IRR vs Return Multiple Explained: The Venture Math Every Founder and VC Must Master

Learn how LPs actually judge performance, why timing matters as much as multiples, and get the Excel template investors already use.

The Metric That Decides Who Gets Funded

In venture capital, the pitch deck is where stories take flight, but the spreadsheet is where decisions are made. LPs might be drawn in by vision, market size, or a founder’s track record, but when the commitment meeting starts, the conversation becomes about the numbers.

And not just any numbers; the ones that quantify how quickly and how efficiently capital comes back.

Let’s take for instance a fund that triples over a decade might sound like a runaway success, until you run the math and see it’s just an 11% IRR, barely edging past public market benchmarks.

Now take a smaller win: a 2× return in just four years. That’s a 19% IRR. The kind of velocity investors light up for. Same money in, same relative gain, but a completely different story in the eyes of someone measuring opportunity cost.

This is why knowing how IRR interacts with return multiples is a prerequisite for serious fundraising and deal-making. Misreading that trade-off can lead to overpricing a round, underestimating LP expectations, or walking into a negotiation with the wrong leverage.

If you’re pitching to LPs, pricing an investment, or raising your next fund, this is the math that will make or break the deal.

Table of Contents

1. Why IRR and Return Multiples Are Two Sides of the Same Coin

2. What is the IRR Analysis: Years Invested vs Return Multiple model?

3. Why this model matters

4. What’s inside (the tabs & KPIs)

5. How to use it (3-step workflow)

6. Who Should Use it and When

7. Master the Math, Control the Narrative

8. Download the IRR vs Return Multiple Excel Template

9. Frequently Asked Questions (FAQs)

1. Why IRR and Return Multiples Are Two Sides of the Same Coin

When investors talk about performance, two metrics dominate the conversation: Internal Rate of Return (IRR) and Multiple on Invested Capital (MOIC). These are complementary measures, not competing ones. One shows how fast value is created, the other shows how much value is created.

IRR is the speedometer. It measures the annualized rate of return on invested capital, compounding over time. The calculation factors in when capital is deployed and when it’s returned, which means the timing of cash flows can dramatically change the figure. It’s the metric that answers: How quickly did this investment grow?

MOIC is the odometer. It measures the total value generated relative to the initial investment, without considering the clock. It answers: How much did we make in total? A 3× MOIC means you turned $10 million into $30 million, whether it took three years or thirteen.

Why They Can’t Be Viewed in Isolation

Same multiple, radically different story:

A 3× return in four years equals roughly a 32% IRR.

But the same 3× return in ten years drops to about 12% IRR, which is barely above what public markets might deliver over the same horizon.

This is why LPs benchmark funds using both metrics. Most multiples show the “what,” while IRR shows the “how fast.”

Together, they give a complete picture of capital efficiency and total value creation.

Where Each Metric Shines (and Misleads)

MOIC alone can flatter slow capital. A fund might post a strong multiple on paper, but if it took too long to realize, the annualized performance may not meet LP hurdle rates.

IRR alone can exaggerate quick wins. A fast partial exit might spike IRR, but without meaningful total gains, it may not justify the risk profile.

Imagine a $10M investment that returns $5M in year 3 and another $25M in year 8. The MOIC is still 3×, but the IRR will land somewhere between the earlier 32% and 12% examples, reflecting the blended speed of capital return. If that first $5M had been delayed to year 8, the IRR would drop sharply, even though the MOIC stays the same.

In practice, fund managers highlight MOIC when talking about scale of outcome and IRR when talking about speed and efficiency.

LPs listen for both, because one without the other can distort the real story.

