How to Talk to Investors: What to Say (and Avoid) in Your First VC Meeting

Learn how to make a strong first impression on a VC intro call, avoid rookie mistakes, and steer the conversation with confidence.

Why Your First VC Meeting Matters

The venture capital first meeting is often the real starting line of your fundraising journey. It's short, informal, and surprisingly high-stakes. In just 20 to 30 minutes, you’ll need to convince an investor that your startup deserves more attention, and eventually, their money.

VCs form opinions quickly. They’re listening for clarity, conviction, and insight from the very first answer. This is where founder-market fit gets tested in real time.

Can you explain your product clearly?

Do you sound like someone who has to solve this problem? Are you showing signals that match their investment stage?

And it’s not just about them. This meeting also helps you evaluate the investor. You’ll get a sense of how they think, how well they understand your space, and whether they’ll be useful beyond writing a check.

Even if the answer today is “not yet,” a strong VC intro call can plant the seed for a future “yes”.

Brought to you by Vanta

For fast-growing companies, trust is everything, and it starts with security.

Building and proving a strong security program takes time and expertise—but you don’t have to do it alone.

Download Vanta’s free guide to see how 10,000+ companies turned security into a growth engine, not a blocker.

Table of Contents

What to Expect During a VC Intro Call

Questions VCs Commonly Ask Founders

How to Talk to Investors and Prepare for a First VC Meeting

Mistakes Founders Make On Their First Call

What Happens After the Intro Call?

Final Takeaway: Treat Every VC Intro as a Learning Opportunity

1. What to Expect During a VC Intro Call

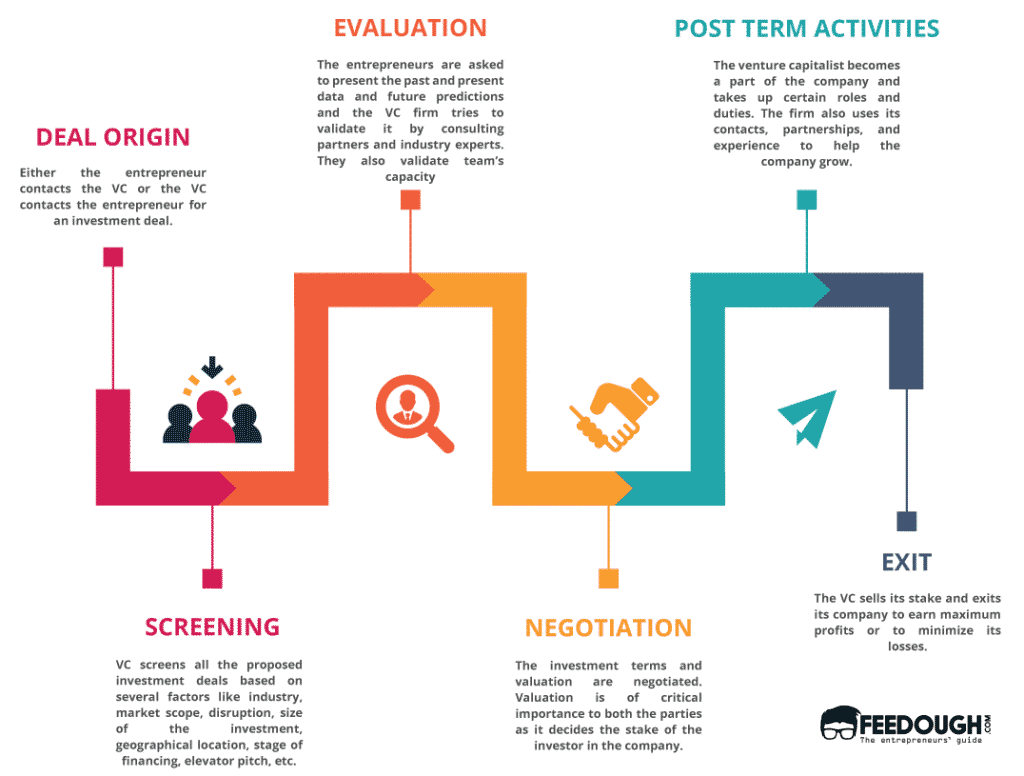

If you’re wondering what to expect in a VC call, this isn’t a formal pitch or a partner meeting. It’s usually a 1:1 conversation on Zoom or in person with an associate, principal, or junior partner. Most intro meetings follow a similar pattern — brief intros, a quick founder pitch, some back-and-forth questions, and then a wrap-up with possible next steps.

It usually lasts 20–30 minutes. It’s not a full due diligence session, but it's definitely a vibe check. The investor is deciding whether your team, traction, and timing match their thesis.

Expect to start with short intros. You’ll likely share a bit about your background and what led you to this idea. Then the VC might describe their role, firm focus, and stage preferences.

