The Most Overlooked Source of Runway in 2025 (And How Top Founders Maximize It)

A founder’s guide to cloud credits and AI tools that reduce burn without raising capital.

The Hidden Capital Founders Don’t Know About

Cloud and AI infrastructure costs have never been heavier, and they’re only trending upward. At the same time, fundraising cycles are dragging out, and VC capital is at its most conservative state it’s ever been.

The result is that early-stage teams are burning 30-40% of their cash just to keep the lights on with infra and tools, and that’s before they’ve even hit product-market fit.

But what if there was another way? A new type of non-dilutive capital that’s actually hiding in plain sight. That’s startup credits.

Most founders think they are just freebies or perks so they tend to overlook them or activate them at the wrong time and waste the leverage.

This guide does not give you clever hacks or coupon-clipping tips. It’s about knowing how the ecosystem actually works and using it to your advantage. The founders who master this earn themselves months of survival without giving up a single percentage of equity.

Here, we lay out over $500K worth of credits across cloud, AI tools, ops platforms, and GTM stacks that every AI-driven startup should be tapping. More importantly, it shows you how to stack, time, and stretch them so they become real capital, the kind that buys you oxygen when you need it most.

- Brought to you by MongoDB for Startups

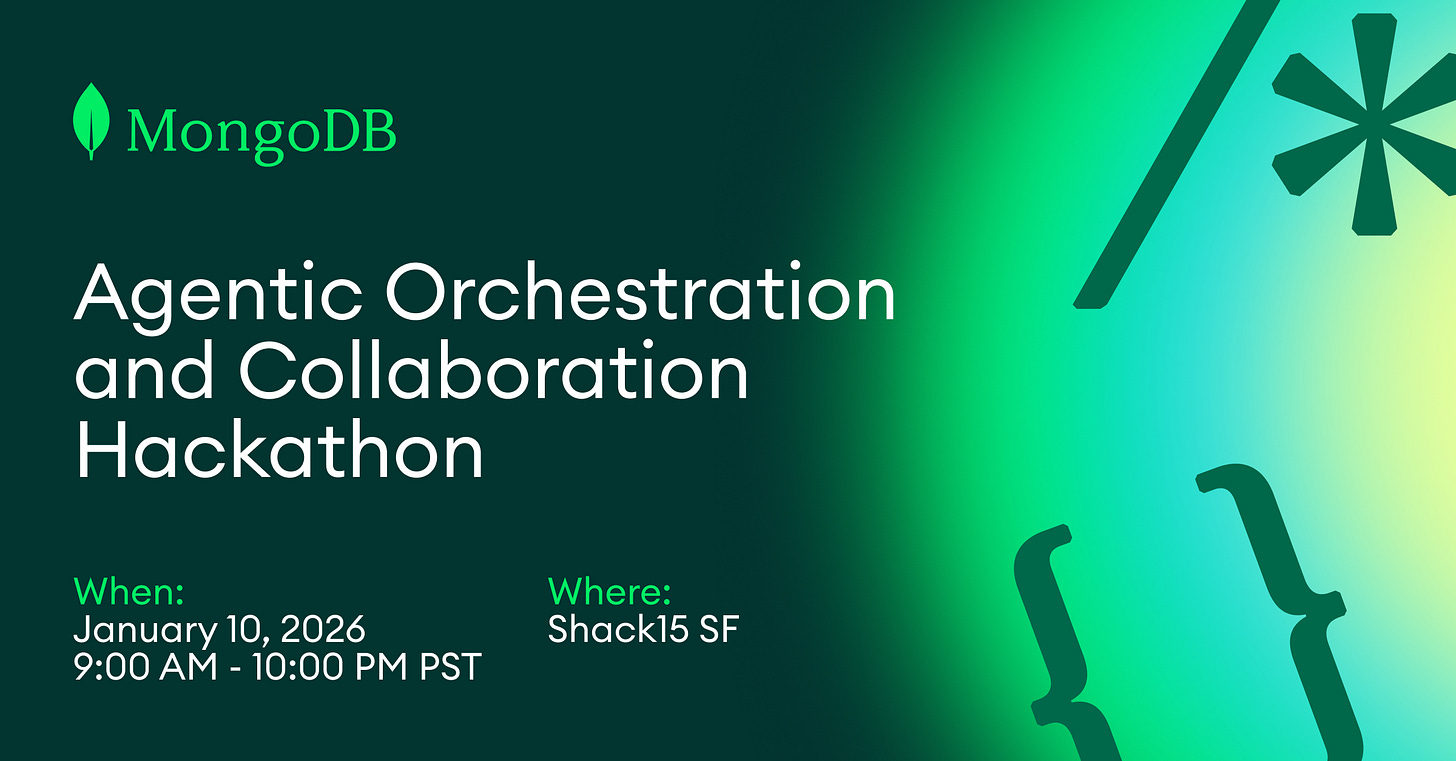

AI agents are everywhere, but how do they work together?

Join MongoDB’s Agentic Orchestration Hackathon and team up with top developers to build tools, agents, and techniques that enable AI agents to communicate.

* $30,000+ in prizes for the most innovative projects

* Pitch your ideas to top industry leaders and get expert feedback

* Finalists showcase live at MongoDB.local San Francisco on January 15

This in-person event is for teams of up to 4, with limited spots. Apply now to secure your spot on January 10 and help shape the future of agentic AI!

Table of Contents

1. Why Credits Are Strategic and Not Just Freebies

2. The Startup Credits Landscape in 2025

3. Deep Dive by Category

4. The Founder Playbook for Maximizing Startup Credits

5. Common Pitfalls and Blind Spots When Using Credits

6. The All in One Checklist for Startup Founders

7. Startup Credits as the Bridge Between Idea and Product Market Fit

1. Why Credits Are Strategic and Not Just Freebies

