The Exit Scenario Tool You Need

This Excel template turns exit hypotheses into cash-flow reality.

The Big Exit Headline

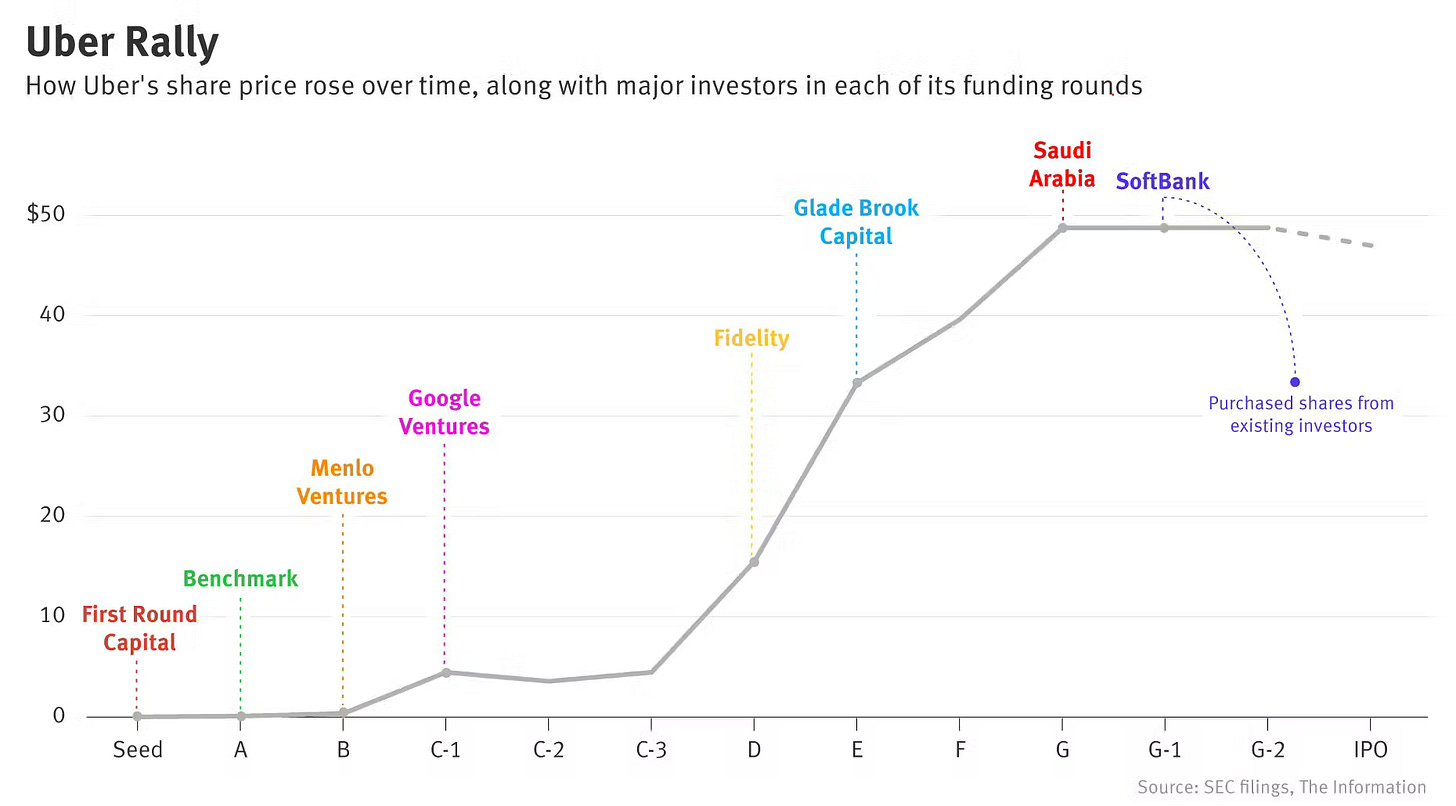

Think about the biggest VC outcomes of the past decades. Companies going public at billion dollar valuations, or merging for combined values in the tens of billions.

