The Cash Runway Model Every Founder Needs (2026 Edition)

We built the model every founder wishes they had before the bank balance hit zero.

Ask 10 founders whose startups failed to give you the number one reason. Almost half of them will admit it is because they simply ran out of money.

And still, most founders don’t even know how many months of cash runway they have left.

You’d think this would be the first metric any startup tracks. But between growth targets, hiring plans, and urgent investor updates, cash visibility often takes a backseat.

And that’s extremely dangerous. According to CB Insights, 38% of startup failures are due to cash depletion. And with median fundraising cycles stretching to 23 months in 2026, if you aren’t tracking your cash, you’re basically running on life support.

Investors aren’t relying on your pitch deck to learn about traction. They want to know what your burn multiple is, how many months of runway you have, and how you would cope if the raise gets delayed. In this market, cash is the truth serum.

That’s why we built the cash runway model every founder wishes they had before the panic set in. It’s a tactical, scenario-ready tool that ties together headcount, operating expenses, and funding events into a single source of truth: how much cash you have, how fast it’s burning, and how long it will last.

Table of Contents

1. Why Every Founder Needs a Cash Runway Model

2. Why This Model Matters Now

3. What’s in the Cash Runway Model

4. Who Should Use It

5. How It Works

7. Frequently Asked Questions (FAQs)

1. Why Every Founder Needs a Cash Runway Model

Running out of cash isn’t a surprise anymore.

In CB Insights’ post-mortem of 110+ failed startups, the most common reason companies die is that they ran out of cash. And in 2026, the risk profile is even sharper.

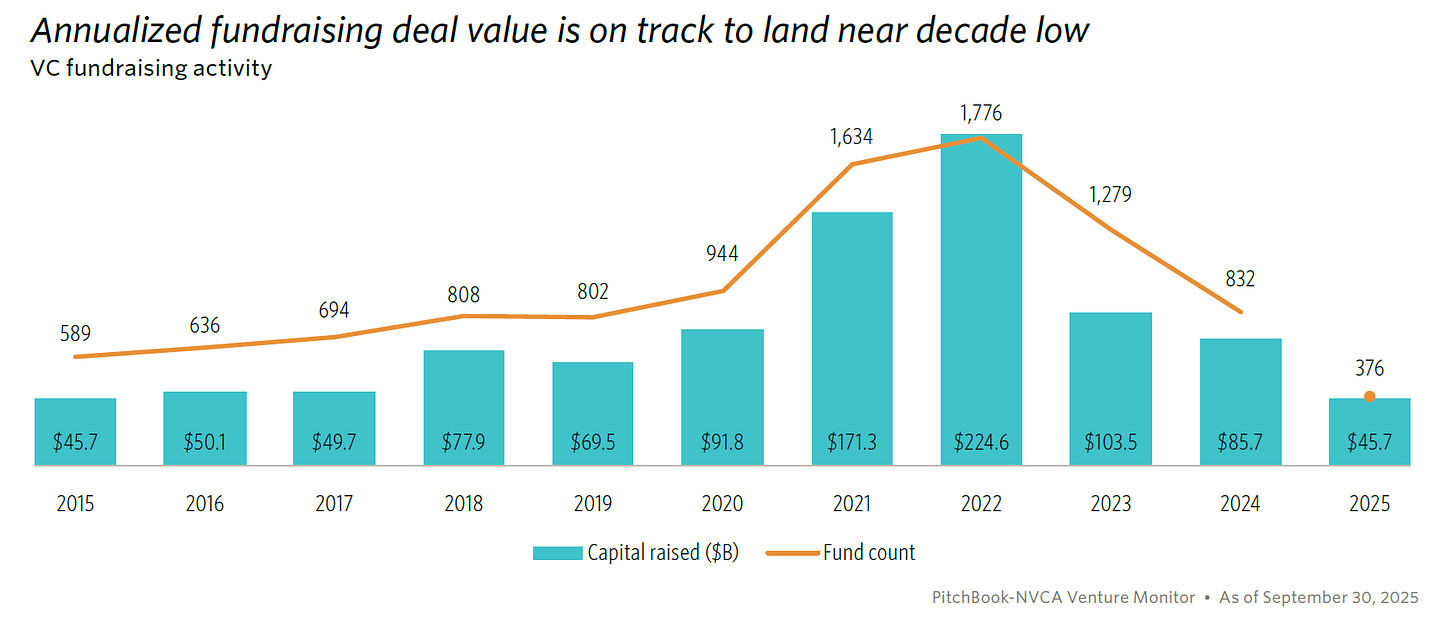

Venture capital isn’t flowing like it used to. According to PitchBook, through Q3 2025, only $45.7 billion was raised across 376 funds, putting the year on pace for one of the weakest fundraising totals of the past decade. Carta reports that as of Q2 2025, bridge rounds made up 16.6% of all VC cash raised, and that number is still climbing.

Many founders are forced to raise internal notes, slash hiring plans, or simply burn slower just to buy time.

But time is not a strategy. You need a proactive system.

Investors are no longer just asking about your ARR or CAC. They want to know your startup burn rate, your runway calculator, and your cash sensitivity if a raise slips by a quarter.

