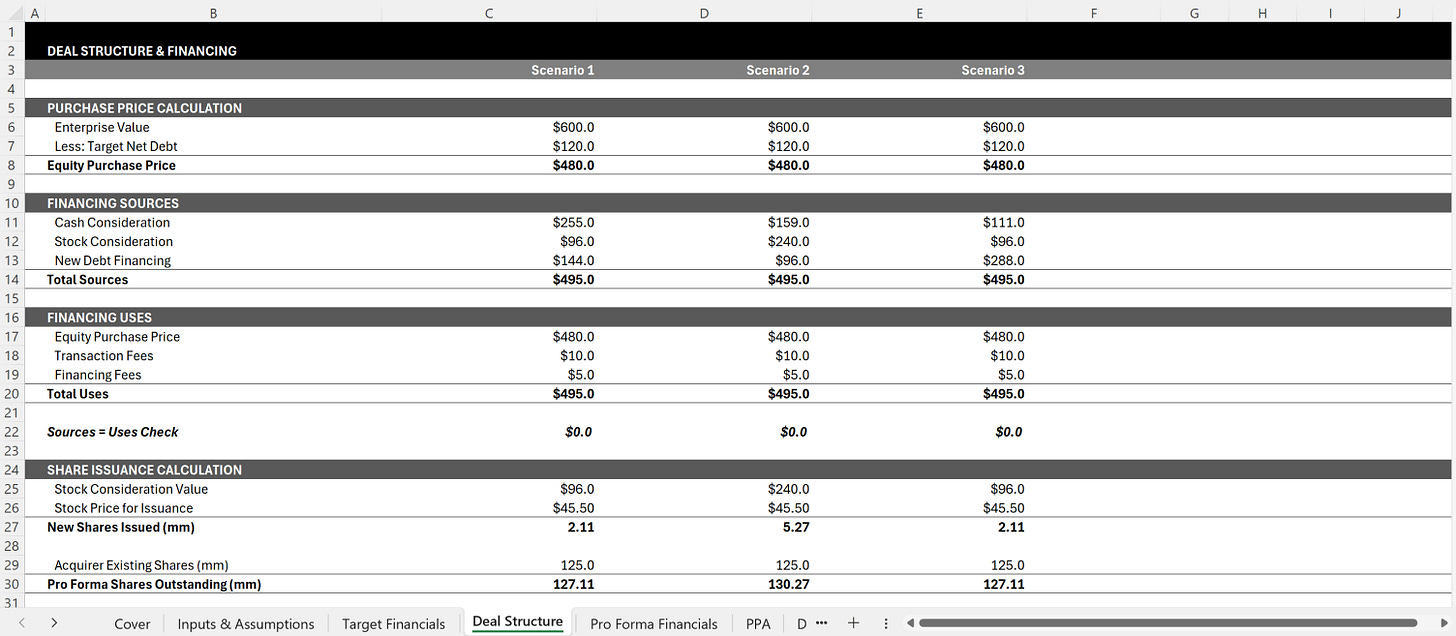

This is where a headline price becomes executable.

Upfront purchase consideration is split into cash and stock, and the model calculates shares issued directly from the acquirer’s share price.

Earn-outs are shown as expected value and as present value. Seeing both at once changes how people talk about them. The enterprise value bridge adjusts equity value for cash, debt, and DTAs so everyone is aligned on what is really being paid.

The Sources and Uses view enforces discipline inside the model and for both sides. Cash on hand, new debt draw, stock issuance value, optional seller notes, and fees as a percentage of upfront consideration all roll up into a single check.

If Sources do not equal Uses, the deal is not real.

Ownership & Leverage

Ownership and leverage are often discussed separately, while in reality, they move together.

Post-deal shares outstanding and new shares issued show dilution clearly, without interpretation. Pro forma net debt and combined EBITDA feed directly into Net Debt to EBITDA, the leverage metric that quietly governs most board conversations.

Cash-heavy deals protect ownership but increase leverage. Stock-heavy deals preserve the balance sheet but dilute control. Earn-outs shift timing of risk, not economics.

This section makes them explicit.

