DCF Valuation Method Template: A Practical Guide for Founders and Growth-Stage Startups

A step-by-step guide to using a Discounted Cash Flow (DCF) model to value your startup, plus a Excel template for founders, CFOs, and groth-stage teams

If you're a founder at a growth-stage startup, understanding how to value your company is essential.

This guide explains how to use the Discounted Cash Flow (DCF) valuation method with a startup-friendly Excel template—designed to calculate your startup valuation based on future cash flows.

Whether you're preparing for a growth round, M&A, or pre-IPO fundraising, this model helps you anchor your valuation in real business fundamentals.

As startups mature and move beyond early traction, investor expectations shift. Storytelling and market size still matter—but they’re not enough on their own. At the growth or pre-IPO stage, serious investors will ask a more fundamental question:

What is this company worth based on its actual future performance?

The Discounted Cash Flow (DCF) Valuation Method helps answer that question with clarity and confidence. And now, founders have access to a robust, templatized version of this model—built for usability, adaptability, and speed.

What Is the Discounted Cash Flow (DCF) Valuation Method for Startups?

The Discounted Cash Flow (DCF) method is a classic valuation technique that estimates a company’s intrinsic value based on the present value of expected future cash flows. It is grounded in the idea that a business is worth the cash it will generate over time—adjusted for risk and time.

While often associated with public companies or traditional finance, DCF is increasingly relevant for later-stage startups with predictable revenue, improving margins, and growing cash flows.

This model works best for:

Post-revenue startups with multi-year visibility into sales and expenses

Late-stage or pre-IPO companies

Capital-efficient businesses with stable or forecastable growth

Founders preparing for growth rounds, strategic M&A, or secondary transactions

Why Founders Need a DCF Template for Growth-Stage Fundraising

In many cases, founders rely on valuation multiples or peer comparisons to justify their raise. While these methods are useful at early stages, they break down when:

You’re building a differentiated business that doesn’t match common comps

You’re entering a more structured diligence process with professional investors

You need to support a high valuation with detailed forecasts and defensibility

That’s where a structured DCF model becomes invaluable.

Our template helps founders and finance leads:

Build a bottoms-up valuation based on real company metrics

See how changes in CAC, churn, or capital expenditure impact long-term value

Understand their business through the lens of investor economics

Communicate with growth investors using a shared financial language

How to Use the DCF Model to Value a Startup

This template is a clean, easy-to-use Excel workbook that walks you through each step of the valuation process. Even if you're not a finance expert, you can follow the logic and customize the inputs.

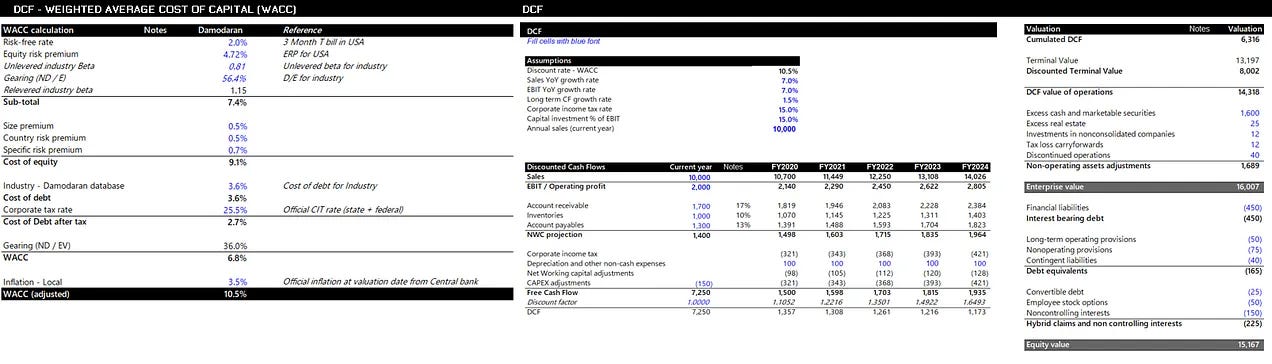

1. Operating Assumptions

Start by entering your core assumptions:

Revenue projections: Multi-year forecasts based on historical growth or pipeline

Gross margins and operating expenses: Breakdown of sales, marketing, R&D, and admin

Capital expenditure (CAPEX) and working capital: Reflecting future reinvestment needs

Discount rate (WACC): Automatically calculated using cost of equity, cost of debt, tax rates, and market risk premiums

Terminal growth rate: Long-term growth assumption beyond the 5-year forecast

2. Cash Flow Forecast

The model calculates Free Cash Flow (FCF) from your operating assumptions:

EBIT (Operating Profit)

Taxes → NOPAT (Net Operating Profit After Tax)

Depreciation and non-cash items

CAPEX

Changes in Net Working Capital (NWC)

This gives you the free cash generated by your business each year—what matters most in intrinsic valuation.

