How to Find Investors for Your Startup (And Actually Get Funded)

A tactical guide to raising capital, connecting with the right investors, and securing funding in a competitive market.

💰 Raising Money Is Hard—But Finding the Right Investor Is Harder

Every founder knows raising money is tough.

But here’s the part no one warns you about:

The hardest part isn’t pitching—it’s knowing who to pitch.

There’s more capital than ever out there.

VCs are flush. Angels are active. Crowdfunding is booming.

But most founders waste time chasing the wrong investors.

🚀 Automate AI Risk Reviews—Free Template Inside

Struggling to evaluate AI tools for risk and compliance? Vanta’s AI Security Assessment Template helps IT and governance teams streamline approvals while ensuring security and accountability.

✅ Assess AI tools before deployment

✅ Align with GRC best practices

✅ Standardize internal risk reviews

Built for fast-moving security, privacy, and risk teams—ready to scale your AI oversight process.

The money is out there.

The challenge is finding the investors who actually write checks for companies like yours—at your stage, in your market, with your traction.

That’s the difference between spinning your wheels and closing your round.

This guide will show you exactly:

✅ Where to find the right investors

✅ How to approach them (even with no warm intro)

✅ What to say to get the meeting—and the money

Let’s dive in.

1. Where to Find Investors for Your Startup

Before you start pitching, you need to know who you’re pitching to. Different types of investors fund startups at different stages, and not all money is created equal. The right investor isn’t just a source of capital—they’re a long-term partner in your business.

Angel Investors: Early Backers Who Bet on Potential

Angel investors are individuals who invest their own money into early-stage startups in exchange for equity. Many are former founders, executives, or industry experts who can offer mentorship and connections in addition to funding.

💰 Typical Investment Size: $25K–$500K

🛠️ What They Care About: Vision, team, market potential

📍 Where to Find Them:

AngelList – A platform connecting startups with angel investors.

Angel networks – Groups like Tech Coast Angels, Golden Seeds, Angel Capital Association.

LinkedIn & Twitter – Many angels share investment interests publicly.

Founder communities – Slack groups, Reddit forums, and Indie Hackers.

Events & demo days – Look for investor-focused networking events.

Angel investors take bigger risks than VCs but expect bigger returns. They usually fund pre-seed and seed rounds and often invest before a startup has significant traction.

Venture Capitalists (VCs): Fuel for High-Growth Startups

VCs manage investment funds that deploy capital into startups with high growth potential. Unlike angel investors, VCs usually invest in rounds Seed to Series C+ and have a structured decision-making process.

💰 Typical Investment Size: $500K–$100M+

🛠️ What They Care About: Scalability, traction, competitive moat

📍 Where to Find Them:

Crunchbase & PitchBook – The best databases for researching VCs.

Warm introductions – The #1 way to get a VC’s attention.

Demo days & conferences – YC Demo Day, TechCrunch Disrupt, Web Summit.

Twitter & newsletters – Many VCs share insights and investment areas publicly.

If you don’t have traction yet, most VCs won’t bite. They want to see early growth metrics, a strong team, and a clear market opportunity.

Accelerators & Incubators: Funding + Mentorship

Startup accelerators provide capital, mentorship, and investor access in exchange for a small equity stake. These programs are a fast track to getting investor exposure.

🏆 Top Startup Accelerators:

Y Combinator (YC) – The most famous accelerator, with alumni like Airbnb, Stripe, Dropbox.

Techstars – Industry-specific programs with deep mentorship.

500 Global – Strong international presence for early-stage startups.

💰 Typical Investment Size: $50K–$500K + mentorship

🛠️ What They Care About: Founder potential, product-market fit, scalability

Crowdfunding: Raising Capital from the Public

Crowdfunding allows startups to raise money from a large pool of backers instead of relying on traditional investors.

Best Crowdfunding Platforms:

Kickstarter – Best for consumer product launches.

Republic & Seedrs – Equity crowdfunding for startups.

Indiegogo – Flexible funding options.

Crowdfunding is great for pre-orders and early adopters but requires a strong marketing push.

Corporate & Strategic Investors

Big companies have venture arms that invest in startups to stay ahead of innovation.

📍 Where to Find Strategic Investors:

Google Ventures (GV), Salesforce Ventures, Intel Capital – Actively fund startups.

Enterprise networking events – Attend industry-specific innovation summits.

LinkedIn & executive connections – Get intros through industry leaders.

Strategic investors offer more than money—they bring distribution, customers, and partnerships.

2. How to Get in Front of Investors

Finding investors is one thing. Getting them to notice you is another. Here’s how to stand out.

1. The Power of Warm Introductions

The easiest way to get an investor’s attention is through a warm intro from someone they trust.

How to Get Warm Intros:

Ask current investors, advisors, or mentors for introductions.

Use LinkedIn to find mutual connections.

Network at startup events where investors are actively looking for deals.

Warm intros increase your chances of securing a meeting 10x compared to cold outreach.

2. Mastering Cold Outreach (When You Have No Warm Intros)

If you can’t get an intro, cold emails and LinkedIn messages can still work—if done right.

