The $100B Question: How SaaS Giants Are Rewriting the Rules of Value with AI in 2025

A complete guide to hybrid, usage-based, and outcome-driven models for modern B2B startups

The Pricing Model Collapse No One Saw Coming

For two decades, SaaS pricing has run on rails. Flat-rate plans and seat-based tiers that make up for a predictable monthly recurring revenue (MRR). But in 2025, things are looking quite different. And you can probably guess why.

AI changes the game. Workloads are heavier. Infrastructure costs are volatile. And most critically, value is no longer tied to how many users log in. The same AI agent that powers one workflow could replace ten human seats. The math doesn’t work anymore…

Brought to you by Attio

The CRM used by both startups and VCs (including me)

I use Attio to manage deal flow, track founder conversations, and sync everything across my team — no clunky setup required.

Startups use it as a sales CRM from day one

VCs use it for deal tracking, LPs, and intros

Fully customizable and updates automatically

It’s fast, flexible, and built for how we actually work.

Finance teams are watching gross margins slip below 60%. Product teams are stuck between undercharging power users or scaring away the rest. And customers are starting to question whether your pricing reflects what they actually use, or what you wish they used.

This is now a monetization reckoning. And if your pricing model doesn’t evolve, your margins, trust, and long-term growth will fall with it.

This guide is your next step. It offers a practical, research-backed breakdown of how top SaaS companies are pricing for value in the AI era. You’ll learn when to use usage-based, hybrid, or outcome-driven models, and how to design pricing that flexes with usage, but still gives you forecastability.

Because the winners in 2025 aren’t just building smarter software. They’re monetizing it with precision. Let’s get into it.

Table of Contents

1. The Fall of Flat-Rate and Seat-Based Pricing: Why Predictability Became a Liability

2. Hybrid Pricing Is the New Standard

3. Outcome-Based Pricing: From Theory to Live Deployment

4. Usage-Based Pricing: Scalable, But Not a Silver Bullet

5. Agentic vs Assistive AI: Two Diverging Paths for Monetization Strategy

6. Behavioral Monetization Is the New PLG Frontier

7. Strategic Monetization = Fundraising Narrative

8. The Future: From Access to Usage to Outcomes

1. The Fall of Flat-Rate and Seat-Based Pricing: Why Predictability Became a Liability

For years, predictability was SaaS’s greatest strength. Per-seat and flat-rate pricing models gave buyers a simple number to budget and vendors a steady stream of recurring revenue. But in 2025, predictability has become a trap and nowhere is that clearer than in AI-powered software.

