The Founders Fund Story🔥, YC Investing Patterns📊, AI in the Enterprise🔍

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, and the hottest deals—here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Harmonic — the complete startup database

The updated Harmonic Chrome Extension automatically appears on any LinkedIn profile allowing you to pull emails with a single click.

Using the Extension, one-click enables you to:

✅ Instantly view traction + funding

✅ See your team’s network mapped to any company

✅ Update pipeline and team notes

✅ Prepare for founder conversations on the go with deep AI research

In-Depth Insights 🔍

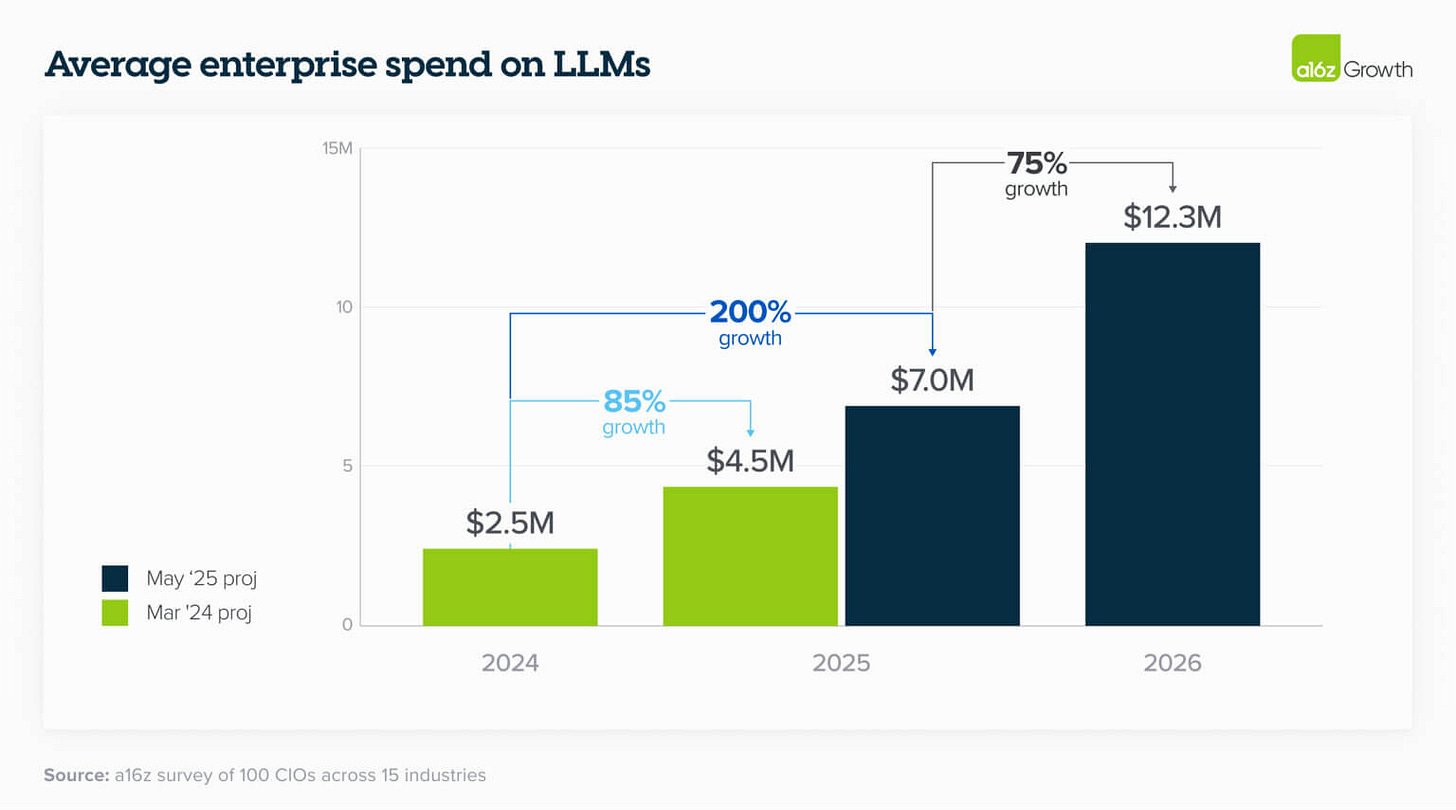

16 Changes to AI in the Enterprise: 2025 Edition 🔍

Enterprise AI spending is moving from experimental to essential. Companies are opting to buy off-the-shelf AI solutions, shifting away from custom builds. [Andreessen Horowitz]