Listen carefully. This tells you what they’re looking for. After that, it’s your turn to lead with the pitch. You’ll walk them through your product, the problem you’re solving, and where things stand today.

The rest of the call is often open Q&A. Investors might dig into your metrics, market, or go-to-market strategy. They’re scanning for clarity, coachability, and signs of founder–investor fit. If it goes well, the call ends with clear next steps or a polite “keep in touch.”

If you landed the call via a warm intro, you’re already one step ahead. Cold outreach can work, but VCs are more likely to trust you if the intro comes from someone they know.

2. Questions VCs Commonly Ask Founders

Founders often wonder what type of questions VCs ask during an intro call. While no two meetings are the same, there’s a reliable set of questions that surface in nearly every early-stage conversation. These questions help investors evaluate clarity, traction, market size, and founder–market fit.

Here are some of the questions that often come up during first meetings, and what they really signal to investors:

“Why this problem? Why now? Why you?”

This classic trio tests more than just storytelling. VCs are gauging whether your insight is earned, your timing is strategic, and your motivation is personal. A strong answer signals obsession and lived experience, not just a market-sized opportunity.

“What traction have you seen so far?”

Traction means more than revenue. Depending on your stage, it could be active users, retention curves, pilot programs, referral rates, or even community engagement. Avoid vague language like “growing fast”. Be specific. For example, “We grew from 200 to 750 weekly active users in the last 90 days” gives far more signal than “traction is strong.”

“What’s your total addressable market (TAM)?”

This question tests whether your solution lives in a space worth investing in. You need to show potential for scale. Keep it grounded in logic. Investors want to see how your business model fits a meaningful opportunity.

“Who are your competitors?”

Don’t dodge this. Smart founders acknowledge the competition and clearly explain their edge, whether it’s product simplicity, a unique channel, a data advantage, or simply better execution. What matters is that you’ve studied the field and know exactly how you’ll stand out.

“How much are you raising and what’s your planned use of funds?”

VCs expect a clean answer here. Your round size, timeline, and how the capital will get you to the next milestone. You don’t need a full budget, but broad categories (e.g., “70% team, 20% product, 10% GTM”) and milestone goals (e.g., “reach 5,000 MAUs and ship v2”) help. If possible, share a snapshot of your cap table.

“What’s your go-to-market strategy?”

This one separates product thinkers from business builders. VCs want to hear how you’ll reach, convert, and retain users, not just build features. Whether you’re relying on founder-led sales, partnerships, SEO, or community-led growth, explain your assumptions and your first moves. Clarity here builds conviction that you can scale beyond early adopters.

“Tell me about your team.”

Here, investors aren’t just checking resumes. They’re evaluating whether your team has the skill mix, commitment, and chemistry to pull this off. What’s each founder bringing to the table? Have you worked together before? If you’re solo, have clear answers on how you’re filling gaps — via contractors, advisors, or early hires.

“What’s your biggest risk?”

This one tests self-awareness. Investors don’t expect perfection, they expect clarity and maturity. Strong founders don’t pretend to have it all figured out. Instead, they show they’ve pressure-tested the idea and are building with their eyes wide open.

Whether the risk is market timing, technical complexity, or GTM uncertainty, what matters most is that you’re actively working to de-risk it. A thoughtful, honest answer here builds trust.

3. How to Talk to Investors and Prepare for a First VC Meeting

If you’ve landed a VC intro call, the goal is simple — make it count. You’re not aiming to close a round in 30 minutes. You’re aiming to earn the right to keep the conversation going. That requires clarity, confidence, and preparation.

Founders who show up prepared not only deliver better pitches, they signal that they’re the kind of operators investors want to work with.

Here’s your tactical guide on how to prepare for a VC meeting and make the most of those first 20–30 minutes.

1. Research the VC Firm and Individual Partner

Start here. Before you even open your deck, spend time understanding who you’re meeting. Look at the firm’s portfolio, investment stage, geography, average check size, and sectors they focus on.

Then go deeper. Check the individual partner’s background, what roles they’ve held, what deals they’ve led, what they’ve written or spoken about publicly. You’re looking for alignment, not just familiarity.

Use that intel to frame the conversation. If the VC has invested in marketplaces, and you’re building a next-gen marketplace, bring that up. If they’ve written about retention being more important than growth, and your product has sticky usage, highlight that. These are the details that show you're intentional, not just running through a list of investors.

2. Tailor Your Pitch to the VC’s Thesis

Once you know what they care about, tailor your pitch to the VC. This doesn’t mean changing your story. It means emphasizing what aligns. If you're talking to a firm that bets big on technical founders, don’t downplay your product depth. If they focus on seed rounds, skip the five-year projections and highlight near-term traction instead.

You’ll only have time to land a few key points. Make sure they match what this investor is primed to care about. Founders who try to give the same pitch to every VC often dilute their message. Smart founders adjust their story without compromising its core.