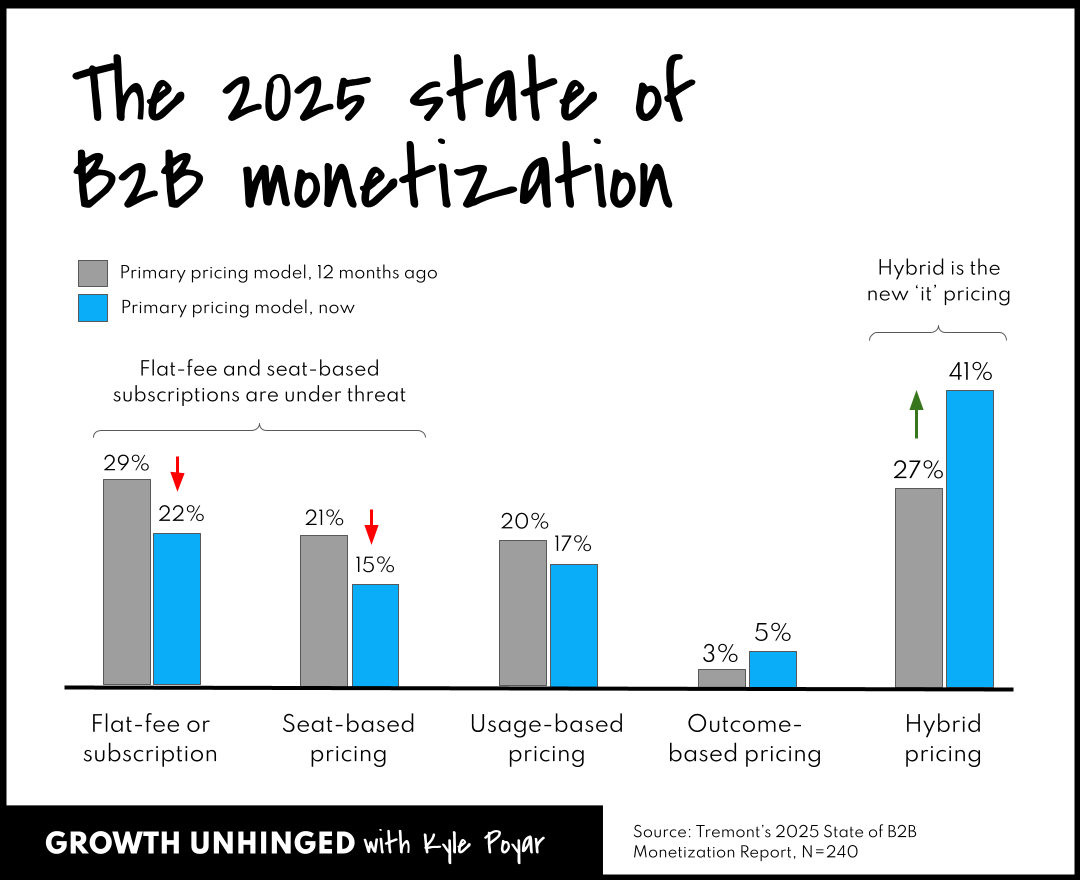

Recent data shows a sharp decline in legacy pricing models. Flat-rate pricing fell from 29% to 22% of companies using it as their primary model. Seat-based pricing dropped from 21% to just 15%. Among AI-native companies, 29% now report gross margins below 60%, compared to the 80–90% norm in traditional SaaS.

Why the collapse? Because AI breaks the math.

AI workloads are compute-intensive and uneven. Power users can trigger expensive queries that spike infrastructure costs overnight. In one reported case, OpenAI’s advanced model required up to $3,500 in compute to answer a single high-context query. Flat fees don’t protect you from that kind of upside-down margin scenario.

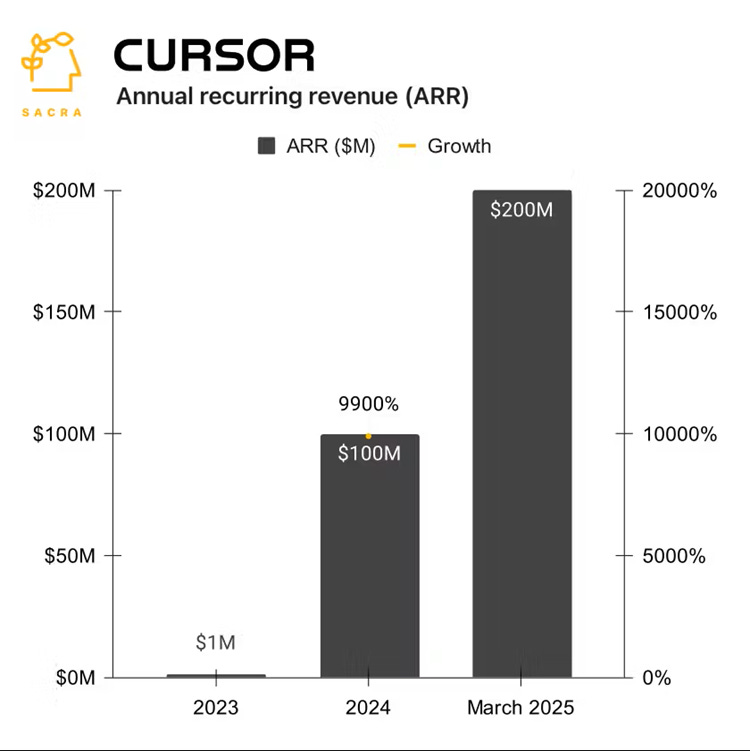

Seat-based pricing is even more fragile. When an AI agent automates what ten users used to do, charging per seat becomes a penalty for your own success. Tools like Cursor, which reportedly reached $200M ARR with just 60 employees, illustrate how revenue can scale independent of headcount.

Klarna doubled its revenue per employee after deploying AI agents across core workflows. And on the cost side, AI models can devour infrastructure budgets:

What we’re seeing is more a value mismatch than a model mismatch. Buyers aren’t paying for access anymore. They’re paying for outcomes now. And vendors who cling to old models risk undercharging high-usage customers, overcharging low-usage ones, and losing both.

The truth is clear: pricing can no longer be anchored in access. It must flex with usage or tie directly to results.

2. Hybrid Pricing Is the New Standard

As flat and seat-based pricing erode under the weight of AI costs and value shifts, one model has surged to the top: hybrid pricing. Today, 41% of SaaS and AI-native companies rely on it as their primary monetization approach.

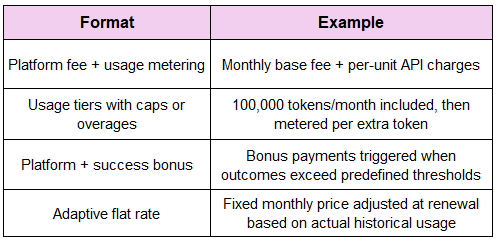

Hybrid pricing blends a fixed subscription with a usage-based component. It’s a toolkit rather than a single model. Depending on the product, vendors mix and match formats like:

What makes hybrid work is that it offers a predictable base for finance teams, while unlocking expansion levers for go-to-market strategies.