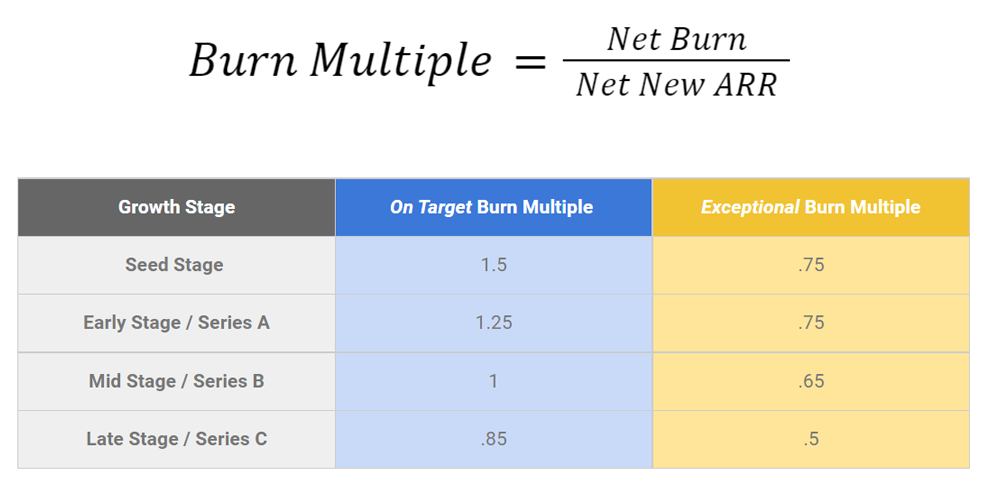

The burn multiple is your net burn divided by net new ARR. This metric has become a filter for capital efficiency. A multiple under 1x is excellent. But if it’s over 2x, then you should expect a tougher conversation.

Add in macro uncertainty like lower sales cycles, cautious enterprise buyers, tighter credit, and your financial clarity becomes a survival tool.

That’s why every startup should be operating with a cash runway model. This model is a living, breathing startup financial model that ties every hire, every dollar of spend, and every financing event to one output that measures how many months of cash you have left, and what moves extend it.

2. Why This Model Matters Now

Most founders don’t run out of ambition. Unfortunately, they run out of time.

And as the years go by, fundraising cycles become longer and longer, risk appetite lowers, and investors are becoming even more selective.

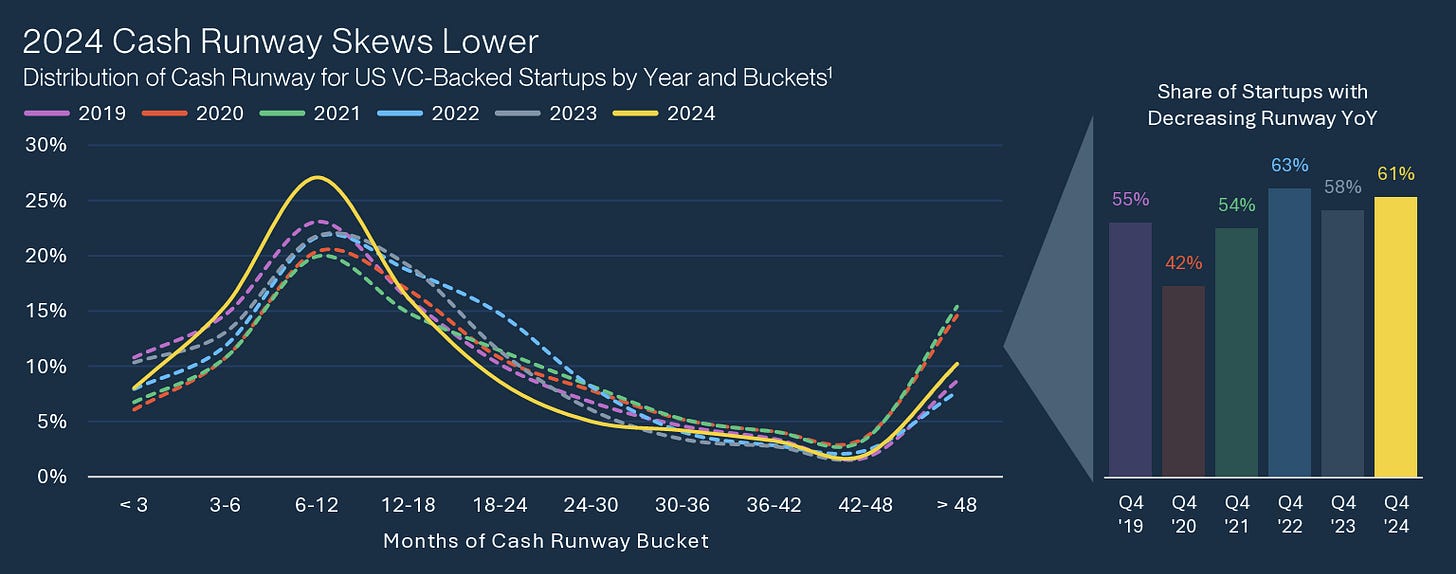

At the same time, venture capital isn’t flowing downstream as smoothly. According to SVB’s H1 2025 report, 61% of startups saw their runway shrink compared with the previous year, a clear sign that follow-on funding is harder to secure. The data also showed a pullback in Series A and B activity, with a rise in bridge rounds, hiring freezes, and burn-rate recalibration.