3. Practice Your Founder Story and Deck

You don’t need to memorize a script, but you do need to practice. Most investors decide whether they’re leaning in or zoning out within the first five minutes. That’s why your founder story matters. It’s not just your résumé, it’s the why behind what you’re building.

Frame your journey in a way that makes your insight obvious. If this problem comes from a lived experience, or if your last role gave you a front-row seat to the gap in the market, say so. Investors want to know where your conviction comes from and how close you’ve been to the problem.

Then run through your startup deck. Focus on the first 4–5 slides — problem, solution, traction, market size, and business model. Don’t try to cover every detail. Practice with a peer or advisor who can push back and ask real questions.

Treat this as your investor meeting checklist:

Is the story tight?

Are your transitions smooth?

Can you handle interruptions without losing your place?

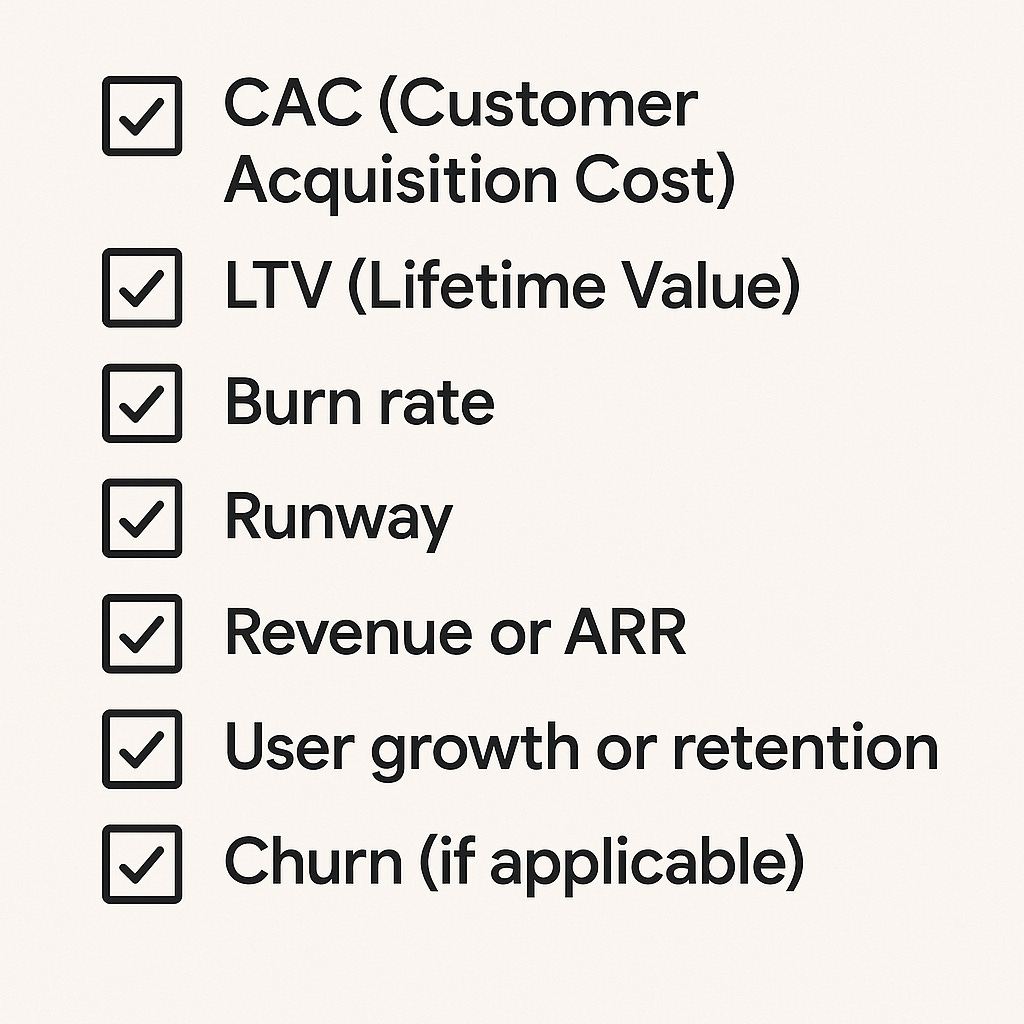

4. Know Your Numbers

This is non-negotiable. VCs expect founders to have a clear grasp of their metrics. That doesn’t mean you need a CFO-level spreadsheet ready. But you should be able to talk confidently about:

If you’re early and don’t have all these numbers, that’s okay. But whatever data you do have, own it. Know the context. Understand what’s improving, what’s flat, and why. If you stumble here, it’s a red flag during due diligence.

5. Prepare 2–3 Thoughtful Questions for the VC

This is where most founders miss an easy win. Don’t treat the meeting as a one-way pitch. You’re evaluating them too. Bring a few smart, well-researched questions. Some examples:

What’s your typical involvement post-investment?