Usage metering aligns revenue with variable AI infrastructure costs, while the base fee keeps billing stable. Most importantly, it gives customers control. They can start with a low-risk entry point and scale spend only when they see value.

Leaders across the stack are using it. Monday.com includes AI credits in its plans and sells more as overages.

Clay removes seat limits altogether, monetizing via usage and advanced features.

OpenAI is shifting from fixed subscriptions to a hybrid of credits plus upsell bundles.

Even Retool, a dev-first platform, introduced usage add-ons layered onto traditional plans.

But hybrid isn’t free of downside. It’s increasingly becoming a “catchall” label, and that’s a risk. As more companies stack usage tiers on top of seat tiers, plus add-on bundles, plus caps and overages, complexity creeps in. Buyers start asking, “What exactly am I paying for?”

Done right, hybrid pricing balances flexibility and clarity. Done poorly, it becomes a maze of exceptions, footnotes, and mistrust.

And in a world where transparency builds trust, that’s a price few SaaS brands can afford.

3. Outcome-Based Pricing: From Theory to Live Deployment

Outcome-based pricing (OBP) has been the holy grail of SaaS monetization for years. That means charging customers not for usage, but for results.

In theory, it's the cleanest alignment of incentives: if your product delivers a specific business outcome, the customer pays a portion of that value. No ambiguity. No over- or under-charging.

But until recently, OBP has mostly lived in whitepapers and sales decks. That’s starting to change.

