Where VC Money Is Going in AI and How SaaS Founders Can Compete

A data-backed deep dive into how venture capital is reinventing itself thanks to artificial intelligence and what SaaS founders must learn from the best in the space.

How Top VCs Are Really Investing in AI Applications

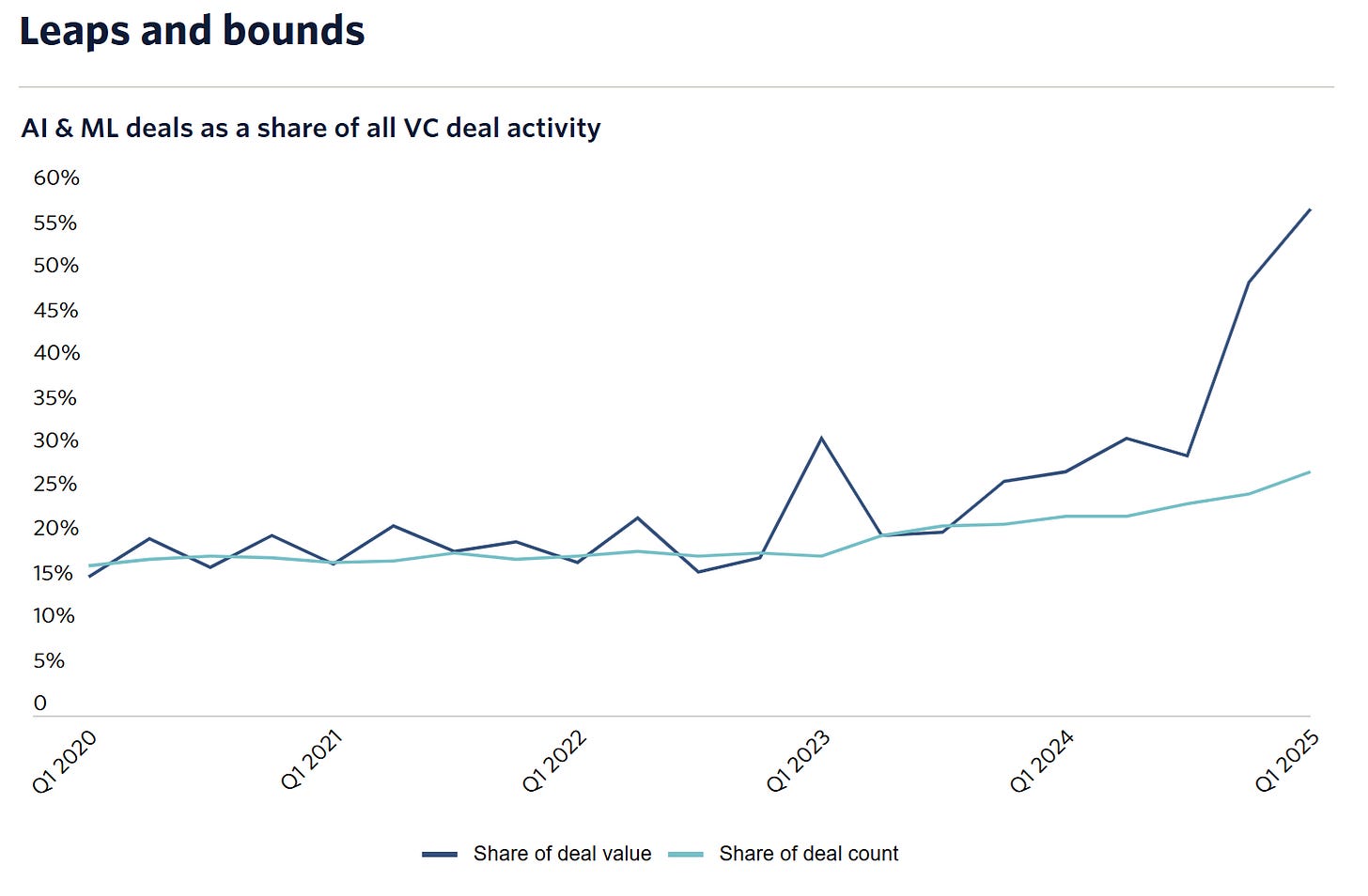

If you haven’t seen the recent numbers, you’re in for a surprise. In 2025 alone, startups building with and for intelligence have absorbed $192.7B. That’s the first time more than half of global VC dollars are flowing into a single category.

