Why Women-Owned Startups Deliver 2x Better Returns (and Still Get Ignored)

A deep dive into closing the $5 trillion venture gap with smarter, data-backed investing in female founders.

In venture, performance should speak for itself. But when it comes to women‑owned startups, the numbers and the funding tell two very different stories.

Female-founded companies generate more than twice the revenue per dollar invested than male-founded ones. Yet in 2023, they received just a fraction of global VC funding.

But this is not a story of inequality. It’s just plain inefficiency, and it’s costing the ecosystem real returns.

This article is about the investment case for investing in female founders, not the moral one. We’ll walk through the actual performance metrics, unpack why the VC gender gap persists, and show where the capital is missing the mark.

Because the conversation isn’t about diversity but about a missed opportunity…

📣Vanta Webinar: Building Security Into Startup Growth

📅 September 30th | ⏰11 AM BST | 12 PM CEST

Join Robin AI’s Head of InfoSec + Pavlov’s Co-Founder & CEO for a live conversation with Vanta on how high-growth startups embed security & compliance without slowing innovation.

✅ Launch a lightweight, high-impact compliance program

✅ Use security 🔒 as a trust signal to win faster

✅ Build credibility with customers, partners & investors 🌍

Table of Contents

1. The VC Gender Gap Is Not Just Unfair. It’s Also Expensive

2. The Metrics You Didn’t Know About: Why Women-Led Startups Outperform

3. Why Bias Still Drives the Capital Flow

4. Beyond the Pitch: Structural Barriers Women Still Face

5. The Missed Markets: Where Women Are Building What Others Can’t See

6. Fixing the Pipeline Myth: The Talent Is There, But Access Isn’t

7. How Investors Can Actually Close the Gap

8. Closing Argument: Don’t Just Do Good. Do Better Business

1. The VC Gender Gap Is Not Just Unfair. It’s Also Expensive

We’re not talking about fairness. This is a clear case of capital misallocation.

Venture capital is supposed to be a search for outliers, the highest-performing founders solving the biggest problems. And yet, when it comes to women‑owned startups, the numbers tell a strangely consistent story: high returns, low capital, year after year.

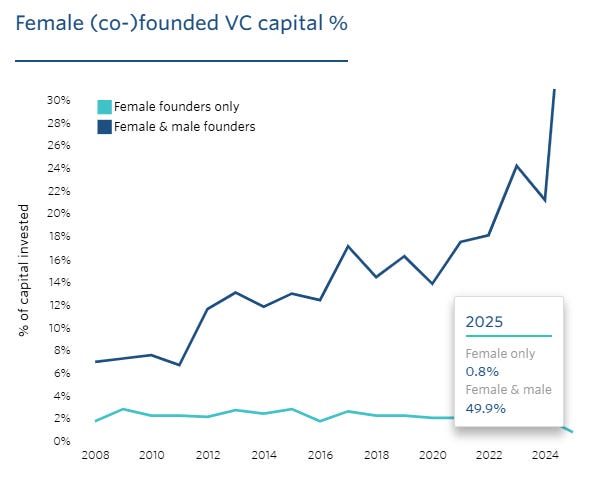

In 2024, startups founded exclusively by women received just 2% of all global VC dollars, while male-only teams captured around 78%. Mixed-gender teams fared slightly better, bringing in about 20% of available capital.

And the trend is pointing downwards. Female-only founders received just 0.8% of global VC funding so far in 2025.

This is despite the fact that investing in female founders has repeatedly shown better capital efficiency.

And yet the checks keep skewing one way.

Two Founders, One Capital Reality

Studies have shown that the average male-led startup raises $2.1 million, while the average female-led one raises just $935,000. Yes, that’s more than double.

And the consequences show up across the board: smaller teams, lower runway, fewer shots at breakout scale.

For an industry that prides itself on pattern recognition, this one should be hard to ignore. But the pattern persists nonetheless.

High-performing founders aren’t being overlooked because they’re underqualified, but because they don’t match the default mold.

