Cap Table at Series A & B: What Every Founder Must Know + Excel Template

Master Series A & B cap tables. Learn to negotiate smarter, avoid dilution, and model exit returns with our founder-grade cap table template.

Why Cap Tables Can Make or Break Your Fundraise

Most founders fundamentally misunderstand what their cap table represents during fundraising rounds.

In the early days of a startup, the cap table functions as a simple ownership ledger. Founders split equity, angels write checks, and early employees receive options.

Equity feels theoretical, like it’s just a spreadsheet. But by the time you’re raising a real institutional round - Series A or B - that same table becomes one of the most powerful, and scrutinized, documents in your company.

VCs read it like a blueprint. It tells them if the founders are still in control, if the company has burned too much equity for too little progress, if the employee pool is right-sized, and whether an exit could actually return meaningful value. One look, and they’ll know if your startup is structured to scale or already set up to stumble.

This article is a strategic guide on cap tables for founders who want to raise smarter, retain leverage in negotiations, and exit with more than just lessons.

We’ll cover what institutional investors look for, how option pools are used against you, why waterfall modeling matters, and where most founders get blindsided.

You’ll also get a downloadable template that you can use immediately. A clean cap table model, waterfall analysis and key metrics that you can use to evaluate your situation.

Let’s make sure your cap table doesn’t just track ownership, but that it also tells the right story.

Table of Contents

1. What Is a Cap Table and Why It Evolves Post-Seed

2. Series A: The First Major Cap Table Stress Test

3. The Option Pool Trap: How to Avoid Founder Over-Dilution

4. Series B: Capital Efficiency, Return Modeling and Control Leverage

5. Scenario Planning: Exit Waterfall and Founder Take-Home Pay

6. Red Flags That Scare Away Investors (and How to Fix Them)

7. Bonus: Download the Full Cap Table + Waterfall Analysis Template (Series A & B)

1. What Is a Cap Table and Why It Evolves Post-Seed

A cap table (short for capitalization table) is the single source of truth for your company’s ownership. It details who owns what, in what form, and under what conditions.

Common stock, preferred shares, options, warrants, SAFEs, convertible notes - they all show up here, often on a fully diluted basis.

Thinking that the cap table only tracks who owns what misses the point entirely.

By the time you’re preparing for a Series A, the cap table becomes a story about competence, control, and whether the founder has what it takes to lead the company through the minefield that is fundraising.

This is how VCs value startups. How they evaluate risk, control, and return potential. They don’t just check the math.

It tells them if your founding team still has skin in the game, if too much equity has gone to advisors or departed team members, if there’s room left to hire without excessive dilution, if your round terms have been clean, or if they’re hiding time bombs from past convertible notes.

This is where your startup capitalization table stops being historical record-keeping and starts becoming negotiation leverage.

A messy or bloated cap table can slow or even kill a deal. A clean, clear cap table for Series A shows that you understand your business not just as a product, but as an investable asset.

And that story starts with proving you understand the difference between giving away equity and investing it wisely.

2. Series A: The First Major Cap Table Stress Test

Series A is where your cap table either graduates to institutional grade or gets expelled.

Early-stage investors may have let things slide. But institutional VCs will comb through your cap table line by line. They’ll reverse-engineer your dilution, forecast their exit return, and test whether your structure is fundable, scalable, and clean.

Before you walk into that first partner meeting, your cap table needs to be ready for scrutiny. Here's what that looks like.

Clean the Slate

There are a few common landmines founders must address before raising a Series A:

Convert every last SAFE and convertible note into equity. These are fine for bridging pre-seed to seed, but VCs don’t invest into uncertainty. If your cap table doesn’t show the fully diluted impact of every security, you’re in trouble.

Eliminate dead equity. That means removing or restructuring equity held by former co-founders, advisors, or early employees who are no longer contributing. A chunk of stock options sitting with someone who left two years ago is a red flag. “Dead equity” tells investors you either can't make hard decisions or don't understand the value of what you're giving away.

Standardize founder vesting. If your shares are fully vested too early, VCs may ask for a re-vesting schedule, especially if you’re still core to execution. That’s because they're about to bet millions on your continued motivation. Unvested equity is their insurance policy that you won’t check out when things get tough.

Prepare for the option pool trap. This is where the real dilution happens.

3. The Option Pool Trap: How to Avoid Founder Over-Dilution

Here’s the play: most investors will ask you to expand your option pool pre-money. That means your new employee equity pool is carved out before they put their money in, reducing your ownership instead of theirs.