The capital isn’t spreading evenly either. It’s currently pooling at the top. Foundation-model leaders, like OpenAI, Anthropic, xAI, and Mistral AI, are commanding the largest checks, a visible break from 2023–2024’s broad-based AI FOMO.

Even PitchBook’s Q1 read captured that FOMO surge; what followed in the rest of the eyar so far is sharper selection and pattern-based bets.

This is a wake-up call for founders. If you want to understand how VCs invest in AI and how they really value startups, think less about adding features and more about building systems that earn trust, compound quality, and move fast.

The rest of this piece translates those investor behaviors into a durable SaaS and AI strategy, a practical AI SaaS playbook for surviving and scaling in the agent era.

brought to you by Delve: Cut hundreds of hours of compliance busywork

Don’t Let Compliance Haunt You 👻

Stop getting ghosted on deals. Get SOC 2, HIPAA, and more done fast with Delve’s AI-powered platform—often in under 15 hours.

Trusted by hundreds of startups like Lovable, Micro1, and Bland to unlock enterprise deals and revenue.

Use code GHOST by midnight Oct 31 for exclusive savings.

Table of Contents

1. The Numbers Behind the AI Funding Explosion

2. How VC Evaluation Criteria Are Changing

3. The Redpoint Framework: What Top VCs Actually Look For

4. From Co-Pilots to Agents: What This Means for SaaS

5. What Investors and Founders Should Measure Now

6. The New Investment Landscape: Opportunities and Pitfalls

7. From Hype to Operating System

1. The Numbers Behind the AI Funding Explosion

The headline figures only hint at how concentrated the market has become. Global VC funding reached $97 billion in Q3 2025, a 38% year-over-year increase.

But the real headline is that nearly half of those dollars went into AI startups, dominated by a few record-breaking rounds, most notably Anthropic’s $13 billion, which represented 29% of all AI funding that quarter.

The United States remains the gravitational center of this surge. PitchBook estimates total U.S. venture activity at roughly $250 billion for 2025, with 63% directed to AI.

North America’s dominance stems from the size of its mega-rounds, with OpenAI, Anthropic, xAI, and Mistral together capturing nearly one-third of all global venture capital money. The top 1% of AI companies now absorb more than a third of total funding, creating a winner-take-most dynamic reminiscent of the early internet era.

Across stages, the pattern is just as obvious. Late-stage AI rounds surged 66% YoY, while early-stage growth stayed modest and seed rounds held flat but far more selective.

Investors are doubling down on proven scale rather than experimentation, channeling billions into companies with clear revenue momentum or deep technical moats. This marks Phase 2 of AI venture investing, transitioning from FOMO to consolidation.

The rush hasn’t slowed, but it’s becoming more disciplined, concentrated, and tilted toward incumbents that already know how to deploy capital at venture speed.

2. How VC Evaluation Criteria Are Changing

It’s getting clear by now that venture investors are rewriting their scorecards. The old SaaS filters like revenue multiples, stickiness, and network effects no longer explain why some billion-dollar AI startups compound while others flame out.

Rocio Wu of F-Prime Capital says that the “RIP Old VC Playbook” moment has arrived, where everything from adoption speed to defensibility now runs on different math.

Speed as the New Signal

Adoption curves that once took a decade now compress into quarters. ChatGPT reached 90% penetration among enterprise users within two years, a diffusion rate unmatched in software history.

For investors tracking AI startup funding trends, this velocity has become the clearest proxy for market pull. What used to be a multi-year proof-of-concept cycle is just a sprint now. The key question is:

Can the product demonstrate user love before the next model release makes it obsolete?