The cost isn’t just borne by the founders. It’s borne by the funds missing out on better returns.

2. The Metrics You Didn’t Know About: Why Women-Led Startups Outperform

If you strip away the noise and follow the numbers, women‑owned startups consistently do more with less. And not just in isolated cases, but across markets, sectors, and funding stages.

Capital Efficiency That Compounds

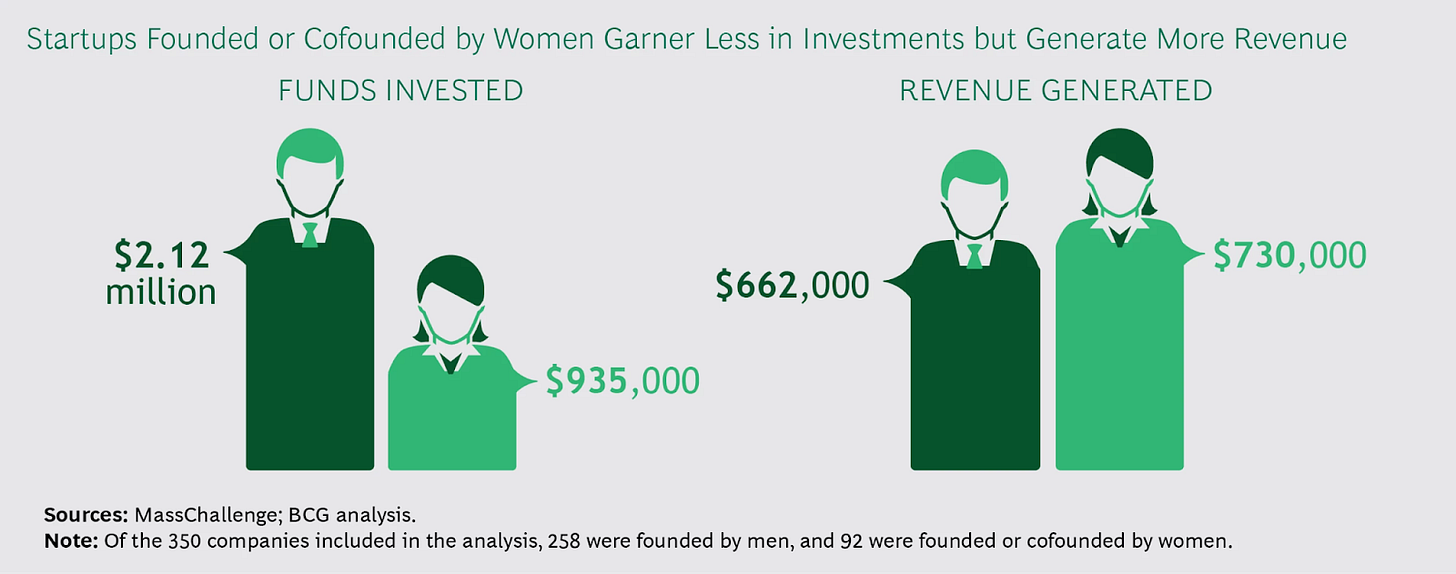

According to BCG’s study, women-led startups generated $730,000 in revenue over five years, compared to $662,000 for male-led startups. That may seem like a modest difference, until you adjust for funding levels.

The average woman-led company raised less than half the capital. When you account for that disparity, the math becomes hard to ignore: $0.78 in revenue per dollar raised for women, versus $0.31 for men. That’s more than 2x in ROI.

Other studies have shown that female founders outperform male male founders by 63%.

For any investor focused on capital efficiency, maybe this demands more attention. These numbers indicate leaner burn, better margin awareness, and smarter use of resources.

If your fund’s thesis prizes discipline and return on invested capital, investing in female founders is a unique, thesis-aligned move.