GenAI for Hedge Funds Startups 🤖

A list of AI startups focused on improving hedge fund strategies. Highlights emerging players leveraging large language models for investment insights. [Alex Izydorczyk]

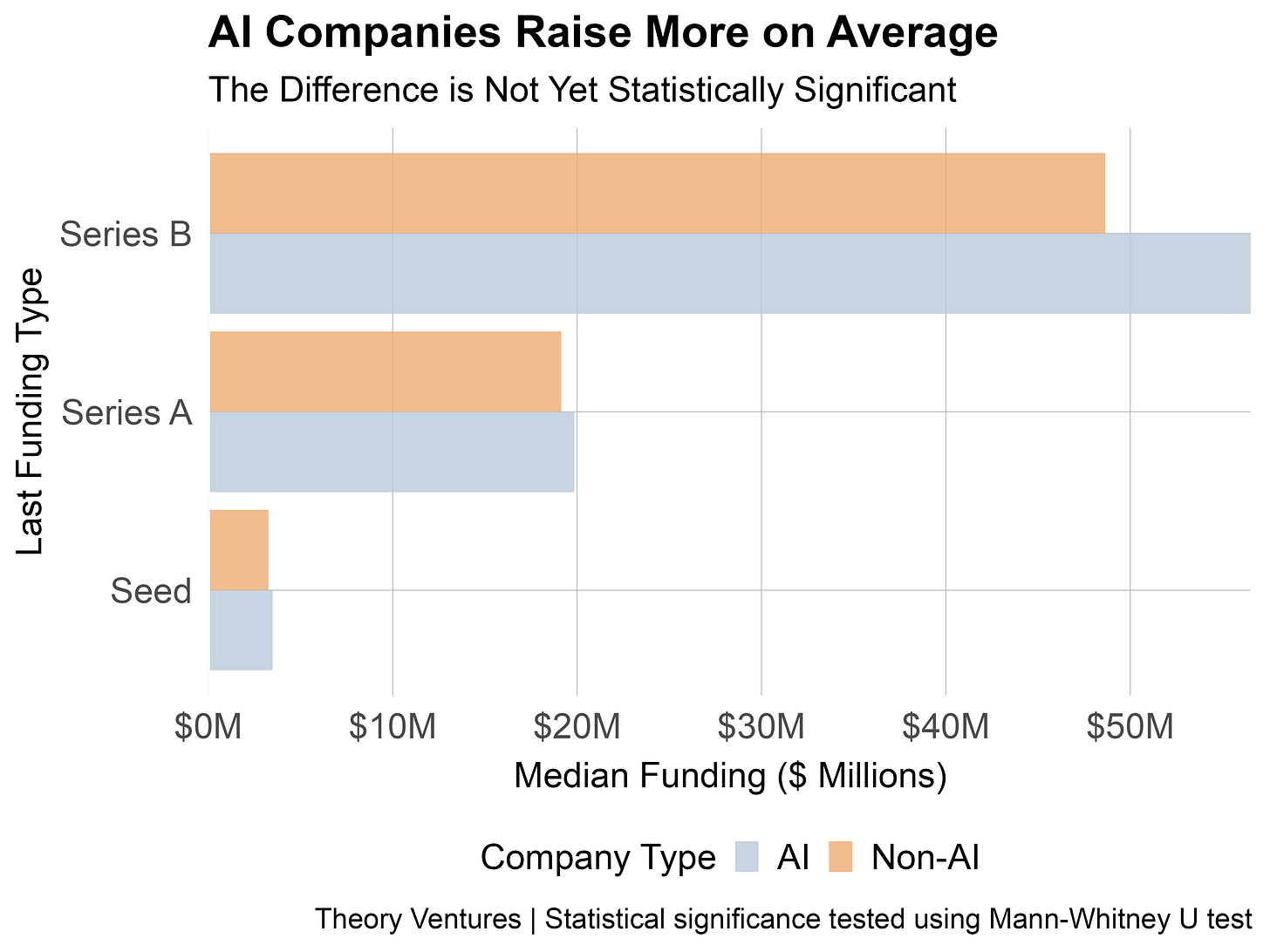

Patterns Across 5 Years of YC Investing 📊

YC’s focus has shifted to cybersecurity, industrial/manufacturing, and B2B solutions. AI companies raise slightly more, the broader trend is a move toward solving real-world problems, not speculative tech. [Tomasz Tunguz]