From Co-Pilots to Agents

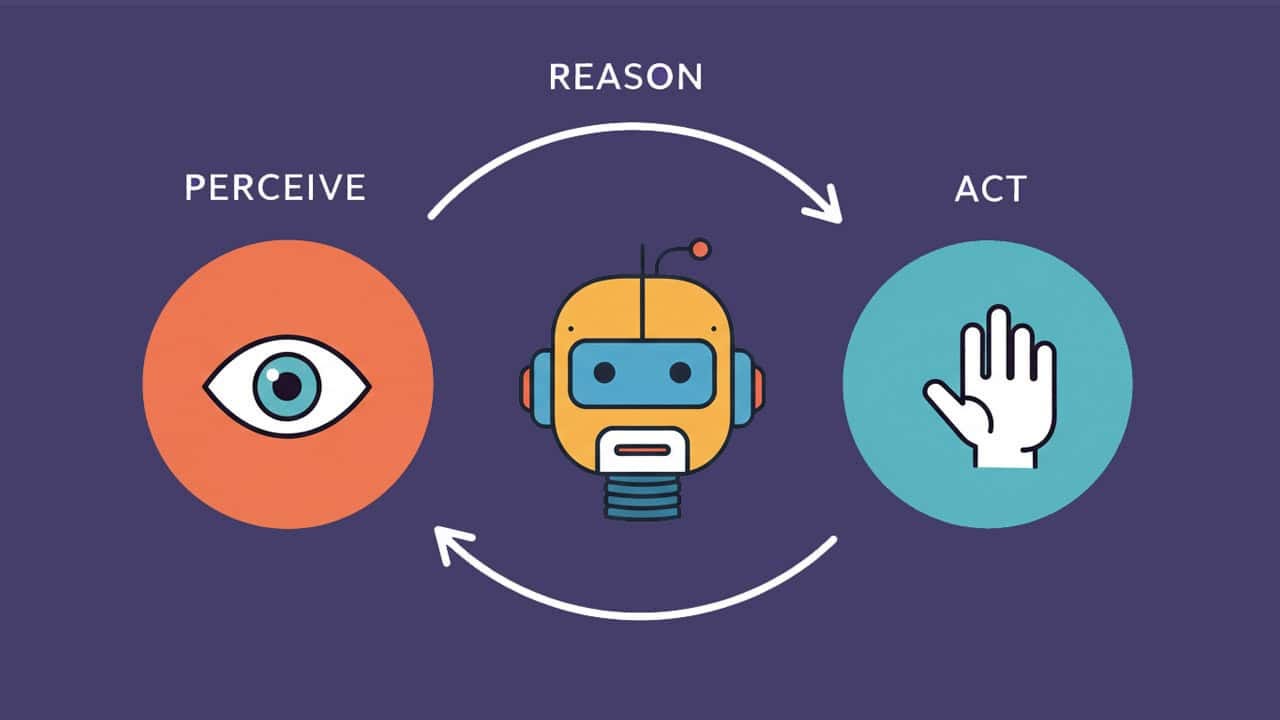

Early AI winners built assistive tools. That means co-pilots that sat beside the user. The new generation builds autonomous agents that act for them.

This evolution reshapes how investment in AI applications is evaluated. Efficiency alone no longer excites LPs or GPs. What matters is outcome automation.

If a startup’s product doesn’t close the loop, from input to execution, it’s seen as feature-level, not platform-level.

VCs now ask: does this replace work or just recommend it?

The Death of the Old Moats

Three SaaS moats that once guaranteed defensibility were implementation complexity, workflow lock-in, and data gravity. All there are now slowly becoming irrelevant.

Foundation models can now integrate, retrain, and migrate data across platforms with minimal friction. Switching costs are near zero.

That’s why investors are hunting for new moats such as enterprise knowledge, trust, and observability. A product that learns from a company’s proprietary workflows, earns sustained confidence, and shows clear model traceability builds a moat no API competitor can clone.

In other words, defensibility now lives in relationship depth, not technical opacity.

Transient PMF and the New Risk Model

Even the best AI startup product-market fit has a short half-life. When adoption is instant, erosion is faster.

