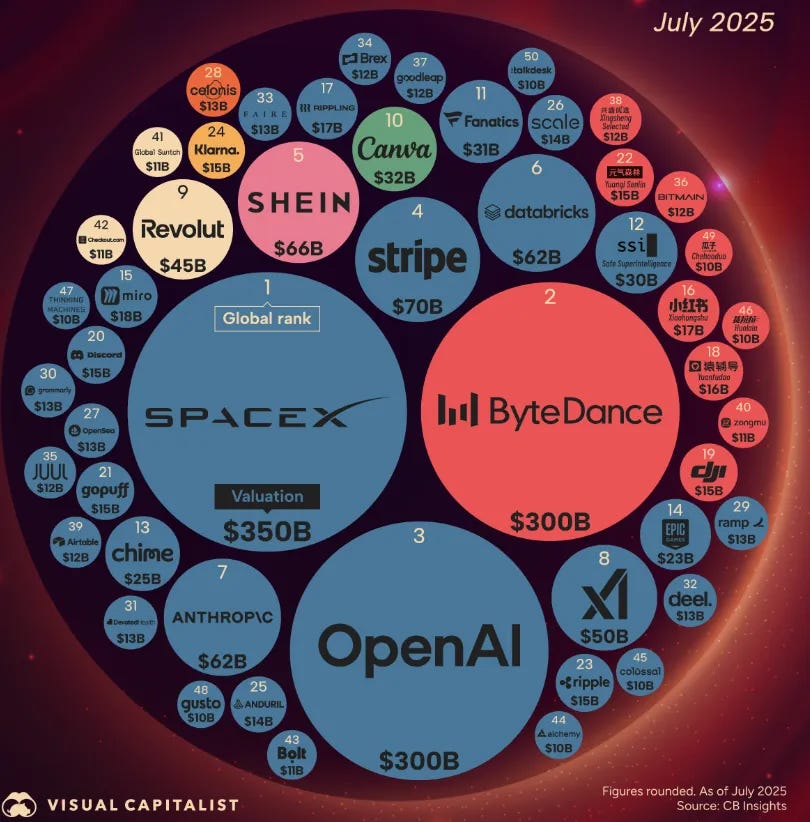

The Most Valuable VC-Backed Startups in the World

What $10B plus private companies reveal about global tech and why venture capital matters more than ever

Every cycle has its signals.

A decade ago, hitting one billion dollars made you a unicorn.

Today, one billion barely gets anyone’s attention.

You do not enter the global conversation unless you are worth at least ten billion.

The list below, curated originally by Trace Cohen, is more than a ranking.

It is a map of where technology, capital, and geopolitical influence are moving.

But it also reveals something deeper:

Venture capital is becoming more important, not less.

And the world’s best companies are staying private far longer than before.

Private markets have become their own universe, with the capital, patience, and scale to support companies in the tens or even hundreds of billions.

Let’s break it down from the bottom up:

By the way, I’ve opened 10 slots for 20 minute 1:1 consulting calls.

First come, first served:

Companies Worth Between $10B and $30B

The frontier where the next generation of global winners is being built

This tier is the most fascinating because it contains companies with the strongest potential to multiply.

Many will reach fifty billion or go public in the next five years.

This is where innovation is moving the fastest.

Perplexity. 20 billion. AI search. United States.

Rippling. 16.8 billion. HR tech. United States.

Discord. 15 billion. Messaging. United States.

Neuralink. 15 billion. Neurotech. United State.

Applied Intuition. 15 billion. Automotive and AI. United States.

Mistral AI. 14 billion. Artificial intelligence. France.

Plaid. 13 billion. Fintech. United States.

Grammarly. 13 billion. AI writing. United States.

Celonis. 13 billion. Process mining. Germany.

Devoted Health. 12.6 billion. Health technology. United States.

Biosplice. 12 billion. Biotech. United States.

Checkout.com. 12 billion. Fintech. United Kingdom.

Helsing. 12 billion. Defense AI. Germany.

Deel. 12 billion plus. HR tech and fintech. United States.