We are not talking about coupons that will save you a few bucks here and there. Startup credits about strategic runway extension.

For an early-stage AI company, every month of oxygen you can buy without giving up equity or draining your bank account is survival capital. And for AI startups, survival capital is the difference between a bankrupt founder and the next unicorn. Credits give you that breathing room.

Used appropriately, credits let you run more model experiments, stress-test infrastructure at scale, and expand your go-to-market stack without locking yourself into burn-heavy contracts. They let you validate product directions faster, hire later, and push fundraising back until traction looks stronger.

Essentially, they are a multiplier on your time to product-market fit.

The opportunity cost of ignoring credits is steep. Every dollar spent unnecessarily on infrastructure or tools is a dollar you can’t use to recruit talent, market your product, or extend runway. Worse, it’s dilution you never needed to take. A founder who leaves credits on the table is effectively throwing away months of operating time.

This is why credits need to be part of your fundraising and operating strategy from day one. Startup credits can become a competitive advantage, and knowing how to unlock and sequence them is one of the sharpest survival skills a founder can have.

2. The Startup Credits Landscape in 2025

The credit ecosystem in 2025 is richer and more fragmented than ever. Every major player in cloud, AI, and SaaS is fighting to lock in founders early, which means there’s real money on the table; often hundreds of thousands of dollars if you know where to look.

The trick here is to stack them smartly and time activations precisely so the clock starts only when you’re ready.

Cloud Infrastructure

AWS, Google Cloud, Azure, IBM, and Scaleway all compete aggressively for early-stage loyalty. Packages range from tens of thousands up to $350K for AI-focused teams.

These credits cover compute, storage, and networking, which is the expensive backbone of every AI company. Used wisely, they let you train, test, and deploy models at enterprise scale long before you raise enterprise-scale money.

AI-Native Tools

A second wave of credits now targets the AI tool layer. ElevenLabs offers a year of voice generation credits, Retool helps you spin up internal dashboards for free, PostHog powers analytics at scale, and Cloudflare Workers AI pushes inference to the edge.