Product-Market Fit in Places Others Miss

One reason for the outperformance is that female founders are often closer to underserved users. They’re building in spaces others overlook, such as caregiving, community health, workplace flexibility, and FemTech. Many might believe these are side markets. But in reality, they are massive, under-monetized categories with real demand and little legacy competition.

That proximity translates into sharper product-market alignment from day one. You see fewer vanity features, fewer pivots, and more direct paths to paying customers.

Smarter Decisions, More Resilience

It’s not just the products. It’s how the companies are run. Decision-making quality improves with diversity, and the data backs that up.

Gender-diverse teams outperform homogenous teams in decision-making 87% of the time. Add to that the fact that women-led businesses often grow more sustainably, with lower volatility and fewer boom-bust cycles, and the long-term appeal becomes clearer.

The Multi-Trillion-Dollar Opportunity

Besides portfolio-level upside, there’s also macroeconomic upside to be accounted for. Equalizing funding between male and female founders could unlock $2.5–$5 trillion in global GDP. That’s the scale of value being left on the table, year after year, because of outdated patterns and capital blind spots.

And in a market where alpha is getting harder to find, that kind of mispricing is more than just notable.

3. Why Bias Still Drives the Capital Flow

If women‑owned startups outperform, and the data’s been out there for years, why hasn’t capital followed?

The answer lies less in logic, and more in human behavior. Venture is a pattern-matching business. And when the patterns are built in a male-dominated ecosystem, bias feels more like a “gut instinct.”

Pattern Recognition or Pattern Restriction?

Most VCs won’t say, “We don’t back women.” But when your mental model of a billion-dollar founder is a 26-year-old Stanford engineer in a hoodie, everything else becomes the exception.

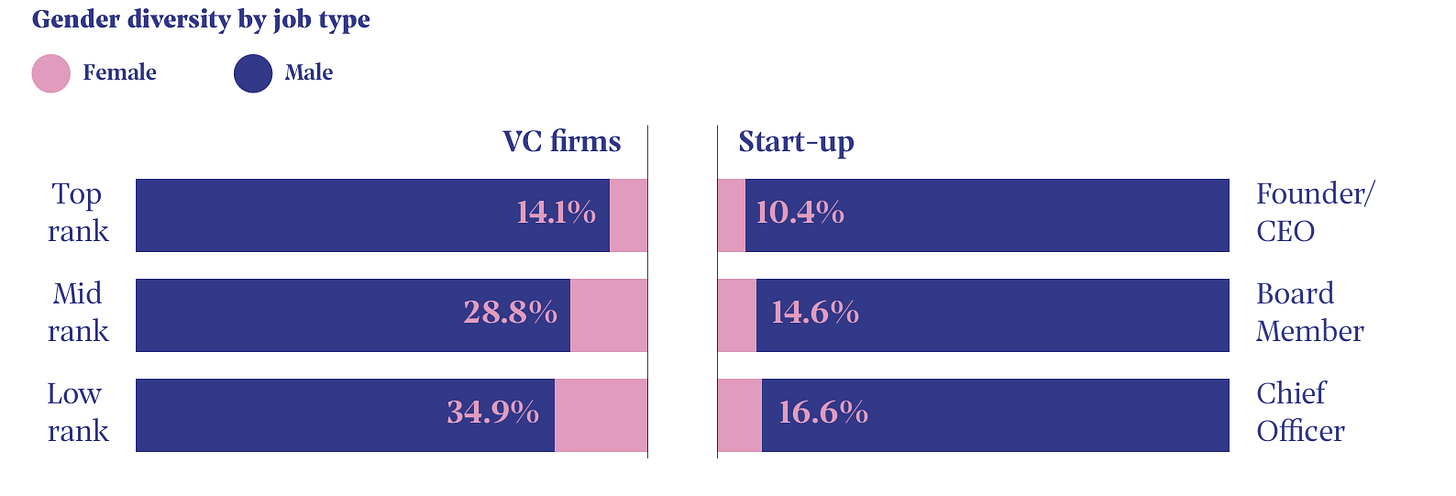

That’s how pattern-matching morphs into exclusion. A woman pitching a high-growth FemTech platform doesn’t look like what the last unicorn looked like. And because 85–90% of VC partners are men, that default pattern rarely gets challenged.

