The Real Cost of Churn: Why Every Lost Customer Is a Growth Killer

You’re focused on top-of-funnel, but churn is bleeding you dry. Here’s what it’s really costing and how to stop the leak.

What Churn Really Measures (And Why It’s Misunderstood)

For most founders, churn lives in a dashboard, a percentage that’s just sitting next to MRR or customer count. But that number isn’t just a signal of how many customers left last month. It’s a judgment.

Churn is a measure of whether your company is worth staying with. Not just for one customer, but across every segment you serve, and every promise you make through your product, pricing, and support. It doesn’t simply reflect customer success. It reflects company viability.

At its core, churn measures how consistently you deliver value. It captures everything from broken onboarding to misaligned pricing to product stagnation. It’s not just about retention, it’s about whether your product truly fits the market you’re selling into, and whether that fit holds over time.

Framer is giving early-stage startups a full year of the Launch Plan — free❗

Why Framer?

The design-first web builder that helps startups launch fast. Hundreds of YC founders are already on it.

Who’s Eligible?

▫️ Pre-seed & seed-stage startups

▫️ New Framer users only

What You Get:

✅ 1 year of Launch Plan ($900 value)

✅ A pro site — no dev team needed

✅ Scales with your startup, from MVP to full site

Spots are limited. Apply before October 31st to claim your free year.

Churn comes in different forms. Customer churn tells you how many logos left the building. Revenue churn tells you what it cost. Losing one enterprise client may look the same on paper as losing ten SMBs, but the revenue signal tells a far more serious story.

There’s also a layer most dashboards gloss over. Some customers leave by choice (voluntary churn), while others leave because of a failed payment or friction they never intended to face (involuntary churn). If you don’t distinguish between them, you won’t solve the real problem.

The most dangerous mistake is treating churn like a lagging indicator. Many founders watch it but don’t investigate it. But churn doesn’t just report on what happened. It reveals why your future might not go the way your model says it will.

Treat churn like a system audit. Because that’s exactly what it is.

Table of Contents

Why Churn Quietly Destroys Growth, Margins, and Valuation

Industry Benchmarks and the Myth of “Acceptable” Churn

The Root Causes of Churn (And Why Founders Miss Them)

Beyond the Formula: How to Model and Predict Churn

How to Reduce Churn (And Build a Retention Engine)

Churn as a Red Flag for Investors and Boards

Churn Isn’t a Metric, It’s the Business Talking

1. Why Churn Quietly Destroys Growth, Margins, and Valuation

Churn doesn’t just shrink your topline, it eats your business from the inside out.

Founders often think of churn in static terms: a 3% loss this month, a few logos gone, maybe a slight dent in MRR. But churn compounds. And compounding loss is lethal. Every customer who leaves takes more than just revenue. They take margin, momentum, and strategic options with them.

