15 Charts That Explain How Tech and Venture Are Changing in 2025

AI adoption, shrinking teams, global capital flows, and the rise of defense and developer tools. This is what’s really happening beneath the headlines.

Everyone in tech can feel it — the pace, the compression, the quiet reordering of how value is created.

AI is scaling faster than the institutions that fund it.

Startups are growing with fewer people.

Europe is learning how to defend and fund itself.

This article looks at the data behind the shift.

Fifteen charts that reveal how technology, capital, and careers are being rewritten in real time.

Let’s dive in.

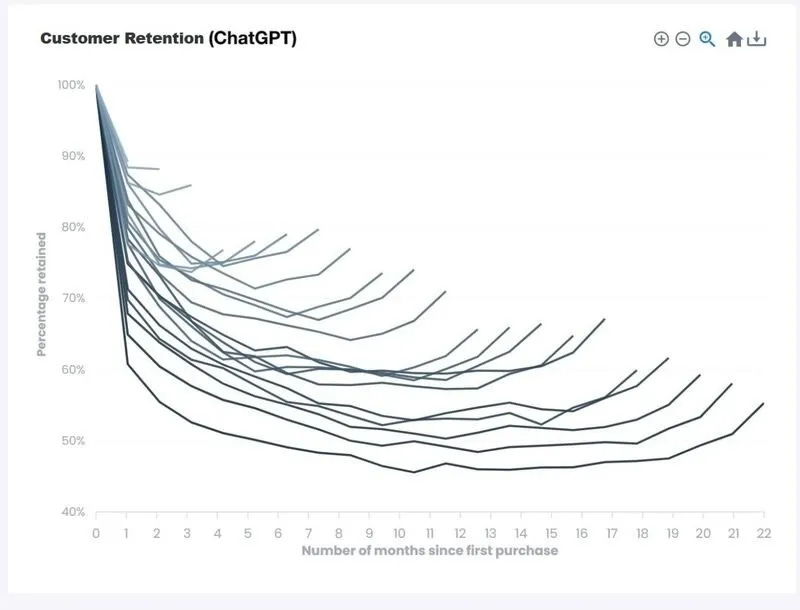

1. ChatGPT Retention Patterns 🧩

(Source: Similarweb)

Most viral apps fade after the first month. ChatGPT bends that curve upward.

Retention improves after year one as users integrate it into work and learning.

Habits compound. AI becomes infrastructure.