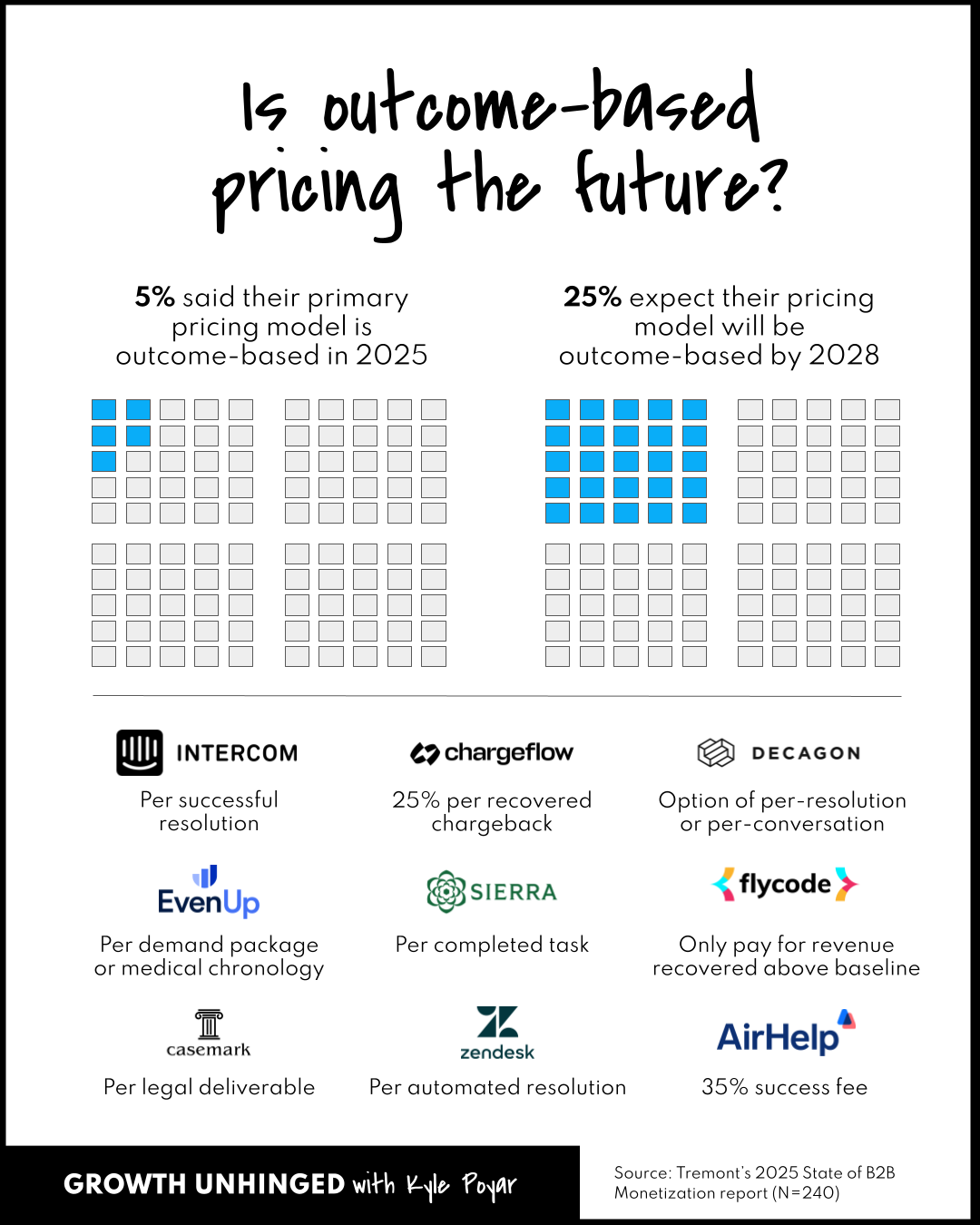

Only 5% of companies use outcome-based pricing today, but 25% expect to adopt it by 2028. And the leaders moving first are AI-native startups, who are 4x more likely to be deploying OBP today.

The reason is structural: AI systems increasingly drive measurable, attributable outcomes. When your product resolves support tickets, generates qualified leads, or drafts legal documents, it becomes easier to charge based on what gets done.

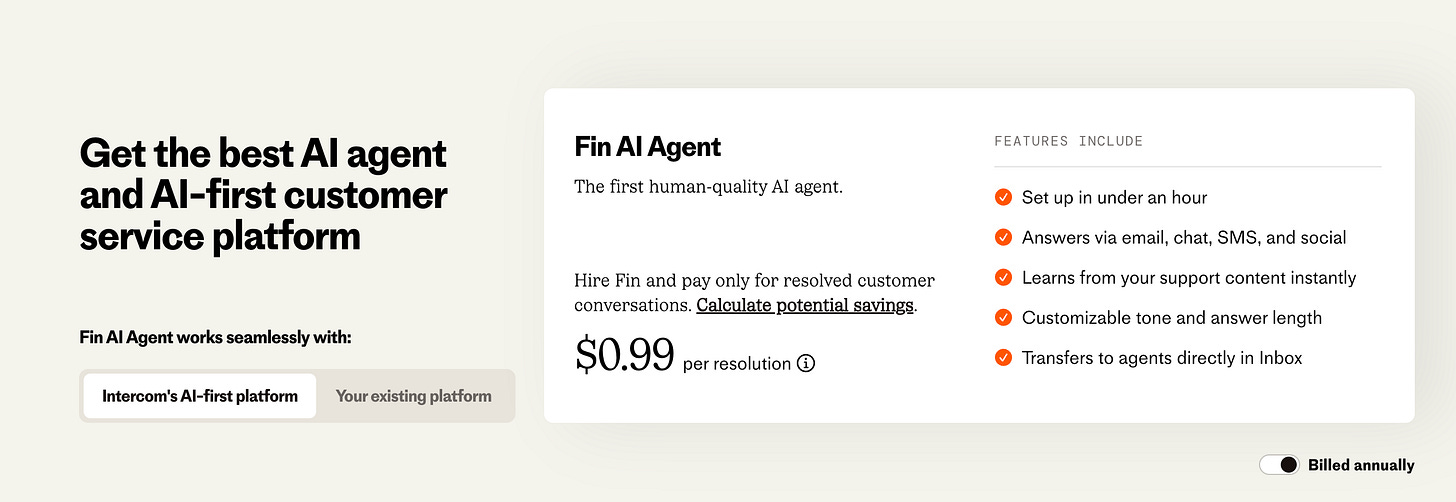

Take Intercom’s Fin as a standout example. Rather than charging for support seats or generic chatbot usage, Intercom introduced a per-resolution model. Customers only pay when Fin successfully resolves a customer inquiry. That means no resolution, no charge.

This model not only reflects value delivered but creates immediate pricing clarity for the buyer. Intercom’s leadership noted that OBP was both a competitive differentiator and a proof point: “Fin is built to do the job of a support agent. So we priced it like one.”

Other companies are following suit. Zendesk and Kustomer have both hinted at performance-linked pricing in their AI support tools. Newer players like Decagon, which applies AI to hiring and assessments, are also experimenting with tying pricing to candidate quality or placement outcomes.

Ultimately. as AI systems become more autonomous, buyers increasingly expect to pay for success, not access.

But if OBP is so elegant, why haven’t more companies adopted it?

The CAMP Framework: Four Frictions That Hold OBP Back

Despite its appeal, outcome-based pricing is hard to scale. The main blockers can be captured in a simple framework: CAMP - Consistency, Attribution, Measurability, and Predictability.