On top of massive cost saving, these programs unlock capabilities you’d otherwise postpone.

Operations and Productivity

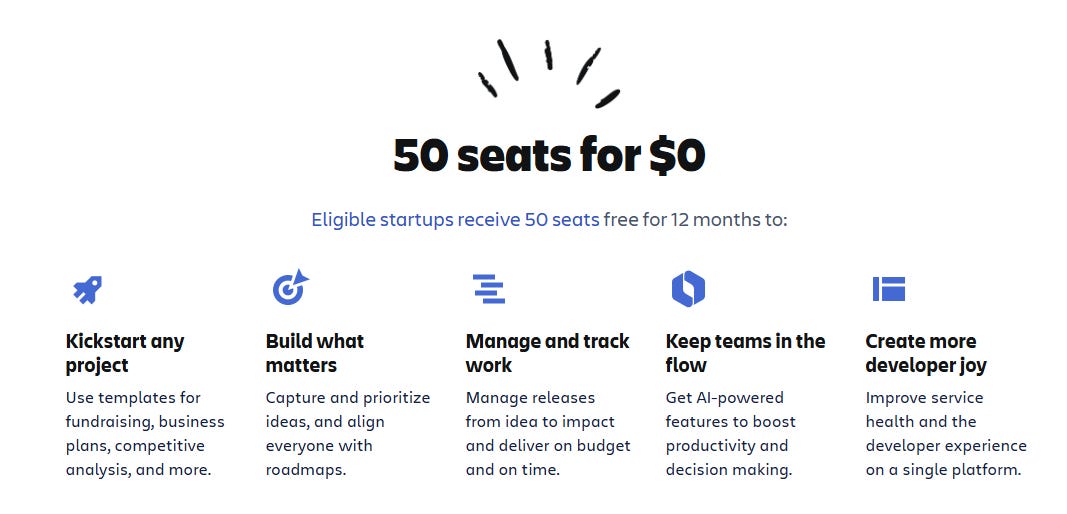

If there’s anything that kills startups faster than tech debt, it’s chaos. So tools like Notion, Linear, Miro, and Atlassian offer free or heavily discounted plans that let small teams run like seasoned operators. The credits here keep you organized without adding burn.

GTM and Customer Stack

HubSpot, Intercom, and Zendesk are generous with early discounts and credits, often covering year one of customer acquisition and support. For founders, this means you can build distribution muscle without being crushed by SaaS pricing.

In 2025, the founders who thrive are the ones who build a credit playbook by stacking, sequencing, and stretching these programs into real runway.

3. Deep Dive by Category

a. AI and Data Tools

For AI-first startups, the bottleneck isn’t just compute, but the tooling layer that makes your product usable, testable, and scalable. This category is where credits act less like savings and more like multipliers. They let you stand up features you couldn’t afford to build from scratch.

ElevenLabs is one of the best examples. Their startup grants give you 12 months and over 33 million characters (roughly 680 hours) of AI-generated audio. For a founder building voice interfaces, this is the difference between shipping a prototype and proving real use cases in gaming, accessibility, or education.

The trick is once again timing. Don’t redeem too early if you’re still iterating, because the 12-month clock starts immediately.

Vapi AI is carving out the conversational agent niche. While their credit program isn’t as publicized, many AI founders report early access deals and partnership discounts. If your product depends on multi-turn interactions, these credits let you stress-test without eating your runway on per-call pricing. The pitfall, however, is that usage-based billing can spike fast. Credits cushion it, but you still need guardrails.

Algolia provides $10,000 in search credits for startups under three years old. It’s invaluable for retrieval-heavy products like marketplaces, knowledge tools, or AI copilots. But remember that many founders have reported Algolia as being sticky. Migrating off it later can be painful, so activate only when you’re confident you’ll stick with it beyond year one.