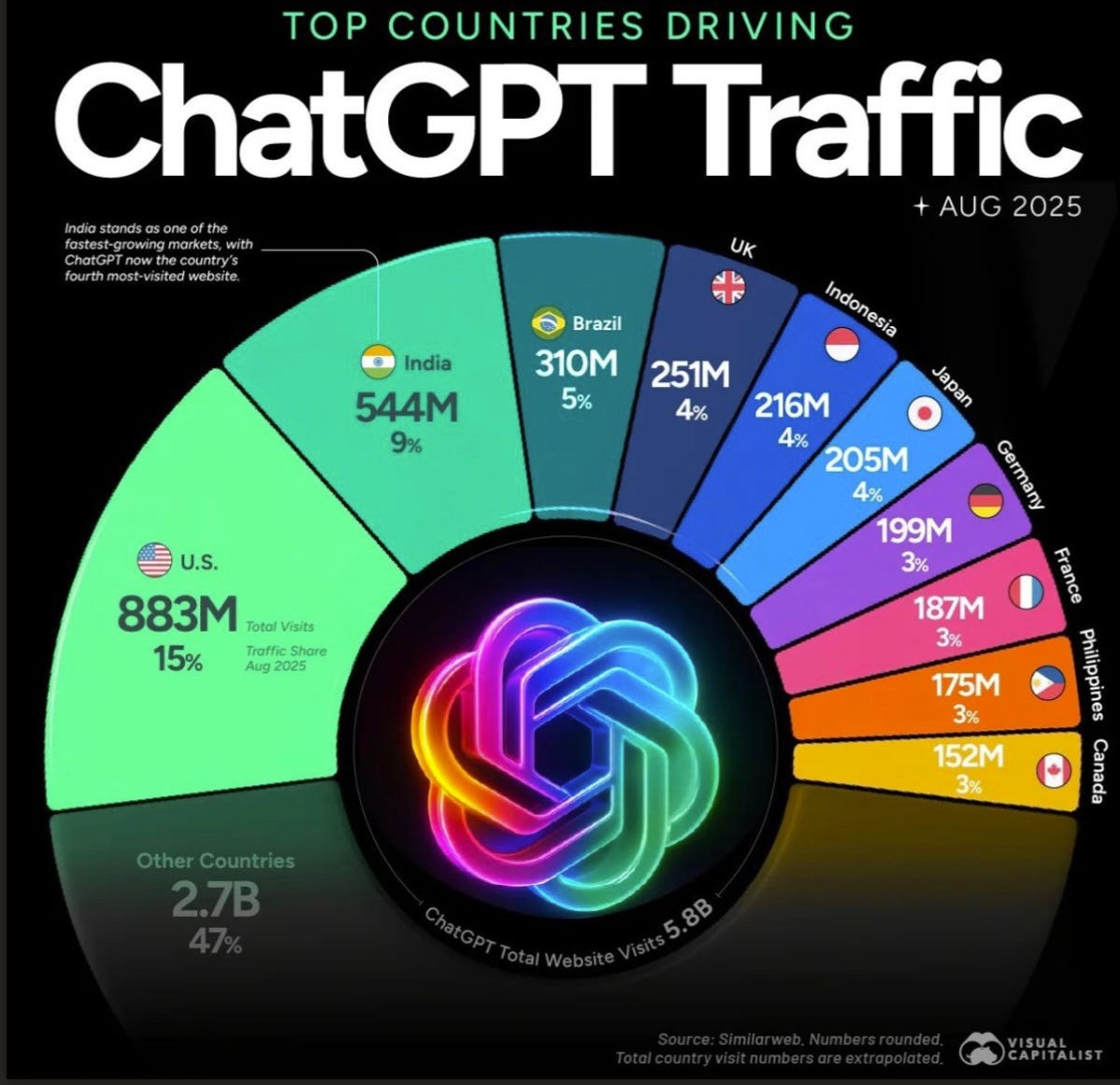

2. ChatGPT’s Global Reach 🌐

(Source: Visual Capitalist / Similarweb)

The United States drives fifteen percent of ChatGPT traffic, while India contributes nine percent.

AI adoption is now truly global.

The next generation of AI users will come from emerging markets, not just Silicon Valley.

a complete system to organize your raise, find investors, and automate your workflow:

Built with Notion and shared exclusively through The VC Corner 💸

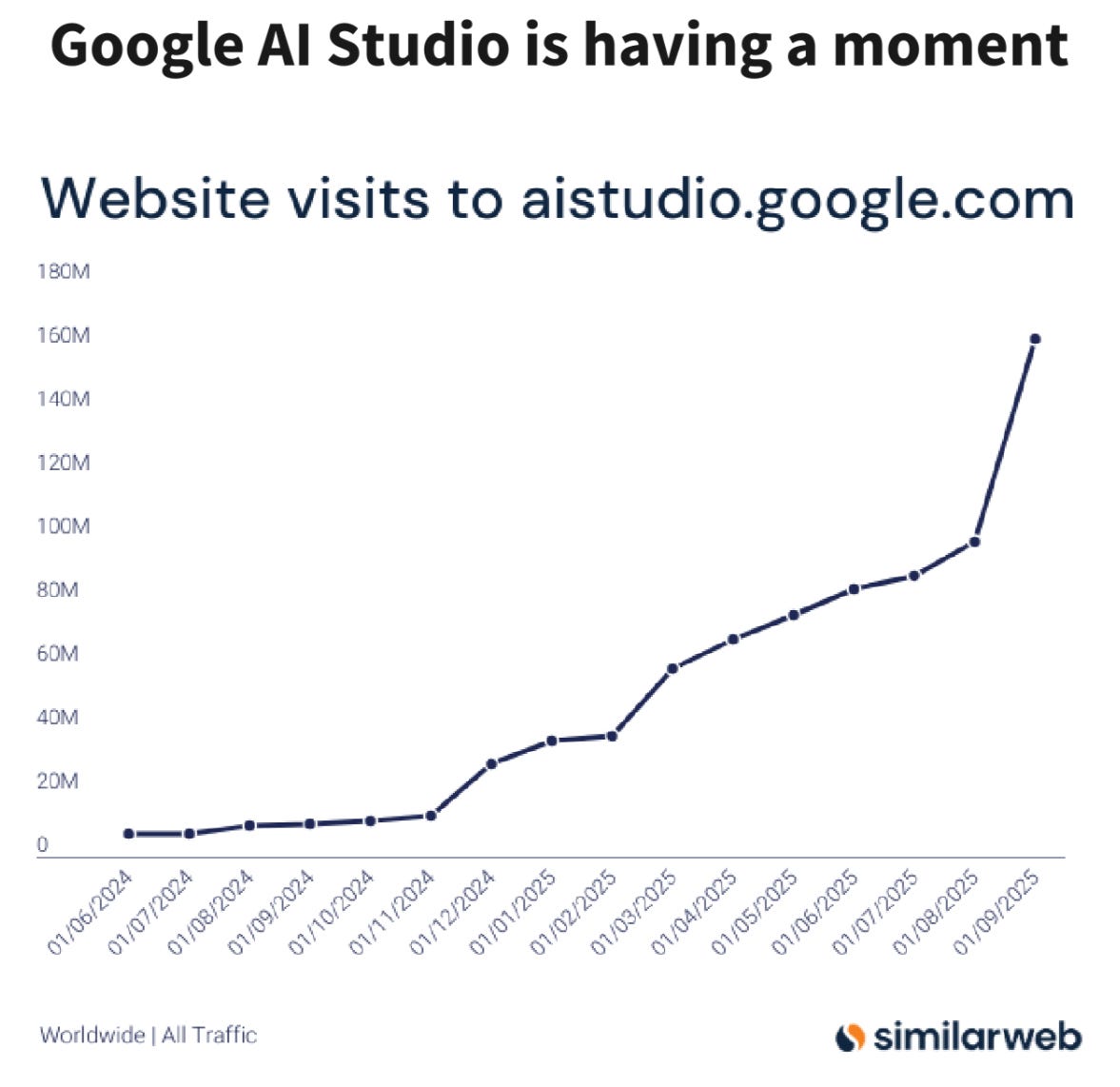

3. Google AI Studio’s Breakout 🚀

(Source: Similarweb)

Google AI Studio’s traffic exploded from almost nothing to more than 160 million visits.