Most people talk about exits as if a giant bag of cash just drops from the sky all at once. But that’s never the case. Yes, some of it might be available on day one, while the rest stays locked away for years or depends on goals that haven’t been met yet.

So if you focus only on the big valuation number at the end, you’re missing everything in between. For a founder, that’s when the money arrives and how much of it is actually guaranteed.

For investors, that is the difference between a high return on paper and actual cash in the bank to fuel the next big bet.

And still, many successful founders discuss exit scenarios without having done any modelling. VCs will also set their expectations without having a template to show.

To get a clear picture, you have to move past the stories and look at the timing. That is exactly why we built this tool. It is a simple way to map out different paths side by side, so you can see how an IPO or a private sale actually pays out over time.

Table of Contents

What This Exit Scenario Tool Includes

Who This Tool is Built For

How to Use This Tool (Step By Step)

Frequently Asked Questions (FAQ)

1. What This Exit Scenario Tool Includes

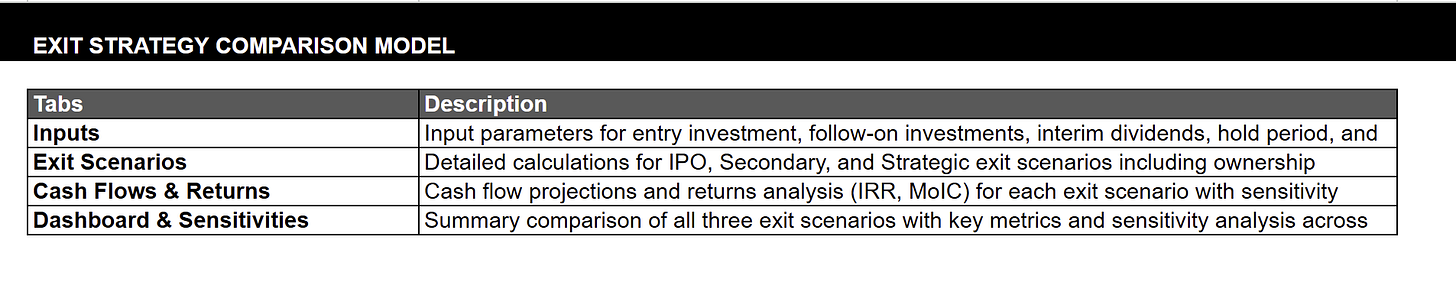

Enough thinking about the theory. Let’s look at how this tool actually works. It is divided into four main parts that guide you from your first investment to the final payout.

Cover Page & Input

The cover page is straightforward and very helpful for understanding what the rest of the workbook does. You’ll find a straight-forward description of each tab included.