The Pitch Room Problem

A Harvard study found that investors asked men questions about potential, while they asked women about risk. Same business. Same metrics. But different framing.

Male founders get, “How big can this get?”

Female founders get, “What if it doesn’t work?”

This distinction is subtle. But over time, those framing differences shape funding outcomes. Investors aren’t just evaluating companies. They care about narratives. And narratives shaped by caution yield smaller checks.

Mistaking Prudence for Small Thinking

Another distortion is that women-led startups often grow sustainably, reinvest in fundamentals, and avoid the “blitzscale or bust” model. And although that’s a strength, it's frequently misread as lack of ambition.

You hear things like: “She’s not swinging hard enough.” “It feels like a nice lifestyle business.” “She’s not thinking big.”

What this usually means is that she’s running the numbers like a responsible CEO. But because it’s not wrapped in bravado, it gets discounted.

The Hypothetical You’ve Probably Seen

Picture two founders with the same pitch. A mobile-first community platform for caregivers.

First is David, a second-time founder, ex-Google, big energy. The other is Neha, first-time founder, deep domain expertise, ex-healthcare operator.

They get their first call with a VC. David gets asked about go-to-market scale and global potential. Neha gets asked about monetization risks and operational challenges. David leaves with a $3M seed. Neha gets told, “We love it, but it’s a little early for us.”

Neither outcome is malicious. But one is habitual.

Bias in venture isn’t always evident. Most of the time, it goes under the radar, while still shaping who gets the capital.

4. Beyond the Pitch: Structural Barriers Women Still Face

Even before a woman walks into a pitch room, the odds are already stacked. The VC gender gap isn’t just a reflection of biased decision-making, it’s the downstream result of a system that makes it harder for women entrepreneurs to get on the starting line, let alone reach scale.

Time, Labor, and the Invisible Tax

Start with time. Globally, women still carry the majority of unpaid labor, whether that’d be in childcare, eldercare, or household management. For many aspiring founders, that translates into time poverty, meaning fewer uninterrupted hours to ideate, network, or travel for capital.

In a world where deals are forged over late-night dinners, weekend retreats, or cross-country conferences, the founder who also handles the daycare pickup often gets left out. Not by choice, but by bandwidth.

The Network Problem Is Structural

Most venture deals are still driven by warm intros, and not cold merit. And informal networks like alumni circles, angel dinners, Slack groups, and Signal threads, are overwhelmingly male. For women without access to those loops, getting in front of the right people requires 3x the effort.

It’s never just about charisma. It’s about being in the room before the pitch ever happens.

Where Are the Mentors Who've Done It?

Role models matter. But in a space where only about 10% of VC-backed founders are women, the mentorship pool is thin. And with fewer exits, there are even fewer second-time female founders; those with battle scars, investor networks, and enough clout to say “no” to bad terms.

And this absence compounds. Without visibility into the path, fewer women start. Without exits, fewer come back to raise again. The pipeline clogs.

The System Isn’t Neutral

None of this is about trying harder. These aren’t personal failings, they’re structural conditions. Access to capital, time, networks, and second chances are not evenly distributed. And until that changes, many high-potential women‑owned startups will remain underfunded.

Not because they’re unqualified, but because the system is optimized to overlook them.

5. The Missed Markets: Where Women Are Building What Others Can’t See

When capital flows through a narrow lens, markets outside that lens stay overlooked, and undervalued. That’s exactly what’s happening in sectors where women‑owned startups are quietly building the next wave of breakout companies.

While some may view them as “passion projects”, those who know are seeing them as arbitrage opportunities.