Runways are shortening; not because startups are failing, but because the market is slower to fund them.

This is why a dynamic cash runway model is the only way to see around corners. To anticipate what’s coming.

It lets founders test tradeoffs, such as delaying two hires, cut burn by 20%, and add three months of survival. It helps answer hard questions before they become hard consequences.

A great startup financial model is what keeps you alive. It’s your cash flow nerve center, your runway calculator, and your secret to staying calm in a jittery boardroom.

3. What’s in It

The cash runway model that we’ve created is a decision engine built to show you exactly how long you’ve got, and what levers buy you more time.

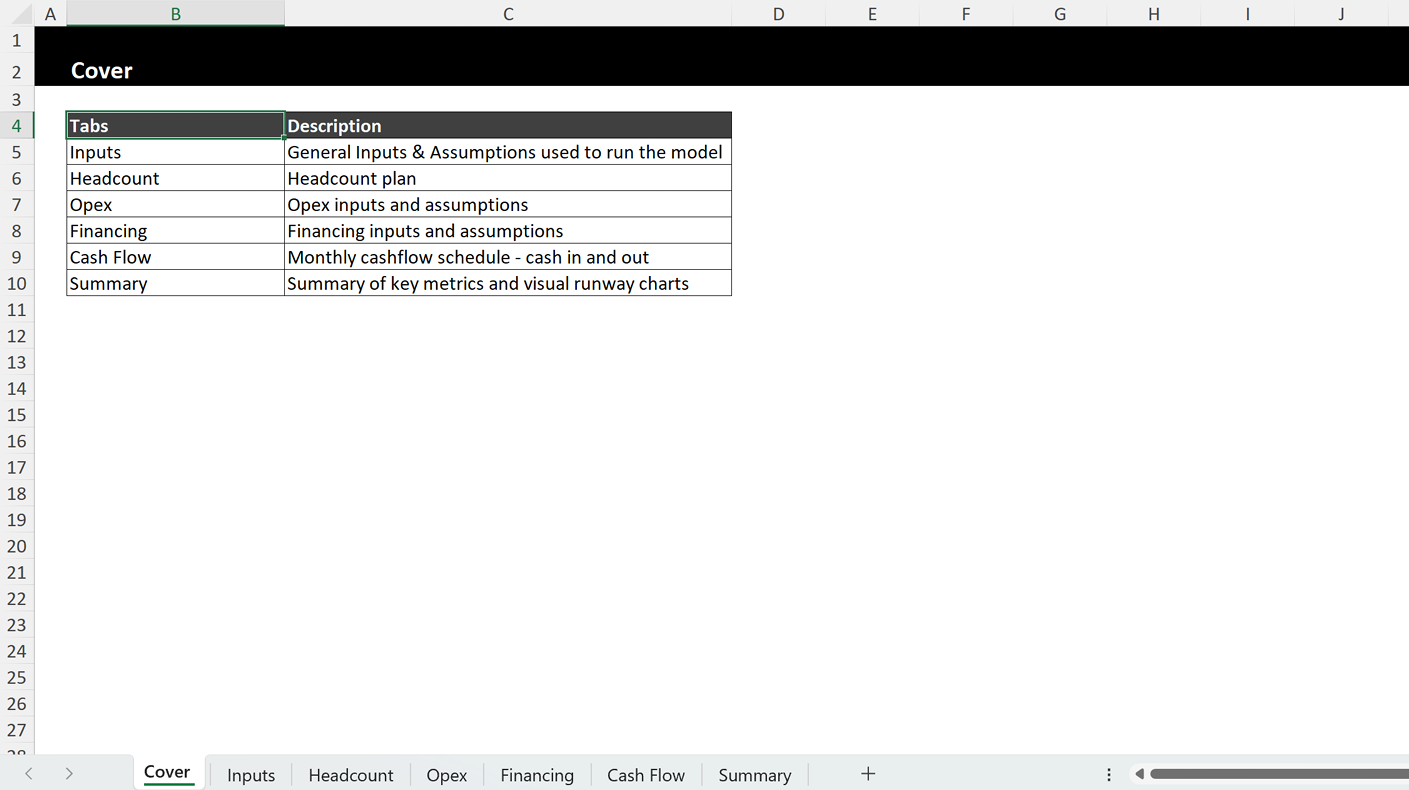

Here’s what each tab in the cash runway model does:

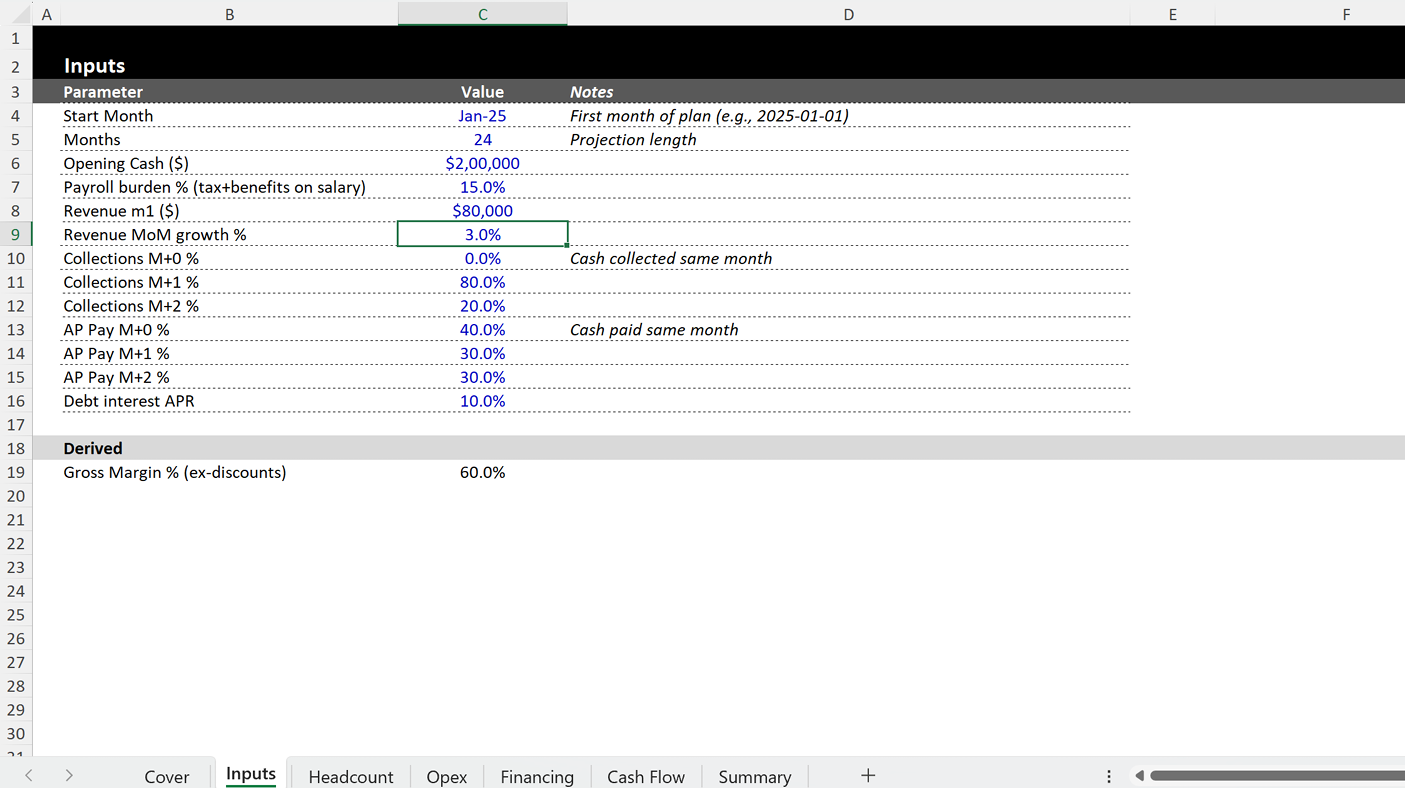

Inputs

This is where the model breathes. You set your assumptions; the start date, currency, opening cash, revenue growth, collection delays, payables timing, and interest rates. Everything flows from here.