Brex. 12.3 billion. Fintech. United States.

GoodLeap. 12 billion. CleanTech. United States.

Kalshi. 11 billion. Prediction markets. United States.

Bending Spoons. 11 billion. Apps. Italy.

ZongMu Tech. 11 billion. Autonomous vehicles. China.

Bolt. 11 billion. Checkout fintech. United States.

Airtable. 11.7 billion. Collaboration. United States.

Whatnot. 11.5 billion. E commerce. United States.

Oura. 11 billion. Wearables. Finland and United States.

Bilt Rewards. 10.8 billion. Proptech. United States.

Cognition AI. 10.2 billion. AI developer tools. United States.

Colossal Biosciences. 10.2 billion. Biotech. United States.

Alchemy. 10.2 billion. Web3 infrastructure. United States.

Gusto. 10 billion. HR technology. United States.

Sierra. 10 billion. Enterprise AI. United States.

Mercor. 10 billion. AI hiring. United States.

Crusoe. 10 billion. Compute and energy. United States.

Notion. 10 billion. Collaboration. United States.

Bitmain. 10 billion plus. Crypto hardware. China.

This category shows the frontier of innovation.

AI touches nearly every vertical, from enterprise software to health, defense, robotics, and even hiring.

Europe has emerged as a serious producer of deep tech and enterprise platforms.

And multiple companies in this range are still in hypergrowth, not maturity.

Companies Worth Between $30B and $100B

Global platforms that feel public, operate globally, and stay private anyway

These companies could go public at any moment.

Many choose not to because private markets now offer enough capital and liquidity to grow without the constraints of quarterly earnings.

Revolut. 75 billion. Fintech. United Kingdom.

Stripe. 70 billion plus. Fintech. United States.

Shein. 66 billion. E commerce and fashion. China and Singapore.

Reliance Retail. 60 billion plus. Retail and commerce. India.

Thinking Machines. 50 billion. AI. United States.

Jio Platforms. 50 billion plus. Telecom and technology. India.

Databricks. 43 billion. Data and AI. United States.

Canva. 42 billion. SaaS and design. Australia.

xAI. 40 billion plus. Artificial intelligence. United States.

Ripple. 40 billion. Crypto and fintech. United States.

Anthropic. 40 billion. Artificial intelligence. United States.

Figure AI. 39.5 billion. Robotics and AI. United States.

Waymo. 30 billion plus. Autonomous vehicles. United States.

Ramp. 32 billion. Fintech. United States.

Safe Superintelligence (SSI). 32 billion. Artificial intelligence. United States.

Epic Games. 32 billion. Gaming. United States.

Fanatics. 31 billion. E commerce and sports. United States.

Xiaohongshu (RED). 31 billion. Social and commerce. China.

Anduril. 30.5 billion. Defense technology. United States.

Binance. 30 billion plus. Crypto. Global.

Telegram. 30 billion plus. Messaging. United Arab Emirates.

Anysphere (Cursor). 29.3 billion. AI developer tools. United States.

Scale AI. 29 billion. Data and AI. United States.

This tier is a global chessboard. Fintech leaders from London, e commerce giants from Singapore and China, telecom titans from India, and AI infrastructure companies from the United States all meet here.

The biggest surprise is how many of the most valuable private companies today choose to remain private.

The private ecosystem has matured into its own financial market.

Companies Worth Over $100 Billion

Private companies that behave like sovereign institutions

Only a few companies in the world reach this level.

When they do, they begin to influence geopolitics, supply chains, talent flows, and capital markets.

ByteDance. 225 billion plus. Consumer and social. China.

SpaceX. 210 billion plus. Aerospace and defense. United States.

OpenAI. 157 billion. Artificial intelligence. United States.

Ant Group. 100 billion plus. Fintech. China.

These companies are not fighting for market share.

They redefine the markets themselves.

AI, finance, and aerospace have become pillars of global power, and the companies operating here are shaping the next decade of technological and economic architecture.

The Patterns That Matter, The Bigger Picture and Downloadable list:

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.