Acquihires Season Is Officially Here🤝, VCs Are Pivoting🧟♂️, McKinsey’s Agentic AI Playbook🕹️

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, and the hottest deals—here’s everything you need to stay ahead.

Let’s dive in 👇

First, don’t miss the latest resources from The VC Corner

These are just some of the most recent resources published in The VC Corner, a growing library of high-value tools and guides for founders and VCs. You’ll get full access to every resource listed below, plus every new one we publish, with a free trial or premium subscription.

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth? Startups

✅ How VCs Value Startups: The VC Method + Excel Template

✅ VC Fund Database: 200+ Funds Under $200M Actively Investing

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed for Funding in 2025

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

In-Depth Insights 🔍

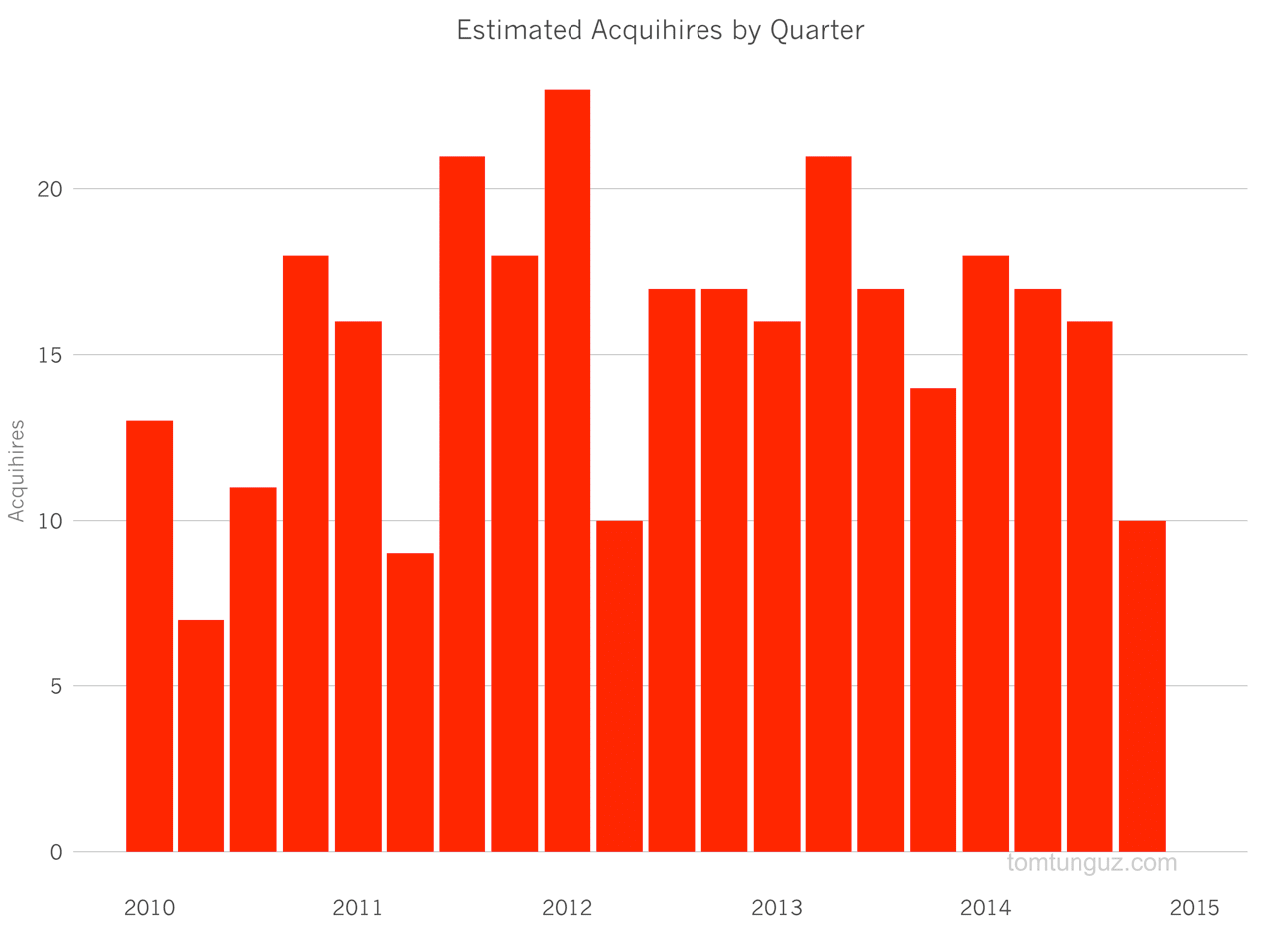

Acquihire Season Is Officially Here🤝

Founders raised too much, built too fast, and hit AI headwinds. Now Big Tech’s back - snapping up teams in quiet, sub-$20M fire sales. [Tomasz Tunguz]