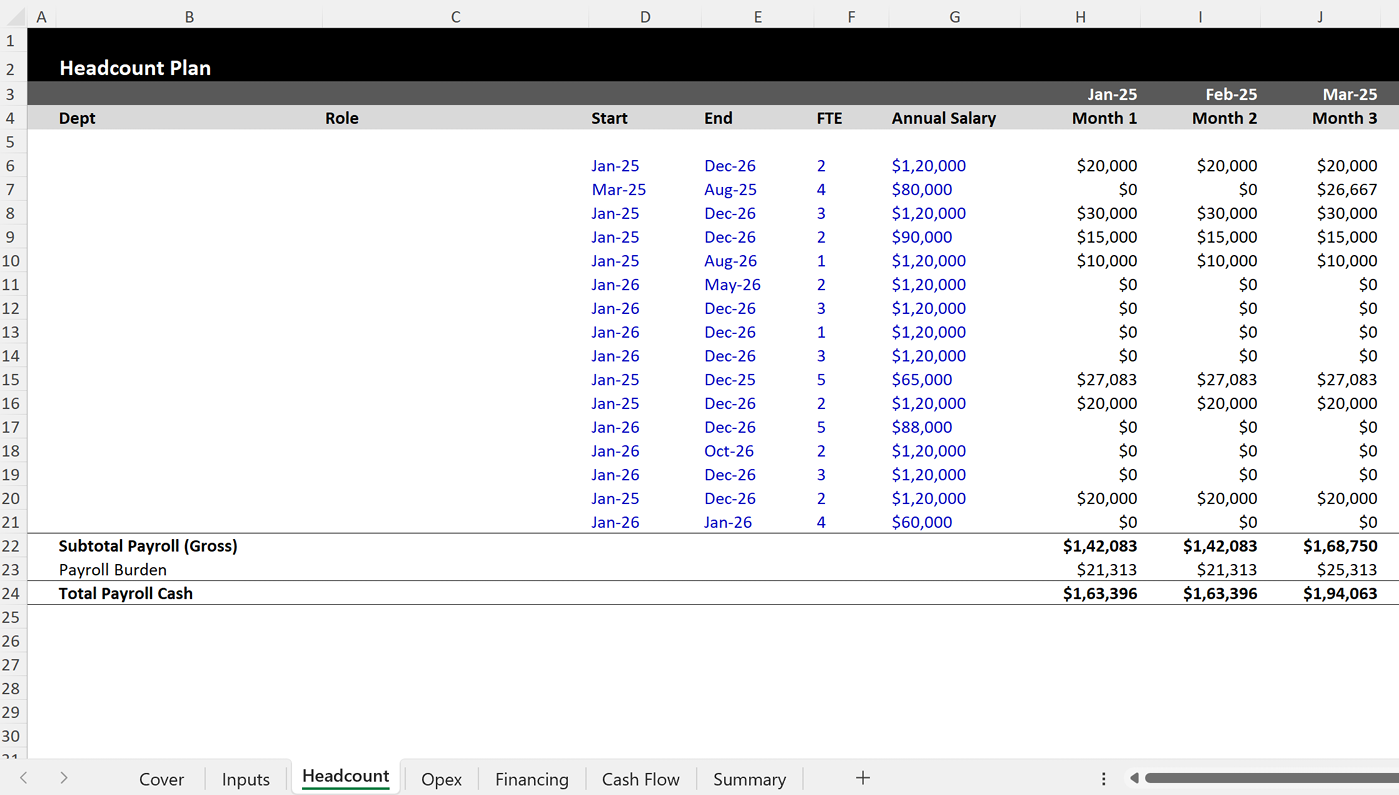

Headcount

This tab is a role-level hiring plan where you define when each role starts, what they earn, and how long they stay. The model auto-calculates salaries, taxes, and total payroll burden, feeding directly into your startup burn rate.