FemTech, Caregiving, and the $1 Trillion Gap

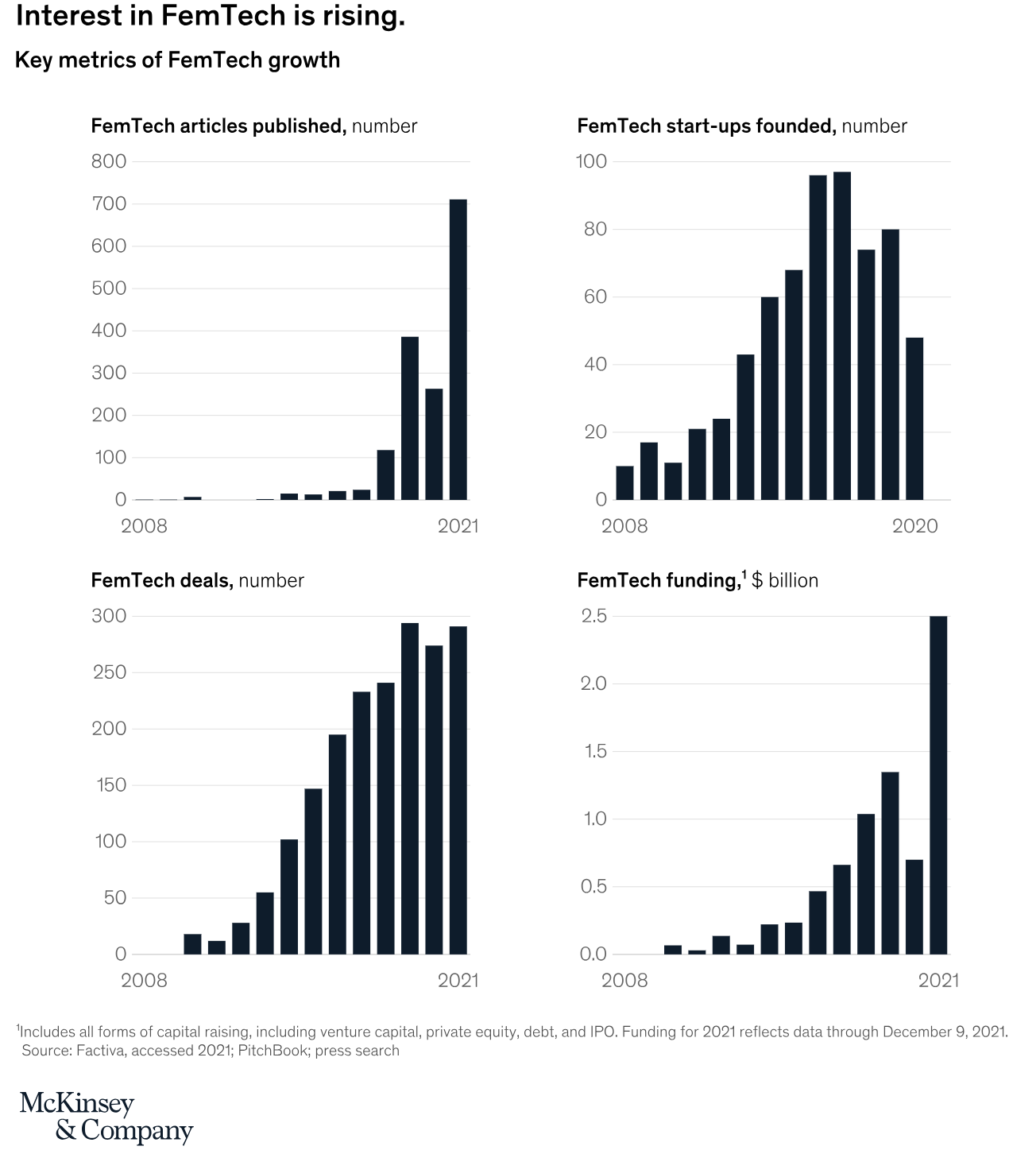

FemTech is projected to become a $1.1 trillion market by 2027, yet historically received less than 3% of digital health funding. Products addressing menstruation, fertility, menopause, or maternal health were once seen as “niche,” simply because male investors couldn’t relate.