How Spotify & Revolut Hacked Global Growth 🎧💳

From wedges to monetization flywheels, these two rewrote the consumer playbook with speed, scale, and surgical retention. [Francesco Frontani]

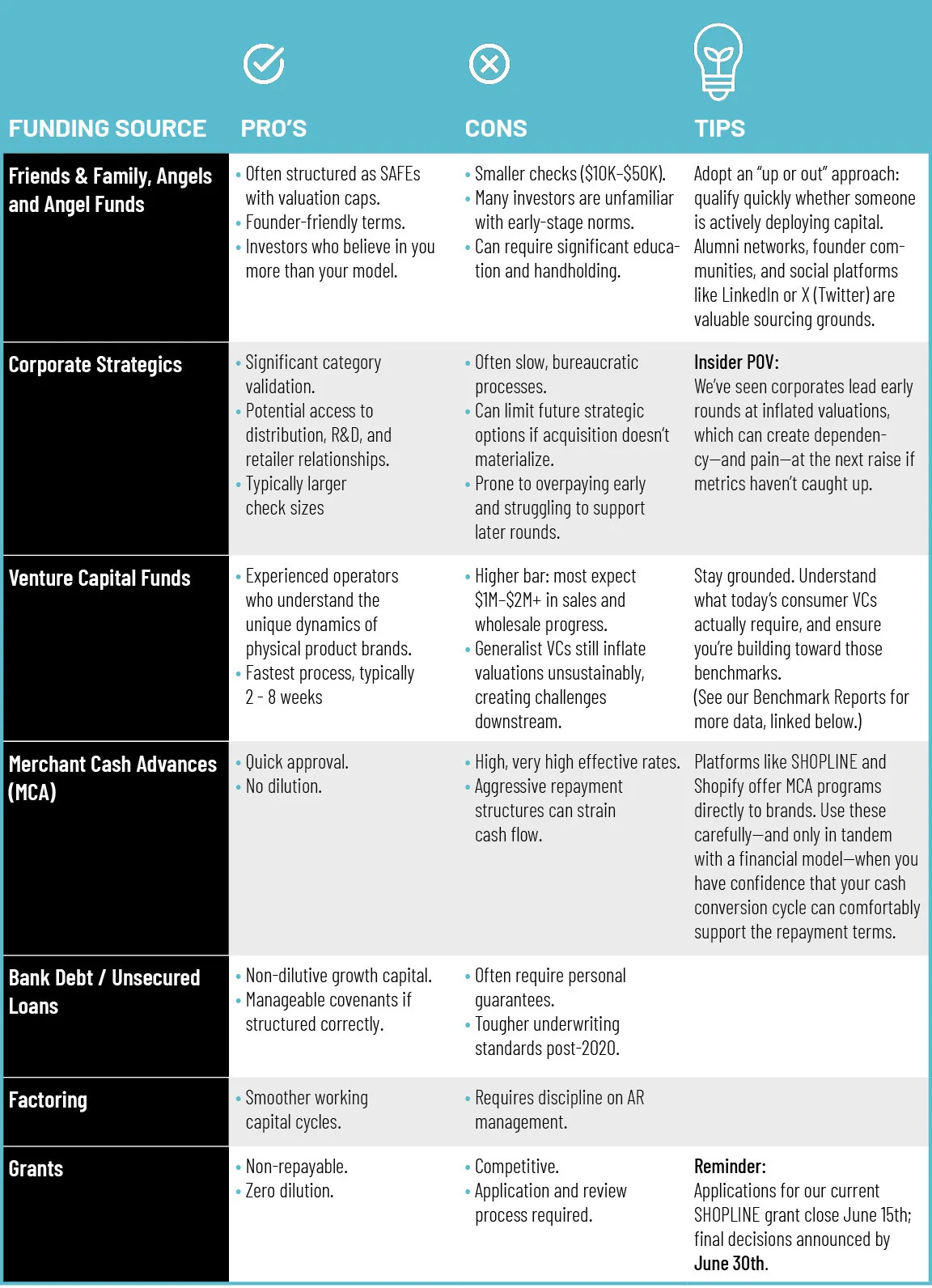

Why Consumer Founders Need a New Capital Stack 💸

CPG funding isn’t dead - but dilution is dumb. Smart founders are blending equity, debt, and revenue-based deals to survive the VC freeze. [The Brand Capital Report]The Tech Bros Are Cutting Their Own Lifeline 🧬