Google is finally building momentum in AI by focusing on developer tools rather than chatbots.

The next frontier will not be conversation. It will be creation.

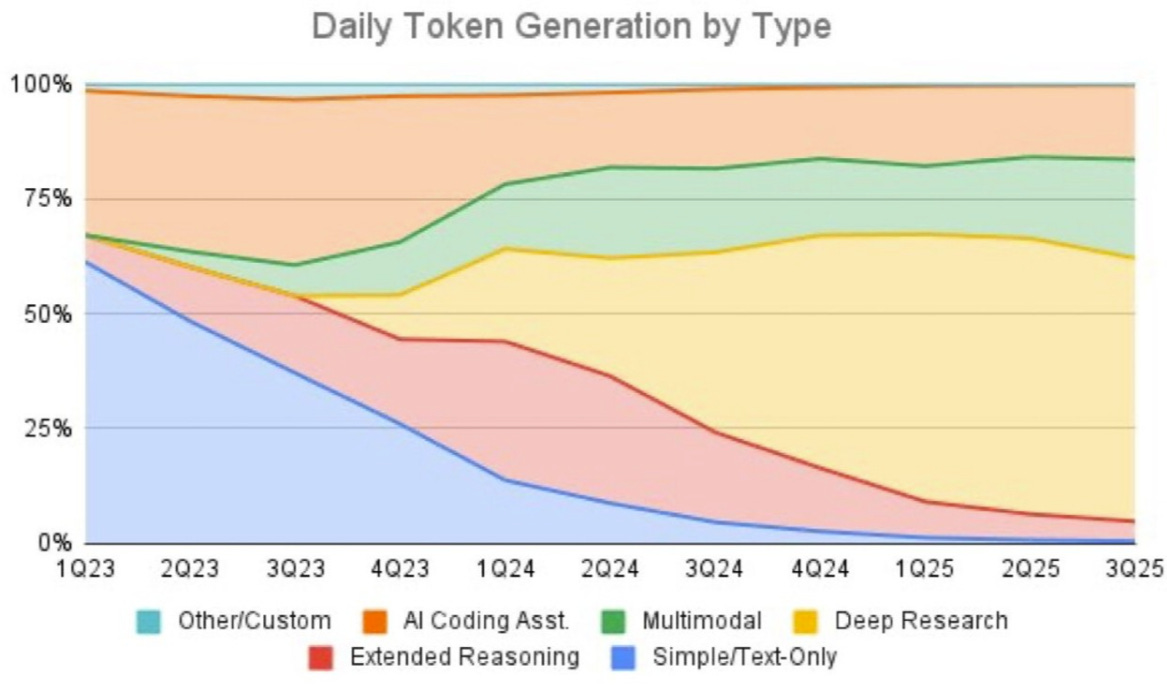

4. The Decline of Simple Text AI 🧩

(Source: OpenAI community data)

Text-only generation is shrinking while multimodal and deep reasoning use cases grow.

AI is moving from writing words to solving problems.

The future of models is not text completion. It is cognition and context.