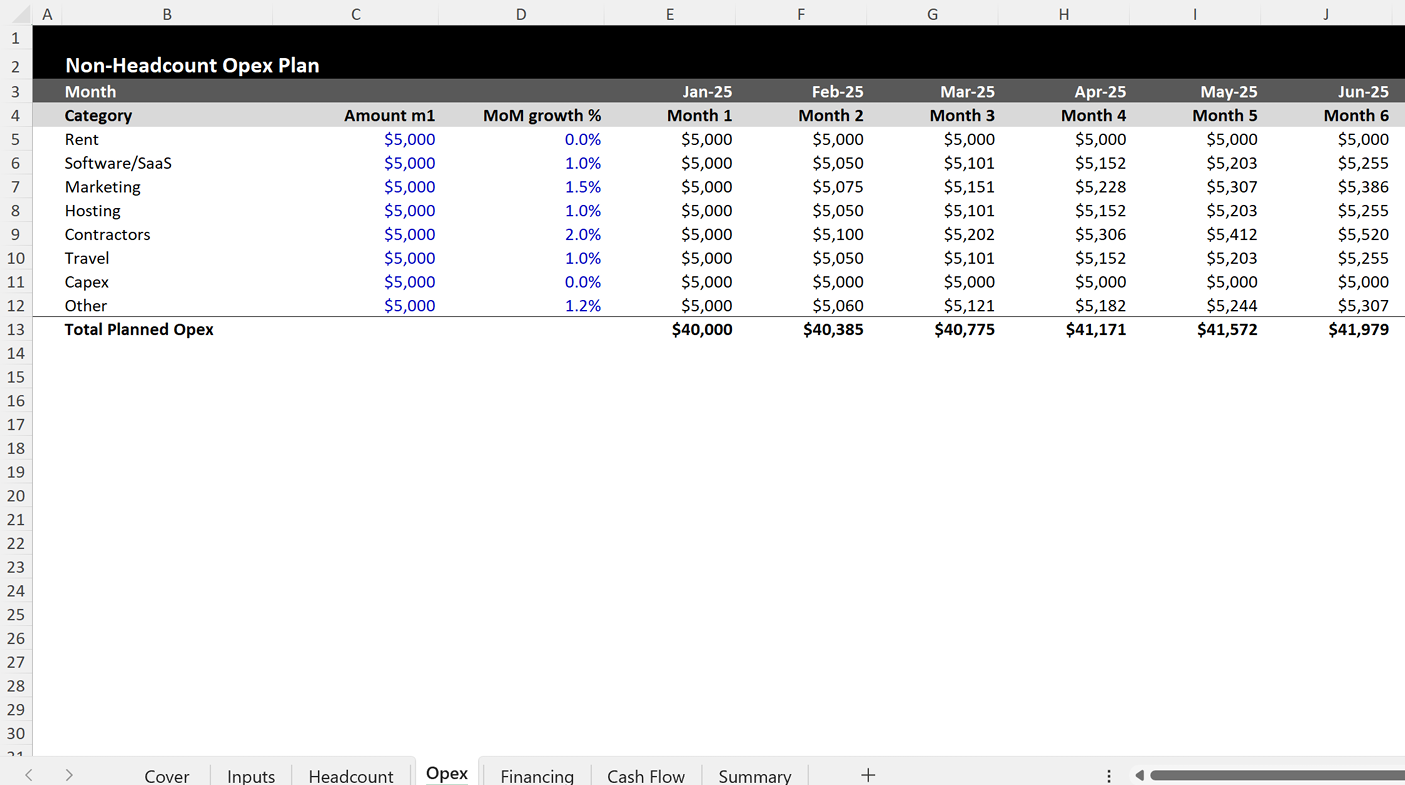

Opex

Opex stands for operating expenditure. This is where you capture all your non-headcount operating expenses, like software, marketing, rent, travel, legal. Each category comes with built-in monthly growth logic, so you can model real-world escalation and test cuts.

Financing

This is where you plug in future equity raises, SAFEs, convertible notes, or loans. You can customize when cash hits the account, what the repayment terms are, and how it affects your cash flow.

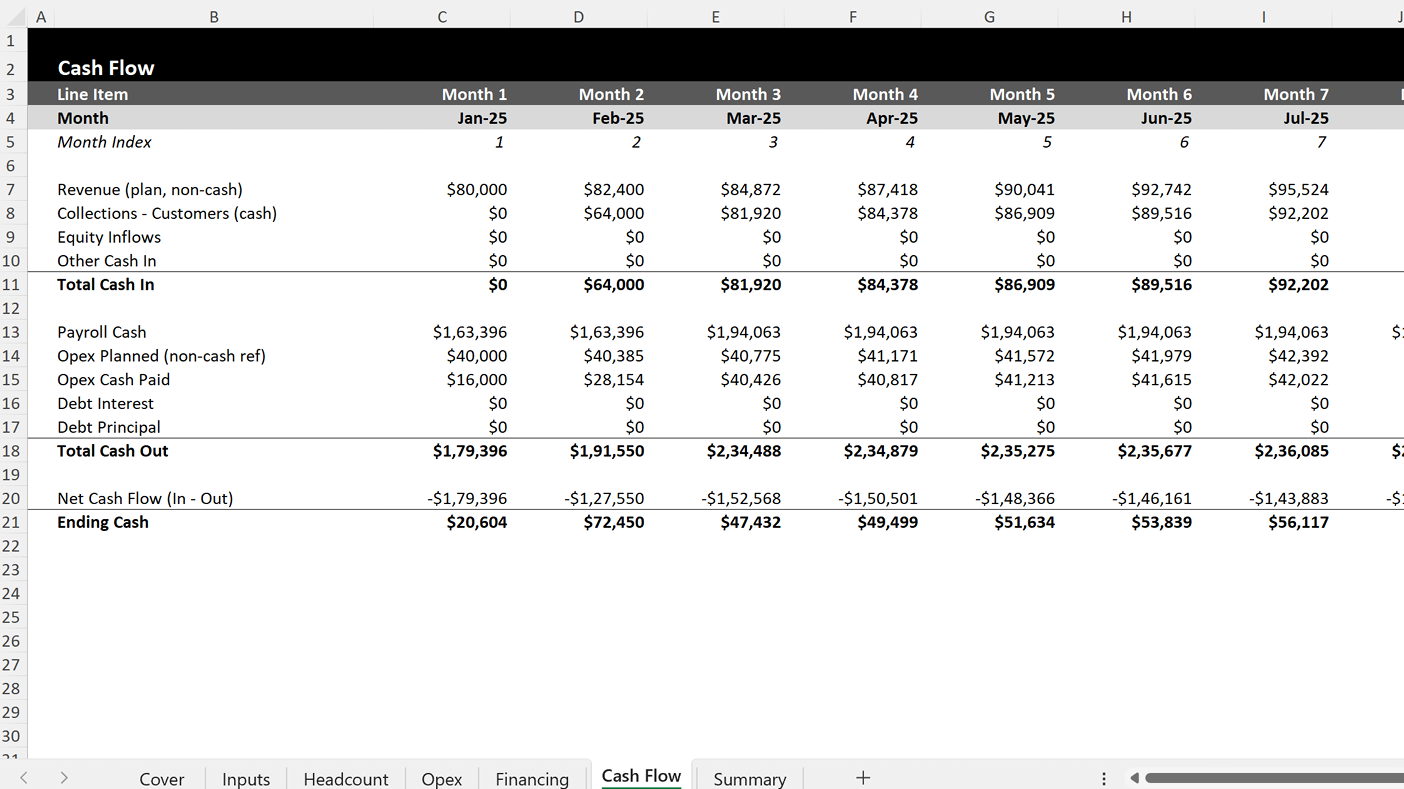

Cash Flow

This is the model’s heartbeat. It rolls together all inflows (revenue, financing) and outflows (payroll, opex, repayments), then calculates net burn and ending cash per month. This is where your runway calculator lives.