PostHog stands out by replacing several tools in one go: analytics, feature flags, A/B testing, and session replay. The free tier alone covers up to 30M events per month, with an extra $50K in credits once you scale. Founders should see this not as a “nice-to-have” but as a PMF weapon that allows them to run real experiments without waiting for budget approval.

Retool offers up to $60K in free credits for building internal tools. Do you know how many early-stage teams burn their time building dashboards, admin panels, and ops workflows from scratch? Retool is a life saver in such cases. Use their credits to free up engineering cycles for customer-facing work. Just know that activation requires a paid plan first, so time it when your team is ready to commit.

Finally, Cloudflare Workers AI allows you to deploy inference at the edge with up to $250K in startup credits (if you qualify for their top tier). For AI founders chasing latency-sensitive use cases, meaning real-time translation and edge voice, this is gold. The catch is the tiering, as most early-stage companies will qualify for $5K–$25K, unless you’re VC-backed or AI-focused enough to get bumped higher.

The throughline here is simple: AI and data tool credits are accelerants. They let you unlock product layers months, even years, earlier than your cash position would normally allow.

b. Cloud Infrastructure

Cloud is where most AI startups bleed out. GPUs, storage, networking; they’re the line items that eat 30–40% of early burn before revenue even shows up. This is why cloud credits are the single most important category to master.