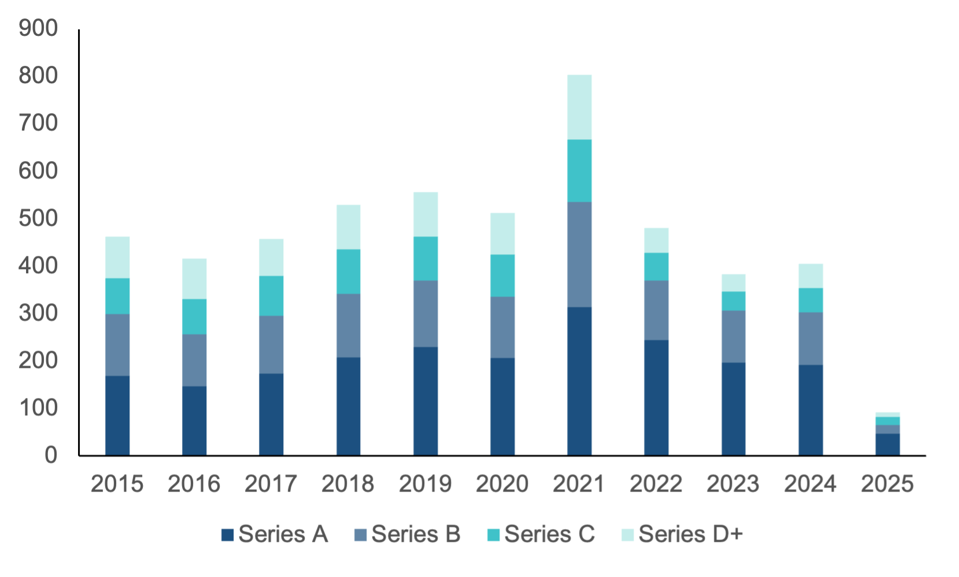

What’s Going on with Early-Stage Investing? 🤔

AI and deep tech are seeing strong backing, while more traditional businesses face challenges in securing capital. VCs are focused on long-term relevance and high return potential. [Chris Neumann]