VCs once rode waves of government-funded research. Now they’re lobbying to kill it - and taking America’s innovation engine down with them. [The New York Times]VCs Are Pivoting - Not Just Portfolios, But Careers 🧟♂️

Zombie funds, zero carry, and no promotions? Junior investors are jumping ship - to startups, family offices, and solo funds. [PitchBook]Databricks vs Snowflake: The $100B Data Showdown ⚔️

Margins are tightening, AI infra is exploding, and Databricks is gaining ground. This isn’t just a race - it’s a decacorn cage match.

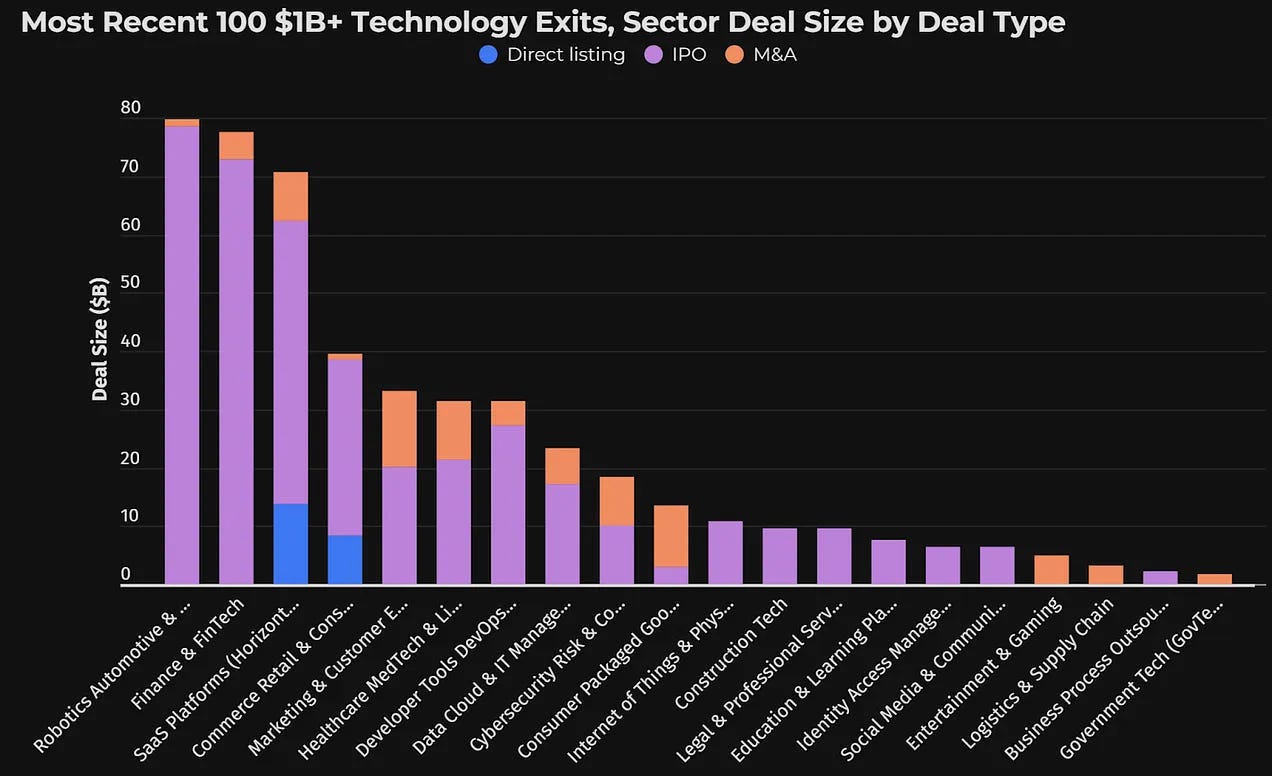

How to Tell If a Startup’s Actually Sellable 🚪

Most founders dream of exits - few are built for one. This guide breaks down the metrics, red flags, and buyer mindsets that really matter. [Ruben Dominguez Ibar]