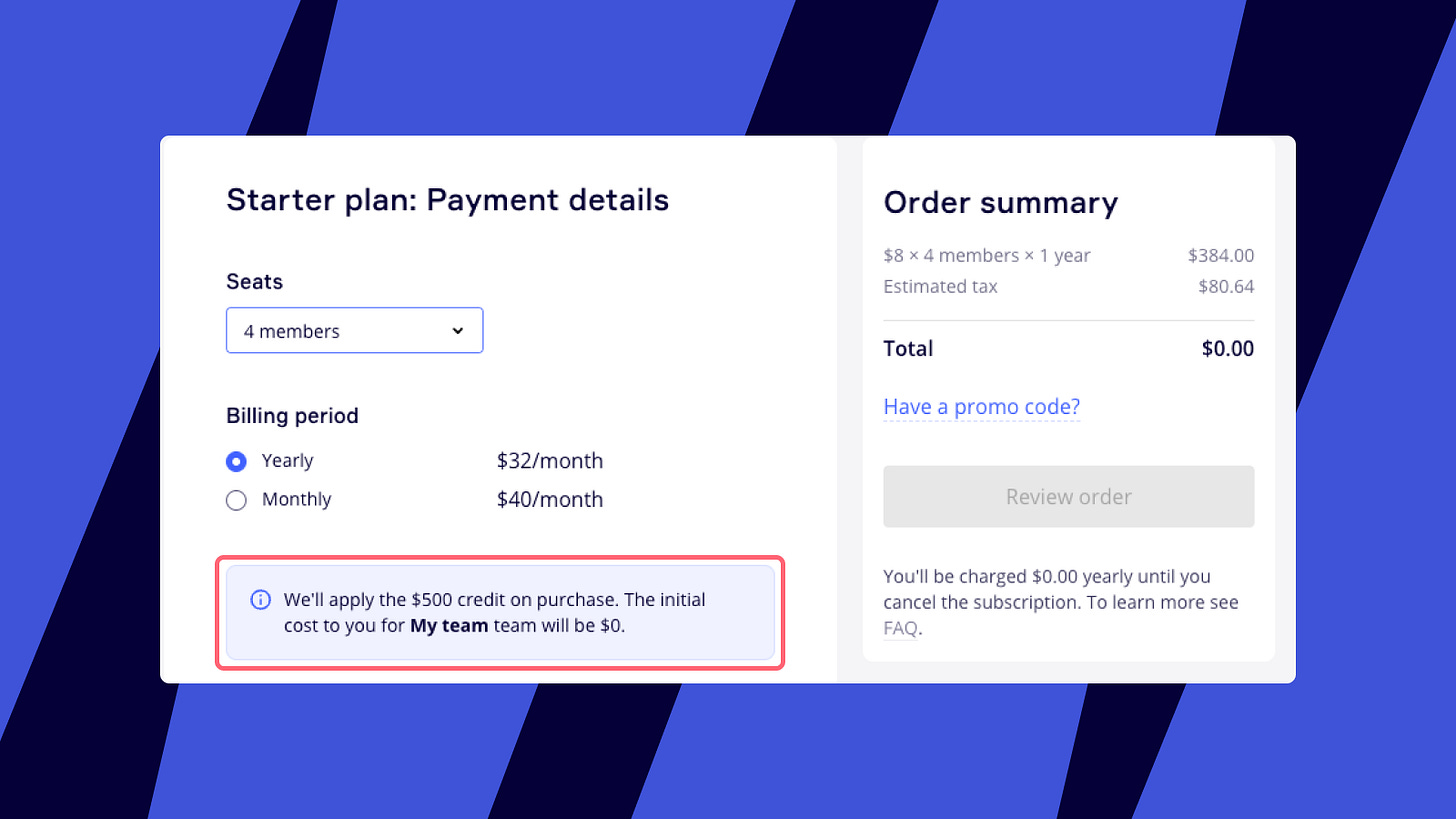

AWS Activate sets the tone with packages ranging from $5K up to $100K in credits. The top tier requires backing from a major accelerator or VC, but even the lower tiers can carry a seed-stage startup through critical experiments. AWS credits are versatile as they cover everything from S3 to SageMaker. However, advanced support tiers often aren’t included, so you’ll need to plan for what happens after the credits expire.

Google Cloud for Startups is especially aggressive with AI companies, offering up to $350K in credits over two years. That two-year runway is huge. Unlike the standard 12-month cliff, you can build with confidence that costs won’t explode in year one. The key strategy is to stagger usage so you’re not consuming everything in the first six months.

Azure Founders Hub gives up to $150K in credits, plus GitHub Enterprise seats and Microsoft 365 licenses bundled in. The unique play here is early accessibility. Even idea-stage founders can apply and get an initial stack. You don’t need VC validation to get started. For bootstrappers or solo builders, this is a strong entry point.

IBM Cloud and Scaleway are less mainstream but strategically valuable. IBM often throws in credits plus access to their enterprise AI tooling, which can help if you’re targeting regulated industries. Scaleway is winning attention for its aggressive GPU pricing, including NVIDIA H100s. Their startup program provides up to €36,000 of credits, free consulting support and a strong startup community that new founders always value.

And that’s the founder’s edge here: multi-cloud arbitrage. Don’t treat cloud credits as a one-and-done. Use AWS credits year one, then transfer your workloads to GCP or Azure in year two. You can also split workloads by hosting your inference-heavy pipelines on GCP’s AI stack, and ops infrastructure on AWS. This method not only saves cost, it also provides both leverage and optionality in vendor negotiations when one program runs out.

The only pitfall is migration costs. Shifting workloads too often can erase the benefit of credits. The right play is to design modular architecture from the start so you can move pieces, not rebuild the house.

c. Ops and Productivity

Founders love to obsess over infra, but operational debt sinks startups faster than compute costs. A messy ops stack bleeds time, creates chaos, and distracts from building the product. The right productivity credits keep you lean and disciplined.

Notion offers three to six months of its Business Plan free (worth up to $6K with AI included). Notion can be used as your startup’s operating system, with all docs, wikis, project boards, and knowledge base in one. The key here is activation timing. Try not to waste the free months when you’re still three co-founders in a Google Doc. Trigger it when you have a team to onboard.

Linear gives up to six months free on its issue tracker if you come via a partner VC or accelerator. Linear’s appeal is speed and clarity; it cuts the bloat of Jira while keeping engineering disciplined. But it’s capped at <50 employees, so use it in your early scaling window.