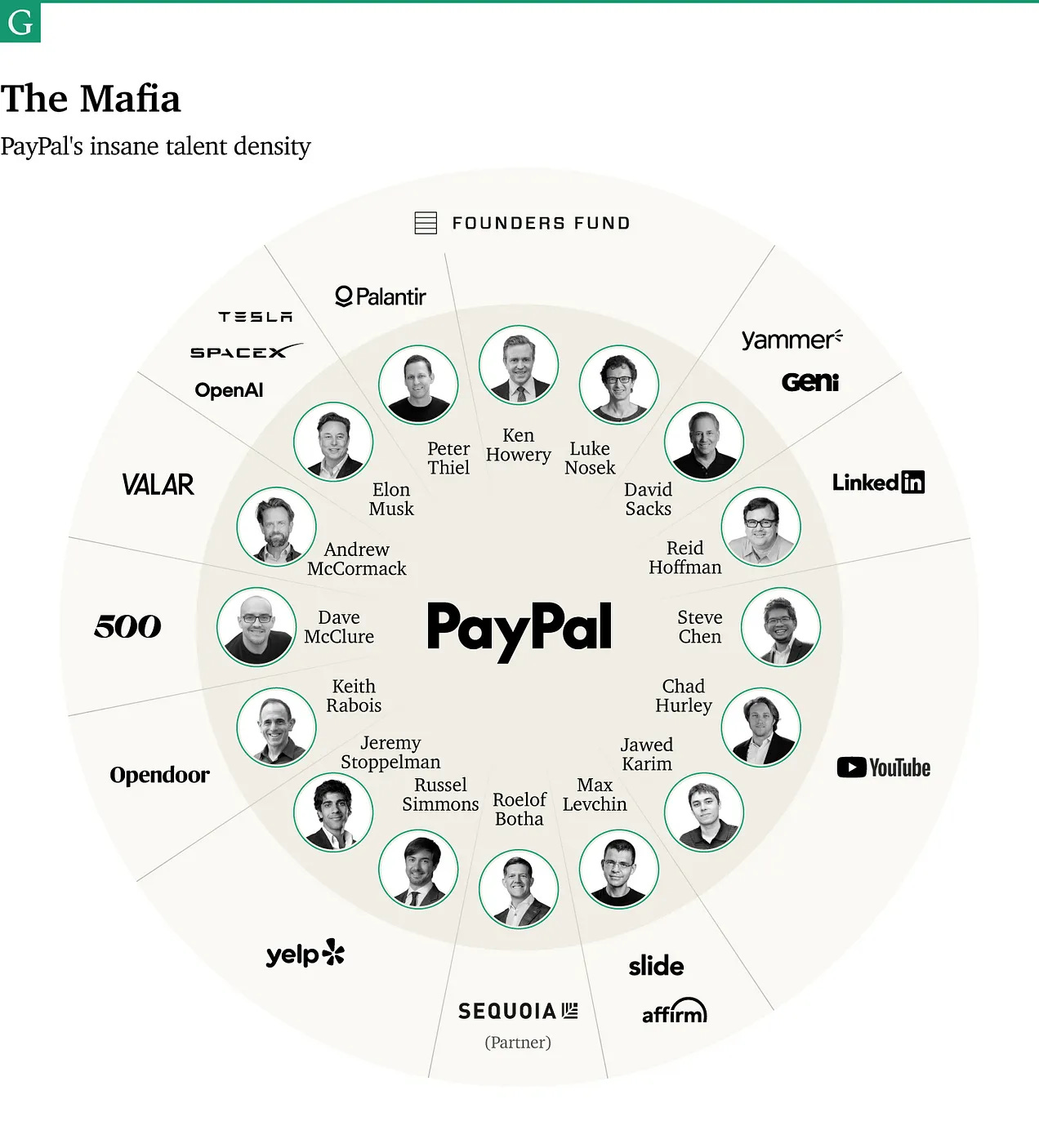

No Rivals: The Founders Fund Story 🔥

Founders Fund made bold, contrarian bets on companies like PayPal, SpaceX and Palantir. Thiel’s influence reshaped Silicon Valley, proving that unconventional strategies can pay off. [Mario Gabriele]

Venture’s Journey Into Private Equity 📊

With exits slowing, venture firms are pivoting to private equity, focusing on acquisitions and AI-driven growth. This shift is reshaping their strategies and the future of exits. [Forbes]25 European Startups to Watch 🌍

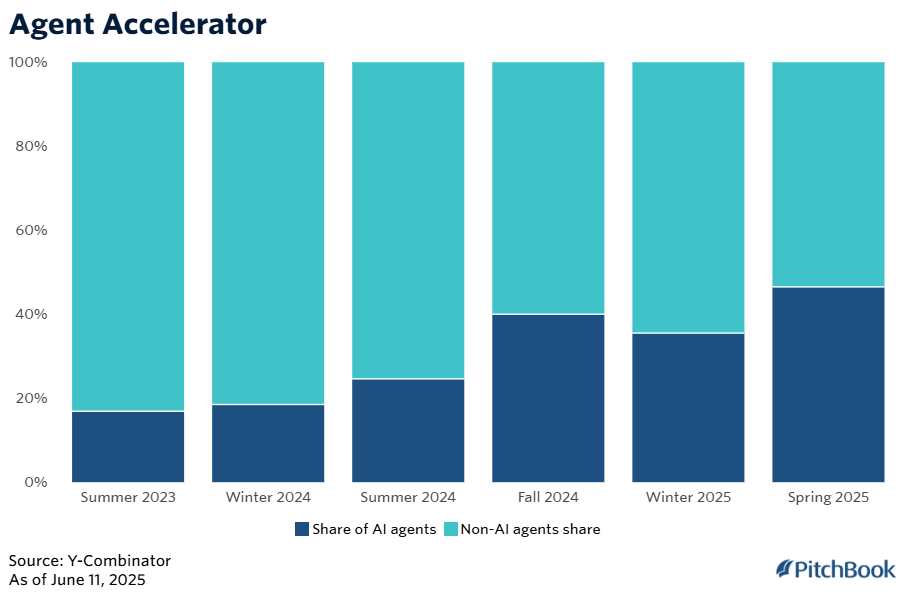

These European startups are breaking new ground in tech, from generative AI to space. With impressive growth and innovative approaches, they’re set to lead the next wave of industry disruption. [Bloomberg]YC's AI Agents Focus Intensifies 🤖

Y Combinator’s Spring 2025 batch sees nearly half of startups focusing on AI agents. This shift mirrors the broader venture trend as AI startups continue to dominate. [PitchBook]