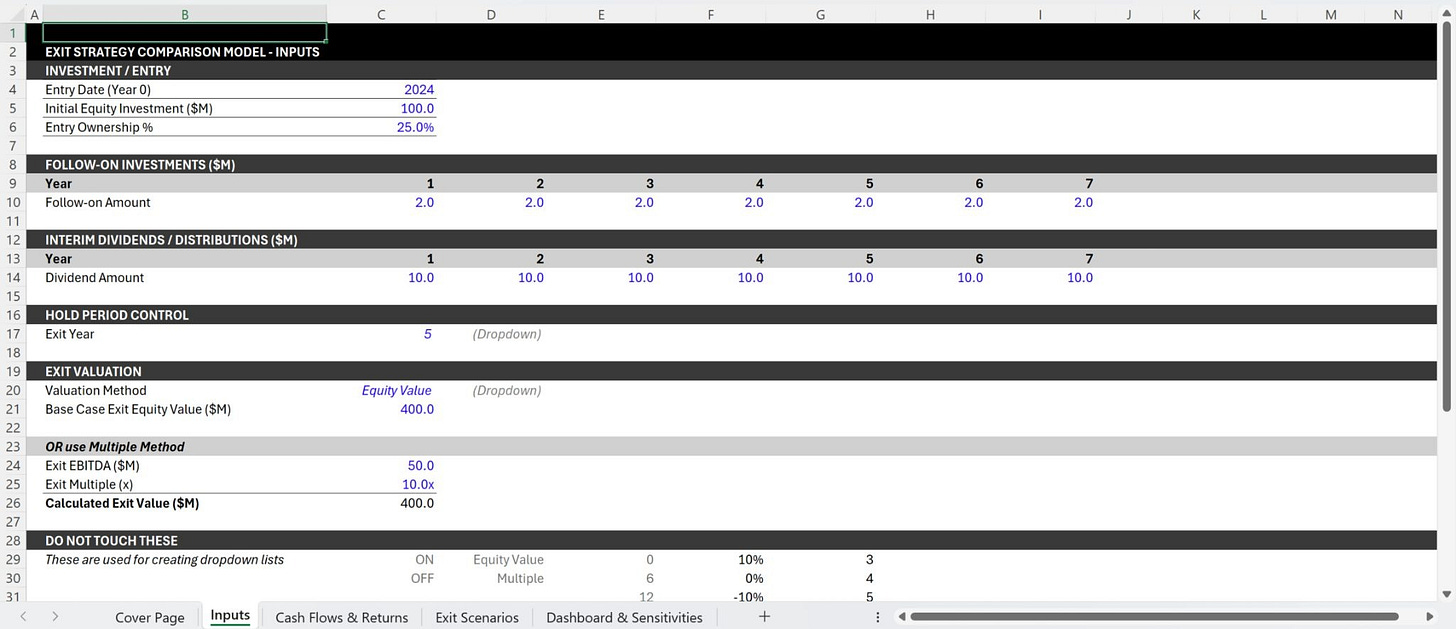

The “inputs” tab is the bread and butter of the model, and it starts exactly where real investments start. That means with time, ownership, and capital that is truly at risk.

You start by entering the basics of your deal. This includes the year you first invested, how much money you put in, and what percentage of the company you owned at that point.

Many people make the mistake of looking at an investment as a single event, but we know that is rarely true. This section allows you to layer in follow-on investments for each year so you can see the total amount of money you have at risk over the life of the company.

You can also record any money that comes back to you before the final sale. If the company pays out dividends or early distributions, you enter those here so they can be counted toward your total return.

Finally, you define the target for the end of the journey. You can choose to enter a specific price you think the company will sell for, or you can use a multiple of their earnings to calculate a likely value. This tab creates the foundation for everything else.