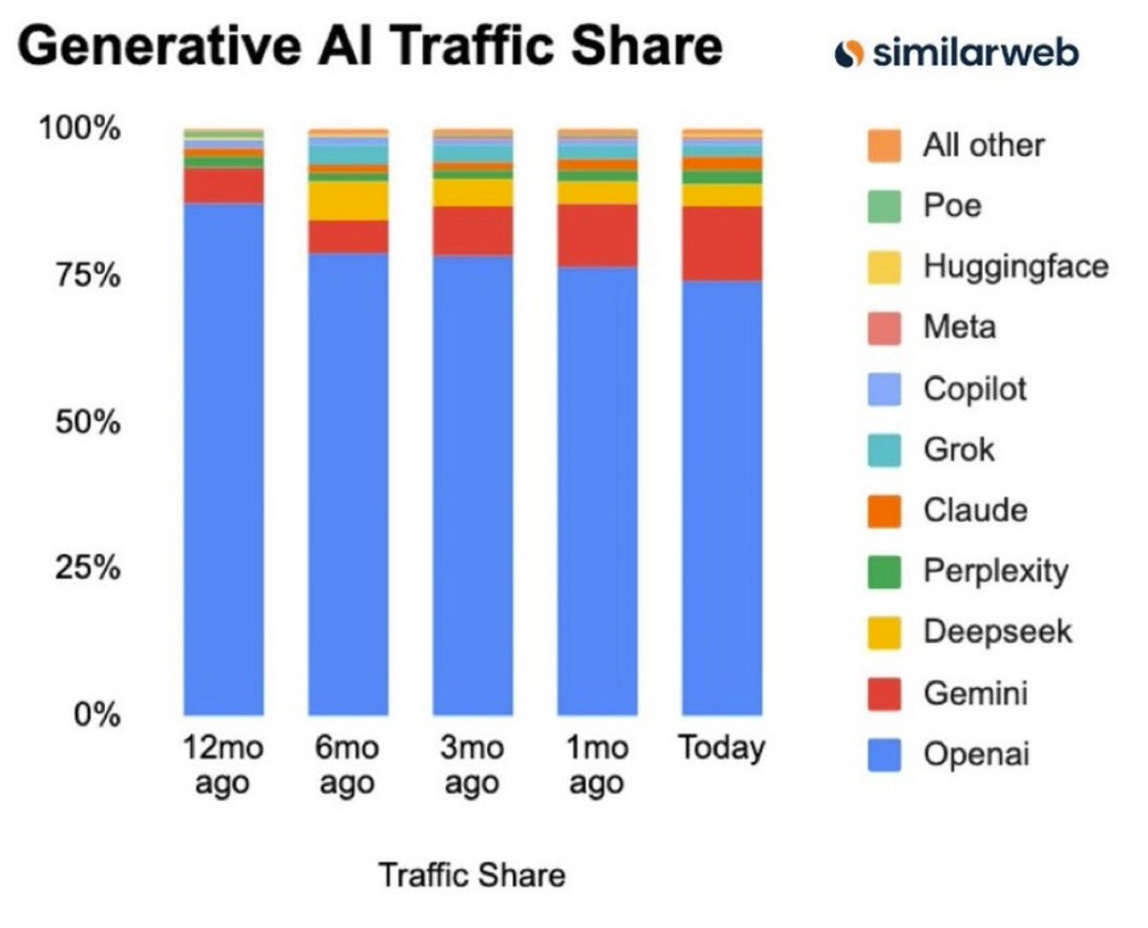

5. Who Controls the AI Traffic 🔍

(Source: Similarweb)

OpenAI still dominates global traffic among generative AI platforms.

Claude, Gemini, and Perplexity are slowly gaining ground.

The race is no longer about model quality. It is about habit and distribution.

6. Vibecoding: Try, Pay, Churn? 💻

(Source: Code Completion Tracker)

The AI coding market is in constant motion.

Tools like Base44 grew more than nine hundred percent, then cooled within weeks.

Developers test, pay, and churn faster than any other category.

It’s a reminder that in developer tools, novelty fades quickly and retention is everything.

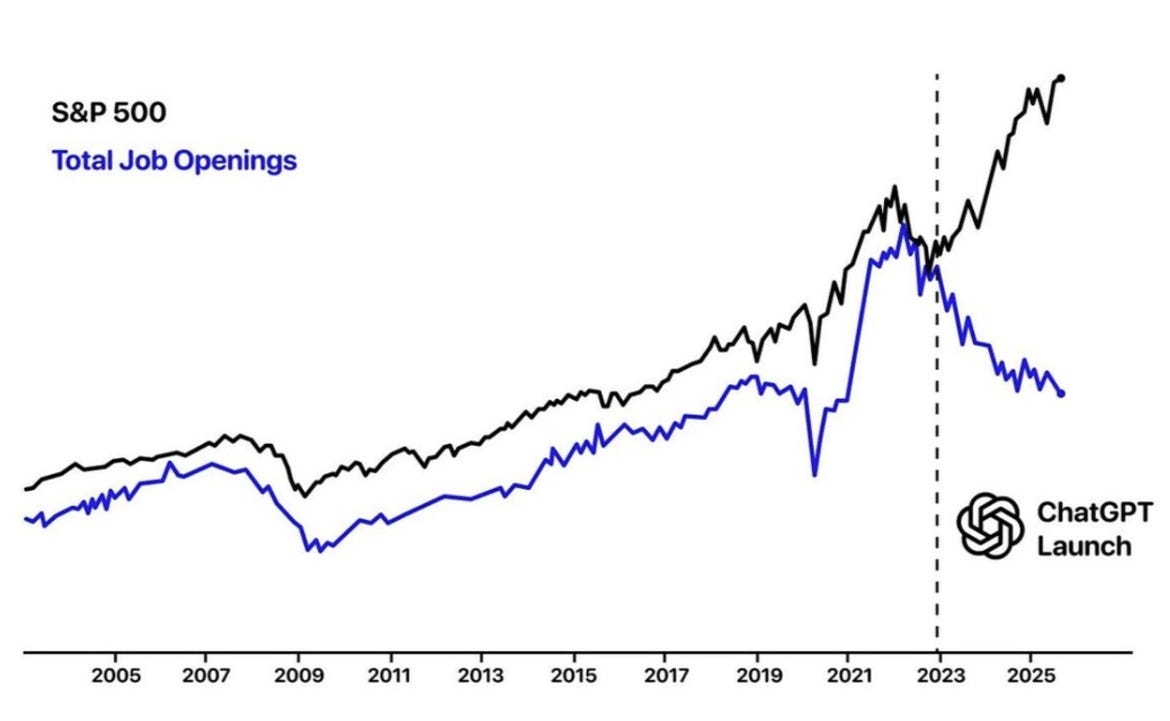

7. Job Openings vs the S&P 500 📈

(Source: Chartr)

Since the launch of ChatGPT, job openings have fallen while the S&P 500 has continued to rise.

The market is rewarding efficiency more than expansion.

AI is not destroying all jobs, but it is compressing the cost of work. Productivity improves while the need for labor adjusts.