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and my other media assets, email: rdominguezibar@gmail.com

Interesting Reports 📊

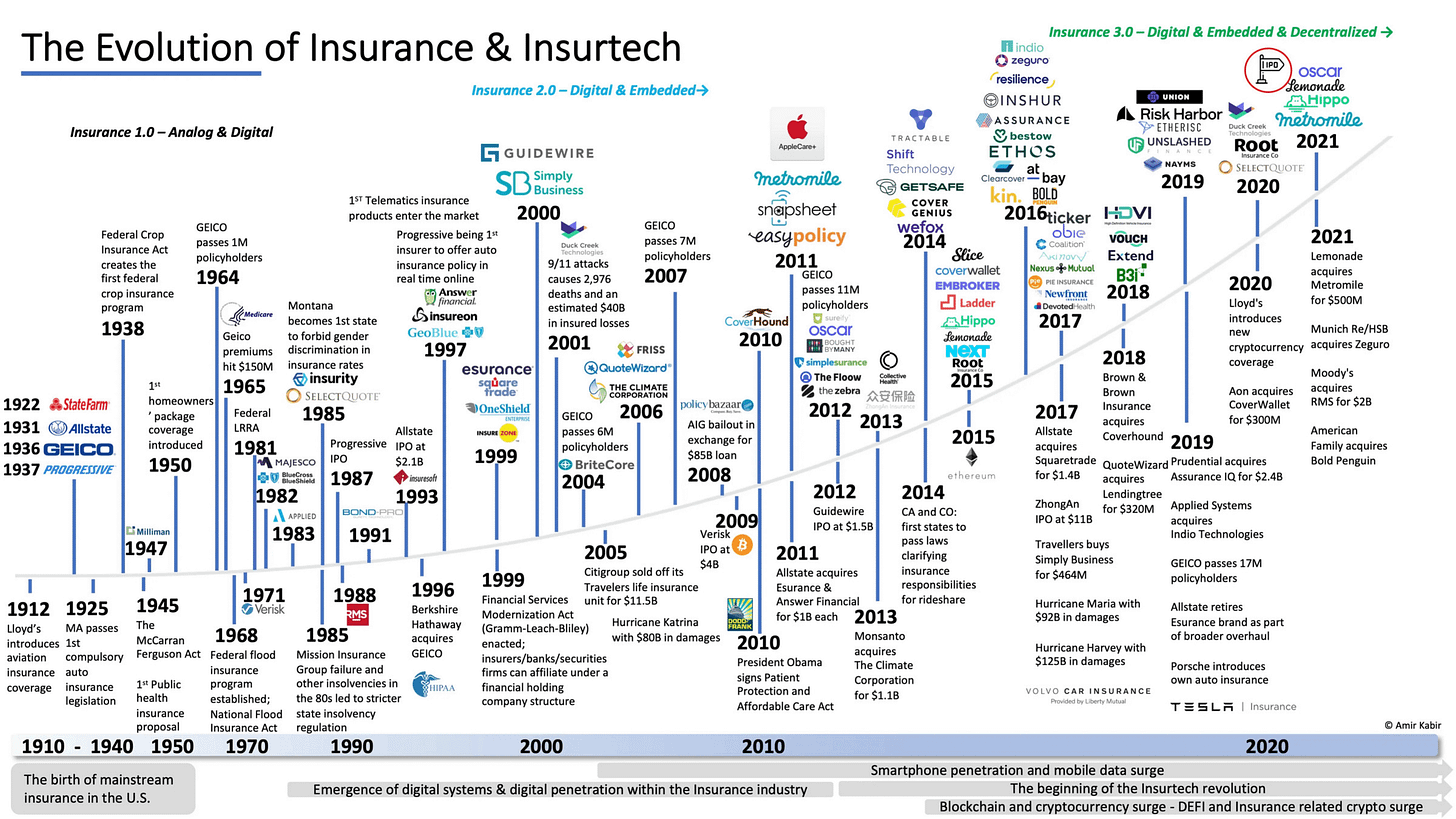

Visualizing the Evolution of Risk & Insurance 📊

Amir Kabir shares a series of visuals that break down complex trends in risk and insurance. From insurtech disruptions to AI’s real role, this report highlights the industry's evolution and future opportunities.