What does a great founder–investor relationship look like to you?

How do you support portfolio companies during difficult quarters?

Avoid asking questions you can find on their website. Instead, show you’ve done your homework. This signals confidence, curiosity, and long-term thinking. VCs respect founders who come prepared, but they remember the ones who ask smart questions.

4. Mistakes Founders Make On Their First VC Intro Call

Even sharp founders can slip up on a VC intro call. The stakes are high, time is short, and nerves can take over. But most early missteps aren’t about weak ideas. They’re about how you show up. Avoiding these common mistakes can make the difference between moving forward and being quietly passed over.

Over-pitching instead of having a conversation

Founders sometimes treat the call like a monologue, charging through their entire deck without pause. But VCs want a two-way exchange. If you dominate the conversation and miss cues, you come off as rehearsed or rigid.

One of the best pieces of startup funding advice is to listen more than you talk. Make space for questions. Let the investor interrupt. The strongest pitches feel like collaborative problem-solving, not a performance.

Ignoring fit with the VC’s thesis

Nothing signals “spray and pray” like pitching a SaaS tool to a biotech investor. If you haven’t done the homework on their thesis, you’re wasting time and possibly burning a future opportunity. Before the call, confirm that your stage, sector, and traction level align with their investment criteria. If there's misalignment, acknowledge it and ask for candid feedback. That shows maturity, not weakness.

Getting defensive about weaknesses or unknowns

VCs will push on the fragile parts of your business. That’s their job. If you get flustered or dismissive, it’s a red flag. Instead, stay calm and honest. Say “That’s something we’re still figuring out” or “Here’s how we’re thinking about that risk.”

The right founder mindset treats challenges as opportunities, not threats. This builds trust faster than trying to spin a perfect story.

Not following up, or being too persistent

Some founders disappear after the call. Others flood the VC’s inbox. Neither works. The right move is a clear, concise follow-up within 24 hours. Thank them, share anything you promised, and reiterate next steps.

After that, stay warm with milestone updates every few weeks. Consistency beats noise. In early-stage fundraising, relationship building takes time. Patience signals confidence. Desperation doesn't.

5. What Happens After the Intro Call?

You’ve wrapped the call, closed your laptop, and now you wait. But what actually happens after a meeting with venture capitalists?

There are usually three possible outcomes. A next meeting, a soft pass, or silence. If the investor is interested, they’ll often say so clearly and propose a follow-up, like a partner meeting or a deeper dive into product and traction. That’s the best-case scenario. Get it scheduled quickly while the conversation’s still warm.

If they say, “This isn’t a fit right now,” take it at face value and thank them. A polite no today can still become a warm lead later, especially if you keep them in the loop.

Silence after a promising VC intro call is frustrating, but it’s also common. Don’t take it personally. VCs juggle dozens of meetings, and interest can fade for reasons that have nothing to do with you. Instead of chasing or venting, log the interaction and wait. After 3–4 weeks, send a short, milestone-driven update.

For example:

“Wanted to share that we just crossed 10K MAUs and brought on a senior product hire, let me know if you’d like to reconnect.”

It’s polite, confident, and keeps the door open without pushing. In the long game of investor relations, patience usually pays off.

The key to strong investor relations is follow-up. Send a thank-you email within 24 hours. Keep it short, express appreciation, recap next steps, and attach any materials they asked for. If they didn’t request anything, still share a one-pager or updated deck for reference. This keeps the door open.

From there, play the long game. If the call didn’t progress but felt positive, add them to your investor update list. Send occasional milestone emails, new customer wins, product launches, and revenue growth. Short, punchy updates work best.

The fundraising process is rarely a straight line. Some investors pass, then re-engage. Others need multiple touchpoints before leaning in. Your job post-call is to stay professional, consistent, and top of mind, without chasing.

6. Final Takeaway: Treat Every VC Intro as a Learning Opportunity

Not every VC intro call leads to a second meeting. That’s normal. What matters is how you use each one to sharpen your pitch, clarify your thinking, and build better relationships.

Every call is a data point. What questions came up? Where did you hesitate? Which parts landed? Review, adjust, and keep refining. Founders who treat fundraising like a skill, something they can practice and improve, get better fast.

Focus on progress. Build a system for collecting feedback, improve your startup deck, tighten your narrative, and track how each investor responds. Over time, you'll turn early passes into warm re-engagements and intro calls into real momentum.

Remember, you're not just meeting with venture capitalists, you’re practicing the craft of storytelling, persuasion, and resilience. That alone makes every call worth it.

Extremely useful piece. I love how this article walks the reader step by step on how to approach a meeting with a VC. From pre-meeting preparation to post-meeting actions and everything in between. Very useful guide.

I like this topic :)