Exit Scenarios

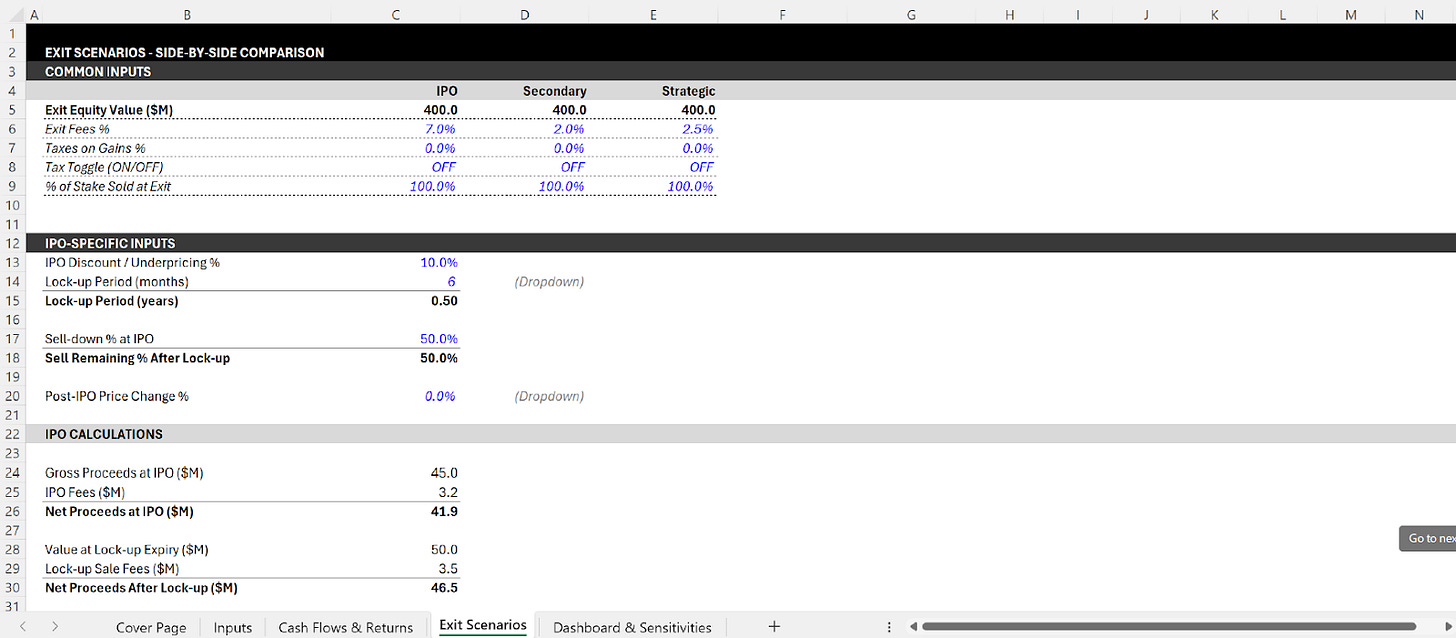

Every exit looks different on paper, so this tab lets you compare three specific paths side by side. The Initial Public Offering (IPO), a secondary market sale, and a strategic merger.

For the IPO path, the model accounts for costs that people often forget. For example, investment banks usually price shares at a discount during an IPO to make sure people buy them. You also have to deal with lock-up periods, which are months where you are legally forbidden from selling your shares even though the company is already public.

For a strategic sale, like when a big tech company buys a smaller one, you can model earn-outs. An earn-out is a part of the price that you only get later if the company hits certain goals.

This tab is where you turn a simple “selling the company” idea into a detailed plan that accounts for fees, taxes, and timing delays. It helps you see which path actually puts the most cash in your pocket at the end of the day.