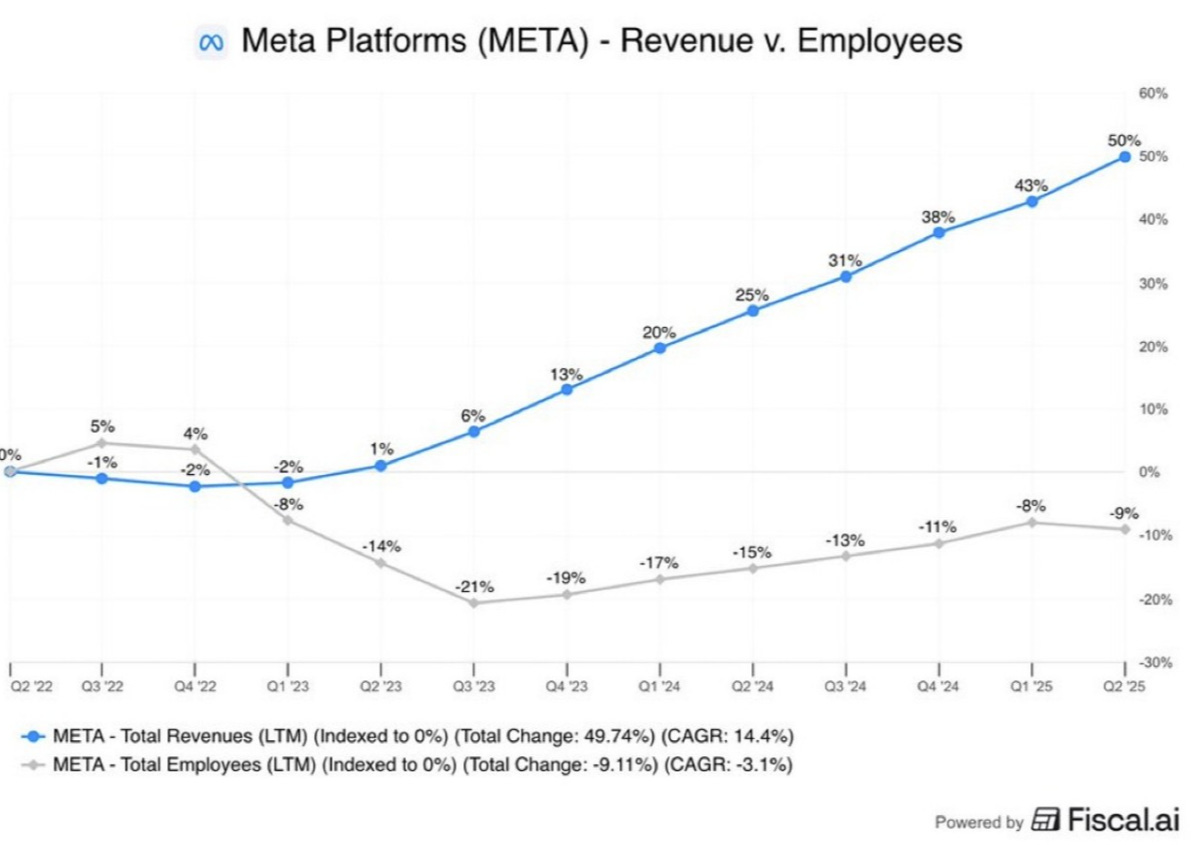

8. Meta’s Year of Efficiency 🧠

(Source: Fiscal.ai)

Meta cut nearly ten percent of its staff and still grew revenue by fifty percent.

Zuckerberg’s “year of efficiency” turned into a masterclass in operational focus.

Smaller teams, clearer priorities, faster execution. The new model for Big Tech.

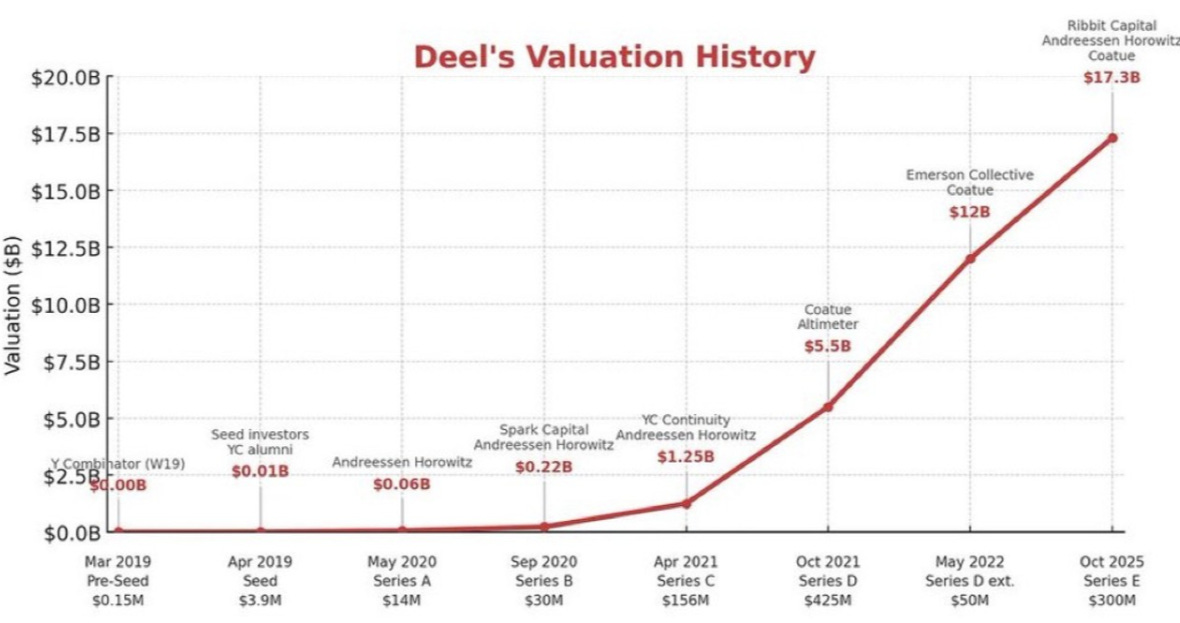

9. Deel’s Rise to Seventeen Billion 🌍

(Source: Deel.com)