Consistency

Not every customer uses the product the same way or values the same outcome. One might care about time saved, another about cost reduced. Without a uniform outcome across your customer base, it’s hard to structure scalable OBP contracts.

Attribution

Can you prove your product caused the result? In real-world environments, outcomes often have multiple contributors. If a sales team closes more deals, was it because of your AI lead scoring, or their own improved outreach? If attribution is fuzzy, OBP loses credibility.

Measurability

Even when outcomes are clear, measuring them can be messy. Some are countable (e.g., “tickets resolved”), but others require integration with internal systems or subjective reporting. If customers can’t see and trust the metrics, they won’t want to pay against them.

Predictability

Both buyer and vendor need the ability to forecast. If outcome volume swings wildly, billing becomes volatile. CFOs can’t plan for it, and vendors can’t guarantee margin. Most OBP deals need floors, caps, or ranges to be viable, turning elegant pricing into a negotiation.

This is why many companies treat OBP as a long-term destination instead of a starting point. Some test it with a few customers. Others offer it as an option alongside usage or hybrid models.

The best take a progressive route: start by measuring outcomes, then build trust and attribution over time, only switching to OBP when the data is airtight.

The direction is clear. As AI tools shift from assistive to agentic, OBP will be the expected pricing model. But in order to make it stick, founders need to solve for CAMP, not just outcomes.