3. Terminal Value Calculation

Beyond the 5-year window, the model uses the Gordon Growth Model to estimate residual value:

Terminal Value = Final Year FCF × (1 + g) / (WACC − g)

This value is then discounted back to present day using the same WACC rate, and added to the total DCF.

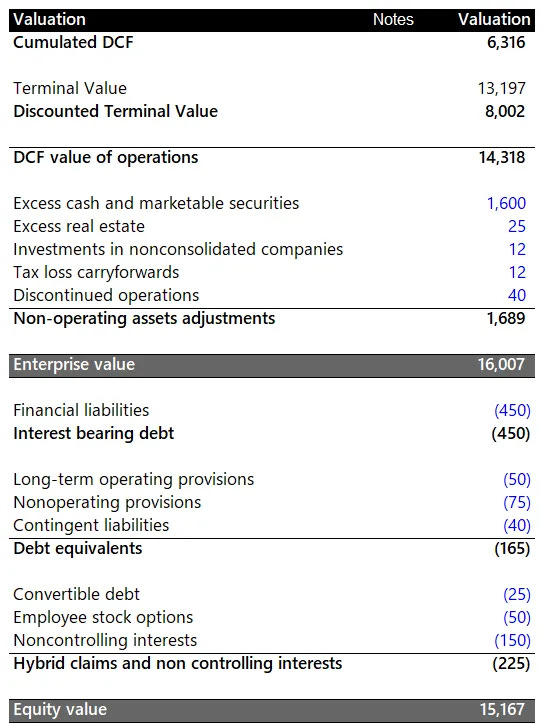

4. Equity Value Calculation

To go from enterprise value to equity value, the model adjusts for:

Cash and marketable securities

Financial liabilities and debt equivalents

Convertible debt, stock options, and non-controlling interests

It also includes an optional input for the number of shares outstanding, allowing you to calculate per-share equity value—useful in pre-IPO scenarios or secondary deals.

Why This DCF Template Is Useful for Startup Founders

This is not a theoretical finance exercise—it’s a practical tool with immediate applications:

Justify your valuation in late-stage fundraising

Prepare for investor conversations with concrete data

Run internal scenario planning with real financial sensitivity

Answer the question: What is your company worth today based on its future performance?

The model is formatted with clearly marked input cells, color-coded assumptions, and structured outputs. You can use it solo, or with your CFO, or send it directly to investors to align expectations.

Download the DCF Valuation Template for Founders

We’re sharing this resource for founders who want to bring rigor to their valuation discussions.

It’s editable, and designed to help you get smarter about how your business creates value.

📥 Want the DCF Valuation Template?

The spreadsheet is fully editable and works in Excel. Just plug in your startup’s projected revenue, round sizes, expected dilution, and the rest is auto-calculated.

The DCF Valuation Template is available exclusively to premium subscribers of The VC Corner.

It’s part of a growing library of resources designed to help startup founders raise capital, grow smarter, and move faster. As a member, you’ll get:

✅ Ultimate Investor List of Lists: +10k VCs, BAs, CVCs, and FOs

✅ 70+ Startup Pitch Decks That Raised Over $1B in 2024

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ The 100+ Pitch Decks That Raised Over $2B

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 118 AI Communication Agent Use Cases

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox 🛠️

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ The Best 23 Accelerators Worldwide for Rapid Growth (and How to Get Into Them)

✅ The Ultimate Startup & Venture Capital Notion Guide: Knowledge Base & Resources

… and much more

If you’re serious about raising, this is the unfair advantage you’ve been looking for.

Download the DCF Method Valuation Template below 👇

I hope you find it helpful :)

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.