Deel started at Y Combinator in 2019 and has reached a valuation above seventeen billion dollars.

It built the financial infrastructure for a global, remote workforce.

The company proved that distributed teams can scale faster than traditional HQ-bound startups.

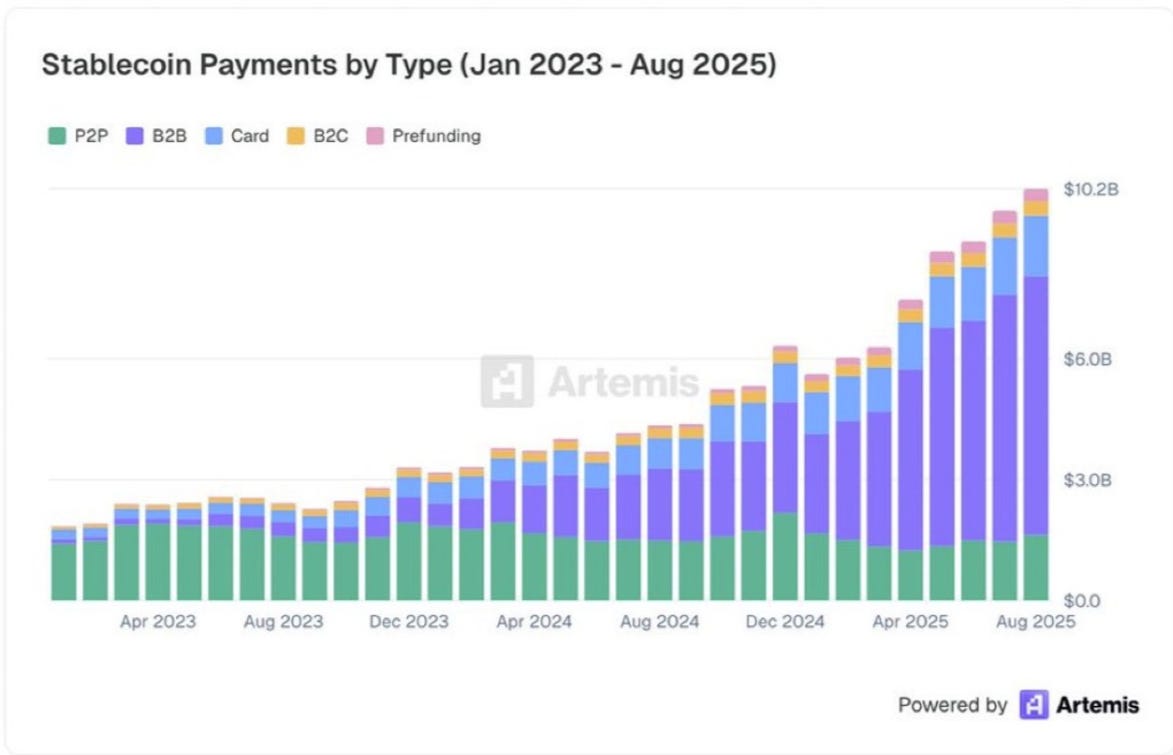

10. Stablecoins Find Their Use Case 💰

(Source: Artemis)

Stablecoin payments now surpass ten billion dollars each month.

The speculative phase is ending, replaced by real utility.

Crypto’s killer app turned out to be speed, not hype.