4. Usage-Based Pricing: Scalable, But Not a Silver Bullet

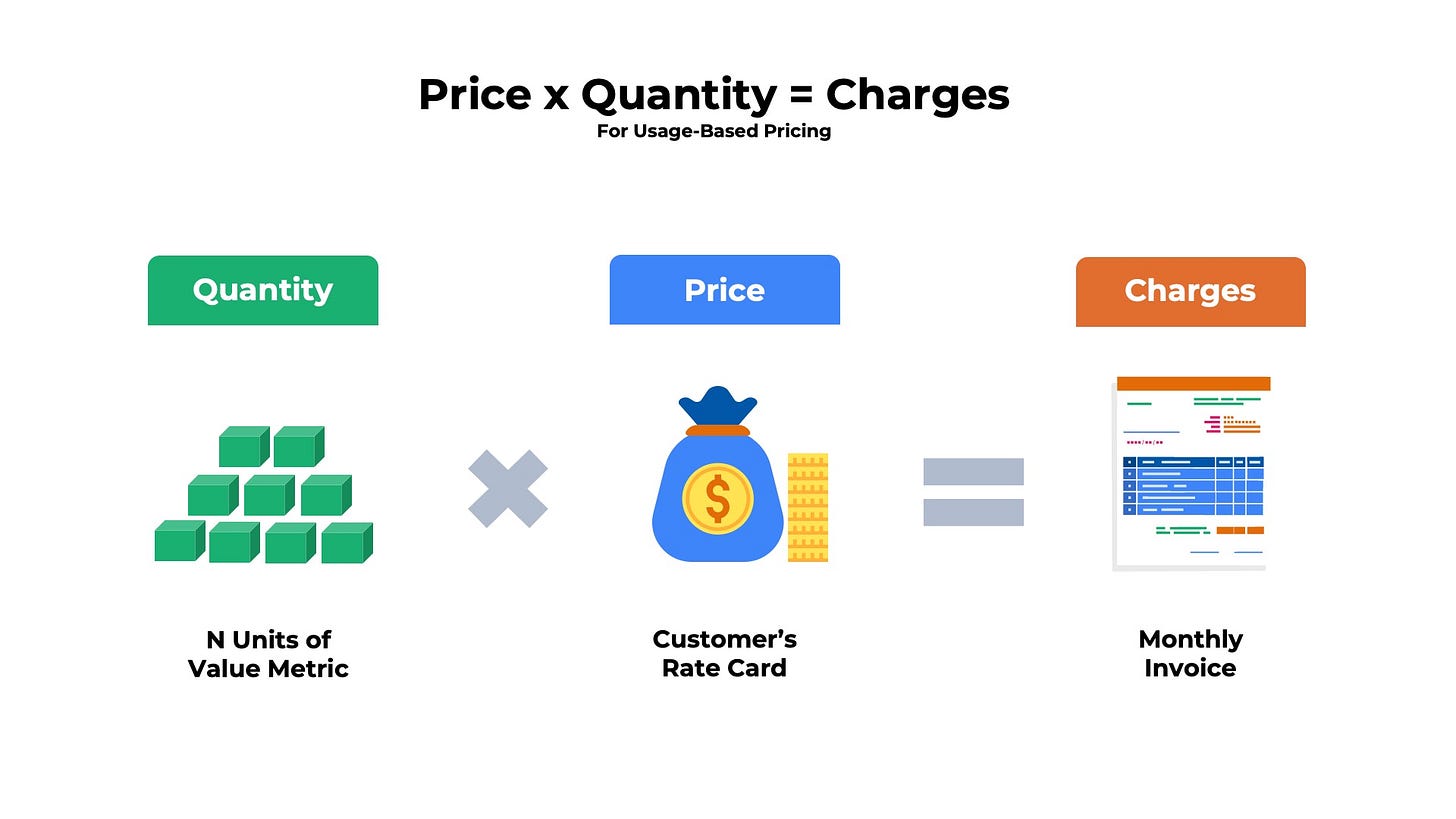

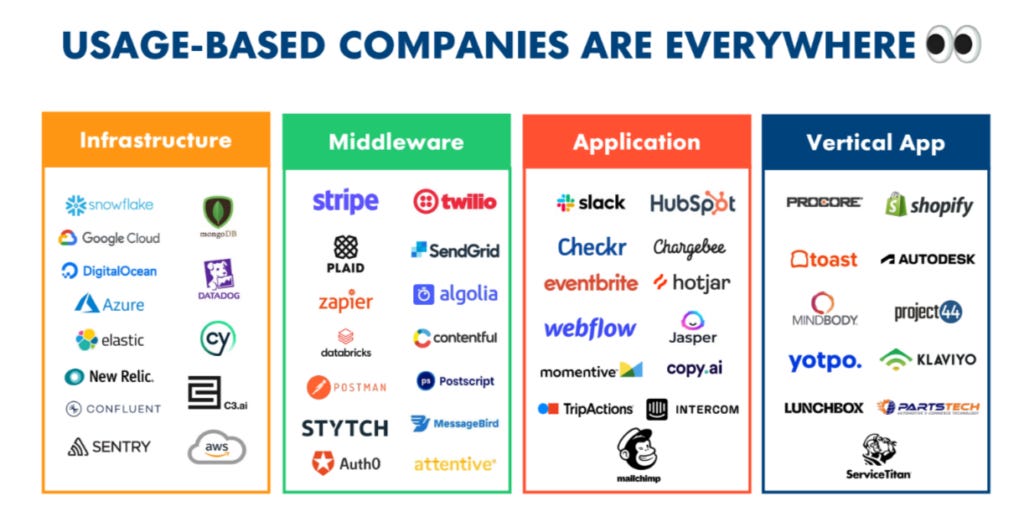

Usage-based pricing has gained traction as AI-driven products demand more flexible monetization. It’s intuitive: the more a customer uses, the more they pay.

For infrastructure-heavy tools or developer-facing platforms, it’s often the most natural fit. But like any model, it comes with tradeoffs, especially when overused or poorly implemented.

When Usage-Based Pricing Works

Usage-first models shine when the unit of value is clear, repeatable, and scalable. That’s why it’s common in:

Token-based APIs (e.g., OpenAI, Anthropic)

Developer platforms like Vercel, which charges based on bandwidth, build minutes, and requests

AI agents that operate autonomously, such as Bolt.new, which switched from flat pricing to token-based billing after usage exploded

Payments infrastructure like Stripe, where per-transaction billing is deeply aligned with customer growth

These products tie cost and value directly to activity. When done right, the pricing feels fair to customers and allows vendors to recoup infrastructure costs while scaling with usage.

Designing Good Usage Pricing

To make usage-based models work in practice, a few principles matter.

Tie usage to perceived value

Billing should align with the customer’s success metric. If your AI drafts 100 emails, don’t charge per API call; charge per email sent or outcome delivered. The closer the unit is to what the customer cares about, the more justified the spend feels.

Avoid surprise bills

Usage-based pricing can turn into a trust killer if customers don’t know what they’re spending. That’s why clear usage dashboards are mandatory. Dashboards that set alerts as thresholds approach, and allow customers to cap spend or opt into notifications. Transparency drives retention.

Preserve forecastability with credits or tiers

Few CFOs enjoy variable bills. That’s why prepaid credits, usage tiers, or high watermark pricing models help bridge the gap between flexibility and predictability. Stripe does this well with its pay-as-you-go pricing. It is stable, and volume discounts and billing dashboards keep finance teams in the loop.

The Catch: Variability Kills Confidence

While usage-based pricing aligns revenue with actual consumption, it introduces volatility.

For vendors, this means revenue can swing month to month. For investors, that makes forecasting a challenge, especially in the early stages.

It’s also harder to land big upfront commitments when buyers don’t know what they’ll spend. Usage-heavy products may see high churn from cost-sensitive customers or pushback from procurement teams that dislike variable expenses.

That’s why many AI-first companies use usage pricing as a layer. They do not make it their entire model. They’ll offer a hybrid: base subscription for access, usage charges for heavy lifting. This preserves upsell potential and cost alignment, while smoothing out the financial model for everyone involved.