But investing in female founders building in these spaces is not about filling a social gap, but about front-running an industry others dismissed for decades.

Same goes for the care economy. Platforms supporting eldercare, childcare logistics, or flexible family support are exploding in demand, and guess who’s been building them?

Women who’ve lived the problem, seen the inefficiencies firsthand, and know how to serve an audience no one else thought to prioritize.

Understanding the Underrepresented Customer

Women entrepreneurs also tend to build for customers who’ve been historically ignored: minority communities, working-class families, aging populations, LGBTQ+ consumers. These aren't just niche cases. They’re becoming massive demographics with unmet needs and growing spending power.

Founders who understand those customers on Day 1 don’t need focus groups. They have instinct. And instinct is a competitive advantage you can’t teach.

A New Kind of Market Signal

When you back a woman-led startup in one of these “invisible markets,” you’re not just funding inclusion. You’re buying early into markets that will soon become mainstream. You’re getting ahead of where culture, policy, and consumer demand are already heading.

And in venture, timing is everything.

6. Fixing the Pipeline Myth: The Talent Is There, But Access Isn’t

One of the most persistent refrains in the ecosystem is: “There just aren’t enough women building VC-worthy startups.” Yet the data tells a different story: the issue isn’t talent, it’s visibility and access.

Education and the Misunderstood Pipeline

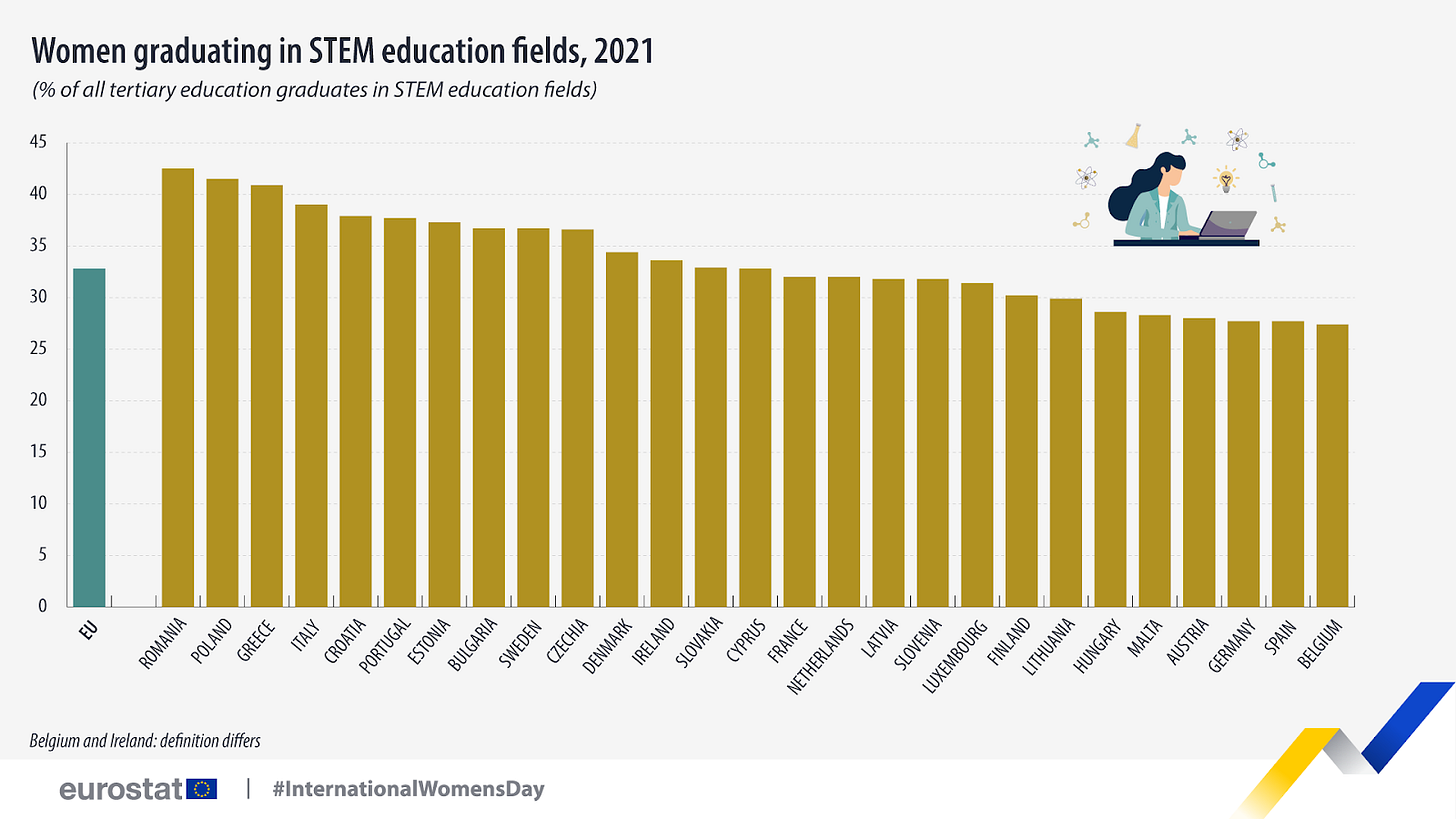

Women earn a substantial share of STEM degrees, but that success doesn’t translate to startup capital.

As of 2023, women made up about 27–35% of STEM graduates globally, a figure that's stagnated in many regions for years.

In the EU, that share hovered at 32.8% in 2021. But translating STEM degrees into startups is not straightforward; confidence, workplace culture, and structural incentives all filter women out before they launch.

This drop-off is systemic, not individual. Women are less likely to stay in STEM fields, switch majors more often, and face higher attrition in technical training programs, even when performance matches or exceeds male peers.