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and my other media assets, email: rdominguezibar@gmail.com

Interesting Reports 📊

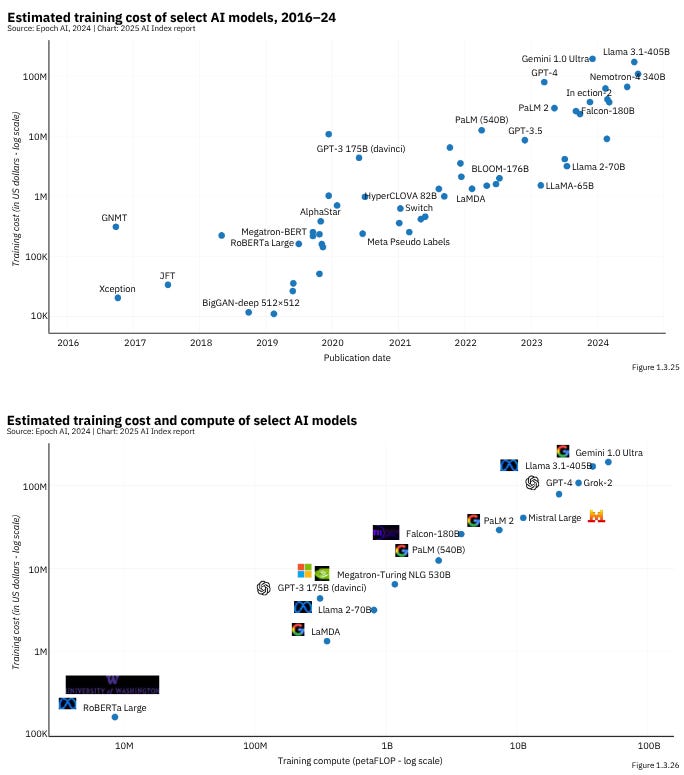

Stanford’s 2025 AI Index Just Dropped 📚

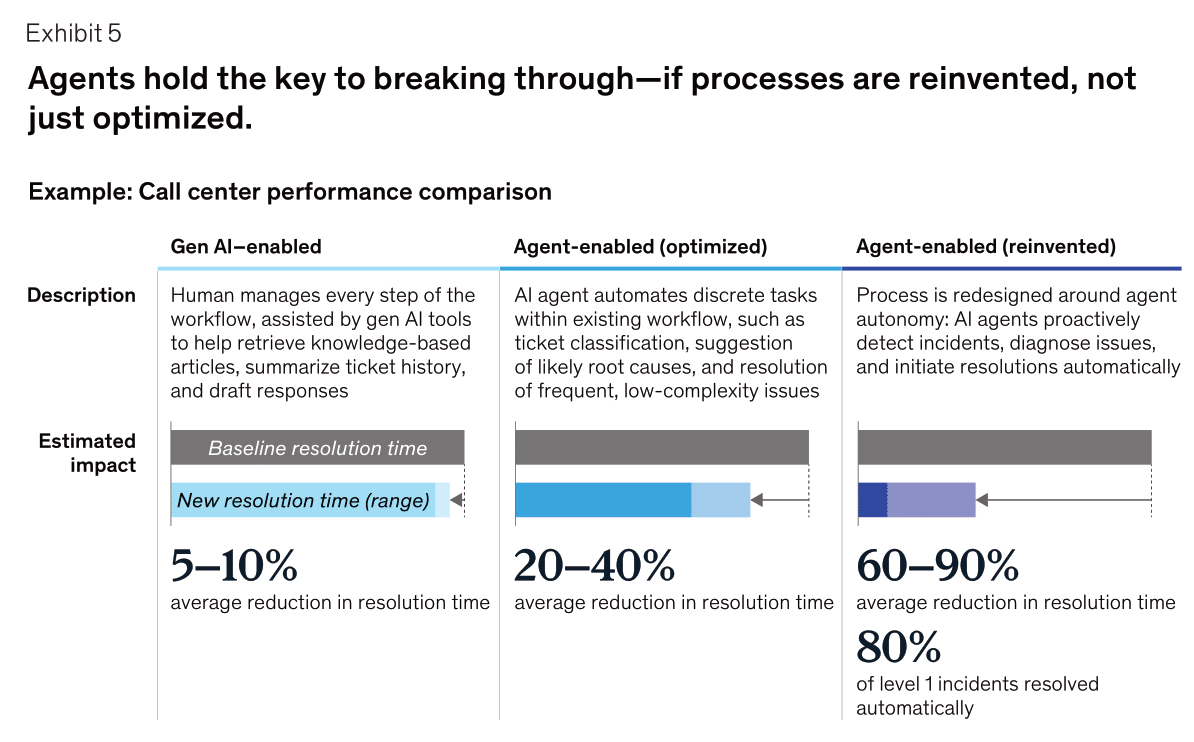

The definitive pulse-check on global AI. From model breakthroughs to policy pivots and real-world impact - it’s all here, in one brutal clarity report.McKinsey’s Agentic AI Playbook Is Live 🕹️

A C-suite cheat sheet on agent orchestration, trust, and enterprise reinvention. Less hype, more how.OpenAI's Guide to Building Agents Is a Goldmine 💻

Code-level clarity meets cutting-edge safety. If you’re serious about agents, this isn’t a read - it’s a roadmap.

Recently Launched Funds 💸

Parkwalk and Northern Gritstone launch the £215M Northern Universities Venture Fund to support spinouts across northern UK universities.

Altitude Accelerator unveils a new investor fund to back early-stage tech ventures in Canada.

Lioncrest Ventures rolls out a $100M multi-strategy platform focusing on both equity and credit investments.

Med Fine Capital closes a new USD-denominated fund aimed at growth-stage healthcare startups.

JETRO and Coolwater Capital launch the second edition of their Emerging VC Fund Accelerator program to boost Japan’s startup ecosystem.

Realyze Ventures announces €50M first close for its debut healthtech-focused venture fund.

Biotope Ventures secures $5M in the first close of its second fund, targeting climate and biodiversity tech.

Orbit Capital launches €100M venture debt fund to power tech scaleups across Central and Eastern Europe.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup enthusiasts. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

VC Jobs 💼

VMG Partners (New York City, NY): VC Investor (apply here)

OMERS Ventures (San Francisco, CA): VC Associate (apply here)

World Business Chicago (Chicago, IL): VC Director (apply here)

Clocktower Ventures (Los Angeles, CA): VC Analyst (apply here)

Essence VC (Remote): VC Internship (apply here)

Avivar Capital (Remote): VC Consultant (apply here)

Noba Capital (London, England): IR Lead (apply here)