2. What is the IRR Analysis: Years Invested vs Return Multiple model?

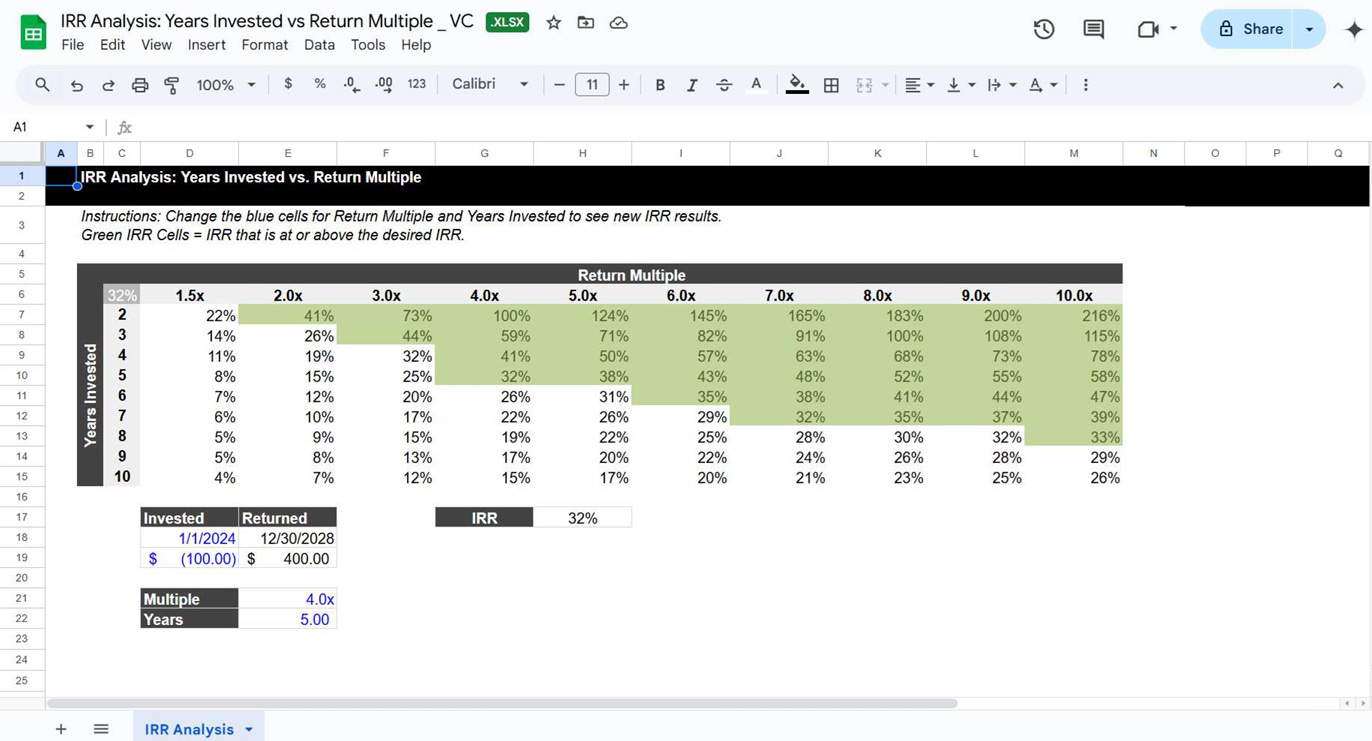

The IRR Analysis: Years Invested vs Return Multiple model is built to strip the guesswork out of return math. It’s a simple but powerful Excel calculator designed for one purpose. To instantly show how exit multiples and holding periods translate into IRR; the same way LPs map it in their investment committee memos.

Here’s how this model works:

All you have to do is plug in any exit multiple and any holding period. The model calculates the IRR for every combination and lays it out in a clear, color-coded grid. Green cells highlight outcomes that meet or beat your target hurdle rate, so you can see which deals or scenarios are worth chasing.

Instead of doing mental math, or worse, trusting your gut, you see the trade-offs visually. A 2× in five years, a 4× in eight, a 3× in three, all right there in context. Instead of guessing IRR, you see it mapped, no math required.

The result is a quick, visual reality check for pacing assumptions, fundraising targets, and valuation negotiations. Whether you’re building a fund model, evaluating a term sheet, or just pressure-testing an exit scenario, the grid turns abstract numbers into tangible decision points.

Picture this: you’re in an LP meeting, walking through your pipeline. Someone asks, “If these three exits land as projected, will we still clear our hurdle?” Instead of fumbling through back-of-the-envelope math, you open the model, adjust a few inputs, and in seconds, the grid shows the answer. Green for “yes,” blank for “no.”

That is how you build trust inside the room.

3. Why this model matters

In venture capital, guessing your IRR is like guessing your runway. It feels fine until you run out of time. Then the risks of getting it wrong are real:

Over-optimistic pacing assumptions in fund models can make projections look great on paper but impossible to execute in reality.

Under-priced rounds happen when founders don’t understand the return speed investors require, leaving capital on the table.

LP confidence erodes when return timelines are vague or inconsistent, even if the multiples look good.

The model earns its keep the moment it sinks a bad deal before it wastes your time.

Founders use it to sanity-check their own ask before walking into a pitch. If you know the IRR math behind your valuation, you’re showing investors exactly why the number works, and not hoping that they magically “get it”.

For VCs, it’s a fast way to catch the traps hiding in “looks good on paper” deals. You can love the team, love the market, but if the grid says it won’t clear your cash-on-cash and %-of-fund hurdles, you know it before the partner meeting turns into an awkward post-mortem.

And it’s brutal on over-confident growth forecasts. I’ve seen founders swear their revenue ramp would deliver a 3× in five years, only to watch the model peg it at a 1.7× without a miracle exit multiple. That’s not fun to discover mid-Series B, when the only cure is a down-round and a lot of awkward board calls.

This is why the Years Invested vs Return Multiple grid changes the conversation. It turns abstract debates about “2× or 3×” into precise, time-aware IRR discussions that LPs actually care about. The math is instant, the trade-offs are clear, and the decision-making becomes grounded in reality instead of optimism.