A team can hit $10 million ARR in months, then watch usage crater when a new open-source model undercuts them. Investors have adapted by valuing durability of value. Is the startup’s advantage renewable, not just remarkable?

Many now underwrite “velocity risk” instead of market risk, accepting churn as long as the team ships faster than the category evolves.

When Everyone Builds AI

What goes below the radar is the fact that incumbents are no longer laggards. Enterprises have access to the same APIs, model weights, and fine-tuning infrastructure. That means startups compete not only with other startups, but also with their own customers.

VCs recognize this. It’s evident because they prize founders who can embed within enterprise ecosystems rather than fight them. The winning AI founders guide is now partnership-oriented, not zero-sum.

The Investor Mindset Reset

Across the board, investors have moved from chasing network effect and “stickiness” to measuring velocity, trust, and durability of value. The first era of AI venture trends rewarded novelty. This one rewards repeatability.

Funds that once prized retention curves now analyze deployment depth, inference cost, and feedback loops. Execution speed is the new moat, and trust is the currency that sustains it.

3. The Redpoint Framework: What Top VCs Actually Look For

When founders ask how VCs invest in AI, Jacob Effron’s playbook at Redpoint is the cleanest answer I’ve seen. In a recent SaaStr session, he laid out a simple but demanding bar: pick a wedge that proves real pull, expand aggressively from it, and win where quality matters.

Speed sits above all of it. He said “velocity is probably the most important thing we look for.”

Redpoint’s three investment questions (the “wedge-first” filter)

Is there an effective wedge? A narrow, high-urgency use case that end-users love, not just a top-down “try AI” pilot.

How much more can the company do from that wedge? The wedge must open into large adjacencies (industry or function) where the product can compound into a platform.

Will quality matter in this market? If “good-enough for cheap” wins, race-to-the-bottom risk is high; Redpoint prefers categories where accuracy, reliability, or compliance sustain pricing power.

Two emphases define that filter: velocity and wedge scalability. Velocity is execution rate. That means you need to ship features as models evolve. To turn new model capability into user value first.

Wedge scalability is strategic geography. That means the initial use case must naturally expand into a larger product surface (vertical suite or cross-functional footprint). Together, they’re how Redpoint scores real investment opportunities in AI applications.

The four AI application categories with proven PMF

Redpoint calls out exactly four patterns where adoption is repeatable at scale:

Conversational interfaces (assistants/agents): Clear 10x in support, success, and internal help.

Document search and summarization: Horizontal (e.g., enterprise search) and deep verticals (legal, construction).

Speech (STT/TTS): Especially strong in healthcare workflows.

Code generation: The breakout category; value is immediate to developers.