✅ Cold Email Template That Gets Replies

Subject: [Your Startup Name] – [Traction Point] – [Funding Round]

Hi [Investor’s Name],

I’m [Your Name], founder of [Startup Name]. We’re building [one-liner description].

🚀 [Traction: e.g., "3x revenue growth in 6 months"]

📊 [Market opportunity: "Huge demand, with $X TAM"]

💡 [Competitive advantage: "We’re the only AI-powered tool in this space"]

We’re raising **[$X million] [funding round]** and I’d love to discuss if this aligns with your investment focus.

Would you be open to a quick chat next week?

Best,

[Your Name]

[Your Email]

[Your Website]🔹 Keep it short – Investors don’t have time for long emails.

🔹 Show traction – Data beats ideas.

🔹 Follow up – If no response, send a concise follow-up in 5–7 days.

3. What Investors Really Care About

Investors see hundreds of pitches every month. If you want to stand out, focus on what actually matters.

💡 What Investors Look For:

The Team – Are you the right people to build this?

Market Size – Is this a $10M idea or a $10B opportunity?

Traction – Are people already using and paying for your product?

Competitive Advantage – Why can’t someone else do this better?

Clear Business Model – How does this become a profitable company?

TL;DR – The Startup Fundraising Playbook

✅ Know your investor type – Angel, VC, accelerator, crowdfunding, or strategic.

✅ Warm intros > cold emails – Use your network to access investors.

✅ Cold outreach still works – But only if it’s concise and data-driven.

✅ Your pitch deck matters – Clarity, traction, and storytelling win deals.

✅ Investors fund businesses, not ideas – Show real growth potential.

Raising money is hard. But with the right strategy, investors, and pitch, you can close your round and build something great. 🚀

FAQ: Everything You Need to Know About Finding Investors

Raising money is hard. Every founder knows it. But it’s even harder if you don’t know where to look, how to approach investors, or what they actually want to see before writing a check.

This FAQ breaks down the most important questions about finding investors and securing funding, with direct answers and actionable insights.

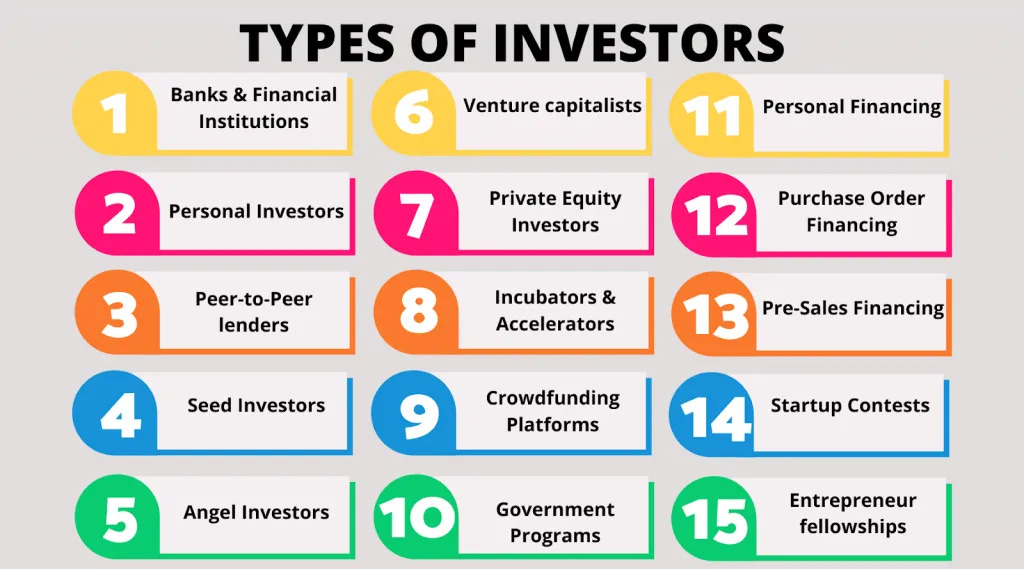

1. What Are the Different Types of Startup Investors?

Not all investors are the same. Here’s who you should consider based on your startup’s stage:

Angel Investors – High-net-worth individuals who invest early in exchange for equity.

Venture Capitalists (VCs) – Institutional investors backing high-growth startups, usually from seed stage onward.

Accelerators & Incubators – Provide funding, mentorship, and network access in exchange for equity.

Crowdfunding Investors – Raise money from the public through platforms like Kickstarter or Republic.

Corporate & Strategic Investors – Large companies investing in startups that align with their business.

Government Grants & Loans – Non-dilutive funding from agencies supporting innovation.

Each type of investor comes with trade-offs. Choose based on your growth goals and willingness to give up equity.

2. How Do I Know If My Startup Is Ready to Raise Money?

Before pitching investors, make sure you can check these boxes:

Validated market demand – Do people actually want what you’re building?

Some form of traction – Revenue, users, partnerships, or at least a compelling waitlist.

A scalable business model – Can this grow into a large company, or is it just a small business?

A strong founding team – Investors bet on people as much as ideas.

Financial projections and a funding plan – How much do you need, and what will it be used for?