Cash Flows & Returns

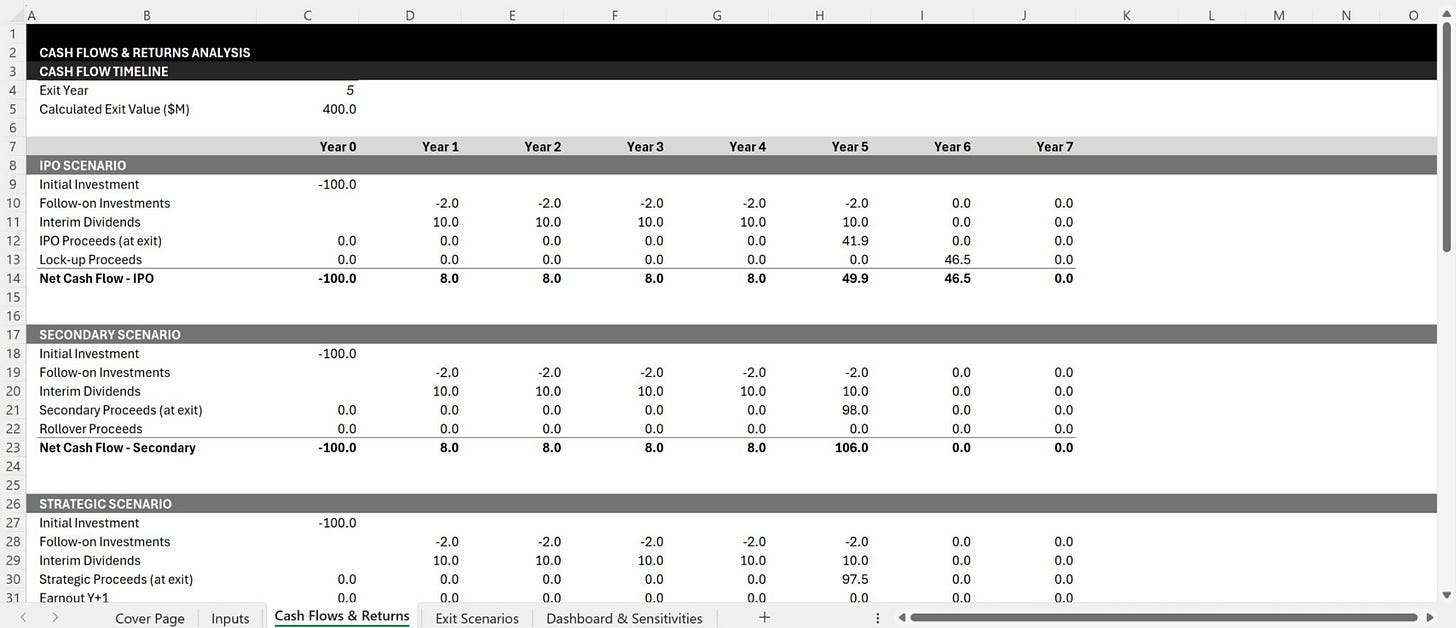

This is the engine room of the model. It takes all the dates and dollar amounts entered and spreads them out across a timeline from year zero to year seven.

By putting every dollar on a specific spot on the calendar, the model can tell you exactly how well the investment performed. This is where it calculates two very important numbers that venture math relies on. The Multiple of Invested Capital (MOIC) and the Internal Rate of Return (IRR).

The MOIC is simple. It just shows how many times your money grew. If you put in one dollar and got five back, your multiple is five.

IRR is more detailed because it considers the cost of time. Getting a million dollars today is worth a lot more than getting that same million five years from now. This tab does the math to show you how much the timing of your exit affects the final result.