So despite ample technical talent, and growing representation, the startup world still looks male-dominated.

Deal Flow: The Real Bottleneck

Pitch decks from women founders remain underrepresented, even today. Female-only founding teams account for just about 5% of deal volume in both the U.S. and Europe, even though their deal-sharing rate has doubled over the past decade.

Moreover, roughly 3 in 4 VC firms in the U.S. have no women partners, which means inbound deal flow is often blind to female entrepreneurs altogether. That imbalance excludes women from pipelines before they reach the pitch stage.

Experience and Repeat Founders: A Self-Fulfilling Cycle

Without exits, there are fewer second-time women founders, and that depresses future investment chances.

A European study showed that female serial founders reap more funding and deal better outcomes, but there simply aren’t that many of them due to earlier-stage hurdles and exit barriers. In turn, investors see fewer women starting again, and think the pipeline is thin.

This cycle reinforces itself:

Fewer exits → less investor confidence → fewer women repeat founders → fewer visible success stories.

It’s not that talent is scarce; it’s that second chances are rare.

Access Trumps Interest

In an illuminating example from the UK, founders applying to “gender-smart” early accelerators, those committed to equity, saw better funding outcomes. The primary driver wasn’t superior business plans, it was access to networks, mentorship, and visibility tied to cohorts and programs.

The takeaway is simple: when women are invited, supported, and given platforms, they compete, and win, on level ground.

Pipeline Isn’t the Problem, Access Is

Talent is abundant. STEM numbers, rising women-led deal volume, successful accelerators , all show that women entrepreneurs exist in force. But systematic filters block visibility, warm intros, and mentorship before the business begins.

If the investor premise is that good entrepreneurs are out there, you’re right. The challenge is that too many of them are simply outside the channels where capital flows.

7. How Investors Can Actually Close the Gap

The gender gap in venture capital isn’t inevitable. It’s the result of how deals are sourced, evaluated, and funded. Which means it can be changed.