Mini-cases of what a great wedge looks like

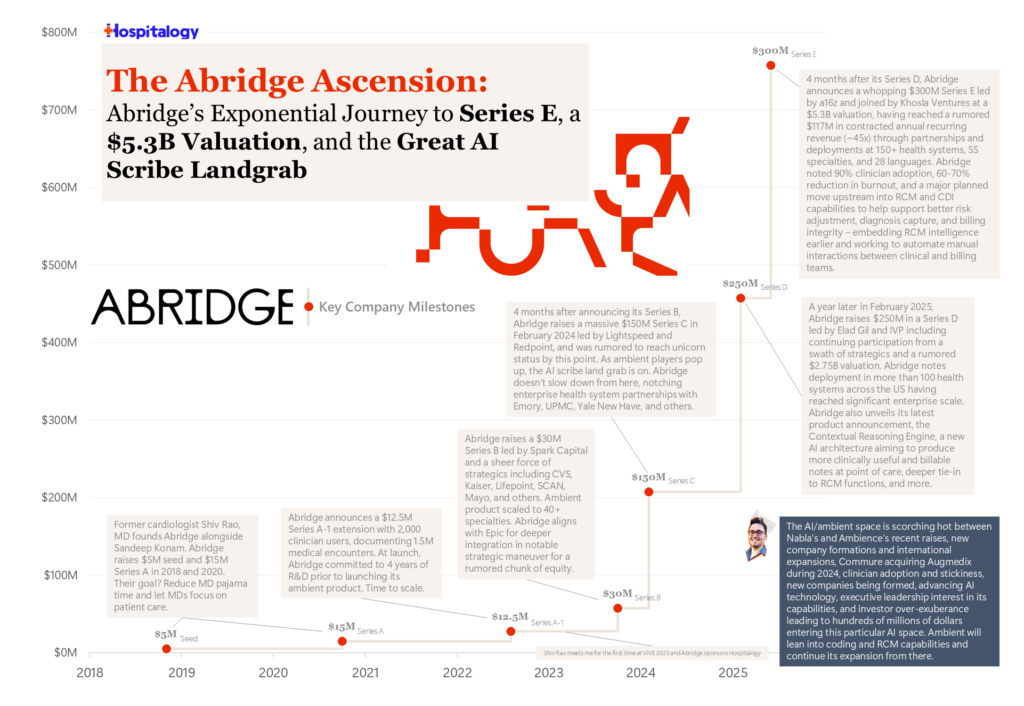

Abridge (healthcare): Abridge turns the doctor–patient conversation into structured notes, killing “pajama time” (hours spent charting at night) and unlocking a broader clinical workflow wedge. The company’s momentum, including a $5.3B valuation, rests on outcome automation plus trust and accuracy. The company recently raised a $250M round to expand its hospital footprint.

Legora (legal AI): A “second mover” that won through speed and vertical focus, starting in the Nordics with end-to-end workflow depth, then expanding. The legal market is a textbook “quality matters” arena, where accuracy and reliability sustain pricing power.

4. From Co-Pilots to Agents: What This Means for SaaS

Something subtle but seismic has happened inside software. The market has moved from AI-enhanced SaaS (tools that help humans), to AI-native systems of action that act on their behalf.

The co-pilot era was about suggestion and speed, while the agent era is about autonomous outcomes. From a VC perspective, this changes how value is created, priced, and defended.

A New Product Philosophy

In the old model, AI features sat on top of existing workflows: autocomplete, summarize, recommend. In the new model, agents own the workflow itself. They read the brief, execute the task, and report completion.

A legal co-pilot drafts a clause and a legal agent files the document. This transition defines what top funds call “systems of action;” products that close the loop between insight and execution.

For founders, it means the end of incrementalism. If your product doesn’t automate the outcome, investors now treat it as just another feature, and not an investable company.

How Monetization Evolves

The revenue model is changing with the product. Traditional SaaS pricing was seat-based, monetizing access. Agents unlock outcome-based pricing, monetizing results. Instead of charging per user, an AI procurement platform might charge a percentage of savings delivered. This taps into services and labor budgets, not just software budgets, massively expanding TAM.

But there’s a catch: today’s “automation arbitrage,” charging human-equivalent rates for digital labor, won’t last.

As agentic competition rises, prices normalize toward marginal compute costs. The winners will be those who sustain margins through data leverage and workflow ownership, not those riding temporary scarcity.

The Founder Imperative

For SaaS founders designing their next act, three imperatives define the AI SaaS playbook:

Integrate agentic workflows, not add-on features. Re-architect around full-cycle automation where the system completes the job.

Build for trust and transparency. Enterprise adoption now depends on observability, dashboards that explain why an agent acted, audit trails, and compliance layers.

Shorten iteration loops. Every new model release is a go-to-market moment. Ship faster, learn faster, and treat updates as campaigns.

This is the new SaaS and AI strategy frontier. The transition from co-pilots to agents redefines not just how software works, but how it earns. In this phase, the durable advantage isn’t simply better algorithms, it’s the ability to turn intelligence into autonomous, accountable action at scale.

5. What Investors and Founders Should Measure Now

The scoreboard for AI venture trends has changed. Investors don’t want vibes or pointless KPIs. What they want is proof that intelligence is turning into outcomes, margins, and durability. Here’s the redefined metrics stack, built from how VCs invest in AI today:

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.