Miro provides $500–$1,000 in credits, enough to cover brainstorming and design sprints for months. It’s perfect for distributed teams that need collaboration rituals without shelling out. Again, timing matters, so you should activate when you’re starting to run structured workshops or remote ideation, not before.

Atlassian (Jira, Confluence, Trello) and Shortcut (another lightweight project tracker) both run startup programs with discounts and free months. However, don’t double-stack these. Choose one system early and stick with it. Switching mid-flight will eventually slow you down. And no amount of free credits can offset it.

The common mistake with productivity credits is treating them as free toys. Founders spin up every tool they qualify for, and teams drown in context switching. The discipline is to choose a lean stack and activate strategically. Credits are oxygen masks, not invitations to tool sprawl.

Executed perfectly, ops and productivity credits let a 5-person team run like a 50-person team; without the overhead. That’s the ultimate leverage.

d. Customer and GTM Stack

Most founders underestimate the go-to-market stack. They’ll obsess over cloud GPUs while running customer acquisition off spreadsheets. But scaling distribution is just as existential as scaling infrastructure, and credits here can buy some serious runway.

HubSpot for Startups offers up to 90% off in year one, tapering to 50% in year two and 25% ongoing. That steep first-year discount lets you run enterprise-grade CRM, marketing automation, and sales ops before you have enterprise-grade revenue. But be mindful because once the taper kicks in, costs rise quickly. Only commit if HubSpot is a long-term fit.

Intercom gives 90% off in year one, then steps down to 50% and 25%. It’s ideal for live chat, onboarding flows, and support bots. For early-stage founders, this means you can look “scaled” from day one, but avoid the trap of overbuilding workflows that you’ll struggle to maintain later.

Zendesk offers six months free on its support suite. That window is long enough to set up help centers, ticketing, and support automation. For B2B AI startups landing early pilots, this can be the difference between looking amateur and looking enterprise-ready as early as possible.

The founder lesson here is to not underestimate distribution credits. Infra keeps your product alive, but GTM tools help you prove there’s a market. Ultimately, these tools help you capture, convert, and support customers at a fraction of the true cost.

Founders who are unaware of these will spend their precious seed round on SaaS bills instead of growth. But using them correctly gives you the credibility to raise your next round with a clean funnel and happy customers.

4. The Founder Playbook for Maximizing Startup Credits

Getting accepted into credit programs is the easy part. The hard part is using them in a way that actually extends runway instead of creating bloat. If you want to do that, here’s the exact founder’s playbook:

Timing

The clock usually starts the moment you activate credits, not when you apply. That means if you’re still building prototypes or running on free tiers, hold off. Trigger credits only when you’re ready to deploy workloads, onboard users, or scale experiments. Poor timing is the number one way founders waste six figures of free capital.

Stacking

Here’s a pro tip: Run your startup like a hedge fund manager.

That means by diversifying across providers. It might sound complicated at first, but your future self will thank you.

Use AWS credits in year one, shift inference to GCP in year two, then test GPU pricing on Scaleway. But do that while avoiding fragmentation: don’t split your architecture in ways that make switching costs unbearable.

Tracking

Building a simple dashboard will do wonders. Use either Notion table, Airtable sheet, or even a Google Doc, to track expiry dates, usage, and what’s left. Founders underestimate how fast a year passes, and nothing stings like leaving $20K of credits unused because you forgot the deadline.

Negotiation

Credits aren’t always fixed. If you’re showing growth, like more users, bigger workloads, traction that benefits the vendor, you can always ask for extensions. Vendors want you hooked, and many will happily add another few months or another tranche of credits to keep you.

Founder Discipline

The most dangerous mistake is treating credits like free cash. Bloated infrastructure, unused SaaS seats, or spinning up workloads you can’t maintain once credits expire are rookie errors. Remember: credits extend runway only if you plan for what comes next.

This is how you turn credits into equity-free oxygen that can buy you the time you need to reach the next milestone.