This is where the conversation shifts from observation to action. If you're a GP, LP, or angel looking to improve outcomes and allocate smarter capital, here’s what doing better actually looks like.

Ask the Right Questions in the Room

Start with the pitch itself. Research from Harvard shows that men are asked promotion-oriented questions (“How will you scale?”), while women are asked prevention-oriented ones (“What are the risks?”).

Instead, train your team to check for that bias in real time. Flip every pitch conversation toward upside, market opportunity, and long-term vision, regardless of who’s pitching. Because sustainable businesses deserve ambitious framing.

Track What You're Actually Funding

If you don’t track it, you can’t fix it.

Start measuring gender at every stage: inbound deal flow, first calls, term sheets, closes. California’s SB-54 already mandates disclosure of founder demographics for funds over $25M. But even if you’re not required to report, tracking internally is smart risk management.

Patterns will emerge. Blind spots will get exposed. And over time, you’ll start building a more balanced, and potentially higher-performing, portfolio.

Don’t Wait for Warm Intros

Most women entrepreneurs are shut out of legacy networks. That means your best female-led deal may never land in your inbox, unless you go looking for it.

Set aside sourcing bandwidth for intentional outreach. Partner with accelerators that back women‑owned startups. Show up at demo days that aren’t filled with the usual suspects, and encourage your associates to surface diverse founders in their thesis areas.

Fund More Women-Led VC Firms

If you want to shift outcomes at scale, invest in the people writing the checks. Women VCs are 2–3x more likely to back female founders. Yet they control a fraction of industry capital.

LPs have leverage here. Back emerging women-led funds. Allocate capital to partners with proven sourcing strength in underrepresented sectors. A more diverse GP landscape creates more diverse cap tables. It’s that simple.

Don’t Stop at Seed

Too many female-led companies get funded early, and then stalled late. Series A+ rounds are where capital gets concentrated, valuations compound, and power shifts. But that’s also where investing in female founders drops off most sharply.

Fix that. Bring your best follow-on support to the women in your portfolio. Back them at growth stages. Champion them during M&A. Include them in co-investment syndicates. These are the moments that define generational wealth, and investors have a front-row seat.

This isn’t a quota play. It’s a quality play. The opportunity is real, the talent is there, and the outcomes are already outperforming. The question is whether you’re willing to adjust the way you look. Because the investors who do will build better portfolios. The ones who don’t will just keep explaining why they missed them.

8. Closing Argument: Don’t Just Do Good. Do Better Business

The real question isn’t “Why invest in women?” It’s “Why haven’t you yet?”

Because here’s what we know: women‑owned startups deliver more revenue per dollar, unlock untapped markets, and outperform on capital efficiency.

They’re not a diversity initiative. They’re a better investment.

And yet, the capital still flows in the opposite direction. The VC gender gap persists not because the talent isn’t there, but because the system hasn’t caught up. It’s easier to fund what looks familiar, even if the returns say otherwise.

This isn’t about virtue signaling. It’s about value creation.

The case for investing in female founders is economic, strategic, and moral. Backing them means better portfolios, stronger exits, and a startup ecosystem that reflects the world it claims to serve. It means rethinking your pipeline, your partners, and your pitch rooms, not as charity, but as alpha.

Because if you're still asking whether women entrepreneurs deserve the capital… you're asking the wrong question

A bit odd to use Elizabeth Holmes as the article image. She’s an outlier and does not represent the majority of women-led businesses. Featuring it as the main image is contradictory to your main point.

You could make an argument Silicon Valley is hostile to women, but it's actually all of America. The U.S. does not provide federally mandated paid maternity leave, being the only industrialized country without a national paid leave policy. That's not a normal policy and it's indicative of wide sexism normalized in the culture. The women in Tech movement back in the early 2010s basically failed and things have been going downhill now with the assault on DEI. Witness how women are treated on social media? Cards are stacked against you in the U.S. if you are a woman, are non-white or have a goofy (non-American) English accent. In VC both on the partner and startup side, this gets magnified.