It sounds like a minor technicality, but it's not. It’s a negotiation move, and it can cost founders 5–10% of their company in a single line item.

Let’s break it down with an example.

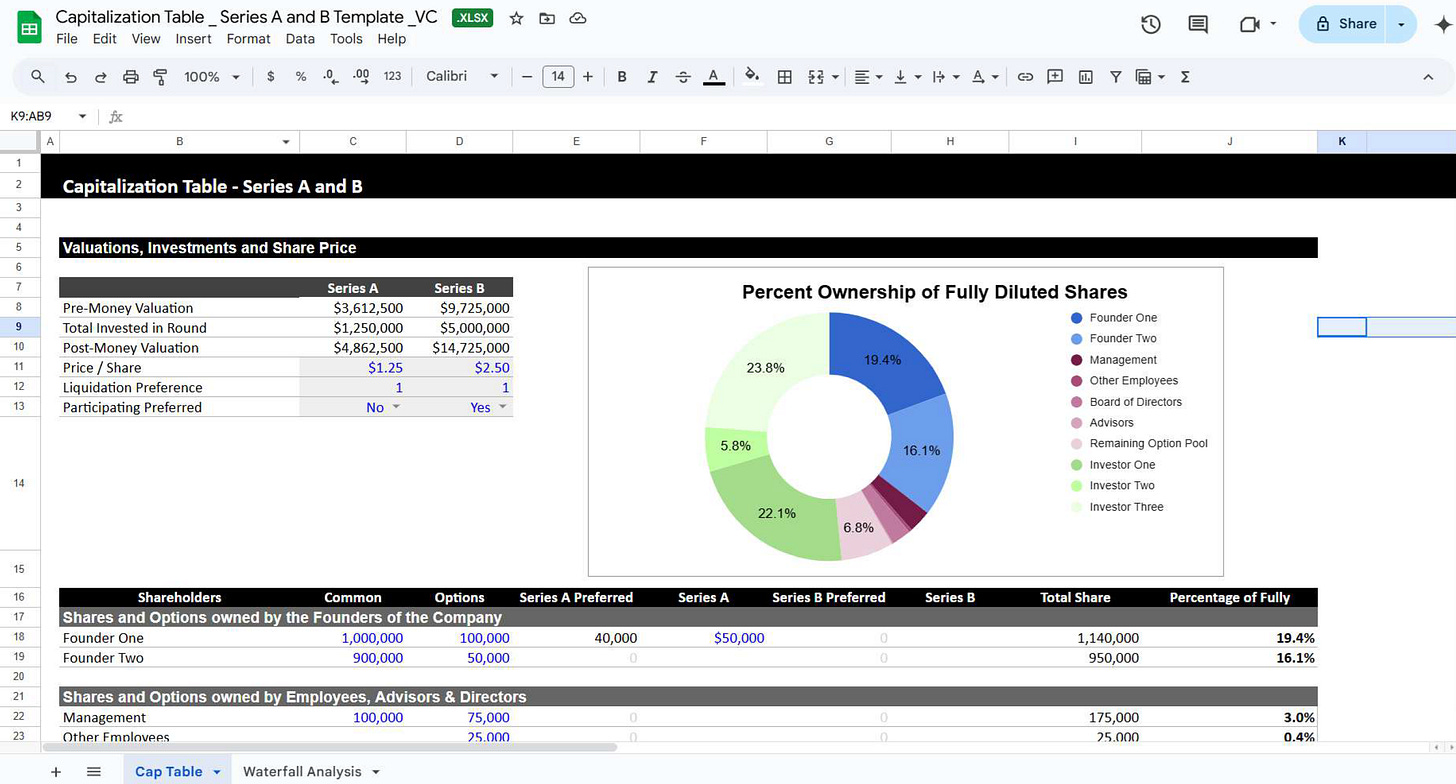

Series A Pre-Money Valuation: $3.61M

Series A Investment: $1.25M

Post-Money Valuation: $4.86M

Price per Share: $1.25

Investors asked for a new 10% option pool, but they structured it pre-money. That means the pool was added before calculating the new investor’s share, diluting founders instead of the investor.

Now look at the ownership breakdown:

Founder One: 19.4%

Founder Two: 16.1%

Remaining Option Pool: 6.8%

Total for founders + unallocated pool: just 42.3%

If the option pool had been added after the investment, founders would’ve retained more equity. Instead, they absorbed the full dilution from the added pool.

This is why Series A is a cap table stress test. It’s not just about getting funded. It’s about whether the structure still supports you, your team, and the next round.