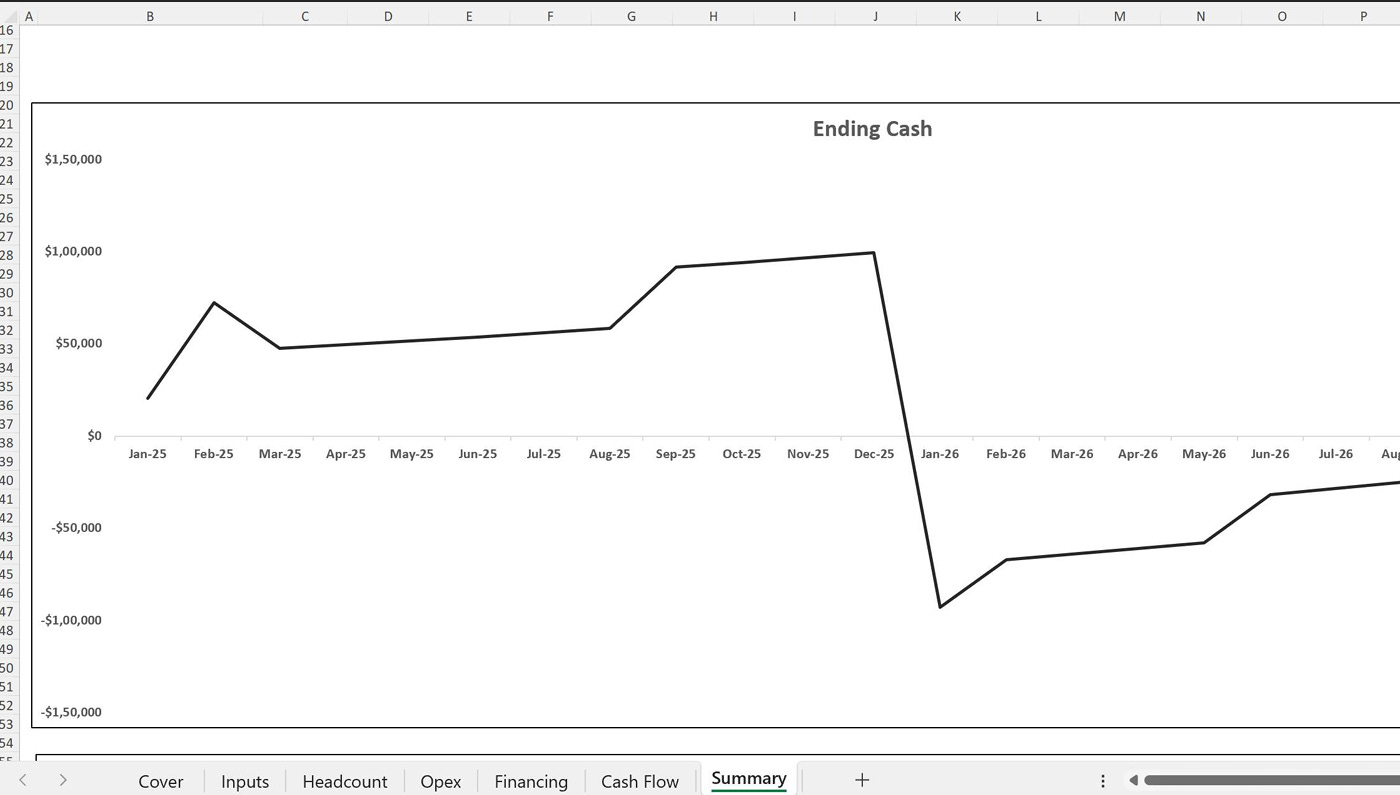

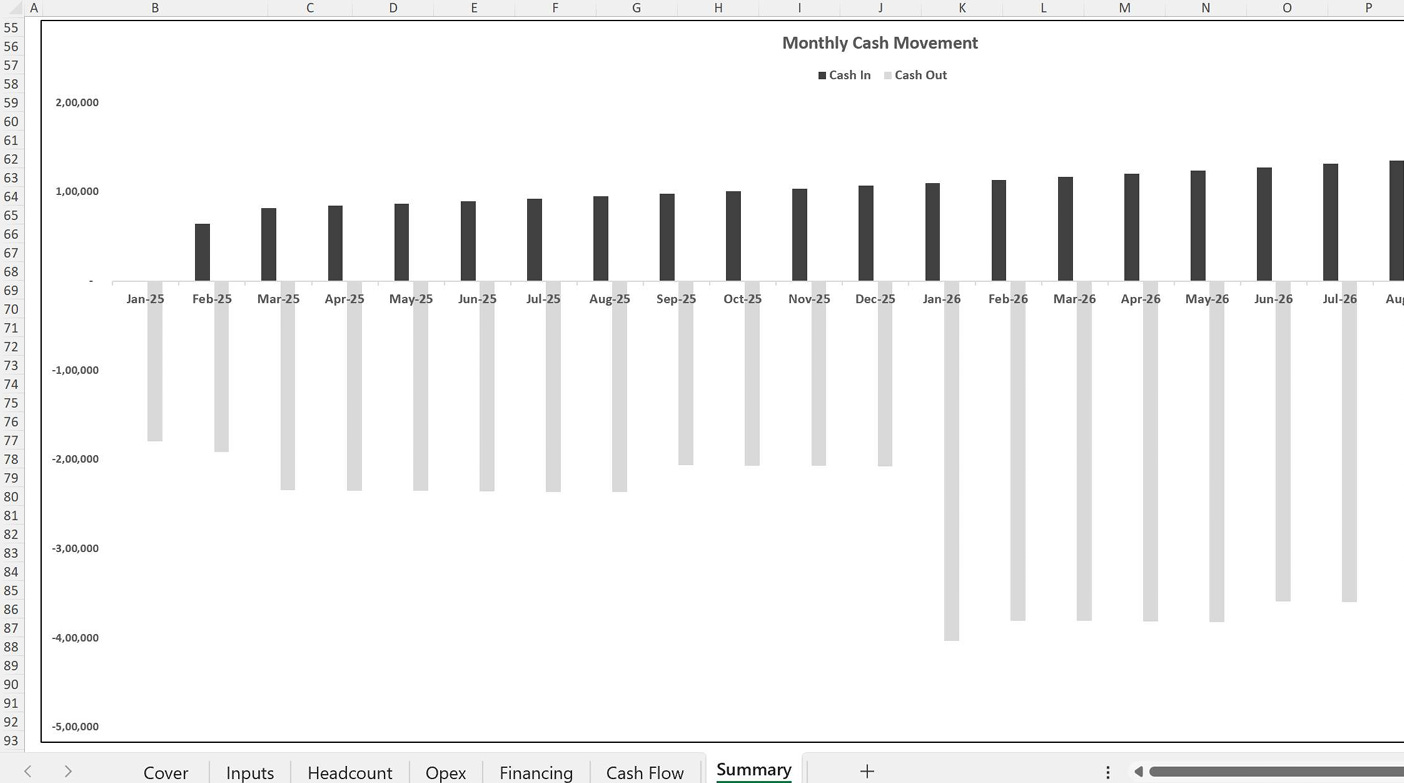

Summary

The dashboard, where you get instant visualizations of your runway, burn trends, and how different financing scenarios push your cash-out date forward. It’s the clearest answer to: “What happens if...?”

The best part is that each tab is interconnected. Change a hiring date or trim marketing spend, and you’ll see the impact cascade across the model.

That’s the power of a real startup financial model. You know where you stand at each time and you finally have a way to steer the wheel.

4. Who Should Use It

This model was built for the people making real tradeoffs under pressure. Whether you’re allocating capital or advising someone who is, it gives you clarity when it matters most.

Founders / CFOs

You’re constantly managing burn against milestones. This model helps you plan hiring in lockstep with cash, knowing exactly what each headcount decision does to your startup runway. If, say, you are thinking about pushing a raise by two quarters, the model shows what you’ll need to cut, and when.

Operators

You need to run downside scenarios. What if revenue comes in 30% light? What if the bridge round takes an extra month? This gives you a flexible testing ground to simulate risk, and respond before it bites.

FP&A Managers/Teams

Ultimately, you don’t need a full accounting department to have a complete picture of what the company’s cash look like at any given point.

So whether you’re a full finance team or a single operator wearing multiple hats, this model gives you the structure to manage runway without needing a full-blown FP&A stack. It standardizes how burn, runway, and financing timelines are forecasted across departments, so even lean teams can make board-ready reports and scenario plans on time.

Investors / Advisors