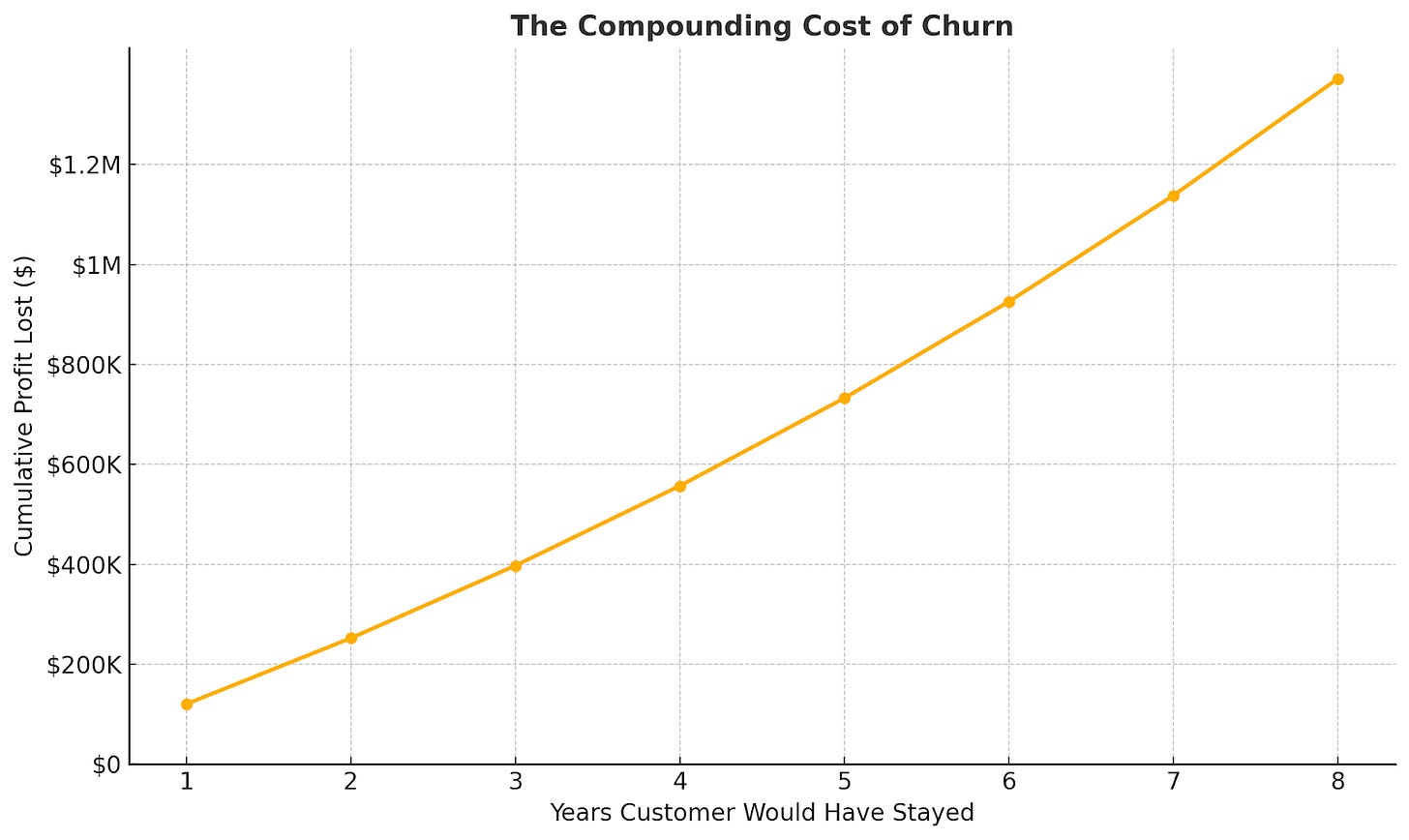

Imagine you lose a $150,000 ARR customer. On paper, that’s a $150,000 hit. But in a SaaS business with high gross margins and strong upsell potential, that single account could have generated over $1 million in profit across a typical 7–8 year lifetime. That’s not a one-time loss. It’s a million-dollar leak.

Now widen the lens. Churn breaks CAC efficiency. Your CAC payback period stretches when customers don’t stick. If your customer acquisition cost is $40,000 and that customer leaves after 12 months, your unit economics implode. LTV drops. Payback windows extend. Growth slows, even if your acquisition machine looks healthy.

This ripple effect hits valuation too. VCs don’t just model growth, they model durability. High churn indicates weak product-market fit, fragile revenue, and a brittle foundation for scale. It lowers expansion potential, damages net retention, and tells investors that future growth will come at too high a cost.

Churn changes the narrative. It turns your company from a high-leverage growth engine into a leaky bucket with a sales addiction. No one pays a premium for that.

Great startups don’t just grow. They compound. And churn breaks the compounding engine.

2. Industry Benchmarks and the Myth of “Acceptable” Churn

Ask five founders what a “good churn rate” is and you’ll get five different answers. The problem is that most of them are wrong, not because the numbers are off, but because they are out of context.

A 5% annual churn rate is excellent for an enterprise SaaS platform with high ACVs and multi-year contracts. But in a B2C subscription business with monthly billing and low price points, that same rate can be fatal. What’s acceptable in one model is unsustainable in another.

Churn is not an absolute number. It’s a contextual signal that must be understood in light of your:

Business model (SaaS vs. transactional)

Average contract value (ACV)

Customer segment (SMB, mid-market, enterprise)

Sales motion (self-serve or high-touch)

Billing cycle (monthly or annual)