Make sure you walk into it knowing your numbers. Model dilution scenarios. Understand where the leverage lies. Because once you sign that term sheet, you’ll live with the cap table you’ve built.

A great excel template allows you to know exactly who owns what and try out different scenarios.

How to Push Back (With a Plan)

VCs don’t love option pools, they love teams. They care about your ability to attract the talent that will make their investment 10x.

So come prepared with a hiring roadmap. Map out who you plan to hire before the next round, how much equity each will likely need, and how compensation will be structured.

This is what a hiring roadmap looks like:

Total equity needed: 2.8%. Current option pool: 7%. Remaining buffer: 4.2%.

If you can show that a 6–7% pool covers all anticipated hires until Series B, investors are far more likely to agree to a smaller pool, or at least shift some of it post-money.

Additionally, most founders forget that they already have an option pool from previous rounds. Maybe it’s 12% but only 4% is allocated to current employees. Which means that 8% is just sitting there, unutilized.

That’s when you can easily remind your investors that some of the hiring equity burden has already been absorbed.

No expansion needed, no dilution necessary. Investors love this.

Ultimately, the option pool negotiation isn’t about math, but about who absorbs the risk of future hiring. Unprepared founders absorb 100% of the risk. Smart founders come up with solutions that eliminate any potential issues.

Negotiate it like it's your own equity. Because it is.

4. Series B: Capital Efficiency, Return Modeling and Control Leverage

By the time you reach Series B, the conversation shifts from potential to performance.

You are no longer a promising startup. You are now a scaling business that needs to prove it can generate institutional returns.

Investors are no longer betting on your vision. They’re analyzing your efficiency, control structure, and the math behind future returns.

Your cap table isn’t just a record of ownership anymore. It’s a test of how well you’ve managed dilution, hiring, governance, and investor terms over time.

Here's what investors are really looking for when they look at your cap table:

Capital Efficiency

Investors want to know: How much equity have you burned to get here?

They’ll compare ownership breakdowns to progress made. If your startup has raised $10M but given up 70% of the company in the process, that signals weak negotiation or inefficient scaling. VCs want to see that you’ve used equity as a strategic tool, not just a giveaway for capital and hires.

Future Dilution Forecasts

They’ll also model what future rounds will cost. Is your option pool large enough to hire the next wave of execs? Are you heading into a Series C with just 5% unallocated equity and no plan to refill? These projections shape whether they believe their ownership can hold or grow over time.

Board Control and Governance

At Series B, board composition becomes a real concern. Investors will review voting rights, reserved matters, and whether the founders still have decision-making leverage. A heavily investor-weighted board without founder protections can be a red flag, even to new investors.

Preference Stack Exposure

Now we get into the heart of structural risk: liquidation preferences.

See the waterfall analysis below:

Here’s the setup:

Series A: Non-participating preferred with a 1x preference

Series B: Participating preferred with a 1x preference

Common Ownership: 40%

Preferred Ownership (A + B): 54% combined

Let’s say the company exits at $50M. Here’s what happens:

Series B takes $5M off the top, then participates in the remaining $45M as if they were common.

This results in $10.70 per share for Series B versus $8.20 for common and Series A.

At $100M or $200M, those gaps grow; Series B investors consistently take more per share than anyone else at the table.

This is what participating preferred means: investors get their money back and their pro-rata share of the upside. It’s a powerful clause, and it can dramatically compress founder and early investor returns in mid-range exits.

Series B investors may insist on these terms as protection for larger checks. But as a founder, you need to know what you’re signing, and what it could cost you.

Model it. Challenge it. And never assume that the biggest number on your exit slide will trickle down the way you hope.

5. Scenario Planning: Exit Waterfall and Founder Take-Home Pay

Founders often celebrate the top-line exit number - $75M, $100M, $200M - without realizing how little of that they might actually take home.

That’s where exit waterfall analysis comes in.

A waterfall is a return distribution model. It lays out, dollar by dollar, how proceeds from a sale or IPO get allocated across different shareholders, starting with preferred investors, then moving through common stockholders, employees, and founders.

And at Series A and B, those layers can get surprisingly steep.

See the example below:

Let’s model three exit scenarios with this stack:

Series A: 1x non-participating preferred

Series B: 1x participating preferred

Ownership: Founders = 35.5% combined; Series B = 36%

Now look at these three price points:

$25M Exit

Series B takes $5M off the top, then participates in the rest.

Series B total return: $12.2M

Founder One: $4.1M

Founder Two: $3.46M

You're selling your company for $25M… and walking away with less than 8 combined.