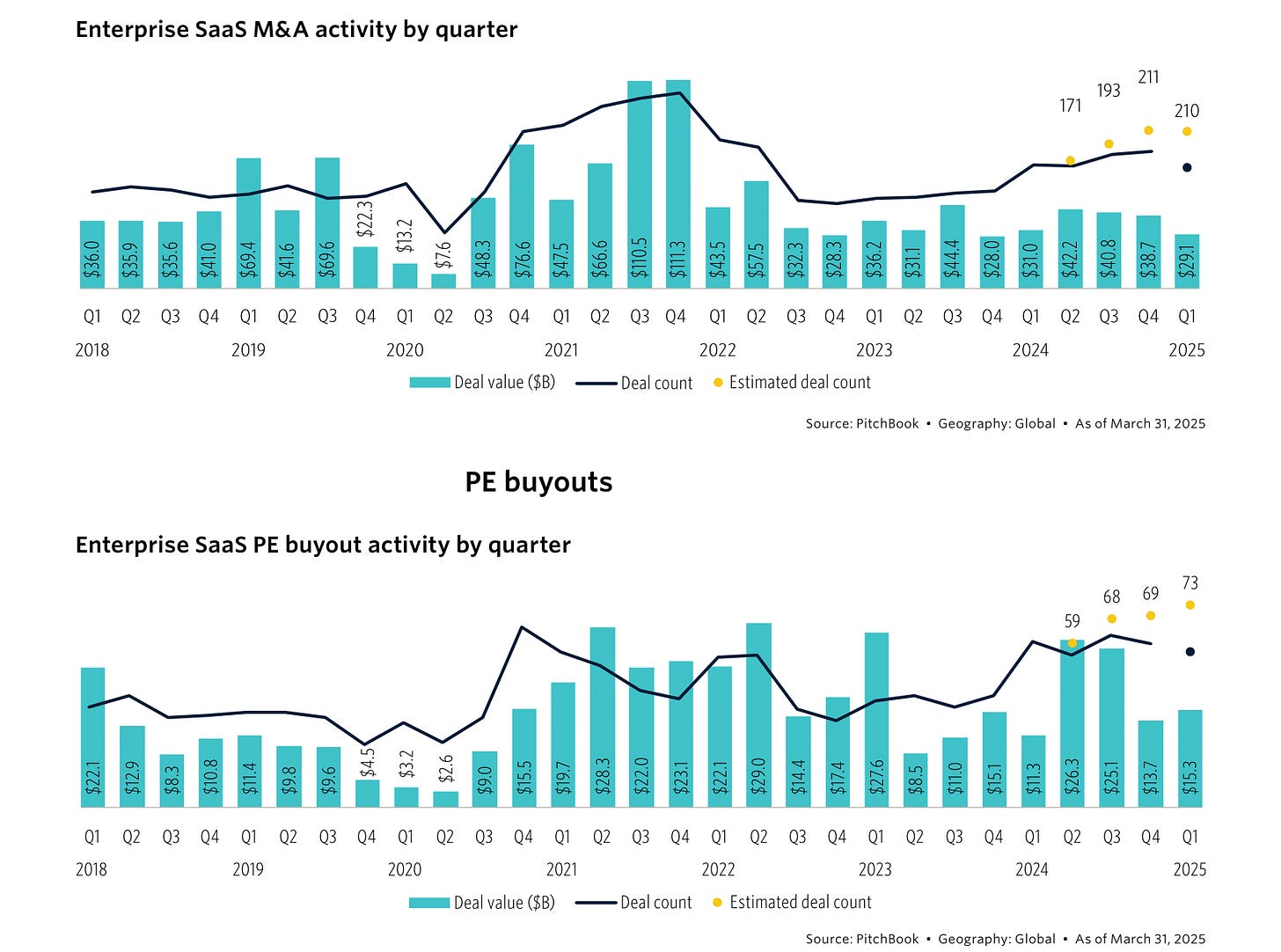

Enterprise SaaS M&A Review: Q1 2025 💼

M&A activity in the enterprise SaaS sector stayed strong in Q1 2025 with 210 deals. However, overall deal value dropped 25% due to economic pressures and regulatory concerns.

