The Venture Capital Method: How Investors Really Value Startups

A founder’s guide to startup valuation, dilution, and investor returns using the same framework VCs rely on in the US and Europe

Why Startup Valuation Isn’t What You Think

If you’re a founder raising money, few moments are more uncomfortable than when an investor asks: “So, what’s your valuation?”

Most founders don’t have a clear answer. Some pick a number based on what other startups are raising. Others guess based on vibes. A few try to anchor high and hope for the best.

But here’s the truth: venture capitalists aren’t guessing. They’re running a simple model that’s been used for decades to back into your valuation based on their expected returns. It’s called the Venture Capital Method, and if you don’t understand it, you’re negotiating blind.

Founders who understand the VC Method raise faster, they avoid painful down rounds, and they protect their ownership over multiple fundraising cycles.

That’s why this guide exists. To show you how the Venture Capital Method works, and to give you a Excel template so you can run the same math VCs do.

What Is the Venture Capital Method?

The Venture Capital Method is a framework investors use to value startups by working backward from a future exit.

It doesn’t try to model cash flows (which is impossible at pre-seed or seed). Instead, it asks: “If this company exits for $X in Y years, and I need a 10x return, how much should I pay today?”

Here’s the flow:

Forecast the exit value: e.g. $100M based on comps or revenue multiples.

Apply a required return: usually 25–40% IRR, or 10x for early-stage.

Discount back to today: that gives the investor’s implied valuation.

Check against their investment: to determine how much equity they’ll need.

The math is straightforward, but the implications are massive. It’s why two founders with the same ARR can end up with totally different term sheets depending on return expectations.

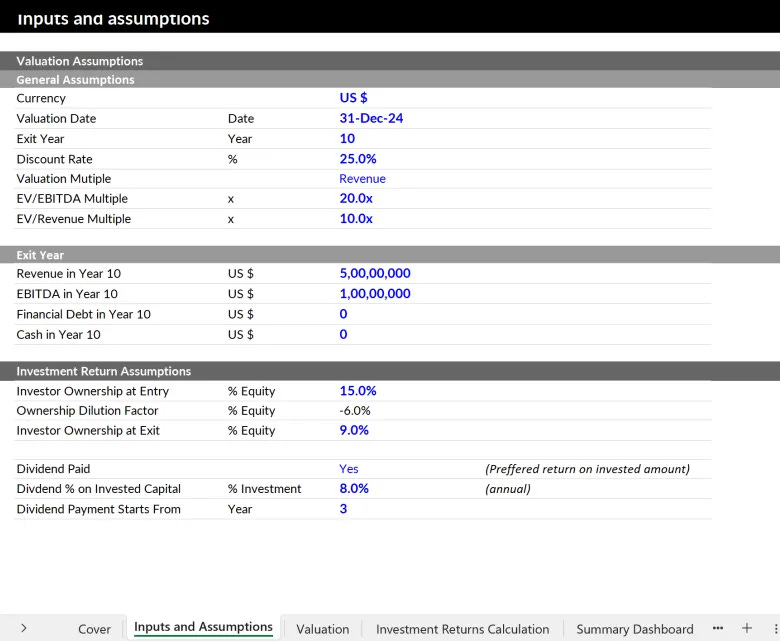

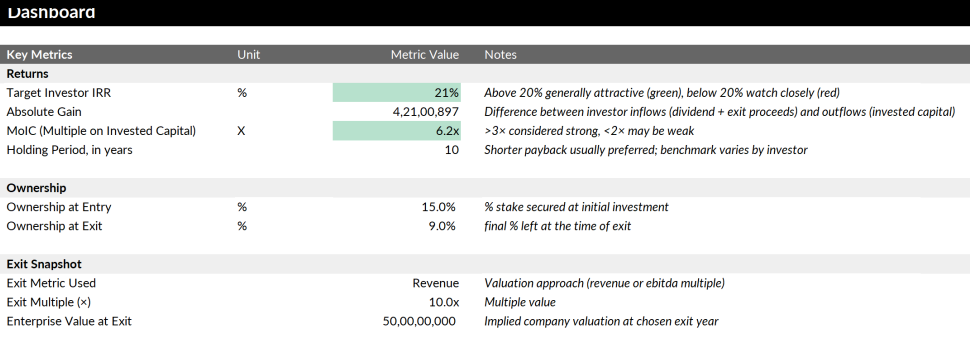

The Excel Template: Valuation, Dilution, and Investor Returns

To make this practical, we built a multi-round Excel template that models the Venture Capital Method from seed through Series C (and beyond).

What it does:

Round-by-round inputs for pre-money, post-money, and investment size

Target exit valuations based on revenue multiples

Dilution modeling across multiple rounds

Ownership waterfalls for founders, investors, and ESOP

IRR and cash-on-cash returns for every investor

Scenario analysis (base, upside, downside)

This is the same math investors use to decide whether your ask makes sense. And now you can run it yourself before you walk into the meeting.

Why Founders Should Care

The biggest mistake founders make is treating valuation one round at a time. “If I can raise at $20M post-money, I’m good.”

But capital is a multi-round game. If you raise $1M now and $10M next year, what does that mean for your ownership at exit? What happens to your early investors if your Series C is overpriced?

The Venture Capital Method forces you to zoom out and see the whole picture.

This template helps you answer:

What’s a fair pre-money valuation given investor return expectations?

How much equity am I actually giving up across multiple rounds?

What does a $200M exit mean for me, my team, and my investors?

Can I justify my valuation with real numbers instead of hand-waving?

Most founders think valuation is about storytelling. And it isn't until the spreadsheet comes out. Then it’s math.

📥 Download the VC Valuation Template 🎁

The spreadsheet is fully editable and works in Excel. Just plug in your startup’s projected revenue, round sizes, expected dilution, and the rest is auto-calculated.

The VC Valuation Template is available exclusively to premium subscribers of The VC Corner.

It’s part of a growing library of resources designed to help startup founders raise capital, grow smarter, and move faster. As a member, you’ll get:

✅ Ultimate Investor List of Lists: +10k VCs, BAs, CVCs, and FOs

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ The 100+ Pitch Decks That Raised Over $2B

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 118 AI Communication Agent Use Cases

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox 🛠️

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ The Best 23 Accelerators Worldwide for Rapid Growth (and How to Get Into Them)

✅ The Ultimate Startup & Venture Capital Notion Guide: Knowledge Base & Resources

… and much more

If you’re serious about raising, this is the unfair advantage you’ve been looking for.

Download the VC Method Valuation Template below 👇

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.