5. Common Pitfalls and Blind Spots When Using Credits

Startup credits can be a lifeline, but only if you avoid the traps that quietly erase their value. Founders who treat credits like free money often find themselves in worse shape once the grace period ends.

Expiry Traps

Most credits expire within 6 to 12 months. If you activate them too early, you’ll burn through the free period before your real workloads even start. The fix is planning: stagger activations, map expiry dates, and make sure credits line up with your product roadmap.

Migration Costs

Yes, you can hop cloud providers or swap SaaS tools when credits run dry. But always keep in mind that migrations aren’t free. Engineering time, downtime risk, and data transfer fees can quickly outpace whatever you saved. Only plan a migration if the credits justify the switch, and design modular systems so you’re moving parts instead of rebuilding everything.

Feature Gaps

Credits often exclude premium features or enterprise support tiers. You might get compute for free but still need to pay out of pocket for service-level agreements (SLAs), advanced monitoring, or customer support. Don’t assume credits cover everything, read the fine print and budget for what’s missing.

Usage-Based Burn

AI tools in particular charge per token, per query, or per event. Credits cushion this at first, but it’s easy to overshoot if you don’t monitor usage. One viral product demo can wipe out months of credits overnight. Guardrails like rate limits, usage alerts, and careful monitoring are essential.

The bottom line is that credits really are a hidden type of capital. But that capital comes with an expiration date. If you don’t plan around expiry, migration, exclusions, and usage spikes, you’ll end up with unexpected burn; and no cushion left when you need it most.

6. The All in One Checklist for Startup Founders

Credits only become capital when you use them with discipline. Here’s the condensed play sequence every founder should follow:

Map Your 12-Month Needs

Lay out your infra, AI tooling, ops, and GTM requirements for the year ahead. Don’t chase every offer; identify what your product actually needs to reach the next milestone.

Apply to Every Relevant Program Now

Even if you won’t activate right away, get approvals in place. Many programs require partner referrals or take weeks to process. Having them lined up gives you flexibility later.Activate Just in Time

Start the clock only when your workloads are real, not when you’re still tinkering. Trigger credits at launch, first user onboarding, or pilot stage. Timing is your biggest lever.Monitor Burn vs. Expiry

Track every program in a single dashboard. Note expiry dates, what’s left, and where burn is accelerating. A simple Notion table beats losing $20K in unused credits.Re-Negotiate When You Show Traction

Growth makes you valuable to vendors. If you’re scaling usage, reach out; many will extend credits or add another tranche. Treat credits like contracts: negotiable when you have leverage.

7. Startup Credits as the Bridge Between Idea and Product Market Fit

We’ve seen that startup credits are a secret, underutilized form of capital. 2025 is the best year to start, because when capital is scarce and infrastructure costs are rising, extending runway is the key to survival.

Every founder who ignores credits is effectively leaving money on the table. These programs exist to give you time. Time to test more, ship faster, and push fundraising back until traction is undeniable.

Startup credits can turn a shaky 12-month runway into an 18–24 month window, enough to cross the hardest gap in startup life, which is the distance between idea and product-market fit.

In the coming years, the AI founder’s success hinges on smarter spending, and not faster raising. And smarter spending is about stacking credits, activating strategically, and treating them as part of their capital strategy.

Credits are the bridge. They don’t replace venture dollars, but they buy you the chance to reach PMF without running out of air. And that chance is often the difference between startups that stall and startups that scale.

Great guide on AI startup credits — those programs can really help new companies experiment and build without immediately worrying about big infrastructure costs. It’s a smart way to stretch limited early‑stage resources while developing product features. While reading about how startups handle broader development and tech support strategies, I came across this page in the middle of my research: https://mobisoftinfotech.com/startup-it-solutions-services, which shares some perspective on how teams manage product development and IT services. Insights like these are useful for anyone trying to balance development priorities and costs in a startup.