$75M Exit

Series B total return: $30.5M

Founders combined: ~$26.6M

On paper, you’ve scaled. But Series B still out-earns both founders combined.

$200M Exit

Founder One: $40.5M

Founder Two: $33.7M

Investor Three (Series B): $53.2M

Even in a $200M exit, your Series B investor walks away with more than any individual founder. That’s the power, and cost, of participating preferred shares.

This is why founders need to model exit waterfalls before signing term sheets. A deal that looks great at $5/share might unravel when you realize who gets paid first, and how preferences stack.

Use a waterfall analysis not just as a spreadsheet, but as a strategy tool. Ask:

What kind of exit justifies the dilution I’m taking?

At what valuation do I earn more than my Series B lead?

Am I still incentivized if the company sells for less than a home run?

Because ownership isn't value unless it pays out, and the waterfall is how that value flows.

6. Red Flags That Scare Away Investors (and How to Fix Them)

By the time you’re raising a Series A or B, your cap table isn’t just a record of the past, it’s a signal of how you make decisions. And a messy cap table tells investors exactly what they don’t want to hear: disorganization, poor judgment, or future legal headaches.

Here are the most common red flags, and how to fix them before they tank your deal.

🚩 1. Too Many Notes with Different Caps

Multiple convertible notes or SAFE notes with varying valuation caps, discounts, or terms create chaos during conversion. It becomes unclear who owns what, and investors can’t easily model their ownership.

Fix: Consolidate where possible. Convert notes ahead of the raise. If terms vary too much, consider capping all conversions at a blended valuation. Use a single trigger valuation and clean up the documentation.

🚩 2. Unvested Founder Shares

Investors want to know founders are in it for the long haul. Fully vested founders, especially early, signal low incentive to stay. Worse, if one founder is fully vested and another isn’t, it creates imbalance and risk.

Fix: Reintroduce vesting. A 4-year schedule with a 1-year cliff is standard, even for founders. If you’ve been operating for a while, negotiate re-vesting on remaining shares or create performance-based cliffs tied to milestones.

🚩 3. Misaligned Co-Founders With Too Much Equity

Early on, founders often split equity equally. But when roles evolve, one founder might no longer be contributing meaningfully, yet still owns 30%+ of the company.

Fix: Don’t ignore this. Offer a refresh grant to active founders or reallocate unused stock options from departed co-founders. If someone is no longer operational, consider a buyback or equity transfer tied to advisory duties with time-based vesting.

🚩 4. No Formal Board or Control Structure

Institutional investors expect a working governance structure. No formal board, unclear voting rights, or ad hoc decision-making is a red flag, especially at Series B.

Fix: Establish a board with clear roles. Typically, post-Series A, you’ll have 1–2 founders, 1–2 investors, and 1 independent seat. Make sure your voting thresholds and reserved matters are documented. This gives investors comfort and keeps future rounds cleaner.

🚩 5. No Exit Scenario Modeling

If you can’t answer how much a $100M exit pays each shareholder, or worse, haven’t considered the implications of liquidation preferences, you’re flying blind. And investors will notice.

Fix: Build a basic waterfall model. Show returns for founders and investors across multiple exit scenarios. This demonstrates maturity, planning, and understanding of how deal mechanics affect outcomes.

Cleaning up your cap table isn’t cosmetic, it’s strategic. These issues don’t just stall diligence; they erode investor confidence. Fix them early, and you’ll walk into the raise with more leverage, more clarity, and better terms.

7. Bonus: Download the Full Cap Table + Waterfall Analysis Template (Series A & B)

If you’ve made it this far, you’re not just skimming. You’re serious about owning your cap table, and understanding exactly how the math plays out when real money is on the line.

We’ve put together a hands-on, founder-grade template that lets you apply everything you’ve just learned. This isn’t a generic spreadsheet. It’s built from actual fundraising scenarios, shaped by term sheet mechanics and real-world cap table data.

Use it to:

Model dilution across multiple rounds

Test different pre- and post-money valuations

Simulate exit payouts from $15M to $200M

See how preferences and participation affect your take-home

Explore per-share payouts across common, Series A, and Series B

Here’s what’s inside:

Full cap table from seed through Series B

Pre- and post-money valuation logic

Option pool modeling (and how it hits founders)

Exit scenario waterfall across 5 sale values

Return multiples by round and security type

Dynamic payout calculations per shareholder

As a premium subscriber (free trial available), you will also get access to the full library of resources (+50) shared on The VC Corner

Download it below 👇

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.