You’re looking at portfolio company health, and spreadsheets often lie by omission. This tool gives you one clean view of cash, burn, and financing needs. It helps assess which teams are operating with foresight, and which are bluffing.

If you’re making hiring or fundraising decisions without this level of clarity, you’re flying blind. And in this market, you can only fly blind for so long.

5. How It Works

This model was created to remove complexity and bring ease of visibility. So, if you can build a hiring plan, set revenue goals, or map out a raise, you can run this model.

Here’s how it works:

Set your assumptions in Inputs

Choose your start month, plug in opening cash, set revenue growth, payment timelines, and financing costs. This is the foundation; get this right, and the rest flows cleanly.Build your team and operating expenses

In Headcount, add roles, salaries, and start dates. In Opex, plug in monthly costs like software, rent, or marketing. These feed directly into your startup burn rate.Add your funding events

Use the Financing tab to schedule equity rounds, convertible notes, or loans. Define how much cash comes in, when, and under what terms.Check your Cash Flow

This tab consolidates everything - inflows, outflows, and your ending cash balance. It’s where your true startup cash flow lives. You’ll see net burn each month and, most importantly, when you run out.Visualize outcomes in Summary

Get instant visuals, like how many months of runway you have, when you hit zero, and how much further a raise or hiring delay gets you. It’s your runway calculator, but in chart form.

Every lever you pull, like delaying a hire, increasing revenue, adjusting raise timing, automatically updates your runway. No guesswork.

Say you delay two hires by one quarter. You might extend your startup runway by 3.5 months. That’s the kind of decision this model makes visible, and fast.

6. Download the Cash Runway Model (2026 Edition) 👇

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.