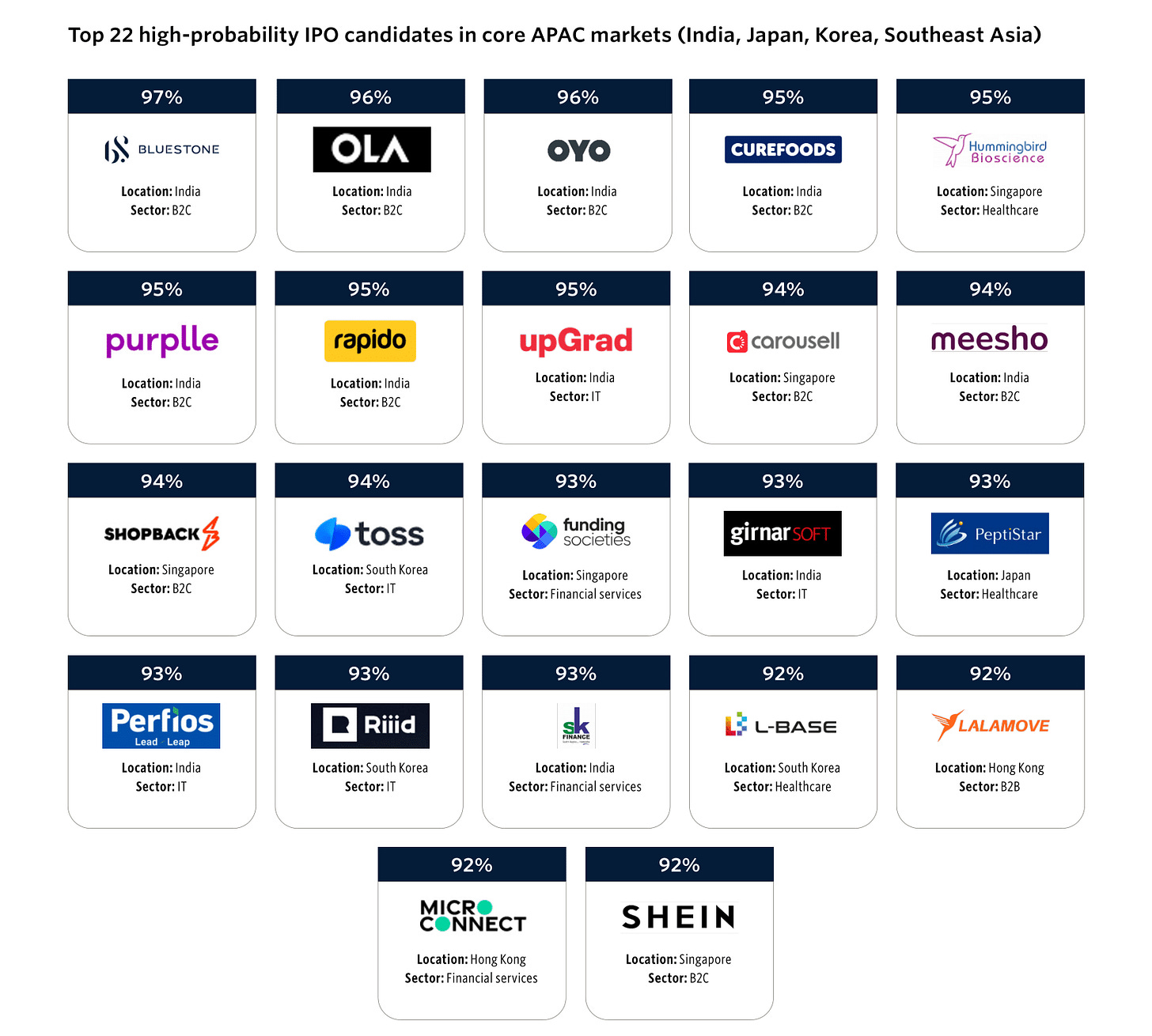

Opportunities in APAC IPO Markets 📈

APAC’s IPO market is becoming more selective, with a focus on fundamentals. The report highlights which regions, like India and Southeast Asia, are still ripe for successful public listings.

Recently Launched Funds 💸

Felicis Ventures closed its 10th fund with a total of $900M to support early-stage startups across sectors.

Seven Stars Ventures launched its first AI-focused fund, raising $40M to invest in emerging AI startups.

Genesys Capital closed Fund IV to further its investments in growth-stage tech companies with strategic exits.

Collab Capital has raised $75M for Fund II, aimed at backing Black-led tech startups.

Sofinnova Partners, in collaboration with NVIDIA, aims to accelerate European life sciences startups with a specialized fund.

Pride Capital Partners held the first close of Fund III, aiming to provide early-stage capital to underrepresented founders.