Market maturity and competitive pressure

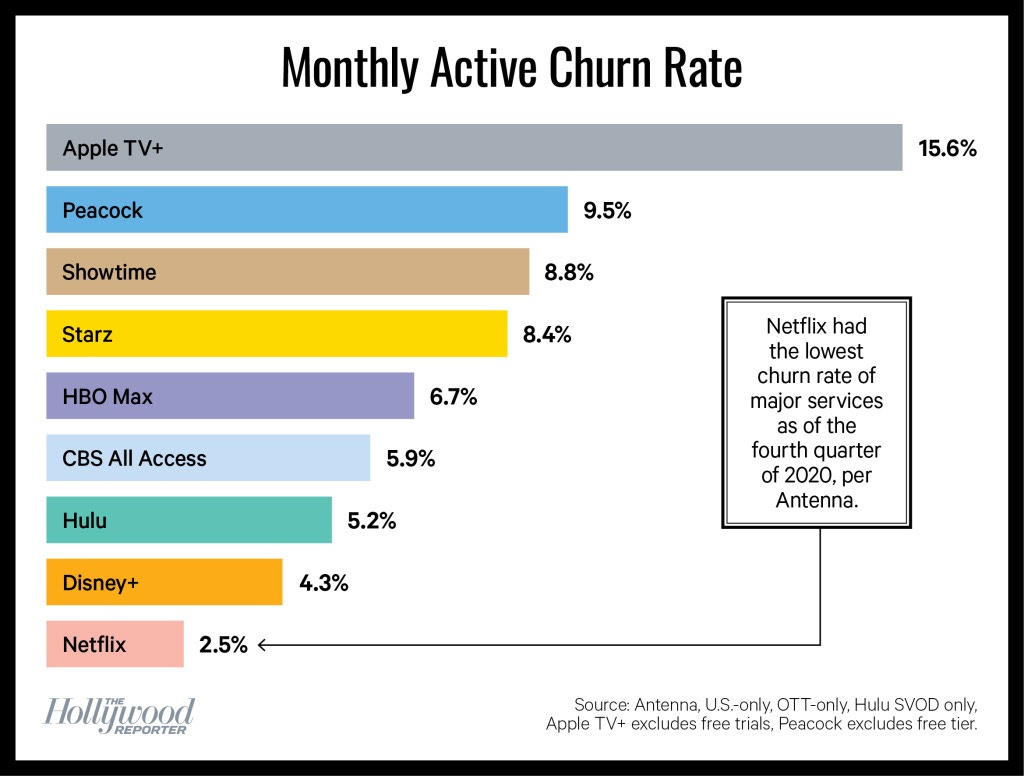

Even within the same vertical, churn behaves differently. Take streaming platforms. Apple TV+ launched with limited content and free bundles, which led to churn spikes when trials ended. Netflix, on the other hand, fights churn with original content, personalized recommendations, and tiered pricing, all designed to extend customer lifetime value in a market where switching is frictionless.

Benchmarks can help you get your bearings. B2B SaaS often aims for <5% annual logo churn, while consumer SaaS may tolerate monthly churn in the 3–5% range. But these are just reference points, not rules.

What matters most is your trend line. Is churn stable? Is it declining? Is it concentrated in a specific segment? Do you have expansion revenue to balance it?

Low churn isn’t just a health metric. It’s an unfair advantage. It means your customers stay, grow, and refer others. And in today’s market, that’s not a nice-to-have. It’s a moat.

3. The Root Causes of Churn (And Why Founders Miss Them)

Churn rarely happens for just one reason. It’s usually the result of multiple small failures compounding quietly over time.

A customer doesn’t cancel because of a single missed feature or one bad support interaction. They cancel because the product never delivered clear value, or because it stopped doing so. And that disconnect is often systemic: a gap between what you promise and what you actually deliver.

Early churn is especially revealing. When users drop off in the first 30–90 days, it usually points to onboarding that failed to surface value quickly enough. Maybe activation steps are buried. Maybe the “aha” moment comes too late. Or maybe sales overpromised what the product could actually do.

Late-stage churn is harder to spot and more damaging. It happens when customers stick around long enough to realize your product isn’t evolving with their needs. They start to feel boxed in. Feature requests go unanswered. ROI becomes vague. They stop logging in and eventually stop seeing a reason to stay.

Pricing can make things worse. If customers feel they’re overpaying for the value they receive, or if your pricing tiers don’t align with real outcomes, perception decays and downgrades follow.

And layered on top of all this: support that’s slow, scripted, or invisible. Frustration that simmers under the surface. A sense that they’re not being heard. By the time it shows up on your dashboard, it’s already too late.

The real danger is that although most of these signals are visible, they are ignored. Founders often stay focused on acquiring new logos and forget that every lost customer holds valuable insight. Every cancellation is feedback. And every pattern in those exits is a mirror reflecting cracks in the business.

Churn doesn’t just happen. It builds. And unless you’re paying attention, it’ll blindside you.

4. Beyond the Formula: How to Model and Predict Churn:

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.