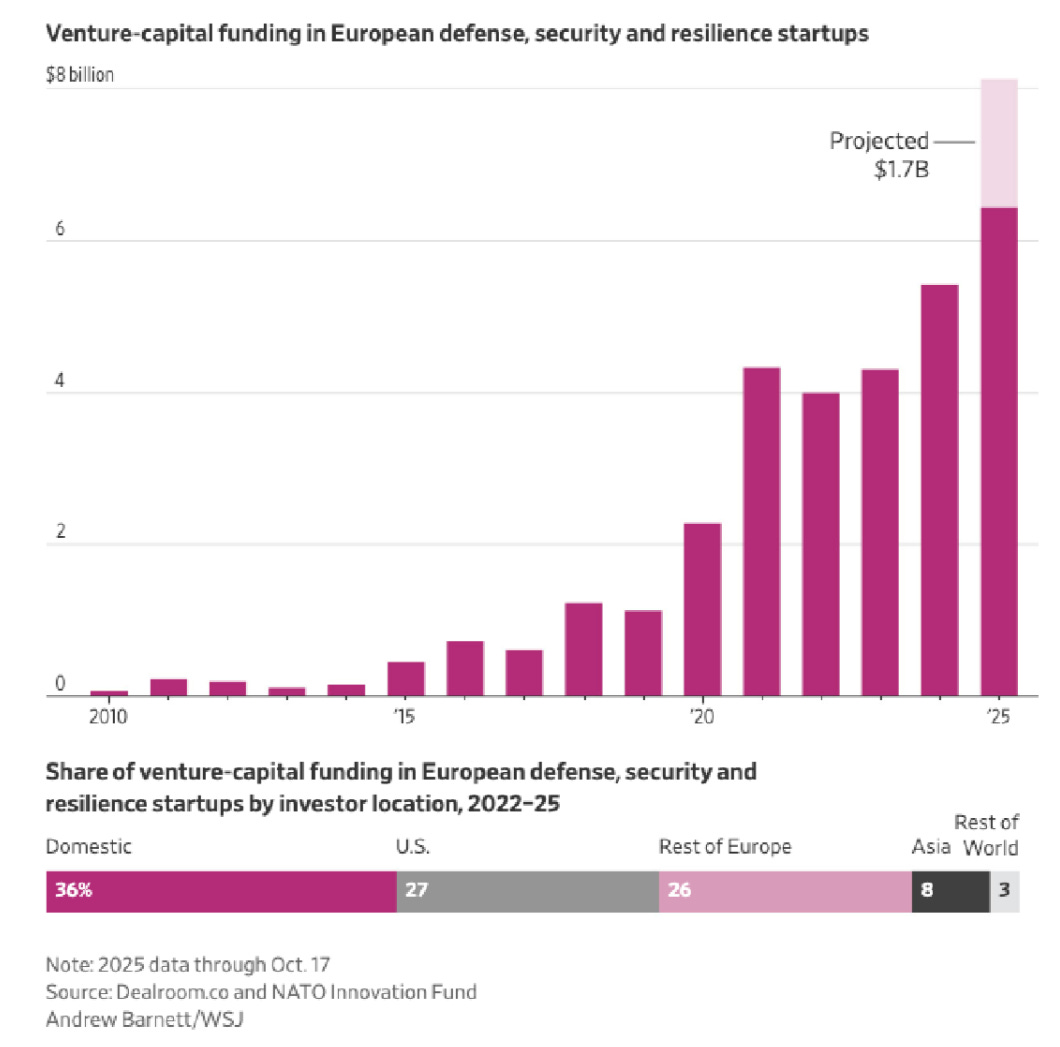

11. Europe’s Defense Tech Moment 🛡️

(Source: Dealroom / WSJ)

Venture investment in European defense, security, and resilience startups has nearly tripled since 2020.

Governments, funds, and founders are aligning around one idea: technological sovereignty.

Europe is finally funding strategic depth, not just convenience apps.

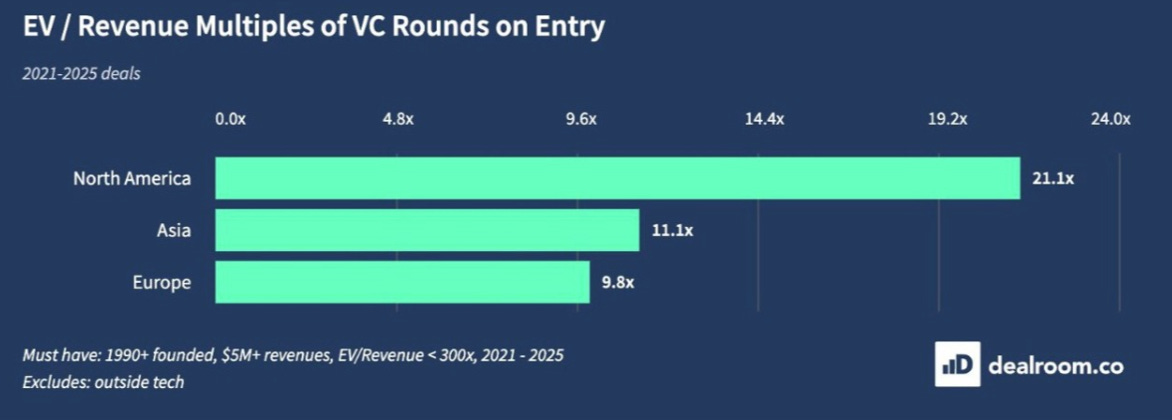

12. VC Funding Multiples by Region 🌎

(Source: Dealroom)

Valuations for startups in North America remain twice as high as those in Europe.

Investors pay a premium for growth stories, not for fundamentals.

For disciplined founders in Europe, this is the opportunity: quality capital at rational prices.