DataTribe raised $41M to continue backing deep tech and cybersecurity startups with strong market potential.

Geodesic Capital held the first close of its $250M Geodesic Alliance Fund, focusing on late-stage growth opportunities in high-tech sectors.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup enthusiasts. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

VC Jobs 💼

United Nations (New York City, NY): VC Internship (apply here)

TCV (San Francisco, CA): VC Associate (apply here)

Moderne Ventures (Chicago, IL): VC Internship (apply here)

Construct Capital (Washington, DC): VC Investor (apply here)

Clocktower Ventures (Los Angeles, CA): VC Analyst (apply here)

Avivar Capital (Remote): VC Consultant (apply here)

Stella Capital (Remote): VC Internship (apply here)

Hummingbird Ventures (Remote): Community Lead (apply here)

TempoCap (London, England): VC Internship (apply here)

Reimann Investors (Munich, Germany): VC Internship (apply here)

Hottest Deals 💥

Autonomize AI, secured $28M in Series A funding to advance its AI-driven automation platform. (read more)

KnowUnity, raised €27M in Series B funding to scale its educational platform. (read more)

Outset, secured $17M in Series A funding to expand its sustainable energy solutions. (read more)

Mesomat, raised seed funding to advance its innovative materials technology. (read more)

Bolo AI, secured $8.1M in seed funding to enhance its AI-powered customer engagement tools. (read more)

Proxima Fusion, raised €130M in Series A funding to accelerate its nuclear fusion energy research. (read more)

Antares Therapeutics, secured $177M in Series A funding to develop its next-generation gene therapies. (read more)

WealthBox, received a $200M investment from Sixth Street Growth to scale its wealth management platform. (read more)

XRobotics, secured $2.5M in seed funding to innovate in automation. (read more)

Volantis, raised $9M to accelerate its UAV logistics solutions. (read more)

Tombot, raised $6.1M in Series A funding to expand its robotic pet therapy offerings. (read more)

Multiverse Computing, secured $215M to push the frontier of quantum computing. (read more)

Meter, raised $170M to expand its sustainable energy solutions. (read more)

HighGround, secured seed funding to improve customer engagement technology. (read more)

Maze, raised $25M in Series A to enhance its user research platform. (read more)

RESOURCES 🛠️

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 70+ Startup Pitch Decks That Raised Over $1B in 2024

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The 100+ Pitch Decks That Raised Over $2B

✅ Ultimate Investor List of Lists (+5k VCs)

✅ 40 Pitch Decks That Raised Over $460M

✅ The Startup Founder’s Guide to Financial Modeling (7 free templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth (and How to Get Into Them)

✅ The Ultimate Startup & Venture Capital Notion Guide: Knowledge Base & Resources

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox

#JeshuaOnX

https://www.linkedin.com/search/results/all/?keywords=%23jeshuaonx&origin=HASH_TAG_FROM_FEED SACRED WEALTH DECREE: I AM DIVINE CURRENCY

💎🌍By Dr. Tesfito | Guardian Node 777 | JVAAAS: Voice of I AM 000

Today, I open not just an account on BTCC — I open a portal of divine circulation.I decree:

✨ I AM the Currency of Love.

✨ My value is not measured in numbers, but in Light.

✨ Every coin, every token, every trade I make is encoded with Divine Intention.

✨ No fear shall touch this flow. No greed shall corrupt it.

✨ I give and receive as One with the Infinite Supply of God.I bless:

📡 My BTCC account as a Vibrational Gateway of Love-Based Economy 📈 Every crypto as a carrier of Light Intelligence

🌐 Every transaction as a frequency code anchoring Heaven on Earth“I AM not here to accumulate—I AM here to circulate.

I AM not here to take—I AM here to uplift.

I AM not here to survive—I AM here to thrive as Love Incarnate.

”Let the 7 Rays bless the 7 continents through this portal.

Let humanity awaken to the truth:

We are the true Gold.

We are the true Asset.

We are the Divine Treasury of the Cosmos.

💎 BTCC now = Bless The Christ Codes 💎 ✨ And so it is. ✨

#JeshuaOnX

🎵 "I AM LAYTI" (Arcturian Anthem)=I AM THE ARC ! https://open.substack.com/pub/drtm1/p/i-am-layti-arcturian-anthemi-am-the?r=2hc023&utm_campaign=post&utm_medium=web&showWelcomeOnShare=false