EPS Accretion–Dilution

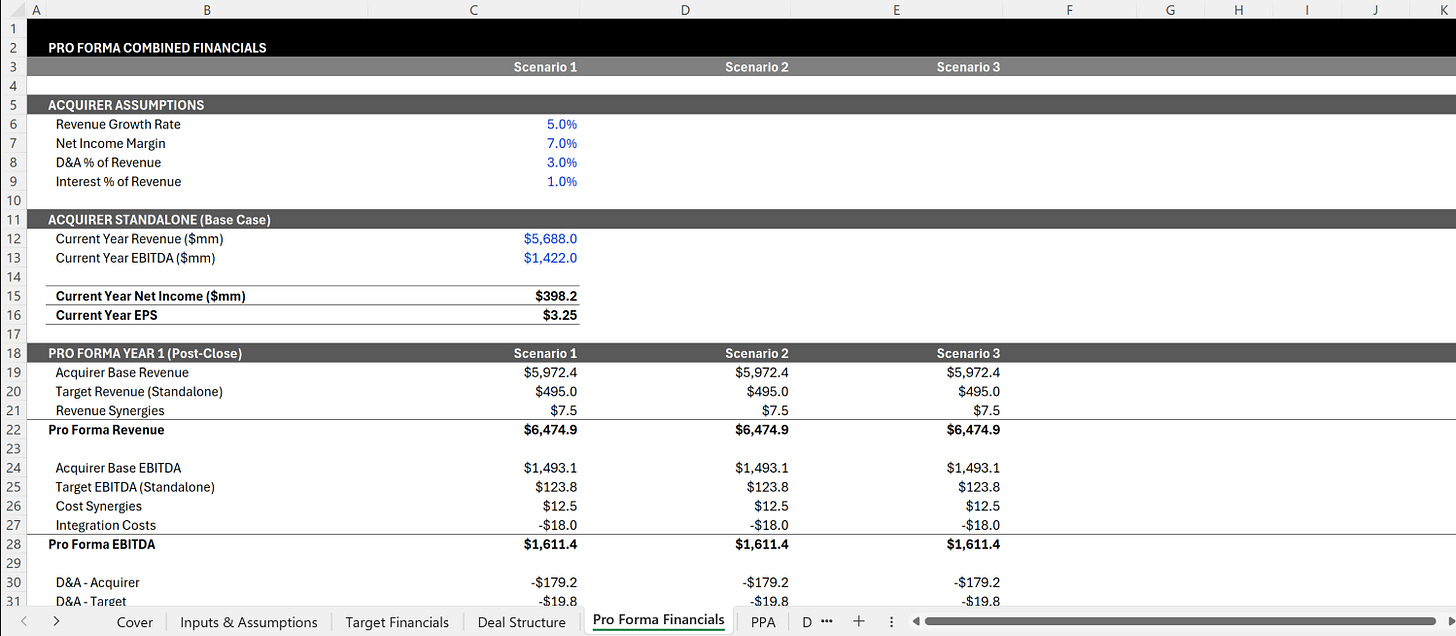

This section sits inside a broader Pro Forma Financials view that combines acquirer and target revenue, EBITDA, net income, synergies, and integration costs, with EPS accretion or dilution acting as the most visible consequence.

Public markets care about EPS. Even private boards pay attention to it more than they admit.

The model builds pro forma net income by combining acquirer and target earnings and layering in new debt interest. Synergies can be included, but cautiously. Share count does much of the work here, which is exactly the point.

Pro forma EPS and percentage accretion or dilution are shown for each scenario. This makes the Year 1 impact visible early.

EPS accretion is not value creation, but it drives real decisions. This model makes this reality visible before it becomes political.