Breega (London, England): VC Associate (apply here)

Cherry Ventures (Berlin, Germany): Chief of Staff (apply here)

PT1 (Berlin, Germany): VC Internship (apply here)

Hottest Deals 💥

SportsVisio, banked $3.2M to double down on its AI sports analytics game. (read more)

Paradigm Therapeutics, scored a fresh check from Eshelman Ventures to fuel rare disease R&D. (read more)

Ostrom, pulled in €20M Series B to take its clean energy ambitions across Europe. (read more)

Sifflet, grabbed $18M to level up its data observability engine. (read more)

Maven AGI, landed $50M Series B to push smarter, AI-first customer experiences. (read more)

RevelAi Health, raised $3.1M seed to build AI that catches disease before it shows up. (read more)

Fleet, fueled up with $27M Series B to streamline global freight moves. (read more)

Hydroblok, raised $6M to keep waterproofing tech flowing with Series A extension. (read more)

Carefull, secured CIBC Innovation Banking support to protect aging adults’ finances. (read more)

Icon Solutions, scored UBS equity to rev up its payments infrastructure. (read more)

Actio Biosciences, raised $66M to fast-track next-gen precision medicines. (read more)

Jet HR, got €25M to automate more of Europe’s HR chaos. (read more)

Sword Health, raised $40M at a cool $4B valuation to make virtual PT the default. (read more)

Pano AI, raised $44M Series B to expand its wildfire-spotting AI nationwide. (read more)

Juniper Square, closed a Series D at a $1.1B valuation to simplify real estate investing. (read more)

RESOURCES 🛠️

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth? Startups

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 70+ Startup Pitch Decks That Raised Over $1B in 2024

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The 100+ Pitch Decks That Raised Over $2B

✅ Ultimate Investor List of Lists (+5k VCs)

✅ 40 Pitch Decks That Raised Over $460M

✅ The Startup Founder’s Guide to Financial Modeling (7 free templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth (and How to Get Into Them)

✅ The Ultimate Startup & Venture Capital Notion Guide: Knowledge Base & Resources

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox