OpenAI’s Product Lead Reveals the 15 AI Distribution Plays That Build Real Moats

From bundling and embedding to viral artifacts and trust loops — here’s how to survive GPT-5 and scale profitably.

By Miqdad Jaffer, @ OpenAI and instructor at AI Product Strategy Cohort

So far, we’ve covered how to find PMF for your AI product.

Then we dove deep into how to build AI product strategy with the simple 4-step framework I personally use.

Today, we’re going to dive into the most important part that can literally 10–100x your company and decide whether you win or lose in the long run: distribution.

Because if there’s one thing that can’t be cloned, it’s how you design and play your distribution.

And let’s be clear: distribution isn’t just running paid ads, cranking SEO, or hiring influencers. Those are surface-level tactics.

For AI products, distribution is way deeper. It’s about how your product embeds itself into workflows, how your outputs become your marketing, how your narrative gets repeated in rooms you’ll never enter, and how you engineer loops and moats that compound over time.

That’s what we’re going to unpack today.

Because whether you realize it or not…

Every founder today is in a distribution war!

It’s easy to think the real competition is in model size, feature velocity, or clever prompts. But the brutal math of this market says otherwise.

Features can be copied in weeks. Access to foundation models is universal. What separates winners from losers isn’t technology. It’s distribution.

We don’t have to look far for proof.

Perplexity didn’t try to out-model OpenAI. They built a retrieval-first search workflow with citations and trust loops & then layered distribution through outputs that begged to be shared on X, Reddit, and TikTok. Every time someone posted a Perplexity answer, they acquired new users for free.

Runway avoided competing with “AI video” in the abstract. Instead, they went straight to professional creators, embedded inside production workflows, and partnered with festivals and film schools. Distribution wasn’t about ads, it was about owning the pro-grade creative ecosystem.

Clay didn’t just launch a CRM enrichment tool. They invented a new role ( the “GTM Engineer”) and positioned Clay as its default stack. By creating identity, they created demand, and every new GTM Engineer hired became a distribution node for Clay.

Cluely could have blended in with a thousand other “meeting copilots.” Instead, they embraced provocation with their “cheating manifesto,” turning controversy itself into distribution. Every debate on X, Reddit, or in the press funneled new users into their orbit.

The pattern is undeniable: distribution moats compound while features evaporate. When you own the channel, the workflow, or the cultural conversation, every new user strengthens your position and makes it harder to dislodge. Competitors can copy your features in a sprint, but they can’t copy the network, the outputs, or the status you’ve already captured.

In AI, you’re either compounding or collapsing. Distribution is the only dividing line.

Which side of that line you end up on will decide if you’re building a company or just a demo.

Side Note: Miqdad is also teaching a 6-week AI Product Strategy Cohort where you’ll go hands-on with everything from choosing the right AI tech stack for maximum profitability, to pricing and packaging, the Four D’s of AI UX, onboarding customers effectively, building moats that last, and so much more.

Leaders from Uber AI, Rippling, and dozens of founders have already joined.

Right now, until they hit their first 100 students (only 25 spots left), you can get $550 off + a written review of your product strategy directly from Miqdad.

Why AI Distribution Is Different From SaaS Distribution

When SaaS was the dominant wave, distribution strategy was a playbook you could copy-paste.

You built a product with near-zero marginal cost.

You bought ads, hired an outbound team, or optimized SEO.

You modeled CAC against LTV, and as long as LTV > CAC, you could scale.

The laws of SaaS distribution were forgiving. Time was on your side. You could tinker with funnels for years before margins caught up.

AI changes all of this.

In AI, distribution is not a “growth channel.” It is your survival system. The reason is simple: AI products don’t follow SaaS economics, and that reshapes every distribution choice you make.

The Marginal Cost Illusion

In SaaS, once you build the product, serving an extra user costs pennies, sometimes nothing.

In AI, every click burns the compute.

Every query, every generation, every workflow has a price tag. And worse, that price doesn’t trend toward zero with scale. In fact, it often gets worse as you grow:

100 early users testing your product may cost you $200/month in inference.

100,000 users hammering your servers may cost you $2M/month.

This destroys the old CAC → LTV comfort zone.

In SaaS, you could overpay for acquisition because unit economics would improve.

In AI, if your distribution is undisciplined, you’ll scale adoption and bleed faster with every user you add.

Compressed Time Windows

SaaS companies had the luxury of slow markets.

Salesforce took years to expand CRM dominance.

Atlassian scaled Jira over a decade.

Even Zoom took half a decade before becoming mainstream.

In AI, you don’t have years. You don’t even have quarters.

When ChatGPT hit 100M users in 2 months, it wasn’t just a viral success story, it reset founder expectations forever.

If you wait six months to roll out distribution, your competitor has already cloned your feature and distributed it across a larger surface.

If you rely on slow outbound or “wait until we’re polished” thinking, you’ve already lost.

The brutal truth: distribution windows in AI collapse to quarters, not years.

Distribution Isn’t Just Reach, It’s Cost Discipline

Here’s what most AI founders get wrong:

They think distribution is about awareness. “Get more users, and we’ll figure out monetization later.”

That logic killed half the AI wrappers of 2023–2024.

Because every “free user” is not free, they are compute burn. A spike in sign-ups without a cost-aware distribution design is a liability, not an asset.

Which means in AI, distribution is a margin lever.

The channels you choose shape the economics of usage.

Viral loops only help if they attract the right users (not freeloaders who never pay).

Embedding into workflows reduces acquisition cost but also reduces wasteful “toy” usage.

In other words: distribution isn’t just about getting used, it’s about being used profitably.

The Commoditization Effect

In SaaS, features gave you breathing room. Competitors needed months or years to catch up.

In AI, the half-life of differentiation is measured in weeks.

A new “AI meeting notes” app launches → 100 clones in 30 days.

You build “AI doc summarization” → Google Docs ships it in the next release.

You add “AI suggestions” → every other productivity tool announces the same.

Which means distribution isn’t just about winning attention. It’s about building defenses against instant commoditization.

If users only know you as “that AI thing that does X,” you’re one OpenAI release away from irrelevance.

But if users know you as “the tool inside my workflow, the one my team already trusts, the one everyone in my community uses” — you survive.

Distribution becomes the moat, not the feature.

The Investor Lens

In SaaS, investors would fund growth first, unit economics later.

In AI, the first question sophisticated investors ask is:

“What happens to your distribution when GPT-5 drops?”

“How do you survive inference costs at 100M queries/month?”

“What channel or wedge do you own that Anthropic or Google can’t replicate?”

Translation: your distribution story is your funding story.

A weak distribution strategy kills your financing before it kills your company.

The Founder's Distribution Dilemma

Here’s the founder’s paradox in the AI era:

Grow too slowly → commoditized.

Grow too quickly → bankrupt on compute.

The only way out is to design distribution like you design infrastructure:

Distribution must be cost-aware (align usage with margins).

Distribution must be defensible (embedded, bundled, or unfair).

Distribution must be compounding (each new user makes the system stronger).

Designing for Distribution From Day 1

In SaaS, you could “ship first, distribute later.” You could afford to get product-market fit before thinking about channels.

AI doesn’t give you that luxury.

Why?

Compressed time windows: Features commoditize in weeks.

High marginal costs: Every free user burns compute.

Investor scrutiny: Without a distribution moat, you don’t raise your next round.

This means distribution is not a GTM exercise. It’s a product design principle.

The way you design features, flows, and pricing has to bake in distribution from the start. Otherwise, you’ll end up with a “beautiful demo” that bleeds money and dies when OpenAI ships your feature for free.

The Distribution-First PRD

You need to write Distribution-First PRDs.

In a traditional PRD (Product Requirement Document), you’ll see:

Feature description

User story

Success metrics

In a Distribution-First PRD, we add three non-negotiables:

Distribution Mechanism

How will this feature distribute itself?

Example: Runway’s “Generative Fill” created outputs that artists shared on TikTok. Distribution was built into the act of using the feature.

Workflow Insertion Point

Where in the user’s daily workflow does this feature live?

Example: Clay’s enrichment suggestions show up in email/calendar. No extra steps, no behavior change.

Economic Impact

What’s the unit cost of distributing this feature at 10x scale?

Example: Perplexity didn’t just ship GPT answers; they added retrieval to cut token costs. Without that design, distribution would’ve bankrupted them.

If your PRD can’t answer those three questions, you’re not designing a feature. You’re designing a liability.

Designing Features That Self-Distribute

Ask yourself: Does this feature create its own distribution loop?

There are three kinds of self-distribution:

Viral Artifacts → Outputs that spread awareness.

Runway: every film or TikTok snippet = free marketing.

MidJourney: every Discord-generated image = community demo.

Your move: Build watermarking, share buttons, and attribution into outputs by default.

Status Loops → Features that make users signal their usage.

Clay: operators flex their “intelligence” on Twitter, tagging Clay as their secret weapon.

Notion AI: early adopters showcased AI notes, making it aspirational.

Your move: Design features that give users something to show off.

Data Flywheels → Features that get better with more usage.

Duolingo: more learners = better feedback loops → more defensibility.

Grammarly: every correction = data for better models.

Your move: Ensure every feature emits structured data you can use to improve the system.

Distribution Insertion Points

One of the hardest founder skills is spotting where to insert AI so distribution feels frictionless.

Here’s how it should work:

High-Frequency Tasks: Embed AI where users repeat actions 10–50 times a day.

Example: Gmail autocomplete. Nobody asked for it; now everyone uses it.

Painful Bottlenecks: Insert AI where users lose time or energy.

Example: Figma’s AI “summarize feedback” shortcuts → reduces designer pain in handoff.

Habit Surfaces: Ride on tools users already keep open.

Example: Slack GPT inside channels → adoption piggybacks on chat habits.

Downstream Leverage Points: Insert where outputs travel beyond your app.

Example: Canva’s AI outputs → shared on social, giving Canva exponential reach.

Your move: Map your ICP’s day. Literally draw a 24-hour workflow and highlight where they switch tools, waste time, or export outputs. Those are your distribution insertion points.

Economic Discipline in Distribution Design

Most AI founders think distribution = “get as many users as possible.”

That’s a trap.

Every “free” user is compute burn.

Every viral spike without monetization = margin collapse.

That’s why distribution design must include economic guardrails.

Default to Cheap Models: Perplexity routes most queries to retrieval + smaller LLMs, saving cost while still giving value.

Tiered Experiences: MidJourney caps free generations, nudging users to paid plans.

Cache & Reuse: If 1,000 users request the same answer, don’t burn 1,000x inference. Cache intelligently.

Pricing Alignment: Package AI features as premium tiers early. Don’t hide AI costs in “free” SaaS pricing.

For every feature, model the economics at 100x scale. If costs don’t bend down, you don’t have distribution, you have a liability.

A Simple Checklist

Before you greenlight any AI feature, ask:

Does this feature distribute itself?

Does it insert into an existing workflow?

Does it generate viral artifacts, status signals, or data flywheels?

Does its economics improve with scale?

If you can’t say yes to at least 3 out of 4, kill it.

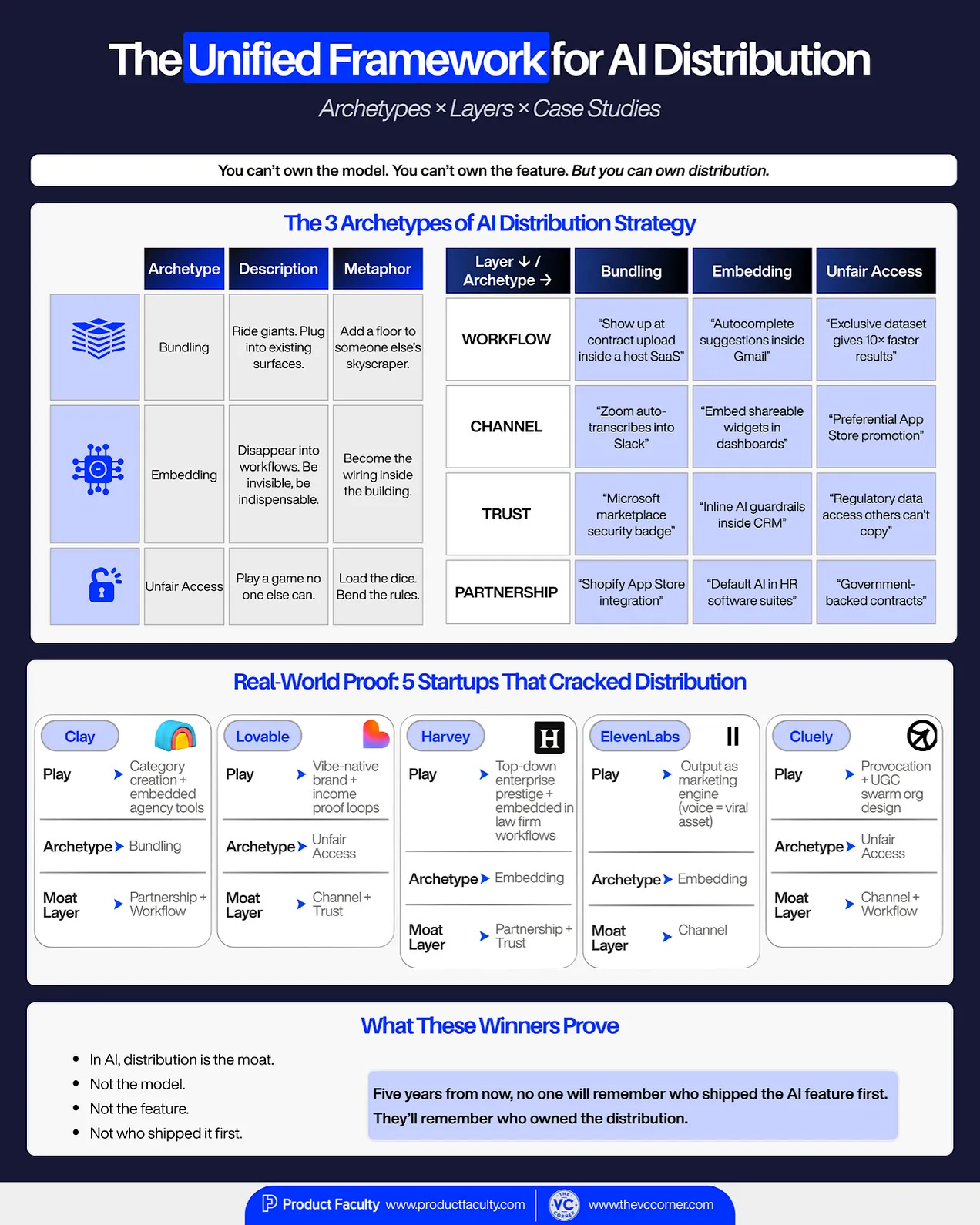

The Unified Framework: Archetypes × Layers of AI Distribution

In AI, you don’t get to own the model. You don’t get to own the feature. You barely even get to own the “first-mover” advantage. What you can own is distribution.

And distribution plays in AI collapse into three major archetypes: Bundling, Embedding, and Unfair Access.

Each archetype is a strategic posture, but for it to become defensible, it has to be built on the four layers of distribution: Workflow, Channel, Trust, and Partnership.

Think of the archetype as the shape of your strategy, and the layers as the concrete floors of your building. Together, they create a distribution system that compounds over time.

We’re going to come up with our own examples here, just to give you an idea of how these all will work!

Archetype 1: Bundling — Riding Giants

Bundling is when you win distribution by attaching yourself to an existing surface that already owns attention, contracts, or daily usage. Instead of fighting to build your own skyscraper from scratch, you add your floor on top of someone else’s.

Imagine you’ve built an AI legal reviewer for SMB contracts. Instead of selling directly to thousands of businesses one by one, you strike a bundling deal with a contract management SaaS used by 50,000 SMBs. Your AI becomes a default feature inside their product, and overnight your distribution footprint multiplies. The SMBs don’t “adopt a new tool”, they just wake up one morning and see your AI inside the platform they already use daily.

Here’s another example for you: An AI sleep coach bundles itself into a smart mattress company. The hardware maker already ships 500,000 mattresses a year but has weak software. By white-labeling your AI as the “smart sleep companion,” you inherit their customer base. The mattress brand gets differentiation; you get instant reach.

Now, here’s how the four layers strengthen bundling:

Workflow Layer: If your AI is bundled into a contract SaaS, it must appear at the exact moment someone uploads or edits a contract. If the user has to dig through settings, bundling loses its value.

Channel Layer: Bundling gives you users, but you need discovery that compounds. Every AI-reviewed contract should generate a clean “audit trail” PDF with your brand subtly on it, so when lawyers pass it around, you get free visibility.

Trust Layer: Your host’s reputation is on the line. If your AI reviewer misses a critical clause, it’s not just your brand at risk, it’s theirs. That’s why bundled AI has a zero-mistake margin.

Partnership Layer: Once you succeed inside one platform, you sequence. Today you’re inside a SaaS contract. Tomorrow you’re bundled into DocuSign. Later you’re OEM’d into enterprise HR platforms. Each step multiplies your base.

Archetype 2: Embedding — Becoming Invisible

Embedding is when your AI doesn’t look like a separate product at all. It becomes part of the workflow your user already lives in, so adoption happens naturally and invisibly.

For example, an AI negotiation coach for sales calls shouldn’t ask reps to log into a separate coaching platform. Instead, it lives inside Zoom or Gong, quietly listening to the conversation and offering prompts: “Ask about budget,” “Follow up on competitor mention,” “Pause here to build rapport.” The workflow doesn’t change, but suddenly the rep’s performance gets sharper in the moment that matters.

Now, here’s how the four layers strengthen embedding:

Workflow Layer: You must show up exactly at the moment of intent. For an AI negotiation coach, that means being present during the call itself (listening as the conversation unfolds) and then immediately delivering a transcript with highlights, missed opportunities, and suggested follow-ups as soon as the meeting ends.

Channel Layer: Embedding doesn’t automatically create discovery; you need outputs that travel. A negotiation coach can do this by generating post-call “team coaching reports” that sales managers share across the organization.

Trust Layer: Embedded tools inside critical workflows have zero tolerance for error. If your AI coach gives poor or irrelevant advice( for example, telling a rep to push budget when the prospect already disclosed it) trust evaporates instantly. Because you’re in the high-stakes flow of sales, even a few bad recommendations can cause reps to mute you permanently.

Partnership Layer: Once you’ve proven real value in one workflow, the path forward is adjacency. A negotiation coach might start inside Zoom calls, but the logical next step is expansion into Microsoft Teams, Google Meet, or even Salesforce call logs.

Archetype 3: Unfair Access — Playing With Loaded Dice

Unfair access is when you don’t compete on features at all, you compete on distribution asymmetries that competitors can’t or won’t copy. It’s not about being first, it’s not about shipping faster. It’s about designing a play that looks risky, messy, or even irrational from the outside, but creates a moat because it bends channels, psychology, or culture in your favor.

Biggest example: Cluely — Rage-Bait as a Distribution Weapon And Getting over $15M in Funding From a16z.

Cluely cracked distribution by leaning into rage-bait marketing. Instead of playing safe and trying to please everyone, they built content that provoked reactions. Posts triggered debates, rants, and polarized commentary — the kind of activity that algorithms love to amplify. Every angry reply or hot take pushed Cluely further up feeds, turning outrage into free distribution.

This wasn’t just “attention hacking”, it became a moat and now they’re building an army of interns & thousands of Tiktok & IG accounts making content and pushing cluely. Competitors can’t replicate it without damaging their own brand positioning. Cluely owned the contrarian, provocative lane so completely that even if others tried, they’d look like copycats, not originals.

Workflow Layer: They placed their narrative where outrage already lives - in the daily scroll of LinkedIn and X, where professionals mix work talk with hot takes.

Channel Layer: Rage itself became the channel. Every argument, repost, or pile-on multiplied their reach without paid spend.

Trust Layer: Polarization split audiences, but it also built tribal loyalty. For their users, Cluely wasn’t just a tool, it was a brand that “said what others wouldn’t.”

Partnership Layer: Their provocation spilled into podcasts, newsletters, and panels. What started as rage-bait posts formalized into earned media and distribution partnerships.

Now, you don’t need to do rage-bait if you don’t want to.

Also, that’s not the only way to win. But you’ve to figure out what’s the gap in the industry and you need to own that narrative.

And there are multiple ways you can think about creating your own moat in distribution.

Here are few best examples:

Case Studies of Startups Cracking Distribution

Frameworks are useful. Archetypes give us mental shortcuts. Layers make distribution feel systematic.

But none of it truly clicks until you see the mechanics in motion. The five contenders below prove the same point in different ways: in AI, distribution is the moat. Not the model, not the feature, not the first-mover advantage.

Each has nailed distribution from a different angle: provocation, category invention, cultural vibes, prestige, or outputs that spread themselves.

Example 1: Clay — Category Creation + Influencer/Agency Rails

Clay didn’t just build a CRM enrichment tool. They built a job. By coining the term GTM Engineer (GTME) and writing the handbook, they defined a new operator identity. And when you define the role, you also define the toolset.

Every startup hiring a GTME lists Clay as the obvious operating system. That’s not luck, it’s distribution through category creation.

But Clay also layered in real channel mechanics. They partnered with influencer databases like Modash and agencies like Influencer Club, integrating those workflows into Clay so GTM teams could discover, enrich, and contact creators without leaving the platform. The effect is that influencers themselves became evangelists — screenshots of Clay “stacks” spread across Twitter/X, turning the product aspirational.

Clay also leaned into the community. A Slack, visible Claybooks, and playbooks from agencies running 200+ creator campaigns all serve as proof and onboarding. Prospects don’t need a sales deck — they can see the exact schema and API calls others are using.

Sometimes the strongest distribution play isn’t buying reach, it’s naming the category and equipping the ecosystem that lives in it. By minting the GTME role and embedding in the workflows of creators and agencies, Clay built a distribution engine competitors can’t copy with ads alone.

Example 2: Lovable — Vibe-Native Growth + Proof Loops

Lovable could have positioned itself as “the fastest way to build apps with AI.” Instead, they literally owned a cultural meme: vibe coding and built their brand around, “anyone can build”

That single phrase reframes coding from something technical and intimidating into something playful, creative, and aspirational. And once “vibe coding” entered the culture, the brand itself started to spread almost independently of ads.

But Lovable didn’t just stop at vibes, they engineered proof loops around them. Their ads feature builders saying, “I built this $6,000 project in Lovable for my client,” directly tying the tool to income. On TikTok and YouTube, creators post “I built this in an hour with Lovable” demos, which are both tutorials and unpaid ads. And the company curates these into a visible community, showing freelancers and agencies exactly how to monetize their use of the platform.

At the same time, mainstream press like Financial Times and Bloomberg amplify their velocity stats (2.3M users, $100M ARR in eight months, $1.8B valuation) which makes skeptics more comfortable adopting.

Now, they’re also starting to market it as a “must-have-skill” or "marketable skill” so people can mention it on their resumes.

If you want cultural adoption, own the language people want to repeat. If you want creators to sell for you, give them economic proof stories to show off. Lovable proves that distribution can come from vibes and receipts, not just channels.

Example 3: Harvey — Prestige as a Distribution Wedge

Most startups try to scale from the bottom up. Harvey went straight to the top. By partnering with Allen & Overy (now A&O Shearman), one of the world’s largest law firms, they didn’t just land a client, they co-built ContractMatrix, a Microsoft-backed AI tool embedded into the firm’s daily workflows.

That move gave Harvey instant credibility. In law (a hierarchical market) adoption flows downstream. When smaller firms see an apex player using a tool, they adopt it for prestige as much as utility.

But Harvey went further. By integrating deeply into enterprise workflows, the product became hard to rip out. By framing the partnership as strategic transformation, not experimentation, they made AI safe for conservative buyers. And by letting A&O Shearman lead PR and awards, Harvey amplified through a megaphone louder than their own.

Example 4: ElevenLabs — Outputs as the Channel

ElevenLabs didn’t buy ads to scale. They designed their product so the outputs were the distribution.

When creators started using ElevenLabs to generate uncanny voice clones for TikTok, YouTube, and podcasts, the product spread organically. Every entertaining clip, every meme, every AI-dubbed narration was both content and marketing.

They leaned into it. ElevenLabs optimized voices for short-form platforms, making TikTok adoption frictionless. They incentivized watermarked outputs by lowering credit costs, so creators would choose the cheaper option that also advertised ElevenLabs to their followers. And they amplified momentum with steady press coverage of their funding and valuation, signaling to studios and brands that they were the default choice.

Finally, creators themselves became the onboarding team. Tutorials on YouTube and X didn’t just showcase ElevenLabs, they taught others how to use it. Every power user became a distribution node.

If your outputs are inherently entertaining or useful, design them to travel. Incentivize branding, optimize for the channels where outputs live, and let your creators teach the world for you.

Example 5: Cluely — Provocation Engine + UGC Swarm

Cluely could have marketed itself as “just another meeting copilot.” Instead, they doubled down on provocation. Their product listens to your calls, watches your screen, and feeds you undetectable answers, all framed under a manifesto of “cheating at work, cheating at life.” That tagline isn’t just branding. It is the distribution channel.

What separates Cluely isn’t technology, it’s how they engineered outrage and curiosity into free media. The Verge and The Times ran stories debating whether it’s genius or dangerous, but either way, the company got global awareness for free.

And they didn’t stop at narrative. They operationalized distribution into their org design. The founders publicly describe the company as made up of “engineers and influencers.” They hire growth interns whose entire job is flooding TikTok and Instagram with demo clips. They run dozens of accounts in parallel, ensuring their message hits your feed whether you want it or not. Recruiting itself becomes PR, because every candidate who posts about interviews spreads the brand further.

On top of that, they share velocity metrics loudly like claiming ARR doubled to ~$7M in a single week. Those numbers are irresistible for tech press and for founders suffering from FOMO. Every announcement renews the conversation, ensuring they’re always in the news cycle.

If your product is inherently provocative, don’t downplay it.

Codify the tension into a manifesto, design your org around attention creation, and treat every metric like a headline.

Cluely shows that provocation, if systematized, can become your primary distribution engine.

Five different companies. Five very different plays.

Clay proves you can invent a role and win distribution by defining the operator, not just the tool.

Lovable demonstrates that vibes and economic proof loops spread faster than features.

Harvey reminds us that in hierarchical markets, prestige unlocks distribution that volume never could.

ElevenLabs proves that if your outputs are good enough, they can be your only channel.

Cluely shows that provocation and UGC swarms can create awareness faster than any ad budget.

Distribution is never “one size fits all.” But in AI, it’s always the deciding factor.

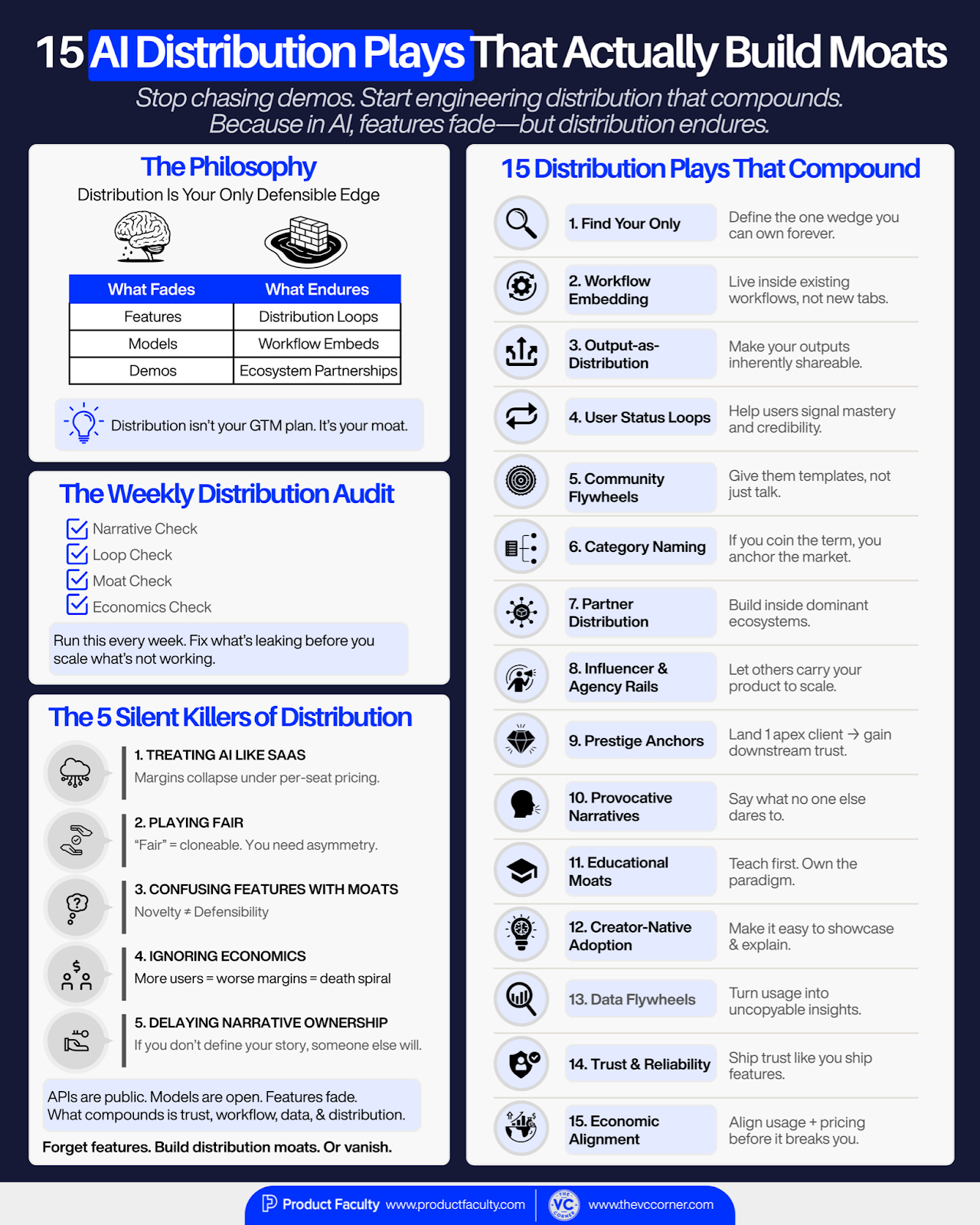

15 AI Distribution Plays You Can Try Today

If you want your AI company to survive the next decade, you must stop treating distribution as a “go-to-market plan” and instead treat it as the only real moat you can build, because unlike technology, which resets every few months, and unlike design, which can be copied in weeks, distribution moats are measured in years, sometimes decades.

This isn’t about growth hacks or marketing stunts; it’s about carefully designing how your product enters workflows, how it spreads between users, how it earns the trust of entire industries, and how it sustains itself economically at scale. Below is a 15-part playbook you can use as both a roadmap and a scorecard.

You don’t need to execute all of them, but you do need to pick three to five that you will bet your company on, and then you need to run them consistently until they harden into advantages no competitor can touch.

1. Find Your Only

Every founder wants to say they have “many differentiators,” but in truth, you only need one wedge that is sharp enough to cut through noise and give you the right to exist. To find this, you need to map the intersection of pain, frequency, and visibility: identify something that is painful enough to matter, happens frequently enough to be noticed daily, and is visible enough that your users will immediately recognize its absence if you disappeared tomorrow. If you can’t articulate what your “only” is in a single sentence, for example, “we reduce post-demo follow-up from two hours to two minutes”, then you don’t yet have an entry wedge, and without an entry wedge, no amount of marketing will carry you.

2. Workflow Embedding

The fastest way to get adopted is to stop asking your users to change their behavior, because friction is the silent killer of distribution. Instead, you need to embed your AI into the workflows where intent already lives, showing up at the exact moment your user is already working on the task you can help with. A developer doesn’t want to open a new AI app; they want your tool to live inside their GitHub PR workflow. A salesperson doesn’t want another dashboard; they want the insights inside their Gmail threads or Salesforce activity logs. The moment you require them to switch tabs, you’ve already lost adoption, but the moment you sit inside the flow they already inhabit, you’ve won the right to compound.

3. Output-as-Distribution

If you want your product to market itself, you need to design every output to act as a distribution node. That means your reports, dashboards, videos, or recommendations must be so useful or entertaining that your users want to share them, and when they do, your product must travel with it through subtle branding, links, or watermarks. If you create outputs that people are proud to show off, you’ve engineered a loop where every use generates another lead, but if your outputs stay locked in private dashboards, your distribution remains invisible.

4. User Status Loops

People don’t just adopt tools for utility; they adopt them for status, credibility, and the signaling power they give in their professional or creative networks. If you give your users proof of mastery, whether it’s certifications, badges, leaderboards, or outputs that clearly showcase competence, they will share it, not because you told them to, but because it makes them look more capable or more valuable in front of their peers. This is why “Pro” watermarks, exclusive titles, and tiered memberships spread distribution faster than traditional ads, because what people want to share most is not your product, but the signal of what using your product says about them.

5. Community Flywheels

A community that just talks is a Slack group; a community that shares proof is a flywheel. If you want a community to become distributed, you need to seed it with artifacts that members can clone, adapt, and reuse, templates, scripts, prompts, or workflows. Each time someone borrows a play from another member and succeeds, they become evangelists not just for your product, but for the community itself. Communities without artifacts become ghost towns, but communities with reusable assets become compounding engines of trust and discovery.

6. Category Naming (Very Hard to Win)

If you cannot own the product, you must own the language. By naming the category, coining a new role, or defining a workflow, you insert your brand into the mental models of your market. When Clay named the “GTM Engineer,” they didn’t just describe their users, they created a job identity that only made sense with Clay at the center. If you can coin a phrase your industry starts to use (whether it’s “vibe coding,” “clinical prompt engineer,” or “AI onboarding OS”), you anchor yourself in every conversation about that category. The product may be cloned, but the language sticks.

7. Partner Distribution

You don’t need to build an audience from scratch when ecosystems already own the surface area you want. Shopify, Slack, Figma, and Zoom control millions of users, and if you can build into their platforms early, you can inherit adoption as default. The most effective founders treat integrations not as side projects, but as wedges: they pick one ecosystem their ICP already spends hours inside and they become indispensable within it. Once you’re bundled into workflows someone else already distributes, you can scale without paid acquisition.

8. Influencer & Agency Rails

Distribution doesn’t always come from the product itself; sometimes it comes from the people who already own your ICP’s attention. Influencers on LinkedIn, TikTok, or YouTube can showcase your tool in ways that drive curiosity at scale, while agencies can bundle your product into their service offerings and push it into dozens of clients at once. Instead of trying to sell individually, you can tap into these multipliers by equipping them with assets, revenue shares, or exclusive features. The result is distribution you don’t directly pay for, but one that compounds across audiences already primed to buy.

9. Prestige Anchors

In hierarchical industries, the fastest way to scale isn’t to sign hundreds of small clients; it’s to win the one apex player everyone else follows. If you land a flagship customer — whether it’s a top law firm, hospital system, or enterprise brand — you don’t just get revenue, you get validation, because in status-driven markets, adoption cascades downstream from the top. By co-building workflows with an elite player and locking in PR rights, you can use one logo to create a halo effect that brings the rest of the market inbound.

10. Provocative Narratives

Distribution loves controversy, and the fastest way to create attention is to say something bold enough that people either rally behind it or argue against it. A manifesto, a contrarian blog post, or a provocative video can travel further than any ad campaign, because every critic becomes another distribution channel. If your story is safe, it won’t spread. If it’s sharp, uncomfortable, or unapologetically true, people will debate it, share it, and remember it. The goal isn’t shock value for its own sake, but conviction expressed so clearly that ignoring it becomes impossible.

11. Educational Moats

In a world where AI feels confusing, whoever teaches first earns trust. If you publish playbooks, certifications, or handbooks that help your ICP operate in the new paradigm, you don’t just win awareness, you win authority. The moment your users learn from you, they begin to trust you, and when they trust you, they adopt from you. Teaching your market how to succeed in the category is one of the most defensible forms of distribution because it compounds into thought leadership that competitors can’t easily copy.

12. Creator-Native Adoption

If you want exponential reach, you need to make your product easy for creators to adopt and showcase. Every time a YouTuber, TikToker, or blogger posts a “how I used this tool” tutorial, you get free distribution, but for that to happen, your product must be simple enough for them to explain and rewarding enough for them to show off. By seeding templates, offering affiliate links, or making outputs inherently shareable, you create an army of micro-distributors who turn their content into your marketing.

13. Data Flywheels

While most features can be copied, proprietary data cannot. If your product generates structured data as a byproduct of usage, you build a moat that doubles as distribution. Benchmarks, state-of-the-industry reports, and performance datasets become assets that attract press, investors, and customers. For example, by aggregating anonymized performance metrics, you can publish an annual “state of” report that only you can produce, turning your data advantage into a content advantage. Every new user strengthens the dataset, and every dataset strengthens distribution.

14. Trust & Reliability

In AI, trust is not just a retention mechanism; it’s a distribution engine. Enterprises don’t spread tools that are merely cheap, they spread tools they can rely on. That means your uptime dashboards, evaluation benchmarks, and governance policies are not internal QA artifacts; they are external marketing assets. When you package reliability as part of your product story, customers begin to evangelize you as the “safe” choice, and in industries where reputation is currency, that kind of trust-based distribution compounds faster than any feature update.

15. Economic Alignment

The most dangerous trap in AI distribution is forgetting that every new user creates incremental cost. Viral adoption feels good until your margins collapse under runaway inference bills. To avoid this, you must design economic alignment into distribution: cap free usage before it kills you, route queries to smaller models for efficiency, and tie pricing to value delivered instead of arbitrary seat counts. When your pricing and usage incentives align with your distribution loops, growth doesn’t bankrupt you; it strengthens you, because every new user improves unit economics instead of worsening them.

The Weekly Distribution Audit

To ensure you’re building compounding distribution moats, not leaky funnels, run this audit every single week with your leadership team:

Narrative Check: Is our story still being repeated by people who aren’t us?

Loop Check: Did we ship at least one new artifact, template, or output that spreads on its own?

Moat Check: Did our data, partnerships, or trust advantage deepen this week?

Economics Check: Did our margins improve or hold steady as usage grew?

If you answer “no” to any of these, assign an owner and fix it before chasing the next feature.

Again, you don’t need all fifteen plays. You need three to five that you can execute with consistency, because consistency is what turns tactics into moats. If you design your distribution with wedges that are uncopyable, loops that compound every use, moats that harden every month, and economics that align with reach, you stop being just another AI demo and start being the company that lasts the decade.

The Silent Killers of AI Distribution

Here’s what I’ve seen so far: ost companies don’t collapse because their models underperform. They collapse because of distribution mistakes that seem small in the beginning but grow fatal as scale arrives. These are the five silent killers that quietly undermine otherwise promising AI startups.

Mistake #1: Treating AI Like SaaS

One of the most common mistakes founders make is assuming that AI can be run with the same distribution and pricing logic as SaaS. In SaaS, marginal costs approach zero: once the product is built, every additional customer is nearly free to serve, which is why free trials, flat per-seat pricing, and unlimited feature bundles became the dominant playbook. AI, however, doesn’t play by those rules.

Every query, every inference, and every generation comes with a real cost in tokens, GPU cycles, and latency. A free tier that looks harmless in the early days can quickly spiral into millions of dollars in compute bills if the product suddenly goes viral. Per-seat pricing may look clean on a pricing page, but if one customer hammers the model 100 times more than another, the entire revenue model collapses.

The danger is that founders think they are acquiring users cheaply when in reality they are paying dearly for every interaction. To avoid this, pricing needs to be tied to usage or outcomes, not to static seats, and free usage must be capped early rather than treated as a growth hack. The SaaS mindset of “scale will smooth out the costs” simply doesn’t hold in AI.

Mistake #2: Playing Fair

Another fatal mistake is playing fair in distribution. Founders believe that if they compete honestly like buying ads, doing SEO, launching on Product Hunt, or running generic content, they will be rewarded for building better features.

But in AI, features are commodities, and channels are crowded. Playing fair means you’re one API wrapper away from being irrelevant. Competitors can replicate your acquisition tactics in weeks, and even if you outspend them for a time, the underlying economics rarely justify it.

The companies that win are those that engineer asymmetry into distribution. That means building data loops competitors can’t access, securing prestige customers that cascade credibility downstream, creating outputs that market the product on their own, or coining the narrative that forces the entire market to play on their terms. Fair competition assumes that features will speak for themselves; asymmetric competition ensures that even if the features are cloned, the distribution edge cannot be copied.

Mistake #3: Confusing Features With Moats

Many founders fall in love with features. They obsess over demos, ship flashy add-ons, and announce that they have found a new “AI-powered” way to summarize, rewrite, or analyze. The problem is that in AI, every feature is temporary. Whatever clever prompt or workflow you release today can be replicated tomorrow by a foundation model provider or by one of the hundreds of wrappers that appear on X each week.

Features create buzz but rarely create defensibility. The true test for every new feature should be simple: does this strengthen our data monopoly, does it deepen trust with users, or does it compound our distribution loops? If the answer is no, then the feature might attract attention but it will not build a moat.

Founders who confuse novelty for defensibility end up running harder and harder on a treadmill, constantly chasing the next shiny launch, while competitors catch up effortlessly.

Mistake #4: Ignoring Economics in Distribution

The fourth silent killer is ignoring economics while chasing distribution. In the early days, vanity metrics like signups, daily active users, or press mentions feel like proof of traction. But without a clear handle on cost-to-serve per user, that growth can be toxic. AI products in particular are vulnerable here because growth without efficiency makes margins worse, not better.

It’s entirely possible to scale from 1,000 users to 100,000 users and discover that every step of growth has pushed the business deeper into the red because compute costs are outpacing revenue. Investors have become very quick to recognize this pattern, and patience runs thin once infra bills start crossing into seven or eight figures.

The founders who avoid this mistake are the ones who treat economics as part of distribution design itself. They build caching, routing, and batching into the product so costs bend downward as usage grows. They run 10x stress tests before scaling further, and they ruthlessly kill acquisition channels that don’t scale profitably.

Mistake #5: Waiting Too Long to Own the Narrative

Finally, perhaps the most subtle but devastating mistake is waiting too long to control the narrative. Founders assume that if their product is good enough, the story will take care of itself, and the market will position them correctly. In AI, that assumption is fatal. If you do not own the narrative, someone else will coin the term, frame the category, and capture the mindshare. The history of technology is littered with companies that built good products but let others define the words customers use to talk about them. In AI, where hundreds of “copilots” and “agents” flood the market, narrative ownership is the difference between being the default option and being another name on a long list of alternatives. The companies that win coin/own their category language early: “vibe coding” for Lovable, “GTM Engineer” for Clay.

Forget Moats Around Models. Your Only Defensible Edge Is Distribution.

Most founders in AI spend 90% of their energy obsessing over models, features, or demos, but those are the easiest things in the world to copy. The brutal reality is that in 2025, no one wins on technology alone, the APIs are public, the weights are open-source, and the gap between “novel” and “commoditized” is measured in weeks, not years.

What cannot be copied as quickly is distribution. If you control how your product enters workflows, how it spreads across teams, and how it embeds into ecosystems, you own the surface area of adoption in a way no model release can erase. Distribution compounds quietly: every integration deepens stickiness, every artifact users share multiplies reach, every ounce of trust earned makes you harder to rip out.

The graveyard of AI startups will be filled with brilliant demos that never solved distribution. And the companies that dominate the decade will be the ones who treated distribution as the product itself, something to architect with the same rigor as infrastructure or UX.

This is why founders need to shift their mental model: you are not just building AI features, you are building distribution moats. If you don’t, the next foundation model upgrade will make you irrelevant overnight. But if you do, even OpenAI or Anthropic cloning your feature tomorrow won’t matter, because your users, your workflows, your data, and your trust will already be compounding in your favor.

In other words: the founders who master distribution in AI will own the decade, and the rest will be remembered as clever wrappers that vanished!

Amazing! thanks for sharing

Remarkable. Thank you.