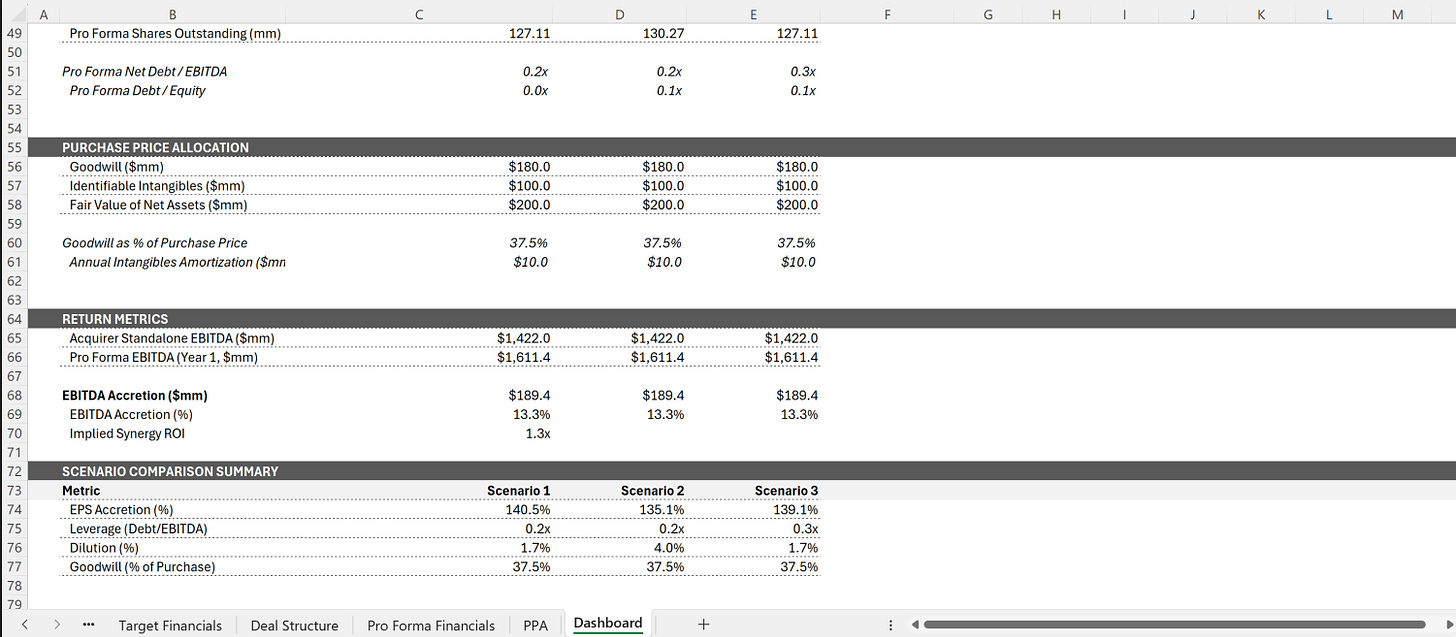

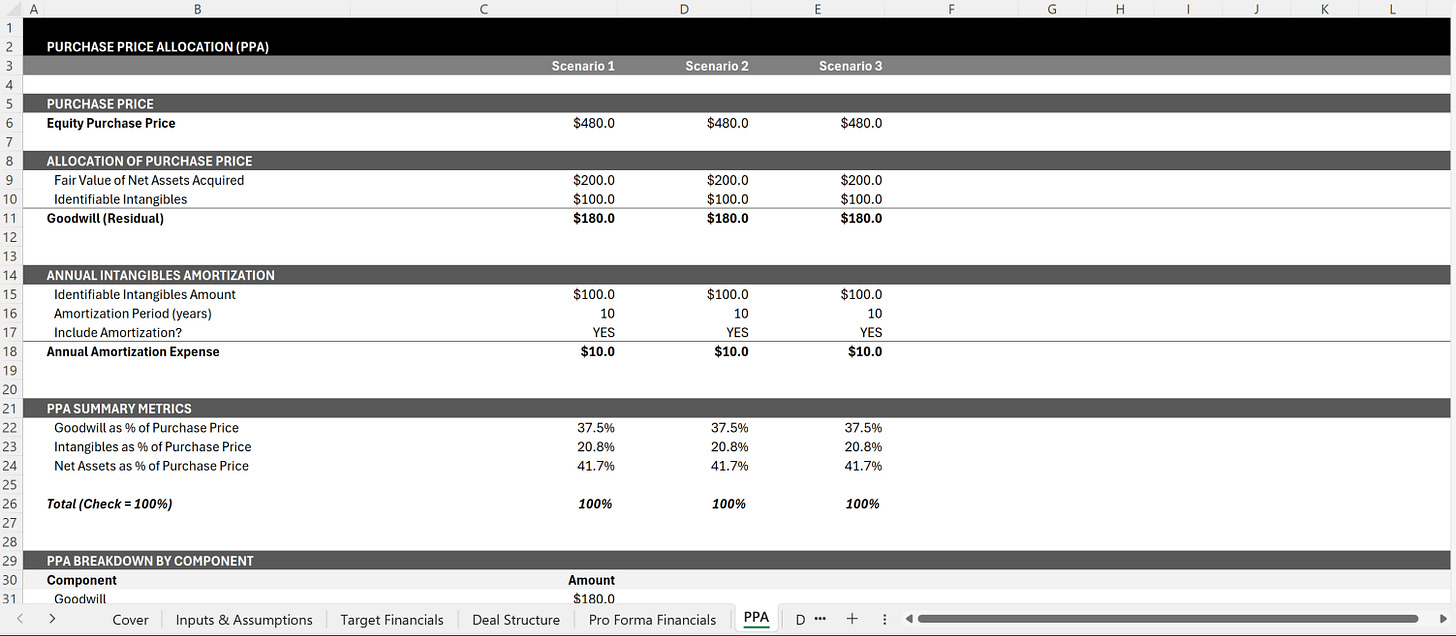

Purchase Price Allocation (PPA)

The model includes a dedicated Purchase Price Allocation (PPA) view that breaks the equity purchase price into fair value of net assets, identifiable intangibles, and goodwill. And since intangible amortization flows directly into post-close earnings, it affects EPS beyond headline deal terms. Seeing PPA alongside deal structure prevents teams from treating goodwill as an abstract plug.

Dashboard

Finally, the dashboard is the decision surface. It pulls from every major tab in the model, from Inputs, Deal Structure, Pro Forma Financials, and PPA, so nothing shown here is disconnected from underlying assumptions.

Instead of flipping between tabs, teams can see scenarios lined up side by side when it comes to equity value paid, cash versus stock, earn-out present value, new debt raised, dilution percentage, net debt to EBITDA, pro forma EPS and accretion or dilution.

This is where iteration happens. Small changes in mix can be tested quickly, and tradeoffs become clear without explanation.

If you cannot explain your deal from this dashboard, you do not understand it yet.

2. Who Should Use This Model

This particular model is useful for anyone who is close to the major decision. First and foremost, it’s a necessity for founders who are planning an exit.

At the exit stage, offers rarely differ much on headline price. What actually affects the outcome is how the offer is structured, and there are key decisions to be made heere.

Cash versus stock, earn-outs, and rollover equity determine how much you really take home, how much risk you keep, and whether your incentives stay aligned after the deal closes. This model helps founders see those consequences clearly before they react emotionally to a number on a term sheet.

If you are a founder looking for an exit, keep this question in mindL

NOT: “Is this a good price?”

BUT: “What does this deal mean for me, in practice?”

CFOs and corporate development leads use the model to test structures before negotiations begin. It allows them to see, in advance, how different mixes affect dilution, leverage, and EPS, and to avoid walking into a deal that looks acceptable on price but breaks internal constraints.