If you can’t confidently answer these, you’re probably too early to raise.

3. Where Can I Find Angel Investors?

AngelList – The go-to platform for early-stage funding.

LinkedIn & Twitter – Many angels share their investment focus publicly.

Angel networks – Groups like Tech Coast Angels and Golden Seeds.

Startup events and networking – Conferences, pitch competitions, and demo days.

Warm introductions – The best deals happen through referrals.

Angels write smaller checks than VCs but move faster and take bigger early risks.

4. What Do Venture Capitalists (VCs) Look for in a Startup?

VCs don’t just look for great ideas. They look for investable companies. Here’s what matters:

Market size – Is this a billion-dollar opportunity, or a niche product?

Traction – Users, revenue, or early momentum that proves demand.

The team – Do the founders have the experience and ability to execute?

Competitive advantage – Why can’t someone else just copy this?

Scalability – Can this become a $100M+ business?

VCs need big outcomes. If you’re not building for scale, you’re not a VC-backed business.

5. How Do I Get a Meeting with a VC?

Warm introductions work best – Get referrals from founders, advisors, or mutual connections.

Cold outreach can work – Keep emails short, highlight traction, and personalize them.

Engage on social media – Many VCs share insights on Twitter and LinkedIn.

Attend startup events – Demo days and conferences are where deals happen.

VCs see hundreds of pitches. The more credibility you have before reaching out, the better.

6. What Should I Include in My Pitch Deck?

Investors don’t need 50 slides. A strong pitch deck should cover:

The Problem – What big pain point are you solving?

The Solution – How does your product fix it?

Market Size – Is this a billion-dollar opportunity?

Traction – Revenue, user growth, partnerships, or early adoption.

Business Model – How do you make money?

Go-To-Market Strategy – How will you acquire customers?

Competition – Who else is in the space, and how are you different?

Financials & Projections – Future revenue, burn rate, and funding needs.

The Team – Why are you the right people to build this?

The Ask – How much are you raising, and what will it be used for?

Investors don’t fund ideas. They fund execution.

7. How Much Equity Should I Give Up to Investors?

Angel investors: 10-25%

Seed investors: 15-30%

VC rounds: 20-30% per round

Never give up more than 50% of your company early on. You need control to build long-term value.

8. What Are Common Investor Red Flags?

Unrealistic promises – Anyone guaranteeing success is lying.

Excessive control demands – Investors asking for too much equity or board seats.

Lack of relevant experience – Investors who don’t understand your industry.

Bad deal terms – Hidden fees, aggressive liquidation preferences, or unfair valuations.

Poor reputation – Do your own due diligence before accepting money.

The wrong investor is worse than no investor.

9. Can I Raise Funding Without Giving Up Equity?

Yes. Consider these options:

Revenue-based financing – Investors get a percentage of future sales.

Small business loans – SBA loans and fintech lenders.

Grants – Government or private grants for startups.

Crowdfunding – Platforms like Kickstarter let you raise money without selling equity.

Not all businesses need VC money. Sometimes, bootstrapping is the smarter move.

10. How Long Does It Take to Raise Funding?

Angel rounds: 2-6 months

Seed rounds: 4-9 months

Series A+ rounds: 6-12 months

The timeline depends on traction, investor interest, and your ability to sell the vision.

11. How Do I Improve My Chances of Raising Investment?

Build relationships before asking for money – Investors back people they trust.

Show traction – The more proof you have, the easier fundraising gets.

Craft a compelling pitch – Investors don’t invest in features, they invest in opportunities.

Target the right investors – Not all capital is good capital.

Be persistent – Fundraising is a numbers game.

The best founders always find a way.

Final Takeaway: Finding Investors is Hard, But Not Impossible

Most founders struggle with fundraising because they focus too much on asking for money instead of earning it.

The founders who raise capital successfully do three things right:

They prove demand. Investors don’t fund ideas—they fund traction.

They build relationships. The best funding rounds happen before a pitch deck is even opened.

They understand investor incentives. Investors need to make money. If you don’t have a billion-dollar vision, you’re in the wrong room.

So before you send another cold email, ask yourself:

Is my business actually investable?

Do I have traction to back up my claims?

Am I targeting the right investors for my stage?

If the answers are yes, you’re on the right track. If not, focus on building before fundraising.

Money follows momentum. Build something people want, and the investors will come.

I would challenge "there’s more capital than ever out there."

Even if it's true in absolute numbers, and the few IPOs and valuation stagnation suggest otherwise, it wouldn't matter that much to startups. What matters is the supply/demand dynamic.

In other words, it doesn't matter if the investors have twice as much money if there are 5x times as many startups around pitching for that money.

And that's kinda what we see: https://bit.ly/3Z8I5vj

Availability of the money—defined through the chances a startup would secure an investment—went significantly down for the last couple of years, and, at least so far, stays so.

Also, the data was gathered before we knew the whole tariff war thing, so the uncertainty levels went even higher now.

There's more context on this here: https://pawelbrodzinski.substack.com/p/support-network-for-earliest-stage (it's focused on early-stage startups, but the investment scene is all interconnected).