Usage-based pricing can scale beautifully when the value is clear and infrastructure costs must be passed on. But it should be treated as a design choice. And like any choice in SaaS monetization, it comes with tradeoffs that founders must navigate carefully.

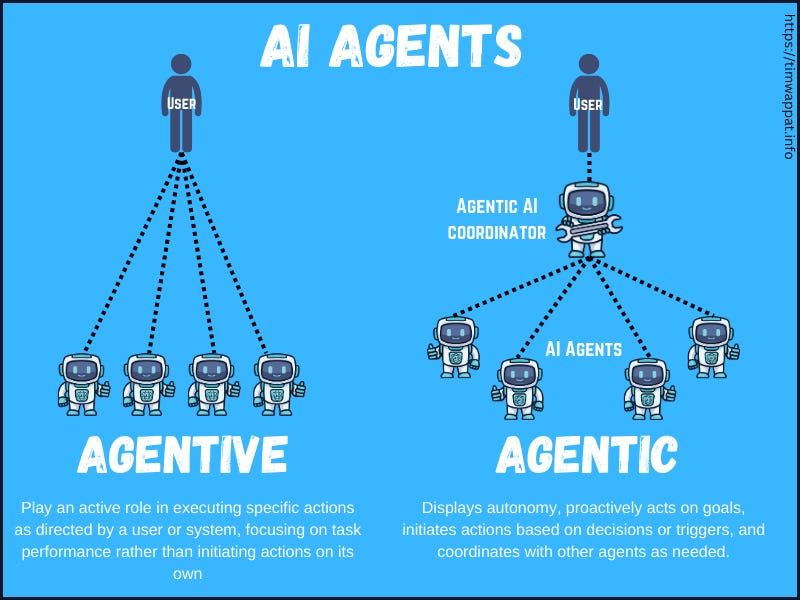

5. Agentic vs Assistive AI: Two Diverging Paths for Monetization Strategy

One of the clearest and most overlooked evolutions in AI monetization is the split between agentic and assistive products. It’s no longer a matter of design but a matter of pricing strategy.

Agentic AI operates autonomously, executing tasks with minimal or no human input. Think: agents that complete support tickets, generate outbound emails, write legal briefs. These tools do the work.

Assistive AI enhances human workflows, helping people move faster or make better decisions, but always with a person in the loop. Think: writing suggestions, code autocompletion, grammar corrections. These tools support the work.

This distinction matters because it directly shapes how value is created, and captured.

Agentic AI = Outcome-Based or Task-Based Pricing

If your AI takes full responsibility for a task, it makes sense to charge per result.

Besides Intercom’s Fin, other emerging companies are adopting this model. Adept is building agents that take actions on behalf of users across enterprise systems, ideal for task-based billing. Jasper can fully draft marketing content, making “per asset” or “per campaign” pricing viable.

In these cases, pricing by user or seat makes no sense. The AI is the user. OBP or per-task pricing maps cleanly to the way the product delivers value.

Assistive AI = Usage-Based or Tiered Pricing

When AI is augmenting humans, which means speeding up work but not replacing it, then usage-based or feature-tiered pricing is more appropriate.

GitHub Copilot charges per developer seat, because the tool fits seamlessly into coding workflows. Grammarly tiers pricing based on advanced suggestions, tone features, and business-level collaboration.

Here, the value still scales with human use. You’re charging for enhanced capability, not complete automation.

Choosing the wrong model can completely tank the monetization of a SaaS company. If you charge per seat for an agentic AI, your TAM shrinks as customers reduce headcount. If you try to charge outcomes for an assistive tool with fuzzy attribution, buyers push back.

Framing your product as agentic or assistive helps clarify what you're really selling: a worker, or a co-pilot. And once you’re clear on that, the pricing logic almost writes itself.

6. Behavioral Monetization Is the New PLG Frontier

Product-led growth (PLG) used to mean one thing: usage-gated upgrades. Let users try the product, then nudge them to upgrade when they hit a quota like 10 dashboards, 500 contacts, or 100MB of storage. But here’s why this model will stop working soon.

Today’s PLG leaders are moving toward behavioral monetization. That is pricing that responds not to arbitrary limits, but to how a user engages, grows, and extracts value from the product.

Instead of gating features at random thresholds, teams are designing upgrade paths around milestones and signals that reflect real activation and value:

Unlocking premium features only after users automate a certain number of tasks or send their first 100 invoices

Triggering upsell nudges when a team adds new integrations or expands usage across departments

Moving users into higher tiers when behavior indicates deep adoption, like using advanced workflows, inviting collaborators, or exceeding success metrics

Companies like Notion, ClickUp, and Clay are leading the way here, tracking user milestones and adapting pricing nudges accordingly.