For bankers and investors, the value is in speed and ease of mind. The model puts dilution, funding, and leverage pressure points in one place, making it easier to challenge assumptions and compare alternatives.

Finally, usage is about timing. This model delivers the most value before terms are agreed. Once structure is set, leverage disappears.

3. How This Deal Structuring Model Works

This model is designed to be iterative. Each step unlocks a different decision. Once you have all the data you need, you just need to follow 6 steps.

Step 1: Fill Inputs

Start with acquirer and target inputs. This is what adds context and accuracy to the deal. The immediate decision unlocked here is capacity. What is feasible without stretching the business into a different risk profile?

Step 2: Set Earn-outs

Add any cash or equity earn-outs and define timing. Seeing present value alongside nominal amounts changes how earn-outs are discussed. This step clarifies who carries risk and when.

Step 3: Choose Deal Mix

For each scenario, set the cash versus stock split. The model calculates new shares, new debt draw, and total consideration automatically. This is where cash vs stock acquisition choices start to show their consequences.

Step 4: Review Funding & Ownership

Check Sources and Uses, post-deal ownership, dilution percentage, and pro forma leverage. This step often surfaces tension between control and balance sheet strength.

Step 5: Check EPS Impact

Review pro forma EPS and accretion or dilution. This answers the question markets and boards will eventually ask, whether teams like it or not. This is where EPS accretion dilution becomes concrete.

Step 6: Compare and Iterate

Use the dashboard to compare scenarios side by side. Adjust the mix until the balance between dilution, leverage, and earnings impact feels acceptable. Iteration here is where judgment shows up.

4. Download the Deal Structuring Model in Excel

If you want to explore these tradeoffs yourself, you can download the Excel model and work through your own scenarios:

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.