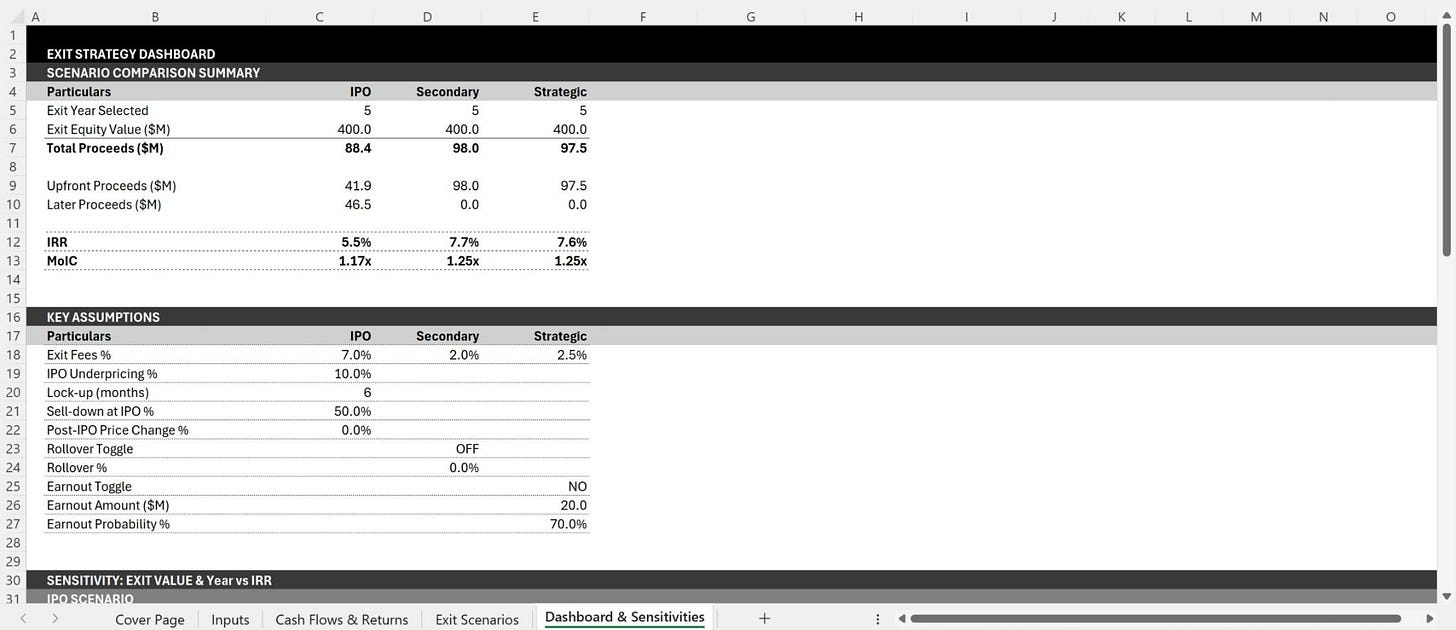

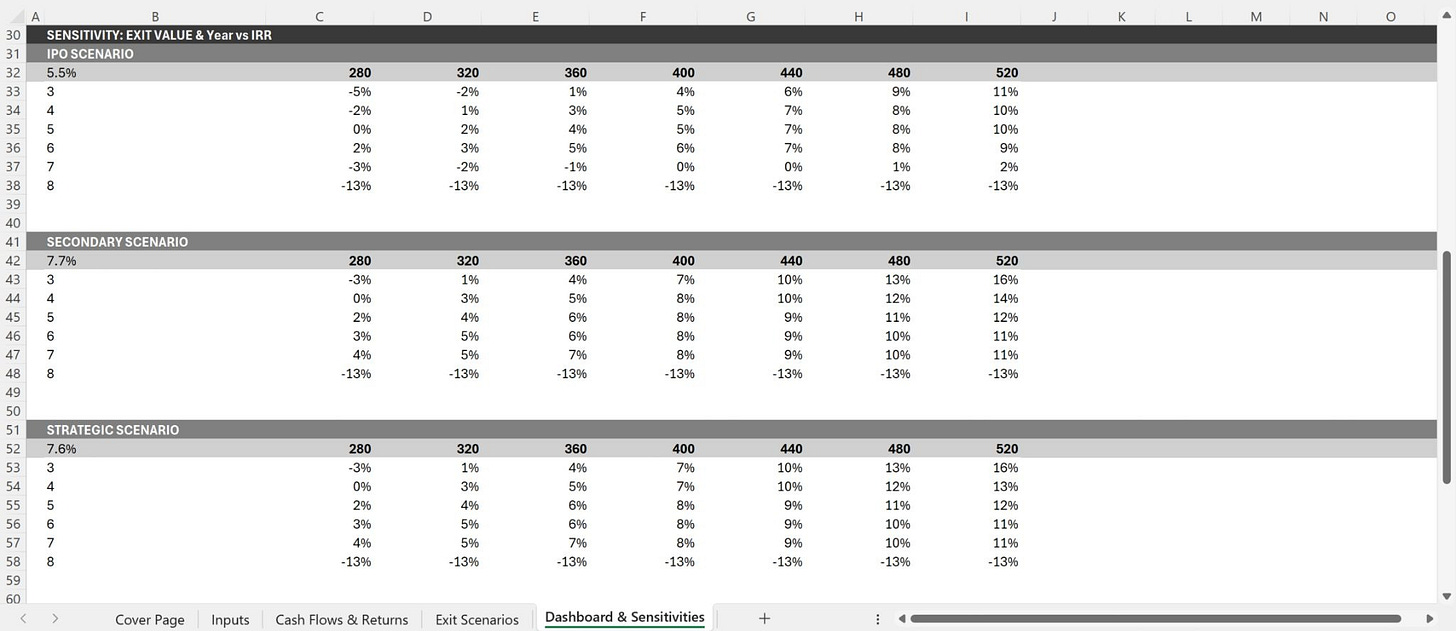

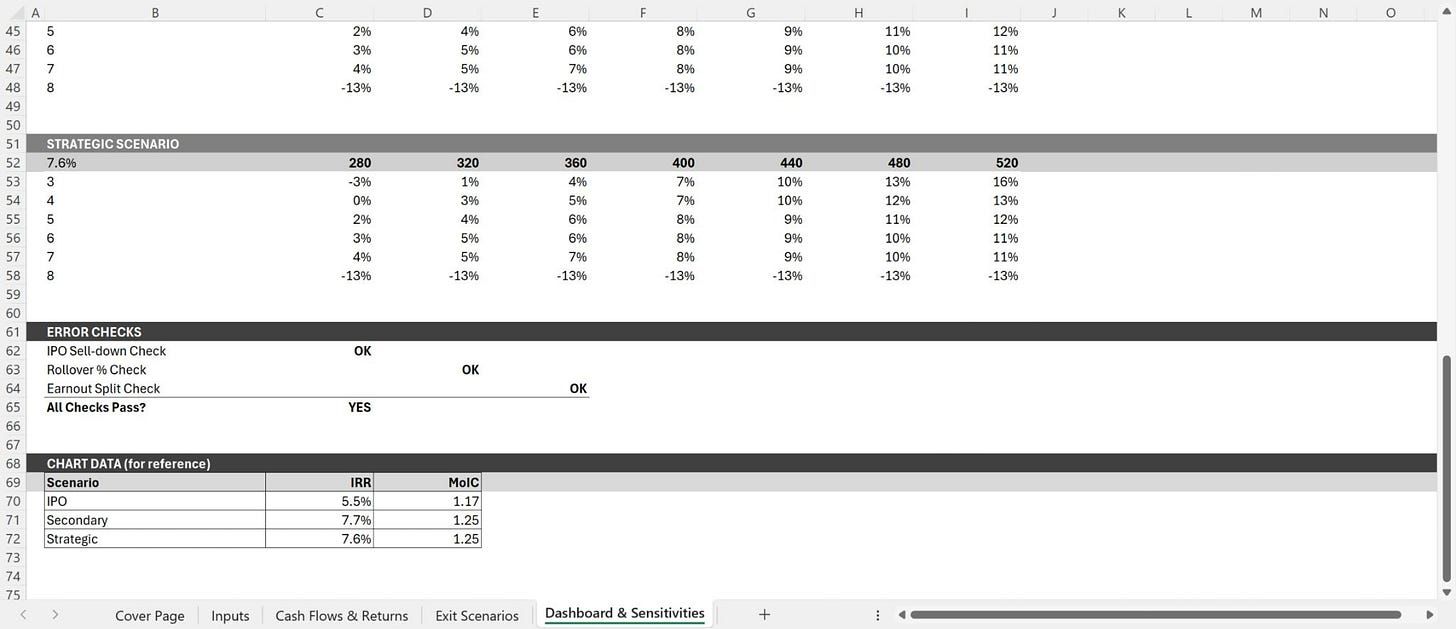

Dashboard & Sensitivities

This is the high-level view used for making real decisions. It pulls all the data into one summary table so you can compare the three exit paths at a glance.

It specifically breaks down your proceeds into “upfront” cash and “later” cash. This distinction is vital because a huge valuation doesn’t help you much if eighty percent of the money is tied up in a three-year earn-out or a long lock-up period.

The bottom of this tab includes sensitivity tables. These are “what if” charts that help you plan for the unexpected. They show how your returns would change if the company sells for less than you hoped, or if the exit takes two years longer than you planned. It allows you to see the risks clearly so you can decide if a deal is still worth it even if things don’t go perfectly.

The takeaway is straightforward. This model does not ask which exit sounds best in theory, but shows which exit actually pays, how much it pays, and when the cash shows up.

(As a premium subscriber, you also get access to 15 more Financial Model Templates) + pitch deck examples + investors lists

2. Download the Exit Scenario Model 👇

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.