Why does this matter? Because static tiers are too generic for today’s power users. A marketing team using 50 AI workflows per month is not the same as a solo founder running one. But under traditional pricing, they might be on the same plan.

Behavioral monetization closes that gap. It helps vendors price closer to actual value delivered, while giving users a more intuitive sense of when and why they’re being asked to pay more. It feels less like a wall, and more like a natural progression.

PLG used to mean “try before you buy.” Now it means grow before you upgrade, with pricing that learns as fast as your users do.

7. Strategic Monetization = Fundraising Narrative

For early-stage founders, pricing is more than a monetization choice; it’s a narrative weapon. In today’s market, the best GTM teams treat pricing strategy as an extension of product strategy, and the best investors expect the same.

A smart pricing model doesn’t just boost revenue, it also emphasizes strength across multiple dimensions. It shows VCs you’ve built in valuation drivers like strong net dollar retention, short CAC payback periods, and improving gross margins, even in the face of rising infrastructure costs.

It also indicates that you have a competitive moat: pricing that aligns with outcomes and leverages proprietary attribution logic is harder to replicate and easier to defend.

And most importantly, it demonstrates scalability, with flexible hybrid or outcome-based models that grow alongside product maturity and customer usage.

Investors are now asking: How well does your pricing track to value? How does it evolve with adoption? How are you protecting margin in an AI-heavy world?

This is especially true for AI-native startups. If your product automates work or delivers measurable results, your pricing better show that. Otherwise, you're signaling a disconnect between your product’s promise and your go-to-market execution.

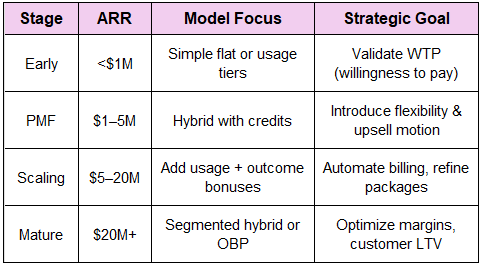

ARR-Based Pricing Maturity Roadmap

This roadmap isn't rigid; it’s a reference point. The real signal is your ability to evolve pricing in step with customer value and operational complexity.

Because in 2025, pricing is a front-page story in every investor memo. If your pricing doesn’t reflect your product’s intelligence, your investors will notice.

8. The Future: From Access to Usage to Outcomes

SaaS pricing is no longer just about packaging features. It’s about matching how your product creates value with how your business captures it.

Flat-rate and seat-based pricing worked in the era of static software, where value scaled with headcount.

Then, usage-based models emerged as a better fit for AI-powered products that chew through compute and API calls.

And now, as AI becomes more agentic and autonomous, we’re entering the era of outcome pricing, where revenue is tied to results instead of activity.

This evolution is already evident in how leading SaaS companies build, sell, and raise capital. They’re not just selling software access. They’re selling success, and charging accordingly.

The best teams are experimenting constantly. They’re treating pricing like product: iterating, testing, improving. They’re assigning ownership, integrating billing design with go-to-market strategy, and preparing for a world where multi-model pricing is the norm, not the exception.

Because in the age of AI, pricing isn't just a business model. It’s a trust contract. It’s a growth lever. And it’s one of the clearest signals of whether your company truly understands the value it delivers.

Augment Code recently switched from per seat pricing to an opaque token based pricing scheme. I immediately canceled when my bill went up 1000%. Check out their reddit to see what other customers are saying. https://www.reddit.com/r/AugmentCodeAI/ A prominent AI blogger has predicted their company will fail within 18 months due to this change. I do believe they got taken to the cleaners by people using their system in agentic mode whereas I was an agentive type user.

I am surprised how little credit Midjourney gets for actually seeing "the pricing model collapse no one saw coming."

They had usage-based pricing (almost?) from the outset, and they dropped the free tier altogether more than two years ago.

Surprise, surprise! They seem to be profitable!

We will probably look at usage-based pricing as the dominant pricing option. It simply moves consideration of how much value is delivered to the end-buyer. For everyone else, it's just renting the infrastructure (hardware, models, software, etc.).

And when you think about it, it's nothing new. It's basically how AWS has operated for 2 decades. As much as with modern AI tools, we actually can't know precisely what's going to be on our AWS bill. So it's not that much of a revolution anyway.

Another interesting thing is the dusk of a free plan: https://pawelbrodzinski.substack.com/p/basic-paid-plan-is-the-new-free

For decades, we've assumed that we can have a fairly decent version of a product for free. It worked because the marginal cost of adding another free user was negligible. With AI-intensive features, it's not true anymore.

So either free versions will be borderline useless (think Lovable) or entirely non-existent (think Supercut).