4. What’s inside (the tabs & KPIs)

The template is designed so you can move from input to insight in minutes. No formulas to write, no manual recalculations. Everything is laid out in tabs that mirror the way LPs and fund managers actually think about return scenarios.

Inputs

This is where you set the stage:

Investment date, currency, and hurdle rate - so the model reflects your actual fund parameters and reporting standards.

Editable multiple and holding period ranges - typically 1× to 10× and 1 to 15 years, but fully customizable depending on your strategy. This flexibility lets you model anything from a quick seed flip to a long-tail growth hold.

IRR Grid

Once the inputs are in place, the model generates a full table showing every combination of return multiple and holding period.

The calculations are automatic. Change a number in the Inputs tab and the grid updates instantly.

Green-highlighted cells flag IRRs that meet or exceed your target hurdle rate, giving you a visual “go/no-go” map at a glance.

The layout is deliberately color-coded and idiot-proof, so you can scan it in seconds and know which scenarios are worth pursuing.

Key Metrics

To the right of the grid, the model distills the essentials:

Annual IRR for the specific scenario you’ve selected.

Equity multiple and holding period so you can contextualize returns in plain language.

Breakeven multiple at your target IRR, showing exactly how much value you need to create in the given timeframe to make the math work.

By packaging these metrics together, the template doesn’t just tell you what the IRR is, it tells you why it matters, and whether it passes the threshold for your investment strategy.

5. How to Use it (3-step workflow)

The template is built for speed, you can go from raw assumptions to informed decisions in minutes. Here’s how to put it to work:

1. Drop your data

Open the Inputs tab and adjust the ranges to match your scenario. Set your investment date, currency, and hurdle rate. Then tweak the multiple and holding period ranges to reflect the deals you’re modelling, whether that’s a quick 2–4 year turnaround or a decade-long growth hold.

2. Review auto-metrics

Flip to the IRR Grid and watch the calculations update instantly. Scan the green-highlighted cells to see which exit scenarios clear your IRR target. Hover over any cell to get the exact IRR, multiple, and breakeven numbers. This step is where you spot the difference between a “good on paper” deal and one that actually meets your fund’s performance criteria.

3. Decide and share

Use the insights to make faster, sharper calls; from pacing your fund’s deployment to negotiating valuation in a live term-sheet discussion. Export the grid or paste snapshots directly into your pitch decks, LP update letters, or portfolio review memos. It’s an easy way to replace vague optimism with hard numbers your stakeholders can trust.

With this workflow, the model becomes more than a calculator, it’s a visual decision engine you can carry into every funding, pricing, and reporting conversation.

6. Who Should Use it and When

The Years Invested vs Return Multiple model isn’t just for fund managers, it’s a versatile tool for anyone involved in venture or growth-stage investing. Different stakeholders can use it to stress-test assumptions, sharpen negotiation positions, and align expectations.

For VCs and LPs

Use the grid to test fund pacing assumptions before committing capital. By mapping projected exits against your hurdle rate, you can see whether your deployment strategy realistically clears LP return targets. This avoids the trap of overestimating IRR based on optimistic timelines.

For Founders

Validate whether your valuation fits investor return math. If your ask requires a 5× multiple for investors to hit their IRR goal, but the market or your business model makes that outcome improbable, you’ll know before you walk into the pitch.

This kind of transparency can strengthen negotiations and build credibility with investors.

For Angel Syndicates

Educate newer investors on timeline vs. return trade-offs. Many first-time angels focus solely on the size of the exit, without realizing how holding period impacts IRR. The grid is a simple teaching tool that makes the concept tangible in seconds.

When to use it

Fundraising: Show LPs how your strategy hits their benchmarks.

Exit strategy planning: Compare potential outcomes and timelines.

Term-sheet negotiations: Pressure-test whether proposed valuations make sense for both sides.

LP reporting: Present portfolio performance in a format LPs intuitively understand.

By pairing this model with your own data, you turn abstract conversations about multiples and years into clear, fact-driven scenarios without guesswork or hidden assumptions.

7. Master the Math, Control the Narrative

In venture capital, you don’t just sell a story, you sell the math behind it.

LPs, co-investors, and even founders will judge your judgment by how well you understand the trade-off between speed and scale. The IRR Analysis: Years Invested vs Return Multiple model gives you that edge.

With it, you can move beyond vague multiples into time-adjusted returns, speak LP language fluently, and make faster, more defensible decisions.

The next time you’re pitching a fund, negotiating a valuation, or updating your investors, you’ll be showing instead of guessing.

As a premium subscriber (free trial available), you will also get access to the full library of resources (+50) shared on The VC Corner

8. Download the IRR vs Return Multiple Excel Template:

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.