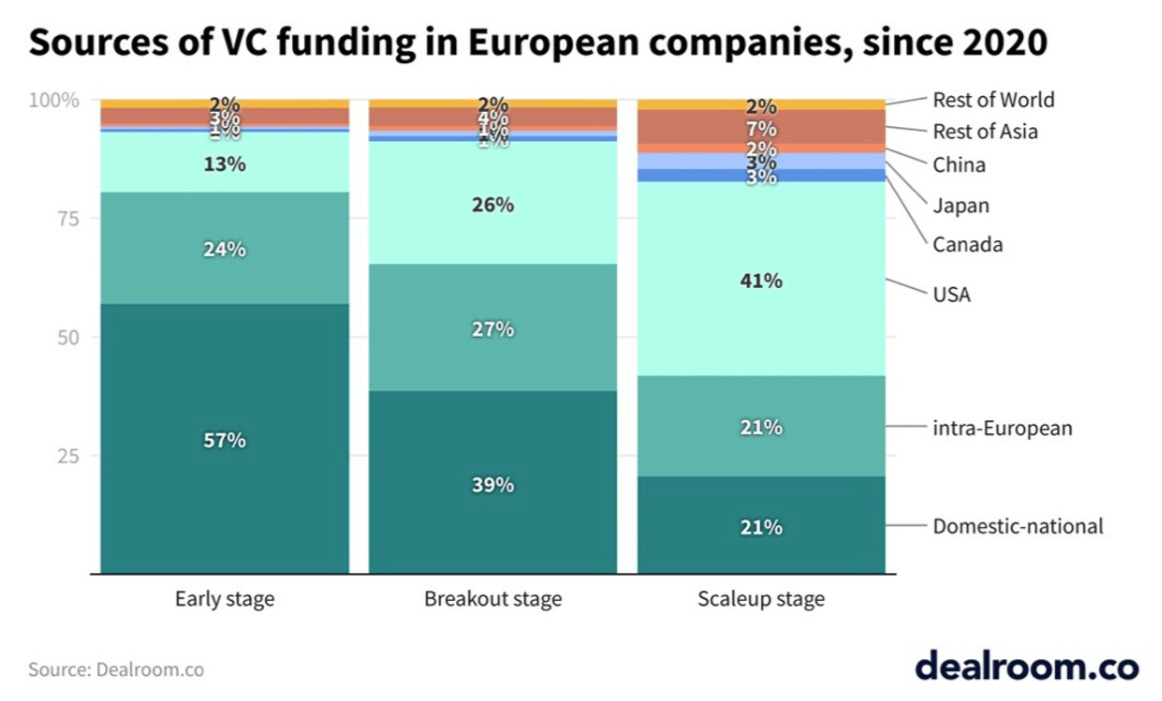

13. The European Funding Gap 💶

(Source: Dealroom)

At the early stage, most capital in Europe comes from domestic and regional investors.

By the scaleup stage, forty-one percent of funding is American.

Europe creates great startups but often exports their upside. Closing that gap will define the next decade of venture here.

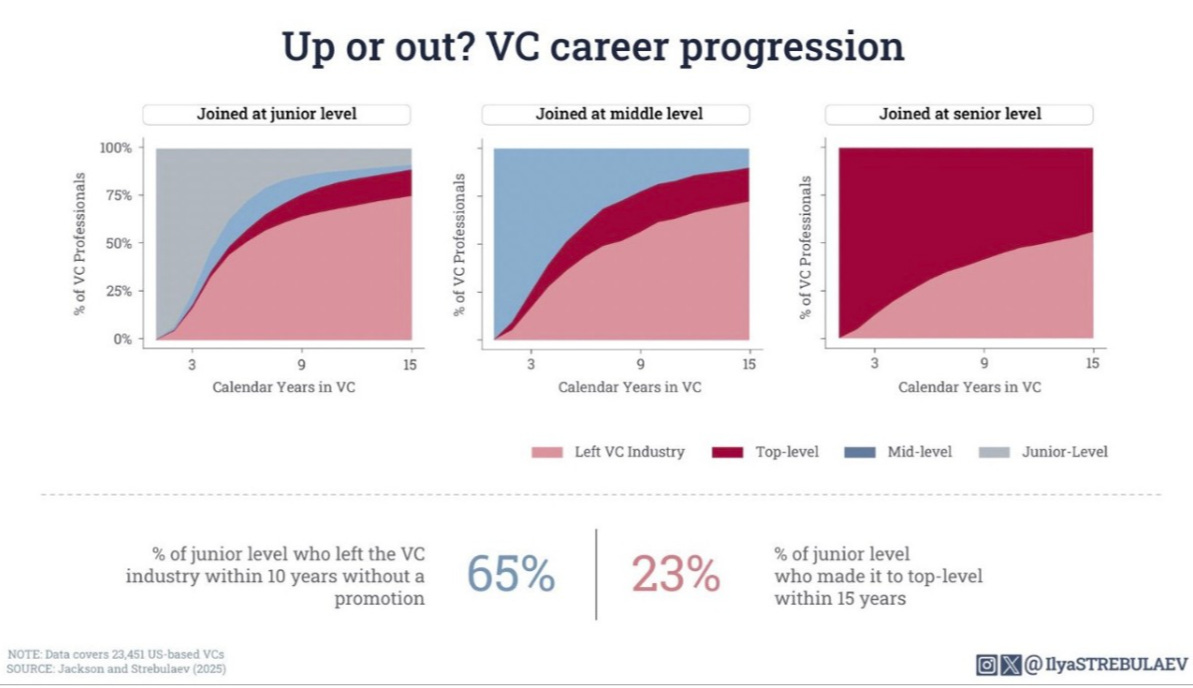

14. VC Career Progression 📉

(Source: Jackson & Strebulaev, 2025)

Sixty-five percent of junior VCs leave the industry within ten years. Only twenty-three percent reach partner level.

Venture capital is not a traditional career path.

It rewards visibility, distribution, and deal flow more than seniority.

Great insights, thank you for sharing

Love it!